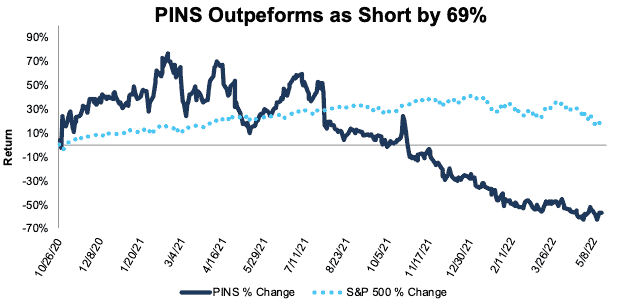

We first put Pinterest (PINS: $23/share) in the Danger Zone in October 2020 and reiterated our opinion in November 2020 and August 2021. Since our original report, the stock has outperformed by 69% as a short vs. the S&P 500, falling 55% while the S&P rose 15%. Investors may think it’s time to buy the dip – we disagree. Pinterest’s 1Q22 earnings and forward guidance indicate record performance in 2021 was an anomaly. The company’s current fundamentals cannot justify the expectations baked into its stock price.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Pinterest’s Stock Could Fall Further Based on:

- slowing revenue growth

- tempered expectations for user growth

- expenses rising faster than revenue, which is driving down profitability

- current valuation of the stock implies Pinterest will maintain record high margins despite guidance indicating otherwise and grow monthly active users (MAUs) to over half that of Facebook (FB)

Figure 1: Danger Zone Outperformance of 69%: From 10/26/20 Through 5/20/22

Sources: New Constructs, LLC

What’s Working

Top-line improvement: Pinterest grew revenue 18% year-over-year (YoY) in 1Q22 and its trailing-twelve-month (TTM) revenue is the highest in company history. Additionally, Pinterest’s average revenue per user (ARPU) improved YoY in each of its three geographic regions, U.S. & Canada, Europe, and Rest of World. Unfortunately for Pinterest investors, the top line was one of the few bright spots in 1Q22, and even it had some holes, as we’ll show below.

What’s Not Working

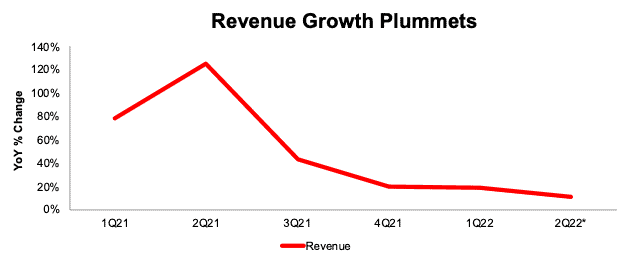

Growth story ending: While Pinterest benefited, as did other tech and stay-at-home stocks during and after the COVID-19 pandemic, that boost is wearing off. Growth rates across many key metrics, while still positive, have fallen in recent quarters. Per Figure 2, revenue grew just 18% YoY in 1Q22, compared to 78% YoY in 1Q21. Similarly, revenue grew 125% YoY in 2Q21 while management has guided for just 11% YoY growth in 2Q22.

Figure 2: Year-Over-Year Revenue Growth Rate: 1Q21 through 2Q22

Sources: New Constructs, LLC and company filings

* Based on management’s 2022 guidance

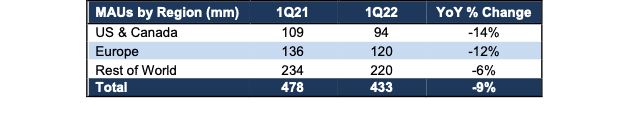

Pinterest is also losing users. Pinterest’s total MAUs have fallen from 478 million in 1Q21 to 433 million in 1Q22, or 9%. The composition of user decline is particularly alarming. See Figure 3. In the U.S. & Canada (Pinterest’s most profitable markets) MAUs are down 13% and Europe MAUs are down 12%. Pinterest’s Rest of World MAUs are down just 6%, but this market generates the lowest average revenue per user.

Figure 3: Monthly Active Users: 1Q21 through 1Q22

Sources: New Constructs, LLC and company filings

Profitability Already Deteriorating: With record revenues and MAUs during and after the COVID-19 pandemic, Pinterest also generated record profitability. It’s net operating profit after-tax (NOPAT) margin was 15% and its return on invested capital (ROIC) was 28% in 2021. That record performance has the dubious distinction of being the first year in which Pinterest generated a positive NOPAT margin and ROIC.

Already, we are seeing steep declines in profits with the firm’s NOPAT margin falling to -0.1% in 1Q22.

Profitability Won’t Improve Anytime Soon: Bulls will argue that 1Q22 represents a blip and that Pinterest will return to profitability moving forward. However, the firm’s own management is warning against such optimism. In its 1Q22 earnings release, management noted that non-GAAP operating expenses (which are adjusted and lower than GAAP operating expenses) are expected to rise 35-40% YoY in 2022. Meanwhile, consensus estimates call for revenue growth of only 18% YoY. Basic math points to diminished margins and fits with Pinterest’s long past of operating losses compared to just one year of profits.

Management Already Tempering User Growth: Investors hoping YoY MAU growth is just around the corner should think again. Pinterest’s management explicitly worked to temper expectations during the 1Q22 earnings call:

“As you think about MAUs for Q2, I’d like to provide you with some additional context. Q2 has historically been our seasonally weakest quarter for MAUs, given that people tend to be outside more, travel more and engage in our core use cases less often.”

Unfortunately for investors, Pinterest is priced for significant growth in MAUs and revenue growth above consensus, as we’ll show below.

Pinterest Priced to Be Half the Size of Facebook

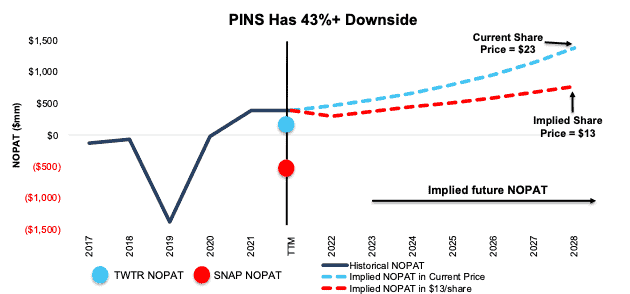

We use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Pinterest’s current valuation. We find that, despite management warnings regarding MAU growth and overall profitability, Pinterest is priced as if it will maintain record margins and grow MAUs to half that of Facebook.

To justify its current price of $23/share, Pinterest must:

- improve its NOPAT margin to 15% (record high in 2021, already fallen to 14.5% over the TTM) and

- grow revenue by 20% compounded annually through 2028.

In this scenario, Pinterest would generate $9.2 billion in revenue in 2028, which is 3.5x its TTM revenue. At its current annual ARPU[2], ($5.86 at the end of 1Q22), this scenario implies the firm would have nearly 1.6 billion MAUs, or 3.6x its 1Q22 MAUs and 54% of Facebook’s 1Q22 MAUs.

We think its overly optimistic to assume Pinterest will reclaim its record margins of 2021 (as it guides for lower profitability) and increase MAUs 3.6 times. Companies that grow revenue 20%+ compounded annually for such a long period are exceedingly rare, which underscores the unrealistic optimism embedded in Pinterest’s share price. In a more realistic scenario, detailed below, the stock has large downside risk.

43% Downside If Pinterest Grows at Consensus Rates

Below, we review an additional DCF scenario to highlight the downside risk in the stock.

If we assume Pinterest’s:

- NOPAT margin equals 10% from 2022-2028,

- revenue grows at consensus rates of 18% in 2022, 23% in 2023, and 19% in 2024, and

- revenue grows 15% a year in 2025-2028, then

the stock is worth $13/share today – a 43% downside to the current price. Even if we assume Pinterest can increase its ARPU by 1.5x current level, this scenario implies the company has 884 million MAUs, or 2x its TTM MAUs. If Pinterest’s profitability fails to improve from 1Q22, or growth slows further, the downside risk in the stock is even higher.

Figure 4 compares Pinterest’s implied future NOPAT in these scenarios to its historical NOPAT. We also include the TTM NOPAT for Twitter and Snap (SNAP) for reference.

Figure 4: Pinterest’s Historical vs. Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Each of the above scenarios also assumes Pinterest’s change in invested capital equals 6% of revenue in each year. This growth in invested capital is half the change in Pinterest’s invested capital as a percent of revenue over the past four years. If we assume Pinterest’s invested capital increases at a similar rate to past years, the downside risk is even larger.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This article originally published on May 23, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Calculated as TTM revenue of $2.7 billion divided by the average MAUs at the beginning and end of the period (1Q21 through 1Q22).