Despite underperforming the market for several years, this long-time Long Idea has all the tools for a successful turnaround and holds significant upside potential. Spirit AeroSystems Holdings (SPR: $49/share) is this week’s Long Idea.

We made Spirit AeroSystems a Long Idea in June 2017 based on improved margins from its 2014 restructuring, history of strong free cash flow (FCF) generation, and superior return on invested capital (ROIC) to peers. Since then, the stock is down 14% while the S&P 500 is up 67%. Today, SPR still offers quality risk/reward given Spirit AeroSystems’:

- large $34 billion backlog

- strong liquidity position

- position to benefit from widespread acceptance of the Boeing 737 MAX

- long-term tailwinds from rising narrow-body jet demand

- valuation implies profits will never return to pre-pandemic levels

What Went Wrong

In our original report, we identified the firm’s exposure to customer concentration risk and negative shocks to worldwide air travel. In a little over a year, both these risks materialized with the grounding of the 737 MAX (56% of the firm’s 2018 revenue) in early 2019 and the pandemic’s shock to global travel in 2020. While these disruptions have affected Spirit AeroSystems’ operations in the interim, the firm is well-positioned for a recovery.

What’s Going Right, Now

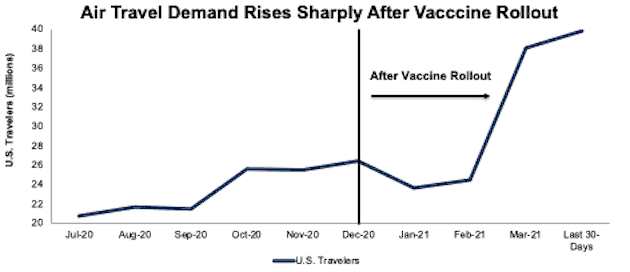

Figure 1 shows the rise in U.S. air travel since vaccinations began in December 2020.

Figure 1: TSA Checkpoint Monthly Travel Numbers

Sources: New Constructs, LLC and TSA.

Before the rollout of vaccines, the number of air traveler’s passing through TSA checkpoints in November 2020 was down 63% year-over-year (YoY). Over the first five days in April 2021, U.S. traveler demand was just 35% below the same period in 2019.

Helping drive demand for passengers to resume travel, airfares have reached the lowest-ever inflation-adjusted levels since the U.S. government began tracking prices in 1995. In addition to ticket prices, airlines are offering more flexibility by waiving fees on changed tickets.

The improved outlook for the industry is echoed by some of the largest airlines in the world. Delta (DAL), United Airlines (UAL), and Alaska Air (ALK) expect to break even by April, and Southwest Airlines (LUV) aims to break even by June. The surge in leisure travel has American Airlines’ domestic flights nearly 80% full while its bookings are almost at “pre-pandemic levels.” Additionally, United Airlines is opening its new pilot training academy and Southwest Airlines has recalled 200 pilots who agreed to take extended time off.

Demand for Narrow-Body Planes Is Also Rising

With an increase in demand for air travel, demand for narrow-body planes such as the B737 MAX will help lead the recovery. Narrow-body planes are the largest segment of the market, and make up 60% of the global fleet. This segment will also lead the recovery in demand. Consulting firm Oliver Wyman projects that global demand for narrow-body aircraft will grow by 3.5% annually over the next 10 years, with cumulative deliveries ~90% of pre-COVID expectations.

Boeing forecasts that airlines will need 32,270 new narrow-body aircraft over the next two decades. As the exclusive provider of B737 MAX fuselages, Spirit AeroSystems is well-positioned to benefit from the long-term demand for narrow-body planes.

High Barriers to Entry & Exclusive Relationships Mitigate Concentration Risk

While Spirit AeroSystems has a limited ability to diversify its customer base, very high barriers to entry into the airframe industry reduces the risk of the Boeing-Airbus duopoly losing market share to new entrants.

Additionally, Spirit AeroSystems has exclusive supplier agreements for several Boeing aircraft parts which extend through the life of each aircraft’s program. In other words, Boeing is also highly dependent on Spirit AeroSystems, and the risk of Spirit AeroSystems losing Boeing as a customer is low.

High Switching Costs Means B737 Customers Will Stick With Boeing, and, Therefore, Spirit

Even considering the problems experienced with the B737 MAX, switching to another aircraft means incurring costs to train flight and maintenance crews on new equipment. Such large switching costs mean that a significant loss in B737 customers is unlikely.

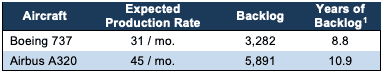

Per Figure 2, Airbus’ larger backlog means customers switching from the B737 to Airbus’ A320 must wait two years longer to take delivery of newer aircraft.

Figure 2: Boeing 737 vs. Airbus A320 Backlog – Fiscal 2020

Sources: New Constructs, LLC and company filings.

Deliveries Are Already Coming Back…

With safety agencies in the U.S., Brazil, Canada, Australia, the U.K. and the E.U. allowing the return of the 737 MAX, orders for the aircraft are picking up again. United Airlines, Southwest Airlines, and Ryanair have recently placed a combined 200 (6% of Boeing’s current 737 backlog) orders for the Boeing 737 MAX. For reference, Spirit AeroSystems made just 71 B737 deliveries in 2020.

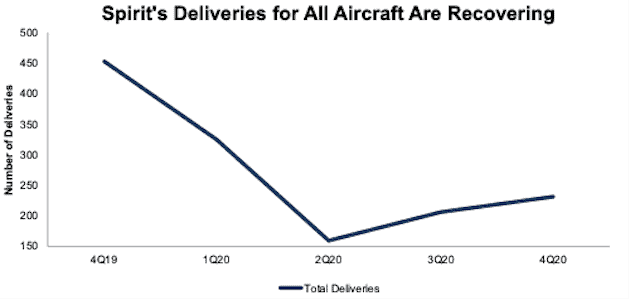

Rising orders means Spirit AeroSystems’ deliveries for all aircraft are also recovering. Per Figure 3, while still nearly 50% below 4Q19 levels, Spirit AeroSystems’ deliveries for all aircraft rose from 159 in 2Q20 to 231 in 4Q20.

Going forward, Spirit AeroSystems expects its deliveries of B737s in 2021 to more than double 2020 levels with ~160 deliveries.

Figure 3: Spirit AeroSystems’ Deliveries for All Aircraft by Quarter

Sources: New Constructs, LLC and company filings.

…And Spirit AeroSystems Has the Liquidity for a Long Recovery

With the threat of a prolonged delay to its normal operations, Spirit AeroSystems is prepared for a long period of cash burn.

Spirit AeroSystems believes it will take about 18 months to sync up its production rates with Boeing’s.

At the end of 2020, Spirit AeroSystems had a cash balance of $1.9 billion and $3.9 billion in debt with no notes due until 2023.

Assuming the firm maintains its 4Q20 level of revenue, cost of sales, selling, general and administrative expense, research and development expense, interest expense, and capital expenditures, the firm can manage its operations for 42 months before needing additional capital. This scenario also assumes Spirit AeroSystems pays back its credit facility, floating rate loan, and its 2023 notes. This scenario conservatively assumes a worst-case scenario with no increase in demand from 4Q20 levels. While this is highly unlikely, it illustrates the firm’s strong cash position.

Spirit AeroSystems Is More Than the 737

Spirit AeroSystems, owned by Boeing prior to 2005, is the exclusive provider all the products the firm makes for the B737, B747, B767, and B777 as long as they are in production. Additionally, Spirit AeroSystems is the exclusive supplier for several components of the B787, as well.

In addition to supplying Boeing, the firm supplies several Airbus (EADSY) aircraft, Bombardier (BDRBF), Rolls-Royce (RLLCF), Mitsubishi Heavy Industries (MHVYF), Lockheed Martin (LMT), Bell Helicopter, and Northrop Grumman (NOC). While demand for narrow-body aircraft, like the B737, will undoubtedly drive revenue growth, Spirit AeroSystems’ other aircraft business (47% of revenue in 2019 and 81% of revenue in 2020) diversifies its revenue.

While B737 deliveries and revenue were down 88% YoY and 84% YoY in 2020, the non-737 deliveries fell only 28% YoY and non-737 revenue fell just 25% YoY.

One area that did grow for Spirit AeroSystems’ in 2020 was its defense segment. The firm’s deliveries from its defense segment increased 20% YoY in 2020, and the firm now targets $1 billion (13% of 2019 revenue) in annual revenue from this segment by the “mid 2020’s”.

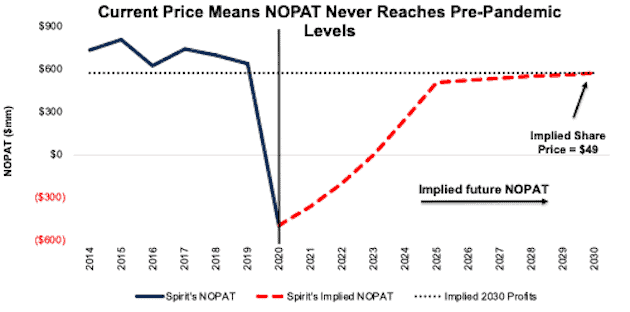

SPR’s Current Price Implies NOPAT Never Recovers to Pre-Pandemic Levels

Below, we use our reverse discounted cash flow (DCF) model to illustrate the expectations embedded in Spirit AeroSystems’ valuation.

To justify its current price of $49/share, the company must:

- gradually improve net operating profit after-tax (NOPAT) margin from -15% in 2020 to 10% (average from 2015 to 2019) in 2025[2] and each year thereafter and

- grow revenue 12% compounded annually from 2021 to 2023 (vs. consensus estimates of 24%) and 3% a year each year thereafter through 2030

In this scenario, Spirit AeroSystems’ NOPAT reaches $573 million in 2030 or 10% below 2019 levels. See the math behind this reverse DCF scenario.

For reference, In 2019, Spirit AeroSystems generated $7.9 billion of revenue from 1,791 deliveries, or $4.4 million per delivery for all aircraft. At $4.4 million per delivery for all aircraft, Spirit AeroSystems’ implied deliveries for all aircraft in 2030 would be 1,311, or 22% below its average deliveries from 2016 to 2019.

Figure 4 compares Spirit AeroSystems’ implied NOPAT in this scenario to its historical NOPAT.

Figure 4: DCF Scenario 1: Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

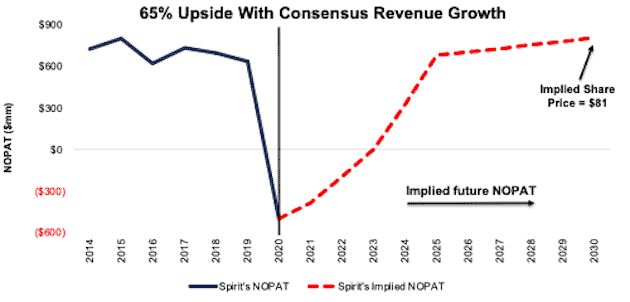

SPR Has 65% Upside If Revenue Simply Matches Consensus Estimates

If Spirit AeroSystems’ revenue grows at consensus estimates, then SPR has 65% upside. In this scenario, we assume:

- NOPAT margin gradually improves from -15% in 2020 to 10% (average from 2015 to 2019) in 2025 and each year thereafter and

- revenue grows 24% compounded annually from 2021 to 2023 (equal to consensus estimates) and 3.5% (the average annual global GDP growth rate since 1961) each year thereafter through 2030

In this scenario, the stock is worth $81/share today – a 65% upside. See the math behind this reverse DCF scenario. In this scenario, Spirit AeroSystems’ NOPAT grows by just 2% compounded annually from 2019 to 2030 and reaches its 2015 levels. For reference, during the 11 years leading up to the pandemic, the firm’s NOPAT grew 8% compounded annually. Figure 5 compares Spirit AeroSystems’ implied NOPAT in this scenario to its historical NOPAT.

Figure 5: DCF Scenario 2: Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Spirit AeroSystems’ business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages also help Spirit AeroSystems grow its market share over the long term:

- exclusive supplier of parts for multiple Boeing aircraft

- one of the few suppliers for narrow-body aircraft, expected to be in high demand for the foreseeable future

- ample liquidity to survive an extended market downturn

What Noise Traders Miss With Spirit AeroSystems

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- accelerated rise in air travel demand since the vaccine rollout

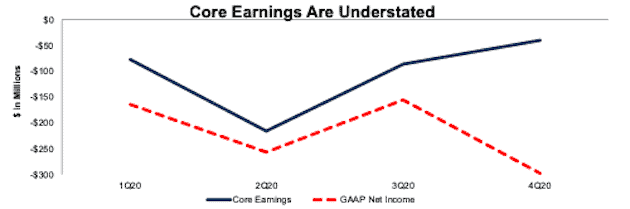

- Core Earnings are much higher than GAAP net income

- valuation implies profits never recover to pre-pandemic levels

Misleading Earnings Could Mean an Earnings Surprise

Spirit AeroSystems currently receives our “Beat” Earnings Distortion score. This score means that Spirit AeroSystems’ GAAP net income understates the true profitability of the business and it is more likely to beat its upcoming earnings. Figure 6 compares the firm’s Core Earnings with GAAP net income over the past four quarters.

Figure 6: Spirit AeroSystems’ Core Earnings vs. GAAP Net Income – 1Q20 to 4Q20

Sources: New Constructs, LLC and Company filings.

Spirit AeroSystems has multiple unusual charges that were hidden in the footnotes of its 2020 10-K. Detailed below, these hidden unusual items along with reported unusual items amount to over -$392 million in Earnings Distortion in 2020 and materially distort (by -45%) Spirit AeroSystems’ GAAP earnings:

Hidden Unusual Items, Net = -$65 million:

- $34 million in costs “related to temporary workforce adjustments” – Page 83 2020 10-K

- $20 million in “acquisition-related expenses” – Page 123 2020 10-K

- $11 million in “acquisition-related expenses” – Page 126 2020 10-K

- $500 thousand in “acquisition-related expenses” – Page 124 2020 10-K

Reported Unusual Items on the income statement, Net = -$428 million:

- $195 million in “interest expense and financing fee amortization” – Page 65 2020 10-K

- $73 million in “restructuring costs” – Page 65 2020 10-K

- $49 million adjustment for contra Earnings Distortion for recurring pension costs

- $37 million in pension loss – Page 117 2020 10-K

- $27 million in “foreign currency losses” – Page 117 2020 10-K

- $23 million in “loss on disposal of assets” – Page 65 2020 10-K

- $11 million in “loss on foreign currency forward contract and interest rate swap” – Page 117 2020 10-K

- $9 million in “loss on sale of accounts receivable” – Page 117 2020 10-K

- $5 million in “ASC 326 credit loss reserve” – Page 117 2020 10-K

- $3 million in “other” expenses – Page 117 2020 10-K

- $3 million in “Kansas Development Finance Authority bond” income – Page 117 2020 10-K

In addition, we made a $101 million adjustment for income tax distortion to normalize reported income taxes by removing the impact of unusual items.

After removing Earnings Distortion, which totals -$3.78/share, we find that Spirit AeroSystems’ 2020 Core Earnings of -$4.60/share are significantly higher than GAAP net income of -$8.38/share.

Additional Catalysts Could Elevate Share Prices

Beyond an earnings surprise, Spirit AeroSystems investors could see their shares rise if air travel demand continues on its recent trajectory and further closes in on pre-pandemic demand levels.

The recent recovery in oil prices also pressures airlines to upgrade aging fleets with new and more efficient aircraft. Should oil prices persist at elevated levels, then airlines could be motivated to increase orders, which could quickly improve both Spirit AeroSystems’ profits and share price.

Share Repurchases Could Resume In a Recovery

Spirit AeroSystems lowered its dividend from $0.48/share in 2019 to just $0.04/share in 2020. Since 2017, the firm has paid $161 million in dividends. While the current dividend provides just a 0.1% yield, should the firm resume dividends at 2019 levels, investors buying at the current price would receive a 1% yield.

Spirit AeroSystems has also traditionally returned capital to shareholders through share repurchases. However, the firm suspended repurchases in response to the 737 MAX grounding and COVID- pandemic. From 2015 to 2019, the firm repurchased $2.3 billion (44% of current market cap). Spirit AeroSystems has $925 million remaining for future repurchases under its current authorization. Once the firm recovers from the disruption to its business, shareholders should expect repurchases buybacks to resume.

Executive Compensation Needs Improvement

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Spirit AeroSystems compensates executives with salaries, cash bonuses, and long-term equity awards. Cash bonuses are tied to metrics such as adjusted net debt, operating cost, new revenue growth, and quality.

Long-term incentives are tied 100% to total shareholder return (TSR). While the company claims that tying executive compensation to TSR aligns executive interests with shareholder interests, we disagree. By incentivizing executives to keep a close eye on the stock price, they could easily sacrifice long-term value creation while chasing short-term price momentum.

Instead Spirit AeroSystems should tie performance compensation to improvement in ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value. Tying executive compensation to ROIC also ensures that executives’ interests are actually aligned with shareholders’ interests.

Insider Trading and Short Interest Trends

Over the past twelve months, insiders have bought 81 thousand shares and sold 42 thousand shares for a net effect of 39 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 6.5 million shares sold short, which equates to 6% of shares outstanding and just more than two days to cover. Short interest is up 14% from the prior month. The low short interest indicates not many investors are willing to get in front of this stock if it takes off.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide more reliable fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Spirit AeroSystems’ 2020 10-K:

Income Statement: we made $585 million of adjustments, with a net effect of removing $375 million in non-operating expenses (11% of revenue). You can see all the adjustments made to Spirit AeroSystems’ income statement here.

Balance Sheet: we made $3.9 billion of adjustments to calculate invested capital with a net decrease of $1.8 billion. One of the largest adjustments was $1.7 billion in excess cash. This adjustment represented 27% of reported net assets. You can see all the adjustments made to Spirit AeroSystems’ balance sheet here.

Valuation: we made $5.8 billion of adjustments with a net effect of decreasing shareholder value by $2.4 billion. Apart from total debt and excess cash noted above, one of the most notable adjustments to shareholder value was $13 million in deferred tax liabilities. This adjustment represents <1% of Spirit AeroSystems’ market cap. See all adjustments to Spirit AeroSystems’ valuation here.

Attractive Fund That Holds SPR

The following fund receives our Attractive rating and allocates significantly to SPR:

- First Trust Rising Dividend Achievers ETF (RDVY) – 2.1% allocation

This article originally published on April 7, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Years of Backlog equals backlog / (monthly expected production rate * 12). The 737 Max target production rate is 31/mo. by early 2022. The A320 target production rate is 45/mo. by 4Q21.

[2] While Spirit AeroSystems believes it can return back to 2018-type cash flows by 2023, Morgan Stanley more conservatively anticipates Spirit AeroSystems to return to “normalized earnings” in 2025. We use Morgan Stanley’s more conservative view in this scenario which delays margins from reaching pre-pandemic levels until 2025.