This position closed when AQQPX was liquidated on May 5, 2020. A copy of the associated Position Update report is here.

We’ve long argued (and proven empirically) that there is a strong correlation between improving ROIC and increasing shareholder value. Nevertheless, the majority of mutual funds managers continue to pick stocks based on flawed metrics that show no correlation to shareholder value, such as price-to-earnings ratios, return on equity, or accounting book value.

We recommend avoiding funds with managers who consider accounting earnings as representative of “fundamentals”. Instead, look for managers that focus on return on invested capital (ROIC)[1].

Next, you should verify that the focus on ROIC is more than just a marketing ploy. The only way to ensure managers apply real diligence and rigor in ROIC research is to evaluate the ROICs of their holdings.

We analyze[2] the ROICs for all the holdings of over 7,500 U.S. ETFs and mutual funds daily to identify which fund managers put their analytical money where their mouth is. Occasionally, we come across a fund whose managers diligently leverage ROIC in their investment strategy. This week we are featuring one such fund, the American Beacon Alpha Quant Quality Fund (AQQPX), as this week’s Long Idea.

Insights You Can’t Get from Morningstar

American Beacon Alpha Quant Quality Fund does not receive a rating from Morningstar, and, therefore, won’t make the radar of many investors, advisors or their clients.

While it’s easy to pick a 5-Star fund from Morningstar, plenty of research shows, and even Morningstar admits, that such a strategy has risks and does not necessarily lead to outperformance. That strategy also means you may never know about funds, like AQQPX.

Doing the Diligence: Holdings Research Reveals Stock Selection Based on ROIC

AQQPX makes it clear in its prospectus that ROIC is the key metric to pick stocks, noting:

“Alpha Quant defines high-quality companies as large and mid-sized companies that display above market average profitability, as measured by return on invested capital.”

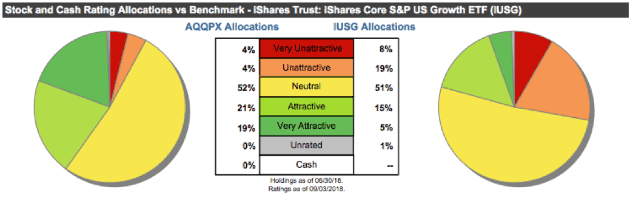

This focus helps AQQPX pick higher quality stocks and avoid riskier stocks compared to its peers. Figure 1 shows that AQQPX allocates a higher percentage of its assets to Attractive-or-better stocks and a lower percentage to Unattractive-or-worse stocks than its benchmark, the iShares Core S&P U.S. Growth ETF (IUSG).

Figure 1: AQQPX Asset Allocation Compared to IUSG

Sources: New Constructs, LLC and company filings

Per Figure 1, AQQPX allocates 40% of its assets to Attractive-or-better rated stocks compared to 20% for IUSG. More impressively, AQQPX allocates more than triple the amount (19% to 5%) to Very Attractive stocks. On the flip side, AQQPX allocates just 8% of its assets to Unattractive-or-worse rated stocks compared to 27% for IUSG.

Given this favorable allocation relative to the benchmark, Alpha Quant Quality Fund appears well positioned to capture more upside with lower risk. Compared to the average mutual fund, AQQPX has a much better chance of generating the outperformance required to justify its fees.

Superior Stock Selection Drive Superior Risk/Reward

AQQPX’s managers excel at finding higher-quality companies (as measured by ROIC) with lower-risk valuations.

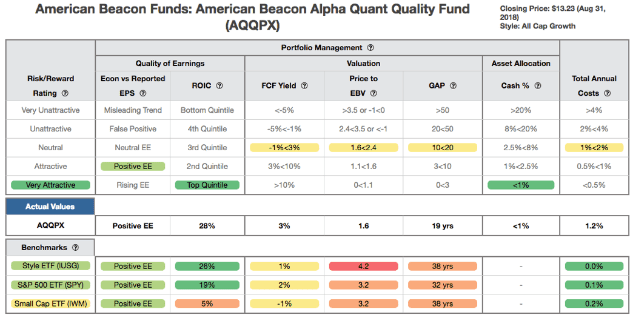

Figure 2 contains our detailed rating for AQQPX, which includes each of the criteria we use to rate all funds under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of a fund’s holdings equals the performance of a fund after fees.

Figure 2: Alpha Quant Quality Fund Rating Breakdown

Sources: New Constructs, LLC and company filings

As Figure 2 shows, AQQPX’s holdings are superior to IUSG in four out of the five criteria that make up our holdings analysis:

- The return on invested capital (ROIC) for AQQPX’s holdings is 28%, just above the 26% ROIC earned by companies held by IUSG and well above the 19% earned by companies held by SPY.

- The 3% free cash flow (FCF) yield of AQQPX’s holdings is greater than the 1% earned by IUSG and 2% earned by SPY stocks.

- The price to economic book value (PEBV) ratio for AQQPX is 1.6, while the PEBV ratio for IUSG is 4.2 and 3.2 for SPY.

- Our discounted cash flow analysis reveals an average market implied growth appreciation period (GAP) of 19 years for AQQPX holdings compared to 38 years for IUSG and 32 years for SPY.

The stocks held by AQQPX generate superior cash flows compared to IUSG, yet the market projects IUSG stocks to grow profits by a larger amount and for a longer period of time.

Understanding the Importance of ROIC Is a Competitive Advantage For these Managers

Because AQQPX’s managers understand that ROIC plays an important role in determining stock valuations, it’s no surprise that the fund’s holdings have superior ROICs. As noted in Alpha Quant’s investment philosophy, it believes quality companies need to create shareholder value and show excess returns. Alpha Quant believes that ROIC meets both these requirements and that “ROIC should be the goal of management, to generate the highest return on the capital invested in the business.”

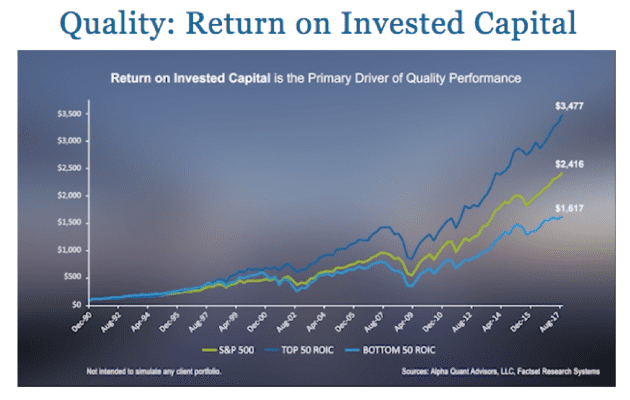

Like our own, Alpha Quant’s research also shows that ROIC drives excess returns. Per Figure 3, Alpha Quant’s research of the S&P 500 finds that the 50 companies with the highest ROIC outperform, while the 50 companies with the lowest ROIC underperform.

Figure 3: Alpha Quant Finds High ROIC Stocks Outperform

Sources: Alpha Quant Advisors

Deep Dive on a Top Holding

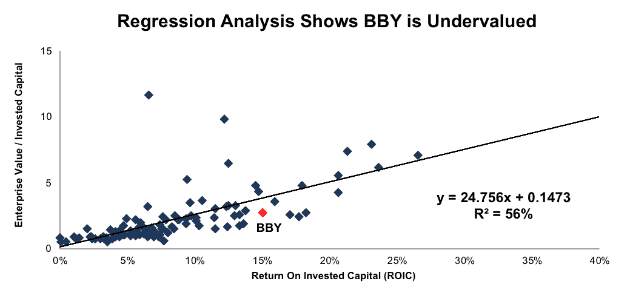

We can see how AQQPX’s methodology leads it to pick high-quality stocks by looking at one of its top holdings, Best Buy (BBY: $81/share), which accounts for ~4% of its portfolio.

BBY is a stock that many investors might screen out from the start due to the (incorrect but popular) narrative that Amazon will end this traditional retailer. However, its 15% ROIC puts it in the top quintile of all 2,800+ companies under our coverage, while the low expectations baked into its stock price earn it our Very Attractive rating. We featured the excellent risk/reward of this stock in “Rising from the Ashes to Lead a New Retail Paradigm.”

Figure 4 compares BBY to the 121 retailers under coverage on the basis of ROIC and enterprise value/invested capital (a cleaner version of price to book). BBY’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 4.

Figure 4: ROIC Explains 56% of Valuation for Retailers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $119/share – a 50% upside to the current stock price.

By utilizing ROIC as part of its methodology, AQQPX is able to identify highly profitable companies trading at large discounts to their fair value.

Low Costs Benefit Investors

Not only does AQQPX offer high-quality stock selection, it does so at a reasonable price. The fund’s total annual costs of 1.20% make it cheaper than 58% of the 509 All Cap Growth ETFs and mutual funds that we cover and cheaper than 62% of all funds under coverage. Its costs are also below the All Cap Growth style average of 1.67% and the cap-weighted average of 1.46%.

Most Investors Miss This Fund

Despite its low costs and high-quality holdings, AQQPX has just $2 million in assets, which makes it the smallest All Cap Growth style fund we cover.

As we’ve written before, investors are good at finding cheap funds, but not as good at identifying funds with high-quality holdings. In fact, most investors do not realize they can get high-quality research on fund holdings and are content with investing based on past performance. If investors focused more on ROIC and, more specifically, on finding funds that pick stocks based on ROIC, we believe more would flock to this gem of a fund.

This article originally published on September 5, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.