We published an update on JBL on April 6, 2023. A copy of the associated update report is here.

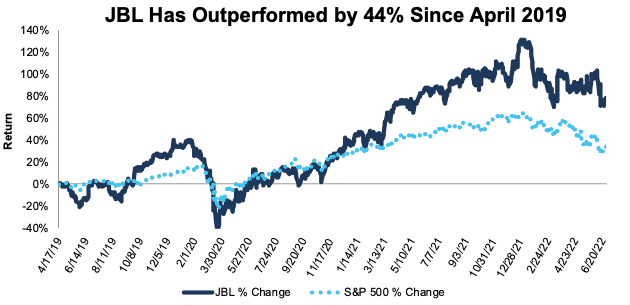

We first made Jabil (JBL: $53/share) a Long Idea in April 2019. Since then, the stock is up 79% compared to a 34% gain for the S&P 500. Despite its large gains, the stock still offers investors plenty of more upside. As we’ll show the stock could be worth at least $70/share today – a 32%+ upside.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Jabil’s Stock Offers Favorable Risk/Reward Based on the Company’s:

- manufacturing and design expertise

- strong customer relationships

- growth prospects across its diversified end markets

Figure 1: Long Idea Performance: From Date of Publication Through 6/27/2022

Sources: New Constructs, LLC

What’s Working

In fiscal 2Q22, the firm’s diversified manufacturing services (DMS) segment rose 4% year-over-year (YoY), while its electronics manufacturing services (EMS) segment rose 19% YoY. The company's strong performance in 1H22 led management to raise its fiscal 2022 forecast to ~$32.6 billion, which is a 11% higher than its fiscal 2021 revenue.

Diversified End Market Exposure: Looking toward the future, Jabil is well positioned for long-term revenue growth in multiple end markets. Specifically, the company has large growth opportunities in electric vehicles, 5G, personalized healthcare, cloud computing, and clean energy markets. Industry researchers expect all but one of the following markets to grow by a double-digit CAGR in coming years:

- 5G devices: 38% CAGR through 2030 according to Report Ocean

- electric vehicle unit sales: 17% CAGR through 2030 according to S&P Global

- cloud computing: 16% CAGR through 2030 according to Research And Markets

- precision medicine: 12% CAGR through 2030 according to Research And Markets

- renewable energy: 9% CAGR through 2030 according to Precedence Research

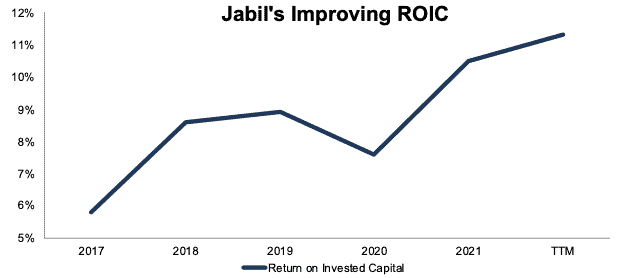

Improving Profitability: Jabil operates an efficient business that has improved its return on invested capital (ROIC) since fiscal 2017. Jabil’s net operating profit after tax (NOPAT) margin rose from 2% in fiscal 2017 to 3% over the trailing twelve months (TTM), while invested capital turns rose from 2.9 to 4.1 over the same time. Rising NOPAT margins and invested capital turns drove Jabil’s ROIC from 6% in fiscal 2017 to 11% TTM.

Figure 2: Jabil’s Return on Invested Capital Since Fiscal 2017

Sources: New Constructs, LLC and company filings

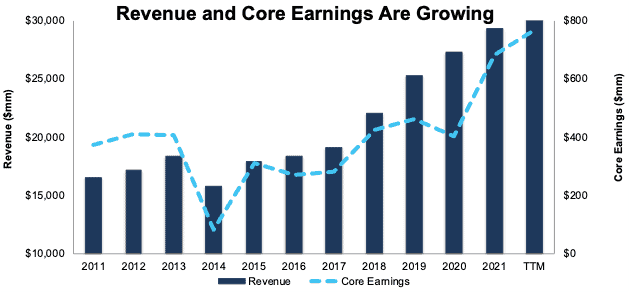

Strong Customer Base Leads to Core Earnings Growth: Jabil’s vast manufacturing and design capabilities attract industry-leading customers such as Apple (AAPL), Johnson & Johnson (JNJ), Alphabet (GOOGL), the Coca-Cola Company (KO), and Amazon (AMZN).

Jabil’s operating model of partnering with profitable customers across diversified end markets delivers strong results. Per Figure 3, Jabil has grown revenue from $16.5 billion in fiscal 2011 to $30.7 billion TTM, while the company’s Core Earnings have grown from $374 million to $766 million over the same time. Impressively, Jabil has generated positive Core Earnings in each of the past 24 years.

Figure 3: Jabil’s Revenue and Core Earnings: Fiscal 2011 Through TTM

Sources: New Constructs, LLC and company filings

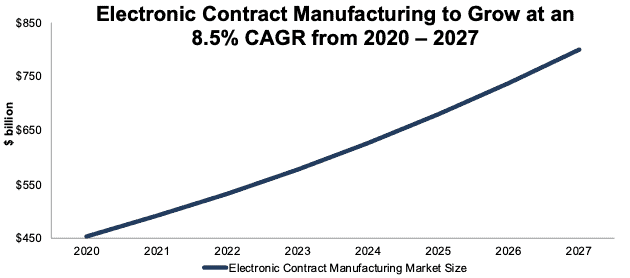

Strong Tailwinds Drive Future Growth: Expected growth in the electronic contract manufacturing market will provide a resilient tailwind for future top-and-bottom line growth for Jabil. Market research provider Quad Intel expects the electronic contract manufacturing market to grow from $452.5 billion in 2020 to $800.9 billion in 2027, or 8.5% compounded annually.

Figure 4: Electronic Contract Manufacturing Market Size: 2020 - 2027

Sources: New Constructs, LLC and Quant Intel

What’s Not Working

Customer Concentration Adds Risk: Jabil’s five largest customers accounted for 47% of the company’s fiscal 2021 revenue. Indeed, Apple (APPL) alone accounted for 22% of Jabil’s revenue in fiscal 2021. Should one of its leading customers leave, Jabil would likely see an immediate decline in revenue and profits. Jabil has had some success reducing its reliance on Apple as Apple accounted for 28% of the firm’s revenue in fiscal 2018.

Jabil’s diversified end market exposure does help to limit customer concentration risk as a downturn in one end market could be offset by growth in another. The issue is one we will continue watching.

On the bright side, Jabil partners with financially strong companies, which reduces the risk of losing a customer due to adverse economic conditions. Of the 51 Jabil customers in our coverage, 90% earn a Credit Rating of Neutral-or-better. That means a loss of business would be the result of competition, which is something the the company can address.

Large Exposure to China: Jabil conducts a large amount of business in China, and any disruption in the country could have a significant impact on Jabil’s operating results. The company’s direct revenue from China accounted for 16% of total revenue in fiscal 2021.

More important to Jabil is the company’s manufacturing exposure in China. Jabil has a “significant portion” of its manufacturing, design, support, and storage operations located in China, which accounted for 41% of the company’s long-lived assets in fiscal 2021. If geo-political tensions between China and the West force Jabil’s customers exit the country, the company would lose a large, highly skilled labor force and large amounts of its manufacturing capacity.

However, if the company were forced to exit operations in China, Jabil’s facilities, and operational experience in 30 other countries would support a transition away from China.

Reduction in Discretionary Spending: Like most companies, the current economic environment is a headwind to Jabil’s near-term revenue and profit growth, as slowdowns in discretionary spending directly affect demand for many of the products Jabil designs and manufactures. However, Jabil’s customers consist of many resilient, industry leaders, that are likely to bounce back strongly after any global recession.

Stock Is Priced for a Decline in Profits

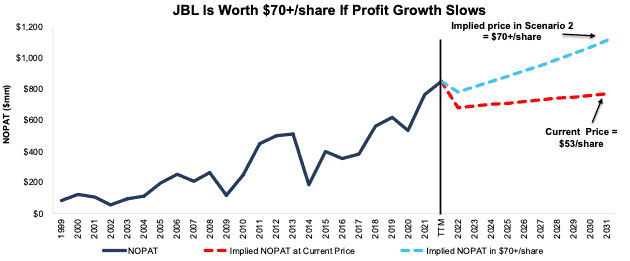

Even after the strong performance of this Long Idea, the market’s expectations for the company’s future cash flows are overly pessimistic. Jabil’s price-to-economic book value (PEBV) ratio is just 0.8, which means the market expects its profits to permanently fall 20% below TTM levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Jabil.

In the first scenario, we quantify the expectations baked into the current price. We assume:

- NOPAT margin falls to its ten-year average of 2.3% (vs. 2.8% TTM) from fiscal 2022 – 2031, and

- revenue grows just 1% (vs. fiscal 2022 – 2023 consensus estimate CAGR of 8%) compounded annually from fiscal 2022 to 2031.

In this scenario, Jabil’s fiscal 2031 NOPAT is 9% below TTM levels, and the stock would be worth $55/share today – nearly equal to the current price.

Shares Could Reach $70+

If we assume Jabil’s:

- NOPAT margin falls to fiscal 2021 levels of 2.6% from fiscal 2022 – 2031,

- Revenue grows at a 4% CAGR from fiscal 2022 – 2031, then

the stock would be worth at least $70/share today – 32% above the current price. In this scenario, Jabil grows NOPAT by 4% compounded annually over the next 10 years. For reference, Jabil grew NOPAT by 17% compounded annually over the past five years and 11% compounded over the past two decades. Should Jabil’s NOPAT growth match historical levels, the stock has even more upside.

Figure 5: Jabil’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on June 29, 2022.

David Trainer, Kyle Guske II, Matt Shuler, and Brian Pellegrini receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.