We published an update on this Long Idea on June 26, 2024. A copy of the associated report is here.

Editor’s Note: Since we published this report, the company changed its name and ticker to HF Sinclair Corporation (DINO).

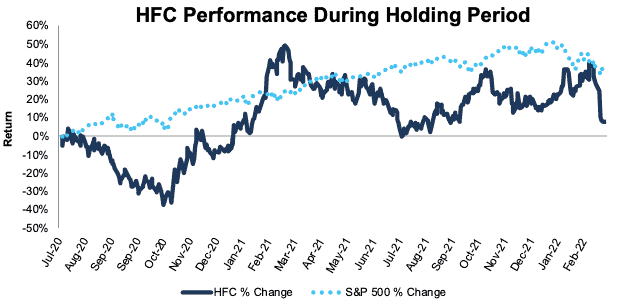

We first made HollyFrontier Corporation (HFC: $30/share) a Long Idea in July 2020 as part of our “See Through the Dip” thesis. Since then, the stock is up 10% compared to a 38% gain for the S&P 500. Despite underperforming the market, the stock could be worth $67+/share today – a 123%+ upside. See our most recent report from March 2021 on HollyFrontier here.

We leverage more reliable fundamental data[1], shown to provide a new source of alpha, with qualitative research to pick this Long Idea.

HollyFrontier’s Stock Has Strong Upside Based on:

- long-term, growing global demand for petroleum products

- recent acquisitions create more shareholder value

- renewables and retail locations improving margins

- the stock has 123% upside if profits return to pre-pandemic levels.

HollyFrontier currently earns an Unattractive stock rating, but we remain bullish on the stock. Our stock ratings are based on criteria that measure the quality of a business’ earnings and the valuation of its stock to assess the risk/reward of owning the stock. While our stock ratings are unbiased and beat the “Street”, there are times when additional analysis of a company will reveal risk or opportunity not captured in the rating. For example, with HollyFrontier, we think the dips in profitability in 2020 and 2021 that drove the company’s quality of a business’ earnings rating lower are likely temporary and will rebound to pre-pandemic levels. As a result, we believe the quality of a business’ earnings rating will improve, and, if so, then the stock’s rating would be Attractive.

Furthermore, we believe the company’s recent acquisitions will drive its profitability above pre-pandemic levels. The recent decline in price provides a buying opportunity for investors who missed out earlier.

Figure 1: Long Idea Performance: From Date of Publication Through 3/1/2022

Sources: New Constructs, LLC

What’s Working

Long-Term Global Demand for Petroleum: HollyFrontier operates in an industry that is critical to the global economy. As such, demand for its products will grow for decades to come even as countries strive toward net zero goals. The U.S. Energy Information Administration (EIA) expects global energy consumption to rise from 2020 levels through 2050 in all five of its Energy Outlook cases.

Acquisitions Create Shareholder Value: HollyFrontier ties its executive compensation (cash and performance share units) to return on capital employed (ROCE) targets. ROCE is similar to return on invested capital (ROIC) and there is a strong correlation between improving ROIC and increasing shareholder value.

This alignment of incentives is especially important considering HollyFrontier’s completed acquisition of Puget Sound from Shell, PLC (SHEL) and announced acquisition of Sinclair Oil Corporation in 2021. The combined value of these deals is ~$2.3 billion, or 47% of HollyFrontier’s market cap. Upon completion, HollyFrontier will be named HF Sinclair.

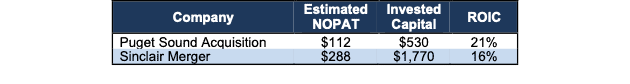

Per Figure 2, we estimate[2] these acquisitions will contribute ~$400 million of additional annual NOPAT. Based on their purchase prices and estimated annual NOPATs, the implied ROICs for the Puget Sound acquisition and Sinclair merger are 21% and 16%, respectively. The implied ROIC on each of these deals is above HollyFrontier’s 5-year average ROIC of 6%. Acquisitions that improve ROIC are very rare and can create significant value for shareholders in the unusual cases where they occur.

Figure 2: Expected ROIC from Puget Sound and Sinclair Acquisitions ($ millions)

Sources: New Constructs, LLC and company filings

Retail Arm Boosts Margins: Included with the Sinclair acquisition is over 300 distributors and 1,500 branded retail locations. By integrating into a branded wholesale network, the refinery gains a consistent sales channel with more stable margins.

Renewables Business Satisfies RIN Requirements: Sinclair blends fuel that qualifies for renewable identification number (RIN) credits. Acquisition of Sinclair provides HollyFrontier with a larger and more mature renewable diesel operation.

The benefits of the acquisition are that renewables can transition from a regulatory challenge to a profit growth driver for HollyFrontier. HollyFrontier completed its conversion of its Cheyenne facility that will have a 6,000 BPD renewable diesel capacity. The company expects its Artesia renewable diesel unit to be operational in 2Q22. Combined, HollyFrontier expects these facilities to produce 200 million gallons of renewable diesel annually. The added experience from Sinclair’s renewables business will help the company grow this new operating segment. The EIA projects renewables will grow from ~90 quadrillion British thermal units (qbtu) in 2020 to ~240 qbtu in 2050, or a 167% increase.

What’s Not Working

Off to a Rocky Start With Puget Sound: HollyFrontier completed its acquisition of Puget Sound on November 1, 2021. The pipeline, which supplies Puget Sound, was shut down for three weeks in November due to widespread flooding and mudslides, and bad weather damaged a hydrocracker unit, which necessitated major maintenance.

The early troubles with the Puget Sound refinery resulted in lower-than-expected crude throughput of 421,000 BPD, or 8% below its midpoint guidance of 460,000 BPD in 4Q21. However, even with problems at Puget Sound, the company’s 4Q21 crude throughput was 1.1x greater than 4Q20 and 1.2x greater than 4Q19. While the weather-related problems in Puget Sound affected the beginning of 1Q22, the problem is now resolved.

Declining Demand in the U.S.: S&P Global Platts expects U.S. gasoline demand to peak in 2023, which means the U.S. refiners could have difficulty growing operations domestically. However, much like with Phillips 66, even with less demand in the U.S., increased global demand will keep complex U.S. refineries in demand well beyond 2023. A decline in demand will likely result in some refinery closures by other firms, but we expect the decline of weaker competitors to create market openings for owners of complex refiners, such as HollyFrontier.

Refining rationalization is already underway, and 2021 was the first year, in at least 30, where more global refining capacity was removed than added. While demand for fuels to move people and goods is rising rapidly across the globe, capacity is shrinking.

Stock Is Priced for Profits to Remain Far Below Pre-Acquisition Levels

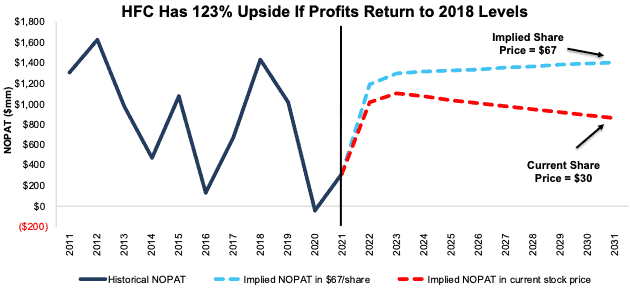

Despite increasing its refining capacity by 67% with its recent acquisitions, HollyFrontier’s stock is priced as if profits will permanently drop below pre-acquisition levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for HollyFrontier.

In the first scenario, we assume HollyFrontier’s:

- NOPAT margin rises to 4% (five-year average vs. 2% in 2021) from 2022 – 2031, and

- revenue grows by 37% in 2022 and 9% in 2023 with increased capacity from Puget Sound and Sinclair (equal to consensus), and

- revenue falls by 3% compounded annually from 2024 – 2031.

In this scenario, HollyFrontier’s NOPAT in 2031 is just $859 million, and the stock is worth $30/share today – equal to the current price. In this scenario, HollyFrontier’s NOPAT in 2031 is 11% below its average pre-pandemic NOPAT from 2011 to 2019 of $969 million.

Shares Could Reach $67 or Higher

If we assume HollyFrontier’s:

- NOPAT margin rises to 5% (all-time average) in 2022 – 2031,

- revenue grows by 37% in 2022 and 9% in 2023 with increased capacity from Puget Sound and Sinclair, and

- revenue grows by just 1% compounded annually from 2024 – 2031, then

the stock is worth $67/share today – 123% above the current price. In this scenario, HollyFrontier’s NOPAT in 2031 is still 2% below 2018 levels. Should HollyFrontier’s NOPAT reach new highs with its increased capacity, the stock has even more upside.

Figure 3: HollyFrontier’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on March 2, 2022.

Disclosure: Matt Shuler owns HFC. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] We estimate the expected NOPAT by applying a 0.64 multiple to the company’s estimated mid-cycle Puget Sound and Sinclair EBITDAs. HollyFrontier’s pre-pandemic NOPAT to EBITDA multiple from 2015 – 2019 = 0.64.