To demonstrate the difference our proprietary Adjusted Fundamental data makes, we are writing a series of reports that show how our Credit Ratings are more reliable than legacy firms’ ratings. This first report compares our “Adjusted” Free Cash Flow (FCF) to Debt ratio to the “Traditional” ratio based on unscrubbed financial data. FCF to Debt is one of the 5 ratios that drives our Credit Ratings. Get explanations and comparisons for the other four metrics here.

No Bias, More Coverage, and Better Analytics: A New Paradigm for Credit Ratings

For too long, legacy providers, e.g. Moody’s, S&P, and Fitch, have dominated the credit ratings industry. Controversy surrounding these providers’ conflicts of interest during the Financial Crisis is well documented, yet conflicts of interest persist because these firms get paid so much by the companies they rate. Our Credit Ratings are free of conflicts of interest and also offer:

- more coverage: ~2,700 companies vs. ~1,500 for S&P

- more frequent updates: we update all ~2,700 of our credit ratings quarterly while S&P updates ratings for ~400 companies per year

Most importantly, superior fundamental data drives material differences in our Credit Ratings and research compared to legacy firms’ research and ratings. This report will show how FCF to Debt ratings for 54% of S&P 500 companies are misleading because they rely on unscrubbed data.

We will also detail the differences that better data makes at the aggregate[1], i.e. S&P 500[2], level and the individual company level (see Appendix) so readers can easily quantify the benefits of our superior data.

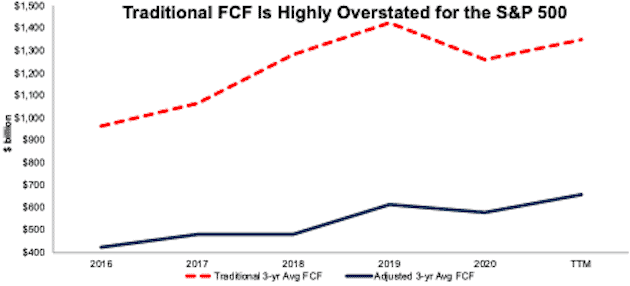

Unscrubbed FCF Is Highly Overstated for the S&P 500

We use 3-year average FCF as the numerator for the FCF to Debt ratio. Figure 1 shows the difference between Traditional 3-Year Average FCF and our Adjusted 3-Year Average FCF since 2016. Over the TTM, Traditional 3-Year Average FCF is overstated by $689 billion, or 51% of the Traditional 3-Year Average FCF.

Figure 1: Traditional Vs. Adjusted 3-Year Average FCF for S&P 500

Sources: New Constructs, LLC and company filings.

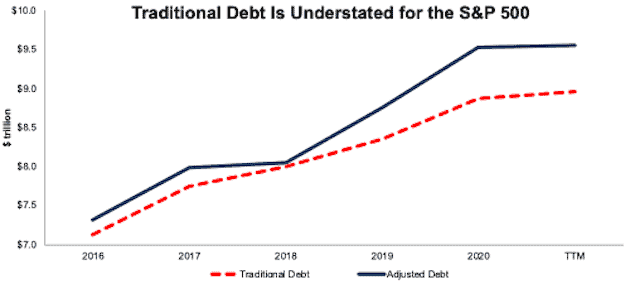

Unscrubbed Total Debt Is Understated for the S&P 500

We use total debt as the denominator for the FCF to Debt ratio. Our Adjusted Total Debt provides a more complete view of the fair value of a firm’s total short-term, long-term, and off-balance sheet debt. Over the trailing twelve months (TTM), Traditional Total Debt is understated by $595 billion, or 7% of Traditional Total Debt.

Figure 2: Traditional Vs. Adjusted FCF to Debt for S&P 500

Sources: New Constructs, LLC and company filings.

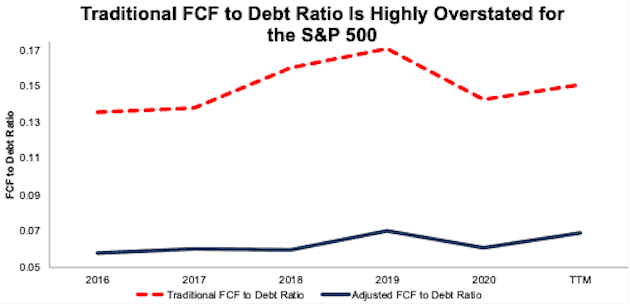

Inflated Numerators + Deflated Denominators = Overstated Ratios

Better inputs yield better outputs. After reviewing Figures 1 and 2, we are not surprised to see in Figure 3 how much higher the Traditional FCF to Debt ratio is compared to our Adjusted version. In the TTM, the Traditional FCF to Debt ratio is more than twice the Adjusted FCF to Debt ratio.

Figure 3: Traditional Vs. Adjusted FCF to Debt Ratio for S&P 500

Sources: New Constructs, LLC and company filings.

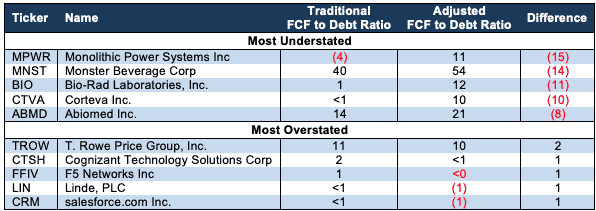

The Five Most Under/Overstated FCF to Debt Ratios in the S&P 500

Given the large difference we see in the results at the aggregate level, we are not surprised to see very large differences at the individual company level. Figure 4 lists ten S&P 500 companies with most understated and overstated FCF to Debt ratios, by total difference over the TTM.

Note: we detail the data and disclosures that drive the differences in Traditional versus Adjusted FCF and Debt for Monolithic Power Systems’ (MPWR) and T. Rowe Price Group’s (TROW) in the Appendix to this report.

Figure 4: Select Companies with Under/Overstated FCF to Debt: TTM

Sources: New Constructs, LLC and company filings.

Ratings Based on Traditional Ratios Are Misleading

Not surprisingly, these large differences between Traditional and Adjusted ratios drive large differences in the Credit Ratings we derive for FCF to Debt.

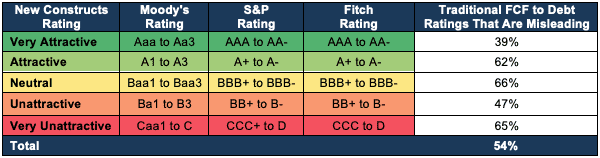

Figure 5 shows how our Credit Ratings align with legacy firms’ ratings systems and the percentage of Traditional FCF to Debt ratings that are different from ratings based on Adjusted ratios for companies in the S&P 500. Overall, 54% of the Traditional FCF to Debt ratings are different from our Adjusted FCF to Debt rating because they rely on unscrubbed data.

As we explain in our Credit Ratings methodology, we set the FCF to Debt ratio thresholds so that the distribution of our ratings is comparable to the distribution of ratings for legacy firms. We use the Traditional version of the FCF to Debt ratio to set thresholds so that the difference in our ratings comes from the difference in our data.

Figure 5: S&P 500[3]: Percent of Traditional FCF to Debt Ratings that Are Misleading

Sources: New Constructs, LLC and company filings.

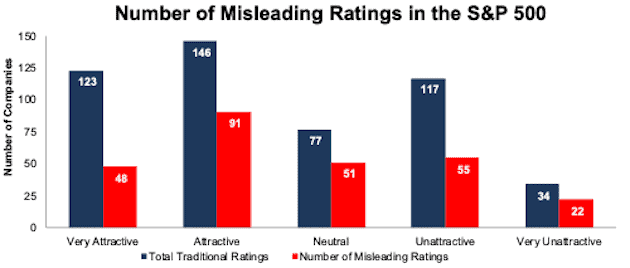

Figure 6 provides more details on the number of companies whose Traditional FCF to Debt ratings are different from the rating based on Adjusted FCF to Debt ratios.

For example, 48 out of 123 (39%) companies that earn a Very Attractive FCF to Debt rating based on the Traditional ratio earn a different rating based on the Adjusted ratio.

Figure 6: S&P 500[4]: Number of Misleading Traditional FCF to Debt Ratings

Sources: New Constructs, LLC and company filings.

We dedicate the Appendix of this report to showing readers exactly how our Adjusted values for FCF and total debt are different and better than the unscrubbed versions.

This article originally published on June 21, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Auditing the Differences in Traditional Vs. Adjusted Values

This Appendix will show exactly how our Adjusted values for FCF and debt differ from the Traditional versions for two companies Monolithic Power Systems and T. Rowe Price.

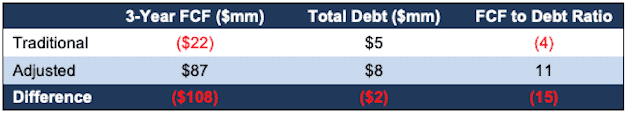

Monolithic Power Systems: The Difference in Traditional Vs. Adjusted Values

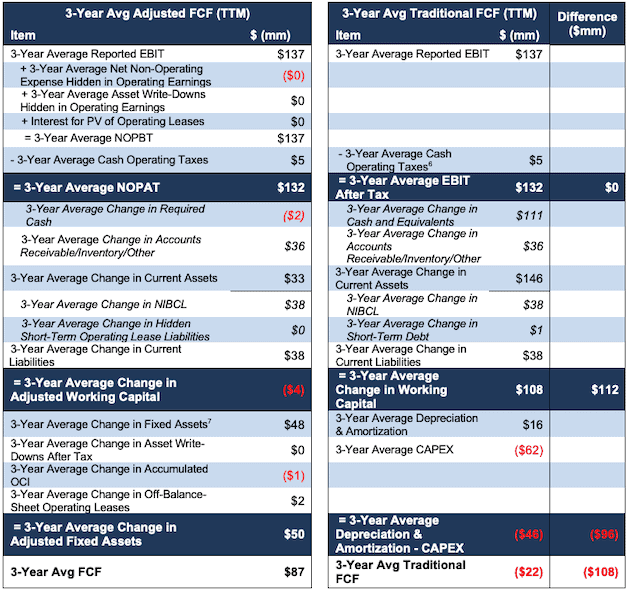

Figure 7 shows the differences between the two components of the FCF to Debt ratio, 3-year average FCF and total debt for Monolithic Power Systems (MPWR). The difference between Monolithic Power Systems’ Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF is -$108 million, or 499% of Traditional 3-Year Average FCF. The difference between Traditional Total Debt and Adjusted Total Debt is $2 million, or 46% of Traditional Total Debt.

Figure 7: Monolithic Power Systems: Traditional Vs. Adjusted FCF to Debt Components

Sources: New Constructs, LLC and company filings.

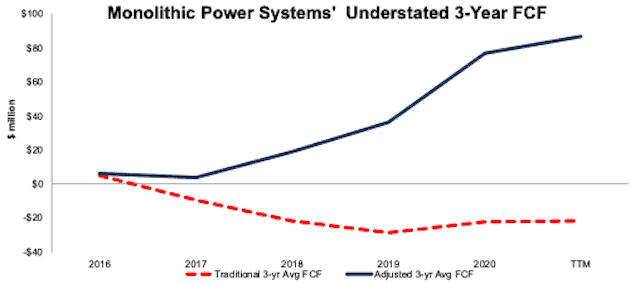

Reconciling Monolithic Power Systems’ Traditional and Adjusted 3-Year Average FCF

The primary driver of Monolithic Power Systems’ understated FCF to Debt ratio is understated 3-year average FCF. Figure 8 shows the firm’s Traditional and Adjusted 3-Year Average FCF have diverged since 2016.

Figure 8: Monolithic Power Systems: Traditional Vs. Adjusted 3-Year Average FCF: 2016-TTM

Sources: New Constructs, LLC and company filings.

The differences between Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF are driven by the differences between:

- NOPAT and EBIT after tax

- change in net working capital vs. change in adjusted net working capital, and

- the change in adjusted fixed assets[5] vs. depreciation and amortization - CAPEX.

For Monolithic Power Systems, those differences are:

- The difference between NOPAT and EBIT after tax is $0.

- The difference between change in net working capital and adjusted net working capital is $112 million.

- The difference between change in adjusted fixed assets vs. depreciation and amortization - CAPEX is -$96 million.

Figure 9 reconciles Monolithic Power Systems’ Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF and details each of the differences listed above.

Figure 9: Monolithic Power Systems: 3-Year Average Adjusted Vs. Traditional FCF Detailed Comparison

Sources: New Constructs, LLC and company filings.

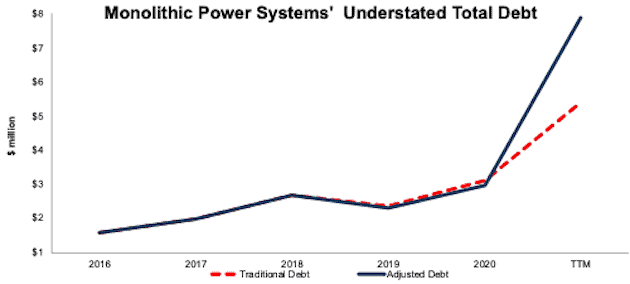

Reconciling Monolithic Power Systems’ Traditional and Adjusted Total Debt

Figure 10 compares Monolithic Power Systems’ Traditional Debt and Adjusted Debt since 2016. The difference over the TTM between the reported net present value (NPV) of operating lease liability of $5.4 million and our adjusted NPV of operating lease liability of $7.9 million drives the -$2.5 million difference between Monolithic Power Systems’ Traditional and Adjusted Total Debt.

Figure 10: Monolithic Power Systems: Traditional Vs. Adjusted Total Debt: 2016-TTM

Sources: New Constructs, LLC and company filings.

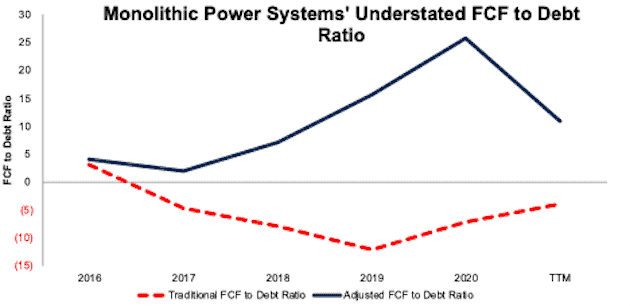

Monolithic Power Systems’ FCF to Debt Ratio Is Understated

With understated 3-year FCF and total debt, Monolithic Power Systems FCF to Debt ratio has the largest difference between Traditional and Adjusted of all companies in the S&P 500. Per Figure 11, Monolithic Power Systems’ FCF to Debt has been largely understated since 2017.

Figure 11: Monolithic Power Systems: Traditional Vs. Adjusted FCF to Debt Ratio: 2016-TTM

Sources: New Constructs, LLC and company filings.

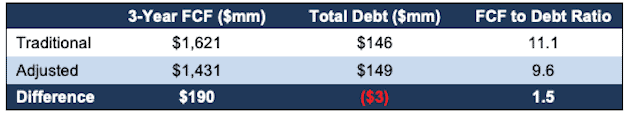

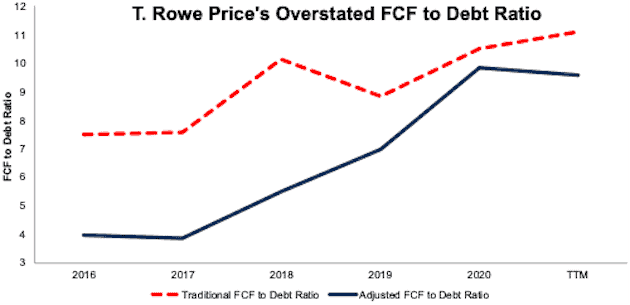

T. Rowe Price: The Difference in Traditional Vs. Adjusted Values

Figure 12 shows the difference between T. Rowe Price’s Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF is $190 million, or 12% of Traditional 3-Year Average FCF. The difference between Traditional Total Debt and Adjusted Total Debt is -$3 million, or just -2% of Traditional Total Debt.

Figure 12: T. Rowe Price: Traditional Vs. Adjusted FCF to Debt Components

Sources: New Constructs, LLC and company filings.

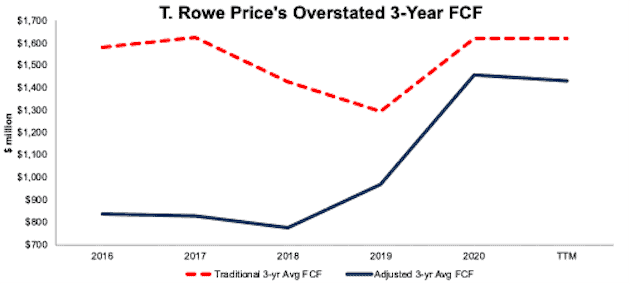

Reconciling T. Rowe Price’s Traditional and Adjusted 3-Year Average FCF

Nearly all the difference between T. Rowe Price’s Traditional and Adjusted FCF to Debt ratio is driven by the difference between its Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF, which is illustrated in Figure 13.

Figure 13: T. Rowe Price: Traditional Vs. Adjusted 3-Year Average FCF: 2016-TTM

Sources: New Constructs, LLC and company filings.

The following is a summary of the differences when calculating T. Rowe Price’s TTM Adjusted 3-Year Average FCF:

- The difference between NOPAT and EBIT after tax is -$5 million.

- The difference between change in net working capital and adjusted net working capital is $0.

- The difference between change in adjusted fixed assets[8] vs. depreciation and amortization - CAPEX is -$232 million.

Figure 14 reconciles T. Rowe Price’s Traditional 3-Year Average FCF and Adjusted 3-Year Average FCF and details each of the differences listed above.

Figure 14: T. Rowe Price: 3-Year Average Adjusted Vs. Traditional FCF Detailed Comparison

Sources: New Constructs, LLC and company filings.

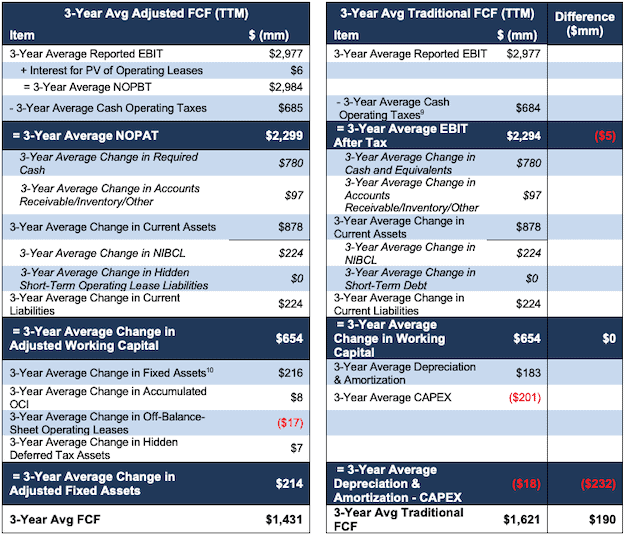

Reconciling T. Rowe Price’s Traditional and Adjusted Total Debt

Figure 15 shows T. Rowe Price’s Traditional Debt and Adjusted Debt since 2016. The difference over the TTM between T. Rowe Price’s reported NPV of operating lease liability of $146 million and our adjusted NPV of operating lease liability of $149 million drives the -$3 million difference between its Traditional and Adjusted Total Debt.

Figure 15: T. Rowe Price: Traditional Vs. Adjusted Total Debt: 2016-TTM

Sources: New Constructs, LLC and company filings.

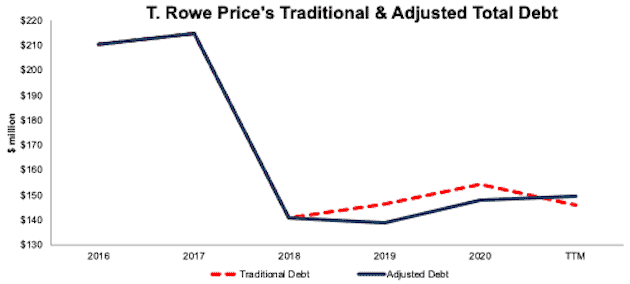

T. Rowe Price’s FCF to Debt Ratio Is Overstated

T. Rowe Price’s Traditional FCF to Debt ratio rose from 10.5 in 2020 to 11.1 TTM, while its Adjusted FCF to Debt ratio fell from 9.9 to 9.6 over the same time. Per Figure 16, T. Rowe Price’s Traditional FCF to Debt ratio has been overstated since 2016.

Figure 16: T. Rowe Price: Traditional Vs. Adjusted FCF to Debt Ratio: 2016-TTM

Sources: New Constructs, LLC and company filings.

[1] We calculate the S&P 500 Traditional and Adjusted 3-Year Average FCF by aggregating the results for all current members of the S&P 500.

[2] In this analysis, we use the 494 companies for which we have data back to 2016 and are currently in the S&P 500.

[3] Due to a lack of a sufficient number of available filings to calculate a Traditional FCF to Debt ratio over the TTM, we exclude Amcor Plc (AMCR), Carrier Global Corp (CARR), and Otis Worldwide Corp (OTIS) from this analysis.

[4] Due to a lack of a sufficient number of available filings to calculate a Traditional FCF to Debt ratio over the TTM, we exclude Amcor Plc (AMCR), Carrier Global Corp (CARR), and Otis Worldwide Corp (OTIS) from this analysis.

[5] The Adjusted FCF used in our Credit Ratings accounts for the impact of acquisitions on the firm’s fixed assets. Over the TTM, however, Monolithic Power Systems’ 3-year average Adjusted FCF equals its 3-year average Adjusted FCF excluding acquisitions.

[6] We calculate the Cash Operating Taxes applied to Reported EBIT and NOPBT using the same cash operating tax rate.

[7] Fixed assets include Net Property, Plant, and Equipment, Goodwill, net, Net Other Intangibles, Long-term Restricted Cash, and Other Fixed Assets.

[8] The Adjusted FCF used in our Credit Ratings accounts for the impact of acquisitions on the firm’s fixed assets. Over the TTM, T. Rowe Price’s 3-year average Adjusted FCF of $1,431 million is equal to its 3-year average Adjusted FCF excluding acquisitions.

[9] We calculate the Cash Operating Taxes applied to Reported EBIT and NOPBT using the same cash operating tax rate.

[10] Fixed assets include Net Property, Plant, and Equipment, Goodwill, net, Net Other Intangibles, Unconsolidated Subsidiary Assets, and Other Fixed Assets.