Volatility reminiscent of the meme stock phenomenon of 2021 is grabbing the headlines. Shares of department store Kohl’s (KSS) surged nearly 90% before plunging more than 25% – all within the same day on July 22. Opendoor (OPEN) surged from $1/share to $5/share and back down to $2/share, all within the past week. While these new meme stocks steal the spotlight, 2Q25 earnings season is picking up steam after banks kicked it off.

With so much happening at once, it’s easy for investors to get swept up in the noise. These are the times when discipline and clarity matter most. Staying grounded in fundamentals, not chasing momentum or headlines, is essential.

Our mission is to equip investors with rigorous, transparent, and reliable research so they can cut through the chaos and make more confident, better-informed investment decisions. The superiority of our research is proven by the outperformance of the Bloomberg indices based on our research.

Our latest Long Idea is a great example of the edge that our superior fundamental research provides. This company is an industry leader, properly aligns executives’ interests with shareholders’ interests, provides high yield backed by ample cash flows, and its stock looks undervalued.

We originally made Korn Ferry (KFY: $74/share) a Long Idea in February 2020 and reiterated our bullish opinion on it in January 2021. Since our original report, the stock is up slightly less than the S&P 500 even as the business grew on both the top and bottom line. We’re here to remind investors that KFY remains cheap and still provides quality risk/reward.

KFY offers favorable Risk/Reward based on the company’s:

- competitive advantages from its proprietary data,

- industry leading profitability,

- consistent revenue and profit growth,

- quality shareholder return backed by strong cash flows, and

- cheap stock valuation.

What’s Working

Proprietary Intellectual Property and Dataset Provides an Edge

Korn Ferry’s key competitive advantage comes from its comprehensive people and pay dataset. The company leverages and monetizes its dataset throughout each of its business segments to offer a more comprehensive solution to clients at scale. Korn Ferry has expanded and improved its dataset at a rapid pace over the last five years.

In fiscal 2Q20, the company’s proprietary dataset included 4 billion individual data points, 69 million assessments, compensation data for 20 million people, and organizational benchmark data on 12,000 firms.

As of fiscal 4Q25, and after the acquisition of both Salo and Trilogy International, the company’s dataset includes 10+ billion individual data points, 108 million assessments, compensation data for 28 million people, and organizational benchmark data on 31,000 firms.

As more firms recognize the importance of specialized high quality data, Korn Ferry’s proprietary dataset has even more value.

Diversified Industry Leader

Korn Ferry’s business is diversified both operationally and geographically. Korn Ferry operates five business segments in more than 50 countries:

- Consulting (24% of fee revenue in fiscal 2025): helps clients design and implement the talent strategies, organizational structures, and workforce capabilities and rewards to drive growth.

- Digital (13% of fee revenue): leads the development, integration, and commercialization of products in the Korn Ferry Talent Suite, and enables technology across Korn Ferry’s other solution areas.

- Executive Search (31% of fee revenue): delivers industry-leading recruitment across global markets. The company helps organizations recruit and retain board-level, C-suite, and senior executive talent.

- Professional Search & Interim (18% of fee revenue): help clients rapidly place permanent professionals and senior/professional interim leaders across business-critical functions such as Finance and Accounting, IT, HR, and Operations.

- Recruitment Process Outsourcing (RPO) (13% of fee revenue): provides high-volume, outsourced hiring solutions that deliver end-to-end talent acquisition services for enterprise clients.

Forbes ranks Korn Ferry the #1 executive recruiting firm and the #4 professional recruiting firm in the U.S. in 2025.

Fee Revenue Picking Back Up

After a slowdown in the hiring and consulting industry over the last two years, Korn Ferry is returning to growth in recent quarters. Korn Ferry grew its “new business”, which represents new contracts, not changes in scope on existing contracts, 1% and 5% YoY on a constant currency basis in fiscal 3Q25 and fiscal 4Q25, respectively.

In fiscal 4Q25, the company grew fee revenue YoY in four of its five operating segments. Overall, the company’s total fee revenue grew 4% YoY on a constant currency basis in fiscal 4Q25.

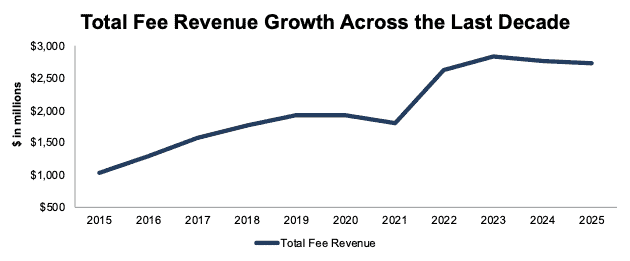

Additionally, Korn Ferry has a long track record of growing its fee revenue, which emphasizes the sustainability and cross selling capabilities of its platform. Korn Ferry’s total fee revenue grew 10% and 9% compounded annually over the last 10 years and 20 years, respectively.

Figure 1: Korn Ferry’s Total Fee Revenue: Fiscal 2015 – Fiscal 2025

Sources: New Constructs, LLC and company filings

Further Growth Opportunities Abound

Korn Ferry enjoys strong tailwinds from the growth in its industry.

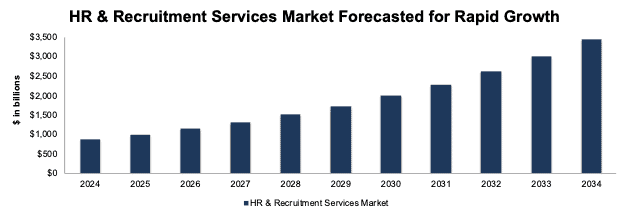

Fact.MR forecasts the overall HR & recruitment services market will grow 15% compounded annually from 2024 to 2034. More specifically, these segments of the market are projected to grow by the following rates:

- Management consulting market is forecasted to grow 5% compounded annually from 2025 to 2032.

- Digital talent acquisition market is forecasted to grow 10% compounded annually from 2025 to 2030.

- RPO market is forecasted to grow 15% compounded annually from 2025 to 2033.

- Executive search market is forecasted to grow 6% from 2024 to 2032.

Figure 2: Global HR & Recruitment Services Market Forecast From 2024 Through 2034

Sources: Fact.MR, and New Constructs, LLC

Top- and Bottom-Line Growth Across Decades

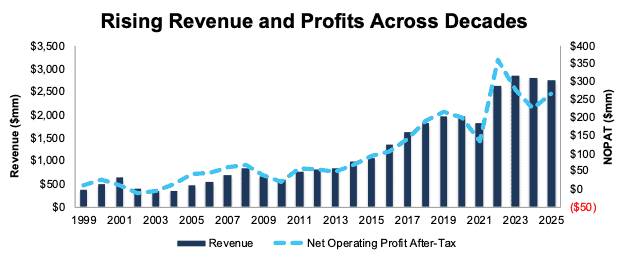

Korn Ferry has grown revenue and net operating profit after-tax (NOPAT) by 8% and 13% compounded annually since fiscal 1999, respectively. See Figure 3.

More recently, the company improved its NOPAT margin from 8.6% in fiscal 2015 to 9.7% in fiscal 2025 while invested capital turns remained the same at 1.4 over the same time. Rising NOPAT margins drive Korn Ferry’s return on invested capital (ROIC) from 12.3% in fiscal 2015 to 13.6% in fiscal 2025.

Additionally, the company’s Core Earnings, which is a cleaner and more accurate measure of a company’s earnings, grew 11% compounded annually from $82 million in fiscal 2015 to $228 million in fiscal 2025.

Figure 3: Korn Ferry’s Revenue and NOPAT: Fiscal 1999 – Fiscal 2025

Sources: New Constructs, LLC and company filings

Industry Leading Profitability

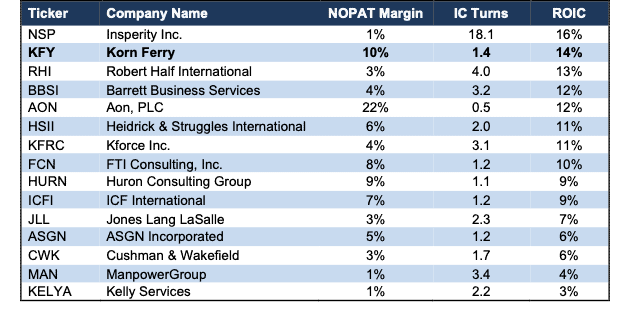

Korn Ferry is not only one of the top-ranked recruitment and consulting service providers, but it is also one of the most profitable. Per Figure 4, Korn Ferry has the second highest ROIC and NOPAT margin among publicly-traded peers listed in the company’s most recent proxy statement, which include Robert Half International (RHI), Cushman & Wakefield (CWK), ManpowerGroup (MAN), FTI Consulting (FCN), and more.

Figure 4: Korn Ferry’s Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

Corporate Governance Aligns with Shareholders’ Interests’

Korn Ferry doesn’t just advise clients how to build quality compensation and corporate governance, it applies those best practices to its own business as well. Specifically, Korn Ferry aligns its own executives’ pay with ROIC, the performance metric that is directly correlated with creating true shareholder value.

Korn Ferry outlines in its proxy statement that one of the most important metrics for its stockholders is “the Company’s ability to allocate and deploy capital effectively so that its return on invested capital exceeds the Company’s cost of capital.”

To ensure executives are held accountable to this key metric, Korn Ferry includes adjusted ROIC as one of four financial metrics used in determining executives’ annual cash incentives.

We think Korn Ferry could benefit further by removing some of the flawed metrics, such as adjusted EBITDA margin, from its compensation plan. However, as it stands, Korn Ferry’s use of ROIC puts its executive compensation plan ahead of many others and earns the company a spot in our latest Exec Comp Aligned with ROIC Model Portfolio.

Potential for 4.8% Yield

Since fiscal 2020, Korn Ferry has paid over $240 million (7% of market cap) in cumulative dividends and has increased its quarterly dividends from $0.10/share in fiscal 1Q20 to $0.48/share in fiscal 4Q25. The company’s current dividend, when annualized, provides a 2.6% yield.

Korn Ferry also returns capital to shareholders through share repurchases. From fiscal 2020-2025, Korn Ferry repurchased $457 million of shares. During fiscal 2025 alone, the company repurchased $89 million of shares.

The company has $94 million remaining under its current repurchase authorization. Should the company repurchase shares at its fiscal 2025 level in fiscal 2026, it would repurchase another $89 million of shares, which is 2.3% of the company’s current market cap. When combined, the dividend and share repurchase yield could reach 4.9%.

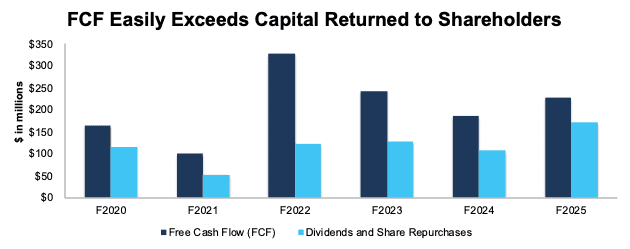

Strong Cash Flow Generation

We believe Korn Ferry will be able to continue funding its dividends and share repurchases because of its large free cash flow (FCF) generation. From fiscal 2020 through fiscal 2025, Korn Ferry generated $1.1 billion in FCF, which equals 35% of the company’s enterprise value. Over the same time, the company paid out $700 million in dividends and share purchases.

Figure 5: Korn Ferry’s Cumulative FCF: Fiscal 2020 – Fiscal 2025

Sources: New Constructs, LLC and company filings

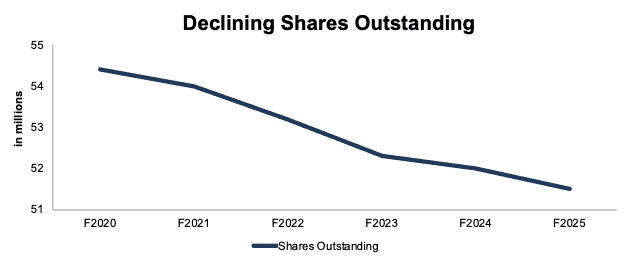

Korn Ferry’s repurchases have also meaningfully reduced its shares outstanding from 54.4 million in fiscal 2020 to 51.5 million in fiscal 2025. See Figure 6.

Figure 6: Korn Ferry’s Shares Outstanding: Fiscal 2020 – Fiscal 2025

Sources: New Constructs, LLC and company filings

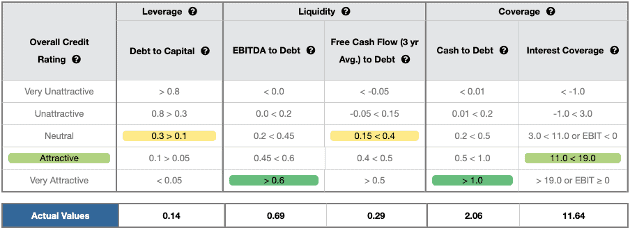

Strong Balance Sheet to Weather Uncertainty

In addition to strong profitability and cash flow generation, Korn Ferry also earns an Attractive overall Credit Rating. The company earns an Attractive-or-better rating in three of the five credit rating metrics.

Even if economic conditions deteriorate, or the current economic downcycle persists longer than expected, the company’s strong financial footing secures its operations for the foreseeable future.

Figure 7: Korn Ferry’s Credit Rating Details

Sources: New Constructs, LLC and company filings

What’s Not Working

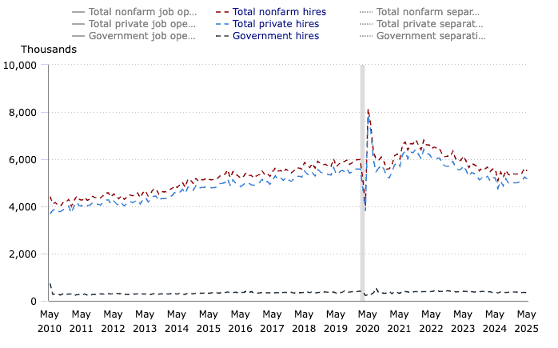

Tight Labor Market May Persist Longer Than Anticipated

A tight labor market presents ongoing headwinds to recruitment services providers.

Data from to the U.S. Bureau of Labor Statistics show that hiring, across nonfarm, private, and government roles, has been trending lower since the post covid surge in mid-2020.

Slowed hiring means companies are less likely to need the services of recruitment service providers, such as Korn Ferry and its peers, as there are simply less roles to fill. However, Korn Ferry’s focus on executive, C-suite, and roles with higher salaries provides some insulation to these trends, as these roles often require specialized experience and expertise that can be more difficult to find through general job postings. Case in point, Korn Ferry has grown its remaining fees under existing contracts from $1.5 billion in fiscal 4Q24 to $1.7 billion in fiscal 4Q25.

Figure 8: Nonfarm, Private, and Government Hires: May 2010 – May 2025

Sources: U.S. Bureau of Labor Statistics

The good news for investors is any potential downside to Korn Ferry’s business is already priced into the current stock price, as we’ll show below.

Current Price Implies Limited Profit Growth

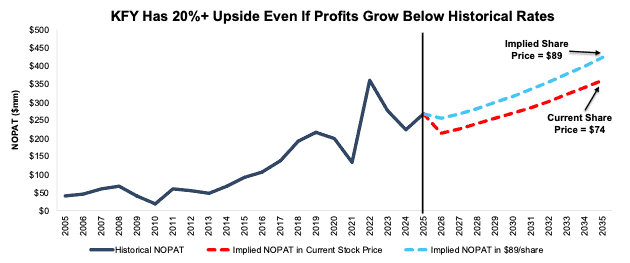

At its current price of $74/share, KFY has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects the company’s profits to never grow again from fiscal 2025 levels. For context, Korn Ferry has grown NOPAT by 13% compounded annually since fiscal 1999 and 11% compounded annually since fiscal 2015.

Below, we use our reverse discounted cash flow (DCF) model to analyze expectations for different stock price scenarios for KFY.

In the first scenario, we quantify the expectations baked into the current price. If we assume:

- NOPAT margin immediately falls to 7.3% (below both five-year average and TTM NOPAT margin of 9.7%) through fiscal 2035, and

- revenue grows at 6% (below 5-year CAGR of 7% and 10-year CAGR of 10%) compounded annually from fiscal 2026 through fiscal 2035, then

the stock would be worth $74/share today – equal to the current stock price. Contact us for the math behind this reverse DCF scenario.

Shares Could Go 20%+ Higher at Consensus Growth Rates

If we instead assume:

- NOPAT margin falls to 9% (still below both five-year average and TTM NOPAT margin of 9.7%) through fiscal 2034,

- revenue grows at consensus rates in fiscal 2026 (2%), fiscal 2027 (5%), and fiscal 2028 (6%) and

- revenue grows at 6% (below 5-year CAGR of 7% and 10-year CAGR of 10%) each year thereafter through fiscal 2035, then

the stock would be worth $89/share today – a 20% upside to the current price. In this scenario, Korn Ferry’s NOPAT would grow 5% compounded annually through fiscal 2035, which is below its five-year CAGR of 6% and ten-year CAGR of 11%. Contact us for the math behind this reverse DCF scenario.

Figure 9 compares Korn Ferry’s historical NOPAT to the NOPAT implied in each of the above scenarios.

Figure 9: Korn Ferry’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article was originally published on July 24, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.