The majority of mutual fund managers pick stocks using flawed accounting-based metrics such as price-to-earnings ratios, return on equity, or accounting book value that have little-to-no correlation with shareholder value. We’ve long argued (and proven empirically) that there is a much stronger correlation between improving return on invested capital (ROIC)[1] and increasing shareholder value.

We analyze[2] these metrics for all the holdings of over 7,500 U.S. ETFs and mutual funds daily to identify which fund managers put their analytical money where their mouth is. Occasionally, we come across a fund whose managers look beyond accounting earnings in their investment strategy. This week we are featuring one such fund, the Deutsche DWS Cash Return on Capital Invested (CROCI) Equity Dividend Fund (KDHCX and other share classes), as this week’s Long Idea.

Backwards Looking Research Underrates this Fund

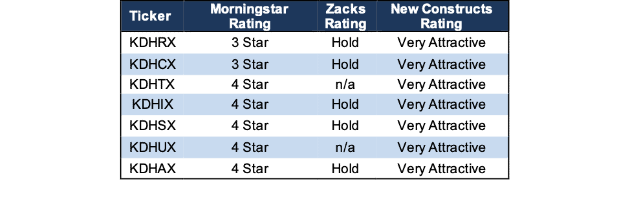

Despite outperforming its benchmark, the iShares Russell 1000 Value ETF (IWD) over the past 1-year, 3-year, and 5-year period, certain share classes of the Deutsche DWS CROCI Equity Dividend Fund receive a 3-Star rating from Morningstar and a Hold rating from Zacks.

As we know, though, past performance does not predict future results. Research from Morningstar itself recently showed that there’s almost no difference in the long-term returns of 3-star vs. 5-star funds.

Figure 1: Deutsche DWS CROCI Equity Dividend Fund Ratings

Sources: New Constructs, LLC, Morningstar, and Zacks

Instead of looking at past performance, we analyze funds based on their holdings. When viewed through our Predictive Risk/Reward Fund Rating methodology, all share classes earn a Very Attractive rating. Higher quality holdings and lower average costs mean Deutsche DWS CROCI Equity Dividend Fund is more likely to outperform moving forward, which is something traditional fund research can’t tell you.

Investment Philosophy Recognizes Limitations of Accounting Data

Deutsche DWS CROCI Equity Dividend managers use an investment philosophy that recognizes the flawed nature of accounting earnings. From the fund’s summary prospectus:

The CROCI Investment Process is based on the belief that the data used in traditional valuations (i.e., accounting data) does not accurately appraise assets, reflect all liabilities or represent the real value of a company. This is because the accounting rules are not always designed specifically for investors and often utilize widely differing standards which can make measuring the real asset value of companies difficult.

Furthermore, management uses the “CROCI economic price to earnings ratio” to value firms. The economic P/E ratio uses enterprise value/invested capital (a cleaner version of price-to-book) as the numerator and CROCI as the denominator. From the fund’s prospectus, this ratio “seeks to measure the “real” economic value rather than the “accounting” value of a company’s invested capital, and the economic returns thereof.”

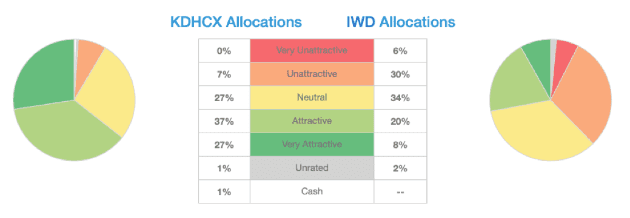

This investment process, along with a focus on “above average and sustainable dividend yield”, helps management pick higher quality stocks and avoid riskier stocks compared to its peers. Figure 2 shows that KDHCX allocates a significantly higher percentage of its assets to Attractive-or-better rated stocks and a significantly lower percentage to Unattractive-or-worse rated stocks than its benchmark.

Figure 2: KDHCX Allocates Capital to Superior Holdings

Sources: New Constructs, LLC and company filings

Per Figure 2, KDHCX allocates 59% of its assets to Attractive-or-better rated stocks compared to just 28% for IWD. On the flip side, KDHCX allocates 7% of its assets to Unattractive rated stocks (and 0% to Very Unattractive stocks) compared to 36% for IWD.

Given this favorable allocation relative to the benchmark, KDHCX appears well-positioned to capture more upside with lower risk. Compared to the average mutual fund, KDHCX and the other share classes have a much better chance of generating the outperformance required to justify fees.

Superior Stock Selection Drives Superior Risk/Reward

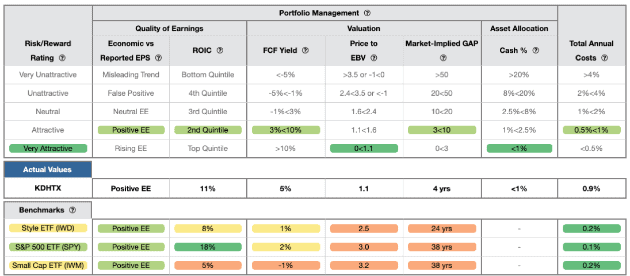

With a focus on economic value and cash return on capital invested, one would expect KDHCX’s managers to excel at finding higher-quality companies (as measured by ROIC) with lower-risk valuation. Per Figure 3, they do just that.

Figure 3 contains our detailed rating for KDHCX, which includes each of the criteria we use to rate all funds under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of a fund’s holdings equals the performance of a fund after fees.

Figure 3: Deutsche DWS CROCI Equity Dividend Fund (KDHTX) Rating Breakdown

Sources: New Constructs, LLC and company filings

As Figure 3 shows, KDHCX’s holdings are superior to IWD in four of the five criteria that make up our holdings analysis (and equal in the other):

- KDHCX’s return on invested capital (ROIC) is 11%, which is greater than the 8% earned by IWD.

- KDHCX’s free cash flow yield of 5% is five times that of IWD (1%) and greater than the S&P 500 (SPY) at 2%.

- The price to economic book value (PEBV) ratio for KDHCX is 1.1, which is less than the 2.5 for IWD holdings and the 2.9 of SPY holdings.

- Our discounted cash flow analysis reveals an average market implied growth appreciation period (GAP) of just four years for KDHCX’s holdings compared to 24 years for IWD and 37 years for SPY.

The stocks held by KDHCX generate superior cash flows compared to IWD, yet the market expects stocks held by IWD to grow profits by more than double that of KDHCX stocks.

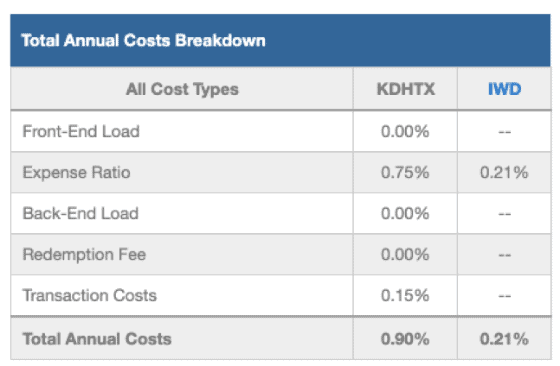

Below Average Costs Benefit Investors

Not only does DWS CROCI Equity Dividend Fund offer high-quality stock selection, it does so at a reasonable price. Three of the fund’s share classes have total annual costs below the Large Cap Value mutual fund average of 1.60% and the asset-weighted average of 1.27%. KDHTX, which is the cheapest of the classes, has total annual costs of 0.90%, which makes it cheaper than 77% of the 885 Large Cap Value mutual funds that we cover. Other share classes, such as KDHUX, KDHAX, and KDHCX have above-average total annual costs. However, these share classes justify higher fees through superior holdings. Figure 4 shows our breakdown of KDHTX’s total annual costs, which is available for all of the 7,500+ mutual funds under coverage.

Figure 4: Deutsche DWS CROCI Equity Dividend Fund (KDHTX) Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

Quality Dividends in KDHCX’s Holdings

The 40 stocks in KDHCX’s portfolio have an average dividend yield of 3.2%, which is greater than IWD’s 2.2% dividend yield and the SPY’s 1.9% dividend yield. Beyond a higher yield, we know that some of these dividends are among the safest in the market, and have a strong potential to grow. Seven of KDHCX’s 40 holdings are also in either our Safest Dividend Yields or Dividend Growth Stocks Model Portfolio.

The CROCI Methodology Could Still Be Better

While the CROCI stock picking method is focused on the right metrics (unlike many value funds), it is still limited in its scope. From the fund’s prospectus, the CROCI coverage universe was limited to 374 companies as of December 31, 2018. With a limited coverage universe KDHCX’s managers are missing out on quality investments that could replace some of the lower-rated stocks currently in the fund’s portfolio.

By leveraging our Robo-Analyst technology, we cover nearly 3,000 stocks, which gives us unique insights into the true economic profitability and valuation on a larger group of stocks. This wider coverage universe reveals that there are better alternatives to some of the stocks held by KDHCX.

For instance, Genuine Parts Company (GPC), which earns our Neutral rating, is one of the few Neutral-or-worse rated Consumer Cyclicals stocks held by KDHCX. Its dividend yield of 3.1% is above the average of the S&P 500.

However, its ROIC has fallen from 9% in 2017 to 8% TTM. Worse, its free cash flow sits at -$173 million TTM, which gives the stock a -1% FCF yield. Negative FCF, should it persist, limits the ability of any firm to pay and grow its dividend.

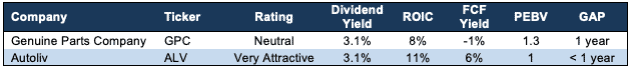

Figure 5: ALV Is A Better Pick than GPC

Sources: New Constructs, LLC and company filings

Another red flag, GPC’s auditor Ernst & Young, noted in the firm’s 2018 10-K that “Genuine Parts and Company has not maintained effective internal control over financial reporting as of December 31, 2018.” Such an opinion raises the risks of investing in GPC. We provide more details on weak internal controls here.

On the other hand, Autoliv (ALV), also an automotive parts manufacturer, earns our Very Attractive rating. The stock pays the same 3.1% dividend yield and has better fundamentals than GPC across the board. Per Figure 5, ALV’s ROIC and FCF yield are both higher than GPC, while its PEBV and market implied GAP are lower, which indicates that ALV’s earnings are stronger while its valuation is cheaper than GPC. These strong fundamentals and low valuation earn ALV a spot in our most recent Dividend Growth Stocks Model Portfolio.

We think ALV is a better pick than GPC. Luckily for investors, GPC appears to be an outlier in what is largely a strong portfolio.

The Importance of Holdings Based Fund Analysis

Smart fund (or ETF) investing means analyzing the holdings of each mutual fund. Failure to do so is a failure to perform proper due diligence. Simply buying a mutual fund or ETF based on past performance does not necessarily lead to outperformance. Only through holdings-based analysis can one determine if a fund’s managers are sticking to their stated methodology and are allocating to high-quality stocks, as KDHCX does.

However, most investors don’t realize they can already get the sophisticated fundamental research that Wall Street insiders use. Our Robo-Analyst technology analyzes the holdings of all 962 ETFs and mutual funds in the Large Cap Value style and 7,500+ ETFs and mutual funds under coverage to avoid “the danger within.” The number of holdings in these Large Cap Value ETFs and mutual funds varies from just 15 stocks to 1198 stocks in a given fund. Our diligence on holdings allows us to cut through the noise and find mutual funds, like Deutsche DWS CROCI Equity Dividend Fund, with a portfolio and methodology that suggests future performance will be strong.

This article originally published on September 18, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

[2] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.