We published an update on this Long Idea on June 29, 2022. A copy of the associated Earnings Update report is here.

GAAP rules allow non-operating gains/losses to obscure real profits. Investors can gain advantage from doing the diligence needed to assess true profits.

For example, this firm has consistently grown true profits over the past five years while net income has declined. It also provides key services to some of the biggest electronics firms in the world and pays executives for creating shareholder value. Despite these positives, the stock is priced as if profits will permanently decline. Jabil Inc. (JBL: $30/share) is this week’s Long Idea.

GAAP Results Mask JBL’s True Profit Growth

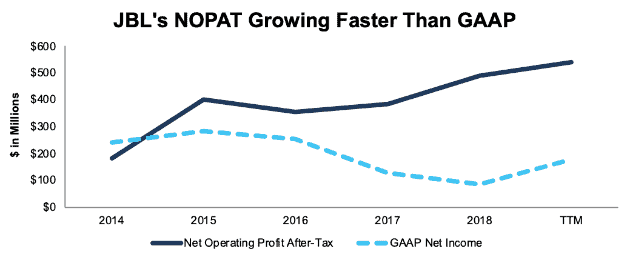

Investors who focus solely on reported earnings can’t see JBL’s profit growth. Over the past five years, JBL’s GAAP net income has fallen 6% compounded annually. On the other hand, after-tax operating profit (NOPAT) has risen an impressive 24% compounded annually over the same time, per Figure 1.

Figure 1: JBL’s GAAP Net Income Vs. NOPAT Since 2014

Sources: New Constructs, LLC and company filings

We closed several accounting loopholes to get an accurate measure of Jabil’s profits. Specifically, we removed $402 million (2% of revenue) of non-operating expenses from JBL’s GAAP net income to calculate JBL’s NOPAT in 2018:

- $232 million in transition tax expense related to the Tax Act

- $33 million in distressed customer charges

- $30 million in foreign currency losses

- $11 million in business interruptions charges

After these adjustments, we can see that 2018 NOPAT grew 27% year-over-year (YoY) while GAAP net income fell 33% YoY.

JBL Improves Competitive Advantages over Peers

In the contract manufacturing industry, Jabil provides electronics design, production and product management services to clients. To remain competitive, JBL is more efficient in manufacturing, faster to market, and offers the latest design and manufacturing technologies. Strict cost controls and intelligent capital allocation help managers avoid overspending when upgrading or increasing manufacturing capabilities.

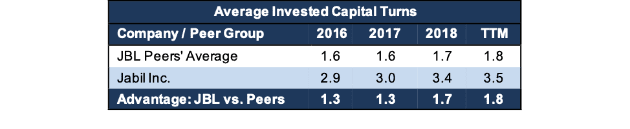

As a result, Jabil runs a more efficient and profitable business than its peers. Figure 2 shows that Jabil’s invested capital turns – annual revenue divided by average invested capital – are higher and rising faster than peers’ in each of the past three years and the TTM period. Competitors in the analysis are taken from Jabil’s 2018 10-K and include Benchmark Electronics (BHE), Flex Ltd (FLEX), Plexus Corporation (PLXS) and AptarGroup (ATR) among others.

Figure 2: JBL’s Invested Capital Turns Vs. Competition

Sources: New Constructs, LLC and company filings

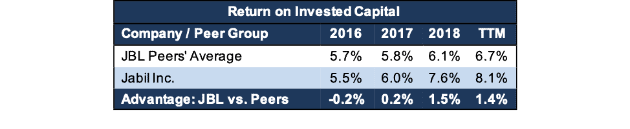

Per Figure 3, JBL has also improved its return on invested capital (ROIC) at a faster rate, and it now earns a higher ROIC than its competitors.

Figure 3: JBL’s ROIC Vs. Peers

Sources: New Constructs, LLC and company filings

Corporate Governance Focuses Executives on Creating Shareholder Value

JBL’s growth in recent years has not come at the expense of prudent capital stewardship, as we often see with Technology companies. Instead, JBL’s corporate governance ensures that executives are focused on creating lasting shareholder value.

In fiscal 2015, JBL added ROIC to the performance targets used to award executive’s annual cash incentives. This decision was made, as JBL’s Board of Director’s noted, “to provide additional focus on optimal deployment of investment and working capital.”

This focus on improving ROIC aligns the interests of executives and shareholders and helps ensure prudent stewardship of capital[1], as shown in Figures 2 and 3. There is also a strong correlation between improving ROIC and increasing shareholder value, a fact highlighted in our recent article “CEO’s That Focus on ROIC Outperform.”

This change in executive incentives helped drive Jabil’s ROIC from 5.5% in fiscal 2016 to 8.1% over the trailing twelve months (TTM), per Figure 3.

Customer Concentration is Less Important Than End-Market Diversification

JBL bears will argue that JBL’s revenue concentration with Apple (28% in 2018) represents significant risk. The risk of a slowdown in or loss of Apple’s business is mitigated by the diversification of JBL’s business segments and its long-term relationship with Apple. In this respect, JBL reminds of us previous Long Idea Lumentum (LITE), which is up 31% vs. the S&P 500 up 10% since we wrote about the stock in January.

By diversifying the end-markets served, Jabil minimizes the impact one product has on its financials. For instance, a downturn in smart phone manufacturing could be offset by growth in wearables, which are experiencing much faster growth.

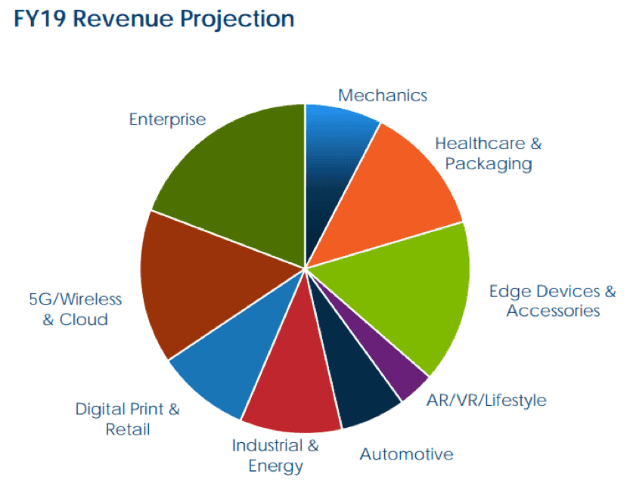

Per Figure 4, JBL’s revenue stretches across nine different end-markets. No one market has an outsized influence over the others. In fact, it is management’s stated goal that no one product family will represent more than 5% of operating income in any fiscal year.

Figure 4: JBL’s Revenue Breakdown by End-Market

Sources: Jabil Inc. 2Q18 Earnings Presentation

Additionally, Apple holds its suppliers to the highest standards in regards to working conditions, eco-friendly initiatives, and more. To keeps its costs low, Apple isn’t in the habit of swapping out suppliers that have consistently proven their ability to meet its high standards. Jabil has listed Apple as a key customer eight years running, and we think the company can continue to meet Apple’s standards going forward.

Tariffs/Trade Concerns Are Minimized Through JBL’s Global Footprint

Bears will also argue that President Trump’s “trade war” with China will also hamper growth at Jabil and peers across the industry with a large presence in the country. However, this argument ignores Jabil’s global footprint, which provides key manufacturing flexibility.

At the end of 2018, Jabil had over 44 million square feet of facilities space, with just around half of this space located in China. The company has an additional 8.5 million square feet of manufacturing space in the United States, nearly 4 million square feet in Mexico and over 1 million square feet in both Hungary and Malaysia. In total, the company has manufacturing space in 29 countries. This global footprint allows Jabil to move production if tariffs become a major issue or if customers decide they want to manufacture elsewhere while a trade agreement is negotiated.

As the company noted in its fiscal 2Q19 conference call, when asked if customers are taking actions to move operations:

“If people want to act on it [moving operations] I think I said this in the December call, we are very well-positioned to accommodate them. But again, overall with our global footprint the way our IT systems are et cetera, we're really well-positioned to assist customers if need be.”

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research is featured by Harvard Business School.

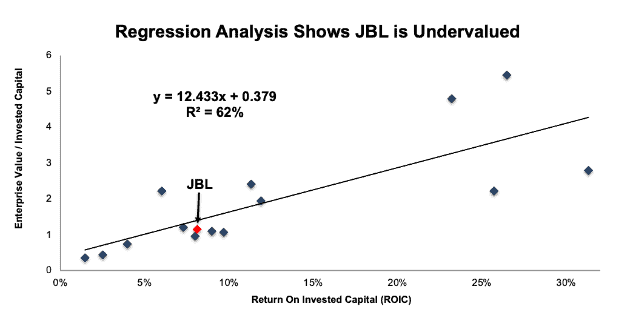

Per Figure 5, ROIC explains 62% of the difference in valuation for the peers listed in JBL’s 2018 proxy statement. JBL’s stock trades at a discount to peers as shown by its position below the trend line.

Figure 5: ROIC Explains 62% Of Valuation for JBL Peers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $41/share – a 37% upside to the current stock price. Given the firm’s rising profits and industry leading position, one would think the stock would garner a premium valuation. Below we’ll use our DCF model to quantify just how high shares could rise assuming conservative profit growth.

JBL Is Priced for Permanent Profit Decline

Despite its strong fundamentals, JBL remains cheap, even though traditional valuation metrics would show otherwise. At its current price of $30/share, JBL has a P/E ratio of 29, which is above the Technology sector average of 26 and the S&P 500 average of 22.

When we analyze the cash flow expectations baked into the stock price though, we find that JBL is significantly undervalued. At its current price of $30/share, JBL has a price-to-economic book value (PEBV) ratio of 0.9. This ratio means the market expects JBL’s NOPAT to permanently decline by 10%. This expectation seems rather pessimistic given that JBL has grown NOPAT by 28% compounded annually since fiscal 2014 and 10% compounded annually since fiscal 1998.

Such pessimistic expectations create large upside potential. If we assume that JBL can simply maintain TTM NOPAT margins (2.2%) and grow NOPAT just 4% compounded annually over the next decade, the stock is worth $42/share today – a 40% upside. See the math behind this dynamic DCF scenario.

Sustainable Competitive Advantage That Will Drive Shareholder Value Creation

Here’s a summary why we think the moat around Jabil’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps Jabil offer better products/services at a lower price and prevents competition from taking market share.

- Strong relationships with some of the largest electronics firms in the world

- Diverse manufacturing capabilities (electronics, automotive, healthcare, and more)

- Global manufacturing footprint spread across 29 countries

- Proven ability to meet demand and quality requirements

- Exec comp aligned with ROIC and shareholder value creation

What Noise Traders Miss with JBL

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing JBL:

- Balance sheet efficiency advantage vs peers (better capital turns)

- NOPAT is rising despite reported profits declining

- Competitive advantages through balance sheet efficiency and profitability

- Diversified business segments minimize impact of weakness in one end market

- Valuation implies permanent profit decline and gives JBL significant upside

Faster Than Expected Growth Could Push Shares Higher

Grand View Research, an industry research provider, expects the electronic contract manufacturing and design services market to grow by 8% compounded annually from 2019-2025. However, JBL management expects their operations to grow at a much higher rate in fiscal 2019 (13% revenue growth), given the higher growth rates in some of their end markets, such as healthcare and cloud.

However, consensus estimates remain slightly down over the past few months. In January 2019, consensus estimates called for $3.00 in earnings per share for fiscal 2019. Now, despite management’s consistent outlook, earnings expectations have fallen to $2.95/share. Lower estimates make an earnings beat easier.

JBL has also noted in its conference calls that weakness in its semiconductor equipment segment has weighed on revenue and margins. However, management expects this segment to recover beginning in 2020, which should not only boost revenue, but improve the profitability of the firm and further drive cash flows above the current expectations.

Lastly, any resolution to the ongoing trade negotiations with China could provide an immediate boost to JBL and peers alike. In the meantime, investors could benefit from a potential 7% yield, as we’ll show below.

Dividends and Share Repurchase Could Offer 7% Yield

Jabil has paid an annual dividend of $0.32/share each year since 2012. The current dividend provides a 1.1% yield. Over the past five years, Jabil has generated $1.2 billion (25% of market cap) in free cash flow while paying about $312 million in dividends. So, the company’s current dividend looks safe.

In addition to dividends, Jabil returns capital to shareholders through share repurchases. In fiscal 2Q19 JBL exhausted its current $350 million repurchase authorization established in June 2018. In fiscal 2017 and 2016, the Board authorized the repurchase of $450 million and $400 million, respectively. These repurchases were completed in fiscal 2016-2018 for an average of $283 million (6.1% of market cap) per year. Should JBL’s Board of Directors authorize a similar repurchase plan moving forward, the combined yield (with dividends) to shareholders could top 7%.

Insider Trading and Short Interest Are Minimal

Insider activity has been minimal over the past 12 months, with 1.3 million shares purchased and 1 million shares sold for a net effect of 300 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 5.2 million shares sold short, which equates to 3% of shares outstanding and 3.9 days to cover. Short interest has increased 3% from the prior month. Continued profit growth could push these shorts out and send shares higher.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Jabil’s fiscal 2018 10-K:

Income Statement: we made $450 million of adjustments, with a net effect of removing $402 million in non-operating expense (2% of revenue). We removed $24 million in non-operating income and $426 million in non-operating expenses. You can see all the adjustments made to JBL’s income statement here.

Balance Sheet: we made $2.7 billion of adjustments to calculate invested capital with a net increase of $1.6 billion. The most notable adjustment was $1.3 billion in asset write-downs. This adjustment represented 28% of reported net assets. You can see all the adjustments made to JBL’s balance sheet here.

Valuation: we made $3.2 billion of adjustments with a net effect of decreasing shareholder value by $3.2 billion. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $3.1 billion in total debt, which includes $472 million in off-balance sheet debt. This operating lease adjustment represents 10% of JBL’s market cap. You can see all the adjustments made to JBL’s valuation here.

Attractive Funds That Hold JBL

The following funds receive our Attractive-or-better rating and allocate significantly to Jabil.

- UBS U.S. Sustainable Equity Fund (BPEQX) – 4.1% allocation and Attractive rating.

- Fuller & Thaler Behavioral Small-Cap Equity Fund (FTHSX) – 3.6% allocation and Attractive rating.

- Aspiration Redwood Fund (REDWX) – 3.3% allocation and Attractive rating.

This article originally published on April 17, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

[2] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.