The Consumer Non-cyclicals sector is the top-ranked sector in our 1Q21 Best & Worst ETFs & Mutual Funds by Sector report. In fact, Consumer Non-cyclicals is the only sector to earn our Very Attractive rating. The Consumer Staples Select Sector SPDR Fund (XLP) is one of the best ETFs in its sector and is this week’s Long Idea.

Our Research Looks Forward, Not Backward

XLP has annualized returns of ~9% over the past five years compared to ~14% for the market, as measured by State Street SPDR S&P 500 ETF (SPY). This underperformance drives Morningstar’s backward-looking rating system to rate XLP below SPY.

Looking forward instead of backward, we assign XLP our highest rating: Very Attractive. We base our forward-looking Predictive Fund Ratings on in-depth analysis of the holdings of funds. Figure 1 shows that Morningstar’s 3-star ratings is much lower than our Very Attractive (equivalent to 5 stars) XLP. Relying only on backward-looking ratings could mislead investors into choosing SPY when more in-depth, holdings-based research shows XLP has superior risk/reward.

Figure 1: Consumer Staples Select Sector SPDR Fund Rating

Sources: New Constructs, LLC, company filings, and Morningstar

To properly evaluate any ETF, including XLP, one must analyze the filings, including the footnotes and MD&A, of each of the ETF’s holdings. This diligence takes an enormous amount of time and is unavailable to most without the aid of technology as featured in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics.

Sector Research Reveals Opportunity for Investors in Consumer Non-cyclicals

The valuation of the S&P 500 is at an all-time high, as we pointed out in our report S&P 500 Valuation Is Over Its Skis. However, not all sectors in the S&P 500 are expensive.

The Consumer Non-cyclicals sector is one of just three S&P 500 sectors that improved Core Earnings[1] through 3Q20 last year (full-year 2020 results available once companies file 10-K’s) and one of only two sectors with a rising return on invested capital (ROIC) over the same time. In other words, with a price-to-economic book value (PEBV) ratio of just 1.1, this sector has a low valuation along with quality earnings.

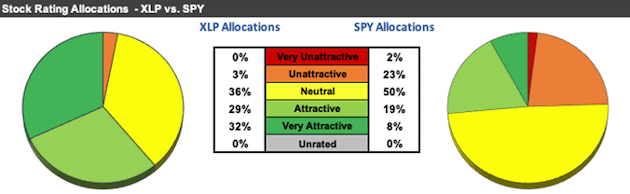

Figure 2 shows that XLP allocates a significantly higher percentage of its assets to Attractive-or-better rated stocks and a significantly lower percentage to Neutral-or-worse rated stocks than its market benchmark, SPY.

Figure 2: XLP Allocates Capital to Superior Holdings

Sources: New Constructs, LLC and company filings

Per Figure 2, XLP allocates 61% of its assets to Attractive-or-better rated stocks compared to just 27% for SPY. On the flip side, XLP allocates just 3% of its assets to Unattractive-or-worse rated stocks compared to 25% for SPY.

Given this favorable allocation relative to the benchmark, XLP appears well-positioned to capture more upside with lower risk. Compared to the average ETF, XLP has a much better chance of generating the outperformance required to justify its already minimal fees.

Superior Stock Selection Drives Superior Risk/Reward

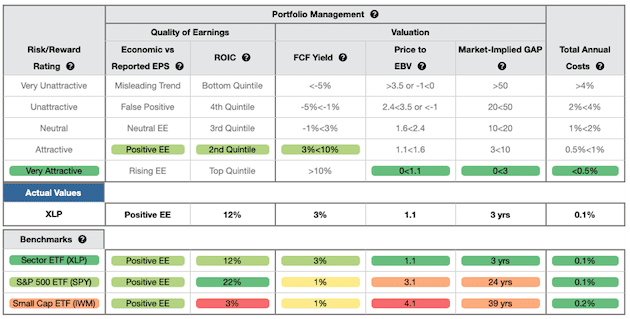

Figure 3 contains our detailed rating for XLP, which includes each of the criteria we use to rate all ETFs under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of an ETF’s holdings equals the performance of the ETF after fees.

Figure 3: Consumer Staples Select Sector SPDR Fund (XLP) Rating Breakdown

Sources: New Constructs, LLC and company filings

Out of all of XLP’s 32 holdings:

- Only two receive a Risk/Reward rating below Neutral

- 26 have a PEBV ratio of 1.6 or less

- 26 have a growth appreciation period (GAP) of ten years or less

Given its focus on quality and valuation, it’s no wonder that 34% of the ETF’s funds are allocated to stocks we’ve featured as Long Ideas. Figure 4 shows the eight holdings that are open Long Ideas.

Figure 4: Open Long Ideas That XLP Holds

Sources: New Constructs, LLC

XLP Finds Cheap Stocks, Too

XLP’s holdings are superior to SPY (click here for our report on SPY) in all three valuation categories:

- XLP’s free cash flow yield of 3% is higher than SPY (1%).

- The PEBV ratio for XLP is 1.1, which is less than the 3.1 for SPY.

- Our discounted cash flow analysis reveals an average market implied GAP of just three years for XLP’s holdings compared to 24 years for SPY.

In other words, the stocks held by XLP generate quality cash flows and have lower valuations compared to SPY. The market expectations for stocks held by XLP imply profits will only grow by 10% (measured by PEBV ratio) while the expectations embedded in SPY’s holdings imply a more than tripling of profits. High historical profits and low expectations for future profits are an attractive combination.

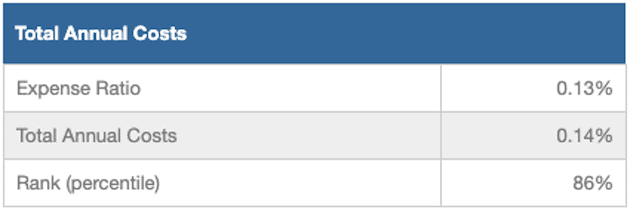

XLP Has Low Costs, Too

XLP’s 0.14% total annual costs (TAC) are below the weighted average of the 12 other Consumer Non-cyclicals ETFs under coverage, which sits at 0.21%.

Figure 5 shows our breakdown of XLP’s total annual costs, which is available for all of the nearly 7,000 mutual funds and 700+ ETFs under coverage.

Figure 5: XLP’s Annual Costs

Sources: New Constructs, LLC and company filings

A Closer Look at a Quality Holding

We first made Walmart Inc. (WMT: $143/share) a Long Idea in June 2011. We wrote about it again in August 2018, December 2018, and July 2019. Since our last report in July 2019, the stock is up 29% while the S&P 500 up 28%. Today, the stock earns an Attractive rating and remains on our Focus List - Long.

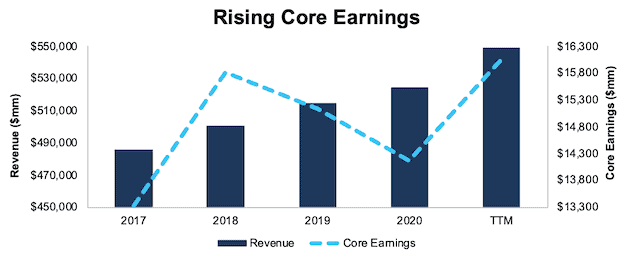

Since 2017, Walmart has grown Core Earnings by 2% compounded annually. The firm improved its ROIC from 9.8% in 2017 to 10.1% TTM. Walmart has also generated $52.5 billion (13% of market cap) in free cash flow (FCF) since 2017 and generated $13.9 billion in FCF over the TTM.

Figure 6: Revenue & Core Earnings Since 2017

Sources: New Constructs, LLC and company filings

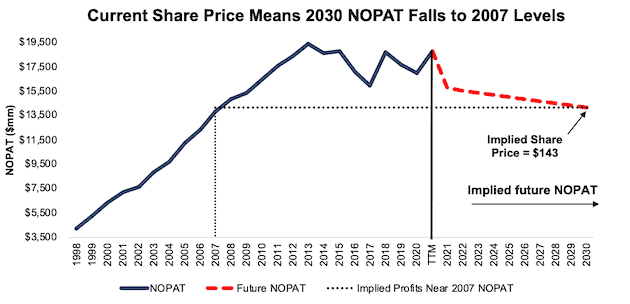

At its current price of $143/share, Walmart has a PEBV ratio of 0.7. This ratio means the market expects Walmart’s net operating profit after tax (NOPAT) to permanently decline by 30%. This expectation seems overly pessimistic for a firm that has grown NOPAT by 3% compounded annually over the past three years and by 5% compounded annually over the past two decades.

The current stock price implies Walmart’s NOPAT margin falls to 3.0% (vs. 3.4% TTM) and NOPAT falls by 1% compounded annually for the next decade. See the math behind this reverse DCF scenario. In this scenario NOPAT in 2030 would fall to 2007 levels and still be 25% below TTM levels.

Figure 7: Current Price Implies NOPAT Falls 25% Below TTM Levels

Sources: New Constructs, LLC and company filings

Big Upside If Walmart Grows Profits by Just 2% Compounded Annually

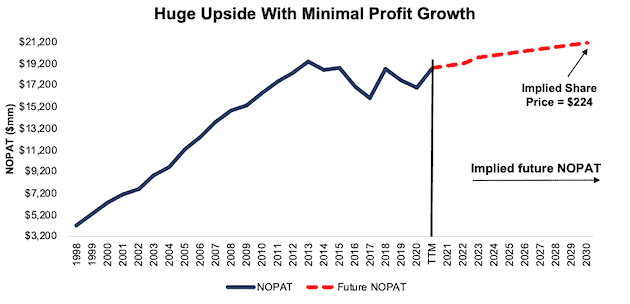

In a more optimistic scenario, where Walmart maintains its TTM NOPAT margin of 3.4% (vs. 10-year average of 3.8%) and the firm grows NOPAT by just 2% compounded annually for the next decade, the stock is worth $224/share today – a 57% upside. See the math behind this reverse DCF scenario.

Figure 8: WMT Holds 57% Upside If 2030 Profits Are Just 13% Above TTM Levels

Sources: New Constructs, LLC and company filings

Even Quality Funds Can Have Some Bad Holdings

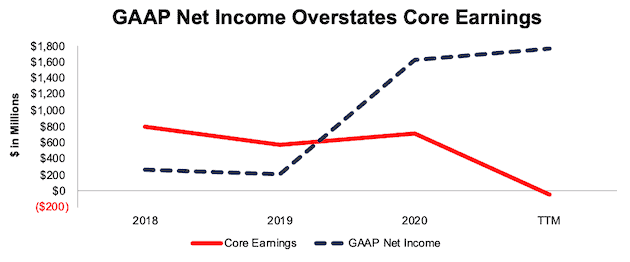

Given that only 3% of XLP’s assets are allocated to stocks with an Unattractive-or-worse rating, it is more difficult to find a stock that does not offer good risk/reward. However, not all stocks, such as Campbell Soup Company (CPB: $46/share) are as profitable as their reported earnings would have you believe.

Figure 9 shows that since 2018, Campbell’s GAAP net income and Core Earnings have been heading in opposite directions. This disconnect means Campbell’s earns our Strong Miss Earnings Distortion Score.

Over the TTM, Campbell’s had over $1.8 billion in net earnings distortion that cause earnings to be overstated by $5.95/share, or 102% of EPS. Majority of the unusual income hidden and reported in Campbell’s filings include:

- $1.1 billion in net gain (pre-tax) on sale of businesses – 2Q20 10-Q

- $1.0 billion in earnings from discontinued operations – 2020 10-K

This unusual income is partially offset by non-operating expenses such as:

- $64 million in loss on sale of business – 2020 10-K

- $60 million in non-operating expense related to cost transformations in the 2020 10-K, which includes:

- $48 million in administrative expenses

- $9 million in cost of products sold

- $2 million in marketing and selling expenses

- $1 million in research and development expenses

- $49 million in investment losses – 2020 10-K

- $43 million in pension settlement charges – 2020 10-K

- $30 million in net periodic benefit expense other than the service cost – 2020 10-K

In addition, we made a $216 million adjustment for income tax distortion. This adjustment normalizes reported income taxes by removing the impact of unusual items.

After removing earnings distortion, we find that Campbell’s TTM Core Earnings of -$39 million are significantly lower than GAAP net income of $1.8 billion, per Figure 9.

Figure 9: GAAP Net Income vs. Core Earnings Since 2018

Sources: New Constructs, LLC and company filings

With misleading earnings, a bottom quintile ROIC, and a PEBV ratio of 9.1, there are better stocks, from an earnings quality and valuation perspective, available in the market.

The Importance of Sector and Holdings Based Fund Analysis

ETF Investors can make better-informed decisions by combining rigorous sector analysis with in depth analysis of the holdings of each ETF. Simply buying a mutual fund or ETF based on past performance does not necessarily lead to outperformance. Only through holdings-based analysis can one determine if an ETF is allocating to undervalued, high-quality stocks, as XLP does.

However, most investors don’t realize they can already get the sophisticated fundamental research[2] that corrects market inefficiencies and generates alpha. Our Robo-Analyst technology analyzes the holdings of all 7,700+ ETFs and mutual funds under coverage to avoid “the danger within.” For reference, the number of holdings in these Consumer Non-cyclicals sector ETFs and mutual funds varies from just 24 stocks to 125 stocks in a given fund. Our diligence on holdings allows us to cut through the noise and find ETFs, like Consumer Staples Select Sector SPDR Fund, with a portfolio that suggests future performance will be strong.

This article originally published on January 20, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Core Earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence, a paper by professors at Harvard Business School (HBS) & MIT Sloan. Recently accepted by the Journal of Financial Economics, the paper proves that our data is superior to all the metrics offered elsewhere.

[2] Three independent studies from respected institutions prove the superiority of our data, models, and ratings. Learn more here.