Building product providers, such as manufacturers of roofing products, windows/doors, fencing, or even shutters, offer an opportunity to partake in the new home construction housing market, while also benefiting from growing home renovations and remodels. With strong profit growth, an impressive return on invested capital (ROIC), and an undervalued stock, Ply Gem Holdings (PGEM: $14/share) is on August’s Most Attractive Stocks list and is also this week’s Long Idea.

Strong Profit Growth at PGEM

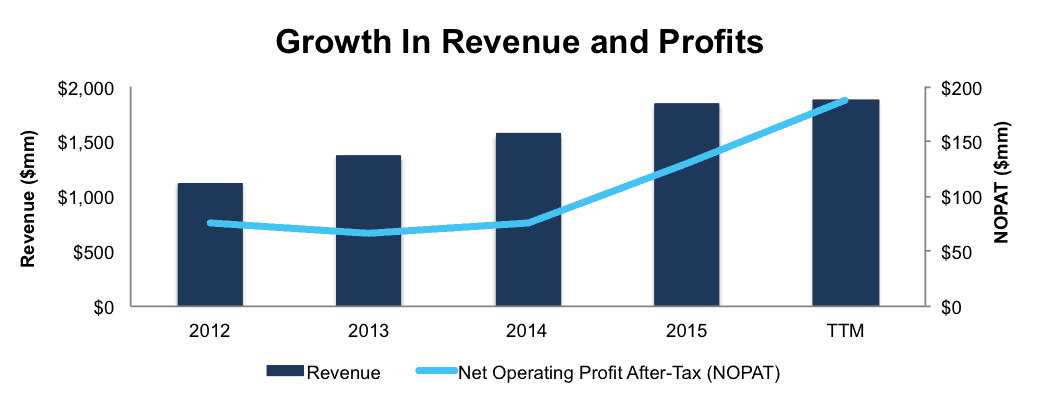

Since 2012, Ply Gem’s after-tax profit (NOPAT) has grown by 20% compounded annually to $130 million in 2015 and to $187 million over the last twelve months. Over the same time, the company’s revenue has grown by 18% compounded annually to $1.8 billion in 2015 and nearly $1.9 billion TTM, per Figure 1.

Figure 1: Ply Gem’s Growing Profits

Sources: New Constructs, LLC and company filings

Ply Gem’s NOPAT margin has improved from 7% in 2012 to 10% TTM. Its ROIC has improved from 9% to a top-quintile 16% over the same time.

Improving ROIC Correlated With Creating Shareholder Value

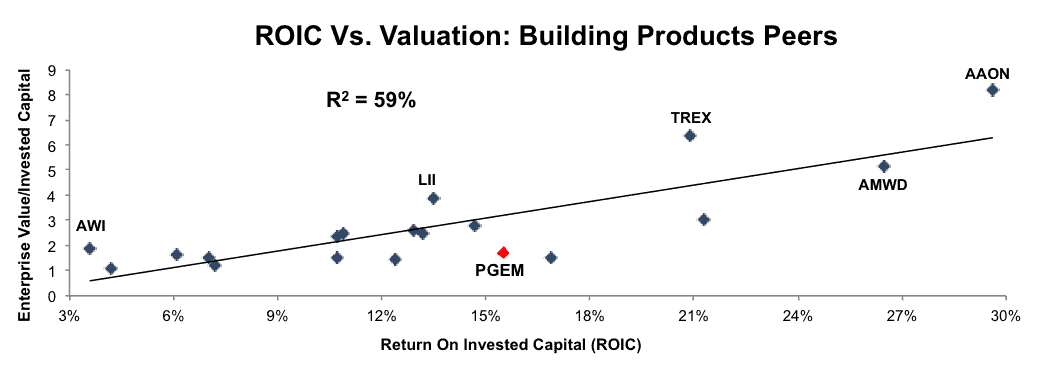

Ply Gem’s 16% ROIC is above the 14% average of the 19 Building Products companies under coverage. Companies with a top-quintile ROIC tend to have wider moats and, on average, premium valuations. Figure 2 shows that ROIC explains 59% of the changes in stock valuation for those 19 Building Products companies and that PGEM is one of the cheapest out of this group.

Figure 2: ROIC Explains 59% Of Valuation for Building Product Stocks

Sources: New Constructs, LLC and company filings

Ply Gem’s Profitability Is On The Rise

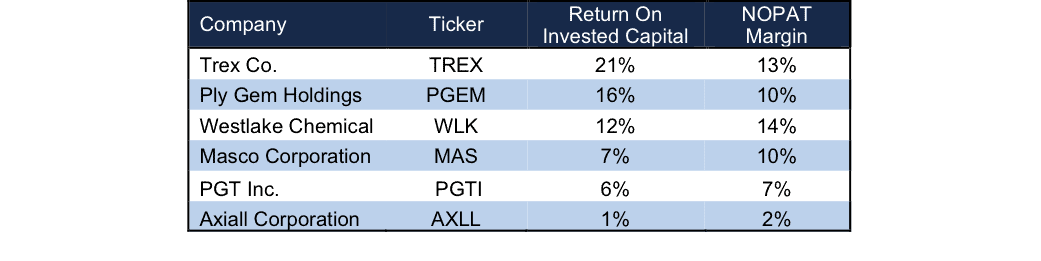

Ply Gem operates in two segments, Siding/Fencing/Stone, and Windows/Doors, which accounted for 46% and 54% of 2015 revenue, respectively. Its primary siding competitors include Royal Building Products (owned by Axiall (AXLL)), Alside, and CertainTeed among other captive companies. Its fencing competition includes Westech (owned by Westlake Chemical (WLK)), Homeland, and Azek. It’s windows/doors segment faces competition from different private/captive firms, in addition to Masco (MAS) and PGT Inc. (PGTI). Despite the fragmentation, Ply Gem reports it has a leading vinyl siding market position of 39% in 2015 and 40% in 2Q16. Per Figure 3, Ply Gem’s profitability is greater than nearly all competitors, apart from, Trex, which focuses more on decking materials but does provide fencing, and Westlake, who’s building products only made up 11% of its 2015 revenues. With leading profitability, Ply Gem has increased pricing power, a strength management noted during its 2Q16 conference call with increased average selling prices in its windows/doors segment.

Figure 3: Ply Gem’s Impressive Profitability

Sources: New Constructs, LLC and company filings.

Bear Concerns Assume Growth In Housing Ends

The largest bear concern, as with any firm tied to construction and/or home building is the current state of the housing market, and whether it has room to grow. At the end of the day, Ply Gem’s products are tied to new construction and remodels/repairs, and data on both would imply the company has significant profit growth opportunities on the horizon. First, we find that the current pace of housing starts is well below the 30-year average.

- From 1985-2015, single-family housing starts averaged 1 million per year.

- Over the past decade, single-family housing starts averaged 792 thousand per year

- Over the past five years, single-family housing starts averaged 590 thousand per year.

Perhaps more importantly than the last five years is the growth occurring in 2016 and the room for improvement if housing starts were to return to the 30-year historical average. In July 2016, annualized housing starts came in at 770 thousand, still 26% below the 30-year historical average. While the housing recovery has not been as fast as many would have hoped, we’re currently in the middle of five years of consecutive growth, yet still well below historical averages.

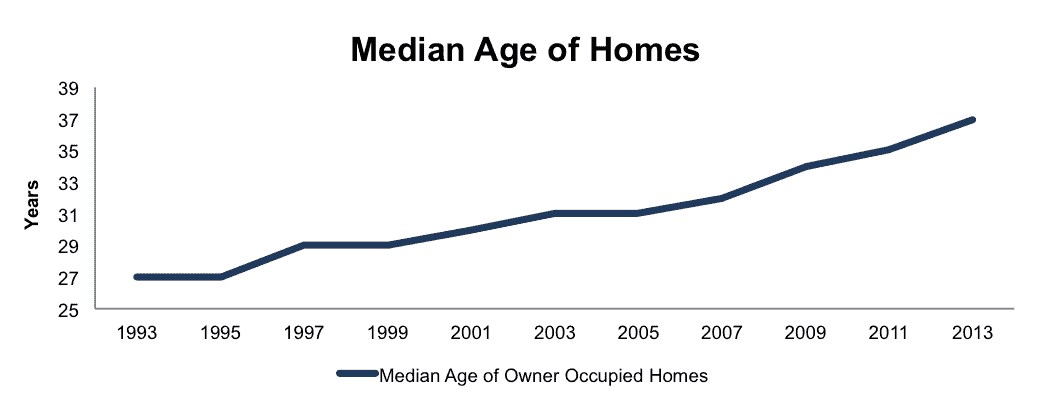

Second, the data on potential repairs and remodels, as measured by the median age of owner-occupied homes, would appear to be in a positive trend for repair and remodel product providers. According to the American Housing Survey, the median age of owner-occupied homes was 37 years in 2013, the most recent year data has been released. 2015 data will be released this October. This median age continues an upward trend, as the median age was 27 years in 1993 and 33 years in 2003, per Figure 4.

Figure 4: Median Age of Houses Is Increasing

Sources: 2013 AHS, U.S. Census Bureau.

As houses age, the need for repair and or remodel only grows. Furthermore, from the AHS survey, only 17% of houses were built after 2000 and 40% of homes were built prior to 1969.

Ply Gem has proven its ability to generate profits, and with a leading market share, coupled with impressive profitability, the company is poised to benefit throughout the recovery. However, despite the bear concerns being largely unfounded, the market is pricing PGEM as if its profits will significantly decline, as we’ll show below.

Valuation Implies Another Housing Crash

PGEM is up just over 10% year-to-date, as the market remains skeptical about the recovery in housing. This skepticism, despite positive economic indicators to the contrary has created a disconnect between the fundamentals of Ply Gem and its share price. At its current price of $14/share, Ply Gem has a price to economic book value (PEBV) ratio of 0.8. This ratio means that the market expects Ply Gem’s NOPAT to permanently decline 20% from current levels. This expectation would seem to run contrary to the company’s profit growth since 2012.

If Ply Gem can maintain 2015 NOPAT margins of 7% (below the 10% TTM margin) and grow NOPAT by just 7% compounded annually for the next decade, the stock is worth $19/share today – a 36% upside. This expectation may be conservative, given the growth in home improvement spending is expected to top 8% and housing starts have grown 13% compounded annually since 2011.This scenario also assumes that Ply Gem’s spending on working capital and fixed assets will be 2% of revenue, which is consistent with Ply Gem’s capex expectations for 2016. Given the low expectations, PGEM offers an excellent way to gain exposure to the housing market with limited downside risk.

No Dividends or Share Buyback at Ply Gem

Currently, Ply Gem pays no dividends and has no authorized share repurchase program.

Rising Housing Market Will Continue The Early Success of 2016

The future success of Ply Gem is reliant upon the continued growth of single-family housing starts and growth in home-repair and remodeling. Through the first six months of 2016, Ply Gem’s siding/fencing/stone segment revenues grew over 5%, excluding acquisitions, U.S. vinyl industry shipments grew nearly 9%, and gross margins grew in part due to lower materials costs. Additionally, the Leading Indicator of Remodeling Activity reported TTM growth of 5.3% over the prior year period. In its Windows/Doors segment, first half 2016 revenues grew 3% year-over-year and gross margins improved in part to higher average selling prices.

Moving forward, the LIRA, which measures the annual rate of change of residential improvements, anticipates growth in home improvement and repairs to reach 8% by the start of 2017, which bodes well for continued profit growth at Ply Gem. Increased remodeling coupled with a continued improvement in the housing market could propel PGEM’s revenue growth, and prudent management of expenses can continue the profit growth Ply Gem has achieved to date.

Insider Trends/ Short Sales Raise No Red Flags

Over the past 12 months, insiders have purchased 19 thousand shares and sold 91 thousand shares for a net effect of 72 thousand insider shares sold. This amount represents less than 1% of shares outstanding. Additionally, short interest sits at just 461 thousand shares, or just under 1% of shares outstanding.

Executive Compensation Should Be Tied to ROIC Rather Than EBITDA

Ply Gem’s executive compensation plan, which includes cash incentives and long-term equity awards, is largely tied to EBITDA goals. Using EBITDA or adjusted EBITDA is problematic when executives exploit the non-GAAP metric to overstate the profitability of the business. However, Ply Gem’s have not done that, as economic earnings, the true cash flows of the business, have grown from $10 million in 2012 to $93 million TTM, a clear creation of shareholder value. We would much rather see Ply Gem tie its executive compensation to ROIC, as there is a strong correlation between ROIC and shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Ply Gem’s 2015 10-K:

Income Statement: we made $109 million of adjustments with a net effect of removing $97 million in non-operating expenses (5% of revenue). We removed $103 million related to non-operating expenses and $6 million related to non-operating income. See all adjustments made to PGEM’s income statement here.

Balance Sheet: we made $211 million of adjustments to calculate invested capital with a net increase of $135 million. One notable adjustment was $37 million (4% of net assets) related to other comprehensive income. See all adjustments to PGEM’s balance sheet here.

Valuation: we made $1.1 billion of adjustments with a net effect of decreasing shareholder value by $1.1 billion. Despite this decrease in shareholder value, PGEM remains undervalued. The largest adjustment to shareholder value was the removal of $1.1 billion in total debt, which includes $106 million in off balance sheet operating leases. This operating lease adjustment represents 11% of PGEM’s market cap.

Attractive Funds That Hold PGEM

There are no funds that receive our Attractive-or-better rating and allocate significantly to Ply Gem.

This report originally published here on September 7, 2016.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

Scottrade clients get a Free Gold Membership ($588/yr value). Login to your Scottrade account & click on the New Constructs banner to access your free Gold membership.