The Federal Reserve’s aggressive rate hikes so far in 2022 have ended the era of free money and exposed a worrisome dynamic throughout capital markets: zombie stocks.

These are companies with poor business models that are burning cash at an alarming rate and are at risk of seeing their stock decline to $0 per share. Since June 2022, we’ve warned investors about 18 zombie stocks, such as Snap (SNAP), Rivian Automotive (RIVN), AMC Entertainment (AMC) and GameStop (GME), among others.

While Tesla (TSLA: $205/share) is not a zombie stock thanks to Elon Musk’s ability to raise lots of capital, it’s still a bellwether for all zombie stocks, as it shares many of the characteristics of zombie companies, like an outrageous valuation and high cash burn.

Investors are fed up with these kinds of companies, especially amid this year’s stock market volatility. If investors start to give up on Tesla and take profits on the stock, which is up over 1,000% over the past three years, that spells terrible news for all zombie stocks that don’t have the cash-raising luxury that Tesla has. We estimate that there are over 300 zombie stocks across the market.

Our message to investors is to take profits in Tesla and avoid zombie stocks at all costs. Do not invest in a company that doesn’t make any money – it’s that simple.

Though Tesla’s stock has declined 49% year-to-date (YTD), the valuation remains nosebleed high because the cash flow expectations baked into the stock price are unreasonably optimistic. We believe the stock is at risk of falling by 88% to $25 per share.

First-Mover Advantage Lost Long Ago

Tesla deserves credit for accelerating the adoption of electric vehicles (EVs) across the world. While it once was the unquestionable leader in the EV market for many years, those days are clearly behind us.

This report is the latest update to a long list of reports we’ve published on Tesla, which we first put in the Danger Zone in August 2013.

Below, we review the many reasons, including mounting competition, market share losses, and growing legal troubles that explain why we see so much downside risk in Tesla’s stock.

No More Range Advantage

Tesla’s once-large range advantage in the EV market has all but disappeared. The average model range for Tesla models was 237 miles in 2014, which was 2.7x the average range of its competitors’ ten longest range models. In 2022, Tesla’s average EV model range of 360 miles is just 6% greater than the average range of its competitors’ ten longest range models. Indeed, Lucid Group (LCID), not Tesla, boasts the longest-range model for 2022 at 520 miles, or 28% greater than Tesla’s longest-range model, the Model S.

Market Share Trend Is Not a Friend

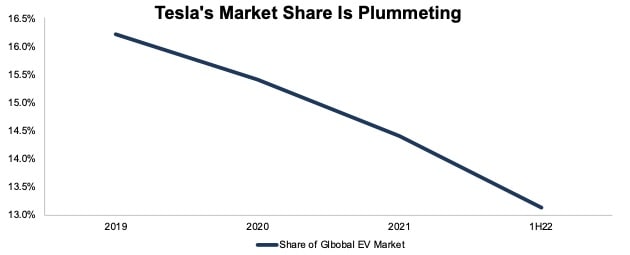

While Tesla’s vehicle sales have risen 204% since 2019, Tesla’s competitive position in the market has weakened as the global EV market has grown at an even faster rate. Per Figure 1, Tesla’s share of global EV sales fell from 16% in 2019 to just 13% in 1H22.

Figure 1: Tesla’s Share of Global EV Sales: 2019 – 1H22

Sources: New Constructs, LLC, Statista, and EV-volumes.com

Market Share Losses are Steepest in the Most Mature EV Markets

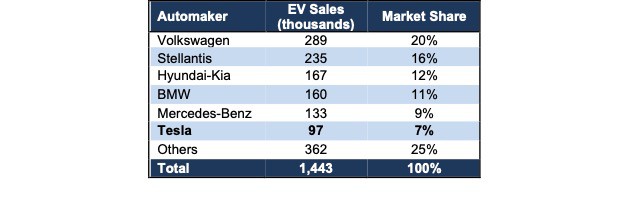

Tesla is mightily struggling to keep up with the competition in the world’s two most mature EV markets: China and Europe. Specifically, Volkswagen, Stellantis, Hyundai-Kia, BMW Group, and Mercedes-Benz Group have each sold more EVs than Tesla January 2022 through August 2022, per Figure 2. The top five EV makers enjoy a combined share of 68% of the European EV market compared to just 7% for Tesla.

Figure 2: Share of European EV Sales: January 2022 through Aug 2022

Sources: New Constructs, LLC and CleanTechnica

Tesla isn’t having any more success in China, either. Tesla’s share of the China EV market from January to August 2022 was also just 7% compared to 28% for BYD and 9.1% from GM-backed SGMW. The numerous new entrants in the Chinese EV market and the government’s willingness to subsidize and even bailout failing EV makers – as we recently noted in this report – make taking market share and growing profitability for outsider Tesla even more difficult.

Competition Is Just Getting Started…

Tesla’s trailing-twelve-month (TTM) return on invested capital (ROIC) of 27% is much higher than the average TTM ROIC of 7% of incumbent peers[1]. In normal circumstances, a high ROIC indicates a strong and persistent competitive moat. However, we think Tesla’s high profitability will be short-lived as competition continues to enter the market in a big way.

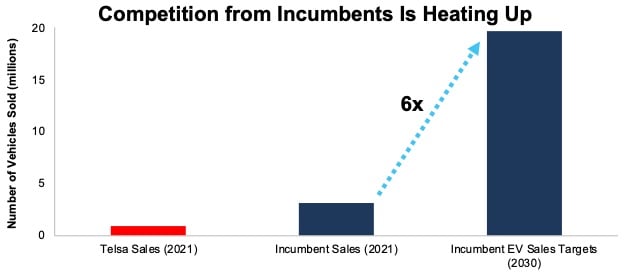

Now that Tesla has proven the market for EVs, demand is large enough (EVs accounted for 15% of global vehicle sales in August 2022) for the incumbents to mass produce EVs profitably. As a result, the incumbents are leveraging their superior mass production and scale efficiencies to quickly grow their presence in the EV market. The combined sales targets for incumbent automakers totals 20 million EVs in 2030, or six times more than incumbents sold in 2021, per Figure 3.

Figure 3: Actual & Targeted EV Sales: Tesla Vs. Incumbents

Sources: New Constructs, LLC, EV-volumes.com, and company press releases

…and Is Heavily Armed

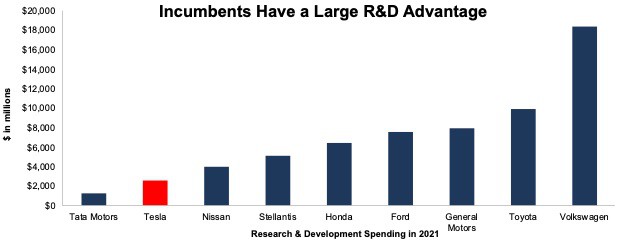

As we have written, we expect incumbents to continue to close any remaining technological gaps that Tesla’s first-mover advantage afforded it. Perhaps, one of the most overlooked advantages for ICE vehicle makers is their profit-generating legacy operations that can fund large research and development (R&D) budgets. And, unlike Tesla, which must continue to develop technology and add production capacity from scratch at the same time, incumbents can afford to focus on developing technology and enhancing product, while converting existing plants to produce EVs.

Figure 4: Tesla’s R&D Spend Vs. Major Incumbent Competitors in 2021

Sources: New Constructs, LLC and company filings

Tesla Will Struggle to Keep Up With the Industry Growth

The superior manufacturing and R&D scale available to incumbents spells long-term trouble for Tesla, which must continue to spend billions to build out comparable production capacity and maintain a competitive product.

Assuming that the EV market grows in line with incumbents’ 2030 production targets, Tesla would need to spend at least $25.4 billion[2] to build the additional capacity required to produce 6x more vehicles than the company sold in 2021. In this scenario, Tesla would triple its current installed production capacity just to maintain its current share of the EV market. Given the long-standing troubles Tesla has had with adding new capacity over the years, we are not very optimistic about the company’s ability to 6x capacity over any time frame.

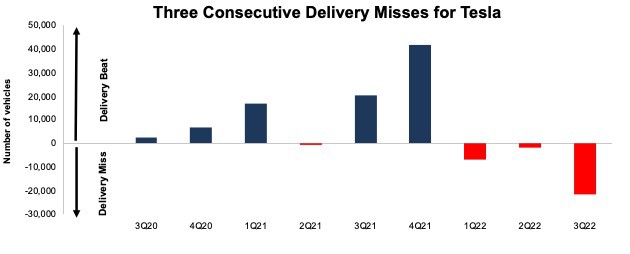

Another Delivery Miss

Tesla set a company record by delivering 343,000 vehicles in 3Q22. Despite a year-over-year (YoY) increase of 42%, Tesla’s deliveries missed the consensus estimate by 6% or 21,660 deliveries. The stock is down 10% since the relatively large miss. Most important, 3Q22’s big miss confirms the long-standing trend that the company is struggling to execute on capacity growth. Per Figure 5, despite beating consensus delivery expectations in five out of six quarters from 3Q20 to 4Q21, Tesla’s deliveries have come in below expectation in each of the past three quarters. Prior to 2020, the company had a very long streak of missing its production estimates – so much that Bloomberg created a Tesla's Weekly Production Rate vs Tesla’s Targets website, which showed just how much CEO Elon Musk overpromised deliveries.

This quarter’s large delivery disappointment underscores the danger in owning TSLA at current levels. The expectations baked into the stock are so high that the stock is at risk of major downside even in the midst of strong YoY delivery growth. If Tesla continues to disappoint in the coming quarters, analysts will likely sour on this much-loved stock, and Tesla’s massive growth story could collapse.

Figure 5: Tesla’s Quarterly Delivery Beats & Misses: 3Q20 – 3Q22

Sources: New Constructs, LLC and CNBC

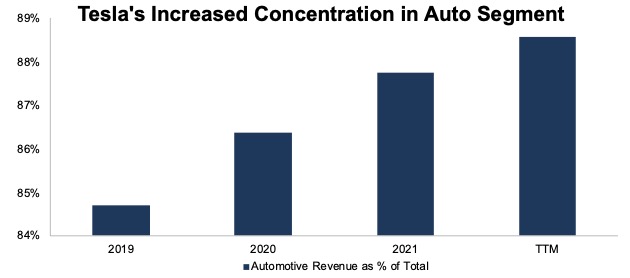

Other Business Segments Aren’t Material

Bulls have long argued that Tesla isn’t just an automaker, but rather a technology company with multiple verticals such as insurance, solar power, housing, and yes, robots. We’ve long refuted these bull dreams. Regardless of the promises of developing multiple business lines, Tesla’s business is increasingly concentrated in its auto segment. Auto revenue accounted for 89% of Tesla’s TTM revenue as of 2Q22, up from 85% in 2019, per Figure 6.

Figure 6: Tesla’s Auto Revenue as % of Total: 2019 – TTM

Sources: New Constructs, LLC and company filings

Lagging Bot Technology Isn’t the Answer, Either

In typical Tesla form, AI Day 2022 was filled with big claims and little substance. Specifically, Tesla’s recent AI Day unveiled a new supercomputer, Dojo, and the demonstration of the previously teased Optimus robot. While Optimus did manage to walk on its own unassisted, walking robots are far from revolutionary.

Nonetheless, Tesla claims it will leverage its self-driving AI and manufacturing capabilities to develop affordable, intelligent, and utilitarian robots. However, other AI-driven companies such as Apple, Google, and even other automakers, are just as well positioned as Tesla with the AI and manufacturing capabilities to offer intelligent robots at scale.

An undifferentiated product in a highly competitive market isn’t a recipe for a highly-profitable business line. Moreover, the personal robot market will likely be similar to today’s heavily commoditized household appliance or personal computer markets, each of which offers machines with very little differentiation and slim profit margins. Even if Tesla is successful in bringing low-cost, personal robots to production at scale, the incremental value of a robot business segment would likely be limited, especially compared to the company’s inflated valuation. For reference, appliance maker, Whirlpool (WHR), has a market cap of $7.9 billion (1% of Tesla’s market cap) and PC giant HP Inc. (HPQ) has a market cap of $26.9 billion (4% of Tesla’s market cap).

Mounting Regulatory and Legal Woes Add Risk

Tesla’s regulatory and legal problems are an underappreciated risk to the stock of a company that has been able to get off scot-free for numerous transgressions. We believe the threat of high-priced litigation has, at least in part, kept regulators and lawsuits at bay. Nevertheless, Tesla’s regulatory and legal problems continue to pile up. Below is a summary of ongoing issues that could be costly. And, if any one of them is successful, it might establish precedents for the success of many more. In which case, litigation could send the company into bankruptcy.

Deceptive Advertising: Tesla is facing a class-action lawsuit over misleading statements involving the company’s Autopilot and Full-Self Driving (FSD) capabilities. Additionally, the California Department of Motor Vehicles has filed two complaints accusing Tesla of falsely advertising its driver-assistance technology. A large settlement or regulatory fines related to these claims could divert Tesla’s cash away from much-needed investment to scale the company’s operations and achieve its long-promised technological goals.

Growing Safety Concerns: The National Highway Traffic Safety Administration (NHTSA) launched an investigation in June 2022 into 35 crashes that resulted in 14 deaths involving Tesla’s Autopilot in the U.S. since 2016. The company’s assisted driving woes could just be beginning. Once Tesla finally caught NHTSA’s attention, NHTSA quickly expanded its investigation into FSD and Autopilot on over 830,000 Tesla’s sold in the U.S. We expect the expansion to continue considering that, in just one year (July 2021 through June 2022), Tesla’s Autopilot was involved in 273 crashes that resulted in five deaths.

If the NHTSA discovers defects in Autopilot or FSD, Tesla could be on the hook to fund the expenses of a massive recall not to mention the liabilities related to the deaths and injuries from the crashes. Furthermore, any design flaws discovered in the investigation could leave Tesla open to more class action litigation.

Union Threat: The National Labor Relations Board recently ruled Tesla violated workers’ rights by not allowing workers to wear pro-union t-shirts at work. While the company’s dress code may not seem like a big deal at face value, the implications of this decision could be profound. Tesla has successfully prevented efforts to unionize its labor force in the past, which has positioned the company with a labor cost advantage as the only automaker in the U.S. with no unionized labor. Should the company fail to keep unions away, labor costs would go up, and Tesla’s bottom line would take a direct hit.

Don’t Buy What Musk Is Selling

Lost in all the buzz around Elon Musk buying Twitter is the fact that Musk keeps dumping shares of Tesla. Musk sold $16.4 billion worth of Tesla stock in November and December of 2021. Then, in the name of funding his proposed Twitter takeover, Musk sold $8.5 billion worth of stock in April 2022 and another $6.9 billion worth of stock in August 2022. Altogether, Musk sold ~$31.8 billion worth of stock (4% of current market cap) in less than a year without causing much of a stir among investors.

While CEOs selling shares of the company they manage is nothing new, much of the bull case for owning Tesla resides in trust in Musk’s creative abilities and belief in his large claims and promises. Musk selling such a large stake in the company as it enters, perhaps, its most challenging era is a red flag that investors shouldn’t ignore. Should the Twitter deal finalize, Musk could end up selling up to $30+ billion dollars of stock in a company that the market expects to become more profitable than Apple (see details below) to invest in a struggling social media platform. Perhaps, investors should consider that Musk actually believes Twitter is the better investment at this point.

Twitter Tussle Adds to Tesla’s Credit Risk

Investors should take note of the enormous amount of money and time that Musk has dedicated to Twitter, especially after Tesla missed consensus delivery expectations in each of the first three quarters of 2022.

Make no mistake, the Twitter tussle has hurt Tesla investors. Since Twitter (TWTR) agreed to Musk’s acquisition offer on April 25, 2022, Tesla’s stock has fallen 28% – including a 12% drop the day after the deal’s announcement – compared to just a 12% decline for the S&P 500 over the same time.

Musk’s shenanigans are forcing banks that committed to the Twitter deal six months ago to follow through with financing $12.5 billion in a market with much less liquidity than in April. Tesla could be forced to pay higher borrowing costs if lenders begin to price in the additional credit risk Musk brings to the table.

TSLA’s Valuation Makes No Sense

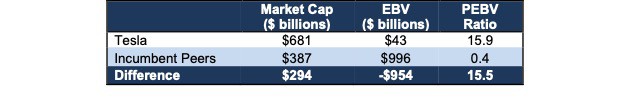

Tesla’s stock is priced for extraordinary profit growth, while incumbents are priced for a 60% profit decline.

Except for Tata Motors, all of Tesla’s incumbent peers in our coverage universe have a positive price-to-economic book value (PEBV) ratio over the TTM. Despite their advances in EV technology and plans for rapid EV production growth through 2030, the aggregate incumbent peer group PEBV ratio is just 0.4, which implies the market expects profits for these legacy makers to permanently decline to 60% below TTM levels. On the other hand, Tesla’s PEBV ratio of 15.9 implies the market expects its profits to grow 1,590%.

Though Tesla’s market cap is nearly 2x the combined market cap of incumbents, the company’s economic book value (EBV) is just 4% the combined incumbent EBV of $992 billion. See Figure 7.

Figure 7: Tesla’s Valuation Compared to Incumbent Peers*: TTM

Sources: New Constructs, LLC and company filings.

*As of market close on October 12, 2022.

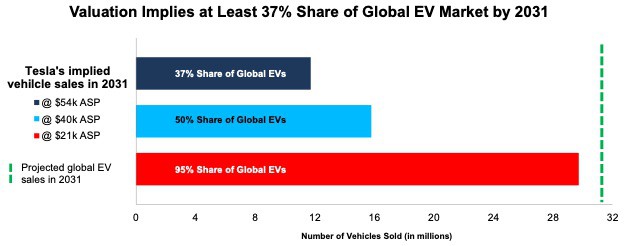

Reverse DCF Math: Valuation Implies Tesla Will Own 37%+ of the Global Passenger EV Market

Tesla selling 1.2 million cars over the TTM is no small feat. However, that number is minuscule compared to the number of vehicles Tesla must sell to justify its stock price – anywhere from 12 million to upwards of 30 million depending on average selling price (ASP) assumptions. For reference, Toyota (TM), the world’s largest automaker, sold 10.2 million vehicles over the TTM ended 6/30/22.

We use our reverse discounted cash flow (DCF) model to provide more clear, mathematical evidence that Tesla’s valuation is too high and offers unattractive risk/reward. At its current average selling price (ASP) per vehicle of ~$54k, Tesla’s stock price at $205/share implies the company will sell 12 million vehicles in 2031 versus 1.2 million over the TTM. 12 million sales in 2031 would represent 40% of the expected global EV passenger vehicle market in 2031. At lower ASPs, implied vehicle sales look even more unrealistic. Details below.

In order to justify its current share price, Tesla would need to:

- immediately achieve a 13% net operating profit after-tax (NOPAT) margin (1.5x Toyota’s TTM margin, compared to Tesla’s TTM margin of 12%)

- grow revenue by 30% compounded annually and

- grow invested capital at a 14% CAGR (vs. 50% CAGR from 2010–2021) to meet capacity requirements for the next decade

In this scenario, Tesla would generate $712 billion in revenue in 2031, which is 1.1x the combined revenues of Toyota, General Motors, Ford (F), Honda Motor Corp (HMC), and Stellantis (STLA) over the TTM.

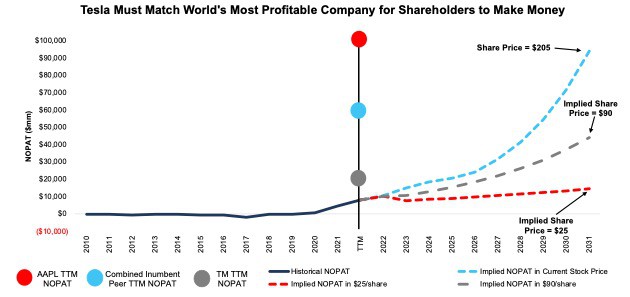

In this scenario, Tesla would achieve a NOPAT margin that is 1.4x higher than the highest margin achieved by any incumbent peer over the past five years and would generate $88.9 billion in net operating profit after-tax (NOPAT) in 2031. At $88.9 billion, Tesla’s NOPAT would be 1.4x all incumbent peers’ TTM NOPAT and 87% of Apple’s (AAPL) TTM NOPAT, which, at $102 billion, is the highest of all companies we cover.

$205/share also implies that, in 2031, Tesla will sell the following number of vehicles based on these ASP benchmarks:

- 12 million vehicles – current ASP of $54k

- 16 million vehicles – ASP of $40k (equal to General Motors in 2Q22)

- 30 million vehicles – ASP of $21k (equal to Toyota in fiscal 1Q23)

Given the difficulty in forecasting the high-growth EV market, we analyze implied market share based on a base-case scenario from S&P Global and a best-case scenario from the International Energy Agency (IEA) for the potential size of the market in 2031.

Base-Case Scenario (EV sales reach 31 million in 2031[3]): If we assume the base-case scenario for global passenger EVs and Tesla achieves the above-mentioned EV sales, the implied market share for the company would be:

- 37% for 12 million vehicles

- 50% for 16 million vehicles

- 95% for 30 million vehicles

Best-Case Scenario (EV sales reach 84 million sales in 2031[4]): If we assume an unlikely, but best-case scenario for global passenger EV from the IEA, the vehicle sales noted above would represent:

- 14% for 12 million vehicles

- 19% for 16 million vehicles

- 35% for 30 million vehicles

The likelihood of reaching any of the above-mentioned market share scenarios is extremely unlikely in such a competitive industry. For reference Toyota’s and Volkswagen’s share of the global passenger vehicle market as of 1H22 was 12% and 10%, respectively.

Figure 8: Tesla’s Implied Vehicle Sales in 2031 to Justify $205/Share

Sources: New Constructs, LLC, company filings, and S&P Global

TSLA Has 56% Downside If Tesla Becomes the World’s Largest Automaker

If we assume Tesla sells 9% more vehicles than Toyota, the world’s largest automaker, sold over the TTM, Tesla has 56%+ downside. In this scenario, Tesla would sell 11.1 million vehicles in 2031 (which implies a 35% share of the global passenger EV market in 2031), at an ASP of $40k (vs. Toyota’s fiscal 1Q23 ASP of $21k). In other words, if we assume Tesla’s:

- NOPAT margin is 12% in 2022 and falls to 9% (equal to Stellantis’ TTM margin) in 2023–2031,

- revenue grows at consensus estimate CAGR of 40% from 2022 to 2024

- revenue grows 19% compounded annually from 2025 to 2031, and

- invested capital grows at a 13% CAGR from 2022 to 2031, then

our model shows the stock is worth just $90/share today – 60% downside to the current price. See the math behind this reverse DCF scenario. In this scenario, Tesla grows NOPAT to $44.0 billion, or 5.5x its TTM NOPAT and 2.2x Toyota’s TTM NOPAT.

TSLA Has 88%+ If Tesla Grows Sales Volume by 4x

If we estimate more reasonable (but still very optimistic) margins and market share achievements for Tesla, the stock is worth just $25/share. Here’s the math, assuming Tesla’s:

- NOPAT margin is 12% in 2022 and falls to 8% (equal to Toyota’s TTM margin) in 2023–2031

- revenue grows 58% in 2022

- revenue grows 8% a year from 2023–2031, and

- invested capital grows at a 5% CAGR from 2023-2031, then

our model shows the stock is worth just $25/share today – an 88% downside to the current price.

In this scenario, Tesla sells 3.9 million cars (12% of the global passenger EV market in 2031) in 2031 at an ASP of $40k. Given the required expansion of plant/manufacturing capabilities and formidable competition, we think Tesla will be lucky to sustain a margin as high as 8% from 2022-2031. If Tesla fails to meet these expectations, then the stock is worth less than $25/share.

Figure 9 compares the firm’s historical NOPAT to the NOPAT implied in the above scenarios to illustrate just how high the expectations baked into Tesla’s stock price remain. For additional context, we show Apple’s, Toyota’s, and the combined incumbent peers’ TTM NOPAT.

Figure 9: Tesla’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Each of the above scenarios assumes Tesla’s invested capital grows just enough to match the required capacity expansion requirements implied in the share price. For reference, Tesla’s invested capital grew 50% compounded annually from 2010-2021. Invested capital at the end of 2Q22 grew 31% year-over-year (YoY). Tesla’s property, plant, and equipment has grown even faster, at 59% compounded annually, since 2010.

In other words, we aim to provide inarguably best-case scenarios for assessing the expectations for future market share and profits reflected in Tesla’s stock market valuation. Even doing so, we find that Tesla is significantly overvalued.

$560+ Billion Fall of the Night King Would Come at Great Cost to Many

@Watuzzi summed up the potential systemic risk of a collapse in Tesla’s stock with this recent tweet:

“Although I am short $TSLA, this is going to be somewhat painful to watch. I have never seen a stock with so many people so heavily concentrated in it and dependent on it to rise in value.”

We agree. Tesla is the Night King of speculative assets and, given the enormous downside in this very popular stock, the fall of the Night King could have widespread consequences. We warned in December 2020 of the risk that the inclusion of Tesla in the S&P 500 poses to indexers. Tesla investors are at risk of losing a combined $560+ billion if the stock drops to $25/share. That much value destruction could have contagion effects and drive selling in other speculative assets, like crypto currencies and Zombie Stocks, which have a combined market cap of $172 billion and are all at risk of going to $0/share.

This article originally published on October 14, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Incumbent peers under coverage include Toyota (TM), General Motors (GM), Ford (F), Stellantis (STLA), Honda (HMC), Tata Motors (TTM), and Nissan (NSANY).

[2] Assuming Tesla expands capacity at the same dollar-per-vehicle-of-added-capacity rate spent on Shanghai, Austin, and Berlin factories. Tesla spent ~$8.6 billion to build its factories in Shanghai, Austin, and Berlin which added a combined capacity of 1.3 million vehicles per year.

[3] We use the global light duty EV market’s projected CAGR from 2021 to 2030 to estimate the market’s value in 2031

[4] We use the IEA’s Net Zero Scenario’s projected EV sales CAGR from 2021 to 2030 to estimate the market’s value in 2031