Twenty seven new stocks made our Most Attractive list this month, while nineteen new stocks joined the Most Dangerous list. We published March’s Most Attractive and Most Dangerous stocks to members on March 2, 2023.

February Performance Recap

Our Most Attractive Stocks (-1.1%) outperformed the S&P 500 (-5.0%) last month by 3.9%. The best performing large cap stock gained 12% and the best performing small cap stock was up 17%. Overall, 28 out of the 40 Most Attractive stocks outperformed the S&P 500.

Our Most Dangerous Stocks (-4.2%) underperformed the S&P 500 (-5.0%) as a short portfolio last month by 0.8%. The best performing large cap short stock fell by 24% and the best performing small cap short stock fell by 42%. Overall, 19 out of the 40 Most Dangerous stocks outperformed the S&P 500 as shorts.

The Most Attractive/Most Dangerous Model Portfolios outperformed as an equal-weighted long/short portfolio by 3.1%.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

All of our Most Attractive stocks have high (and rising) return on invested capital (ROIC) and low price to economic book value ratio. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stocks Feature for March: Synchrony Financial (SYF: $29/share)

Synchrony Financial is the featured stock from March’s Most Attractive Stocks Model Portfolio.

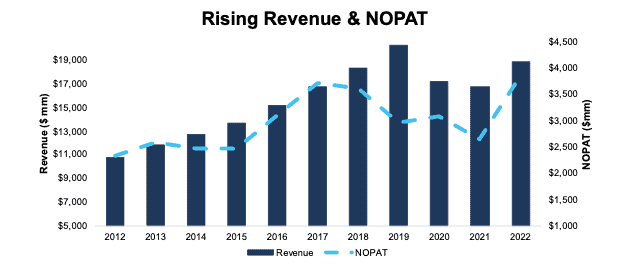

Synchrony Financial has grown revenue by 6% compounded annually and net operating profit after tax (NOPAT) by 5% compounded annually since 2012. Synchrony’s NOPAT margin increased from 15% in 2019 to 21% in 2022, while invested capital turns fell slightly from 1.0 to 0.9 over the same time. Rising NOPAT margins are enough to drive Synchrony Financial’s return on invested capital (ROIC) from 14% in 2019 to 19% in 2022.

Figure 1: Synchrony Financial Revenue and NOPAT Since 2012

Sources: New Constructs, LLC and company filings

Synchrony Financial Is Undervalued

At its current price of $29/share, SYF has a price-to-economic book value (PEBV) ratio of 0.3. This ratio means the market expects Synchrony’s NOPAT to permanently decline by 70%. This expectation seems overly pessimistic for a company that has grown NOPAT by 9% compounded annually since 2019 and 5% compounded annually since 2012.

Even if Synchrony’s NOPAT margin falls to 10% (from a five-year average of 18%) and the company grows revenue by just 2% compounded annually for the next decade, the stock would be worth $44+/share today – a 52% upside. In this scenario, Synchrony Financial’s NOPAT would fall 5% compounded annually over the next ten years. See the math behind this reverse DCF scenario. Should Synchrony Financial grow profits more in line with historical levels, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Synchrony Financial’s 10-Qs and 10-Ks:

Income Statement: we made $888 million in adjustments, with a net effect of removing $888 million in non-operating expenses (5% of revenue). Clients can see all adjustments made to Synchrony Financial’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $11.7 billion in adjustments to calculate invested capital with a net increase of $8.0 billion. One of the most notable adjustments was $9.5 billion in adjustments for total reserves. This adjustment represents 74% of reported net assets. Clients can see all adjustments made to Synchrony Financial’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $897 million in adjustments, all of which decreased shareholder value. The most notable adjustment was $734 million in the fair value of preferred capital. This adjustment represents 6% of Synchrony Financial’s market value. Clients can see all adjustments to Synchrony Financial’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

Most Dangerous Stocks Feature: Koss Corp (KOSS: $5/share)

Koss Corp (KOSS) is the featured stock from March’s Most Dangerous Stocks Model Portfolio. We put Koss in the Danger Zone in May 2021 during the midst of its meme stock rally. Since then, the stock has fallen 75% while the S&P is down 5%. We still consider the stock to be Very Unattractive.

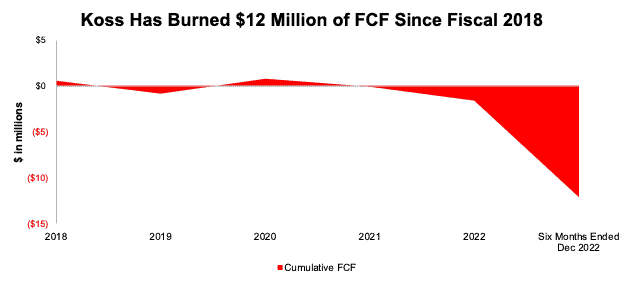

Koss’s revenue, NOPAT margin and ROIC have steadily declined in the past few years, despite the meme stock craze that drove KOSS to a high of $64/share in 2021. Koss’s revenue fell from $24 million in fiscal 2018 to $15 million over the TTM. Over the same time, Koss’s NOPAT margin fell from -1% to -11%, while invested capital turns fell from 1.8 to 1.0. Falling NOPAT margins and invested capital turns drive Koss’s ROIC from -1% in fiscal 2018 to -11% over the TTM. Since fiscal 2018, Koss has burned $12 million in free cash flow (FCF), which amounts to 35% of enterprise value. See Figure 2.

Figure 2: Koss Corp FCF since 2018

Sources: New Constructs, LLC and company filings

Koss Provides Poor Risk/Reward

Despite its poor fundamentals, Koss’s stock is priced for significant profit growth, and we believe the stock is overvalued.

To justify its current price of $5/share, Koss must improve its NOPAT margin to 7% (compared to -11% in the TTM) and grow revenue by 5.5% compounded annually for the next 10 years. See the math behind this reverse DCF scenario. Given that Koss’ revenue has fallen 9% compounded annually since 2018 and NOPAT has been negative in all but one year in that time period, we think these expectations are overly optimistic.

Even if Koss improves its NOPAT margin to 3% and grows revenue by 3% compounded annually for the next decade, the stock would be worth no more than $2/share today – a 60% downside to the current stock price. See the math behind this reverse DCF scenario.

Each of these scenarios also assumes Koss can grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate the high expectations embedded in the current valuation.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in Koss’s 10-Qs and 10-Ks:

Income Statement: we made less than $1 million in adjustments, with a net effect of removing <$1 million in non-operating income (2% of revenue). Clients can see all adjustments made to Koss’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $17 million in adjustments to calculate invested capital with a net decrease of $13 million. One of the most notable adjustments was $2 million in adjustments for total reserves. This adjustment represented 7% of reported net assets. Clients can see all adjustments made to Koss’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $23 million in adjustments, with a net increase to shareholder value of $8 million. The most notable adjustment to shareholder value was $15 million in excess cash. This adjustment represents 35% of Koss’s market value. Clients can see all adjustments to Koss’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on March 17, 2023.

Disclosure: David Trainer, Kyle Guske II, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.