We published an update to this Danger Zone pick on July 20, 2022. A copy of the associated Earnings Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Investors are clamoring to invest in publicly-traded cannabis companies as the legal marijuana market expands. Despite the clear growth potential in this industry, investors still need to exercise caution.

Most of the nine publicly-traded cannabis stocks we currently have under coverage are unprofitable. Some of them have fundamentals that are trending the wrong way, and the majority of them look overvalued.

As we add more cannabis and cannabis related firms to coverage, we’ve come across one that looks particularly unattractive. Cronos Group (CRON: $9/share) is in the Danger Zone.

Misleading Earnings

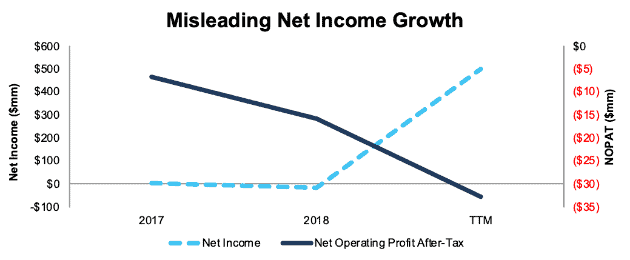

From 2017 to the trailing twelve months (TTM) period, CRON’s net income improved from $2 million to $498 million. Meanwhile, over the same time, after-tax operating profit (NOPAT), fell from -$7 million to -$33 million, per Figure 1.

Figure 1: CRON’s Net Income Hides Real Losses

Sources: New Constructs, LLC and company filings

The disconnect between net income and NOPAT stems from over $533 million in non-operating income reported in operating earnings. These non-operating items artificially increase net income and give investors a misleading picture of the firms true profitability.

We removed the following non-operating items from CRON’s income statement:

- $436 million in gains on the revaluation of derivatives in 1Q19

- $264 million in gains on the revaluation of derivatives in 2Q19

- $21 million in gains on the divestment of Whistler Medical Marijuana Company in 1Q19

- $18 million in the unrealized change in fair value of biological assets in 1Q and 2Q19

Combined, these non-operating items total $739 million, or 3,827% of CRON’s TTM revenue. CRON’s non-operating income completely overshadows its operating results.

Revenue Growth Won’t Remain So High Forever

The last item on the list above, unrealized change in the fair value of biological assets, is worth pointing out as it requires special attention in CRON’s filings. CRON and other cannabis growers such as Aurora Cannabis (ACB) and Canopy Growth Corp (CGC) record biological assets on their balance sheets. These items are disclosed as a separate line item from inventory. However, these biological assets consist of cannabis plants, which, for a firm that sells cannabis and cannabis oils, are inventory.

Recognizing unrealized gains to the fair value of these biological assets materially impacts CRON’s reported results. In 2018, CRON recorded an $11.6 million (67% of revenue) gain due to the unrealized change in fair value of biological assets. CRON also records losses for realized changes in fair value adjustments on inventory sold, which somewhat offset this large gain.

We treat these unrealized losses (gains) as non-operating expenses (income) and cull them out of our calculation of NOPAT.

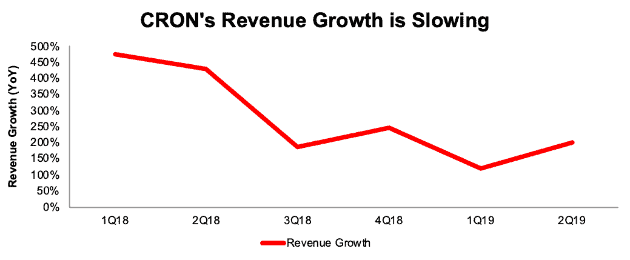

Revenue Growth Already Slowing

As with many cannabis stocks, CRON garnered significant attention due to revenue growth rates running upwards of 400%. However, these growth rates are already falling (as one would expect), as seen in Figure 2.

Figure 2: Cronos Group’s Revenue Growth Will Come Back to Earth

Sources: New Constructs, LLC and company filings

Non-GAAP Metrics Unable to Hide Losses

Often times money losing firms would rather investors focus on non-GAAP (or non-IFRS) metrics such as adjusted EBITDA. By using such flawed metrics, management ignores real costs of doing business. However, in Cronos Group’s case, its non-IFRS metrics cannot even hide the losses of the firm, despite removing real costs of the business, such as share-based payments.

From 2017 to 2018, Cronos Group’s adjusted EBITDA declined from -$4.4 million to -$14.6 million. Over the TTM period, adjusted EBITDA is even lower at -$37 million.

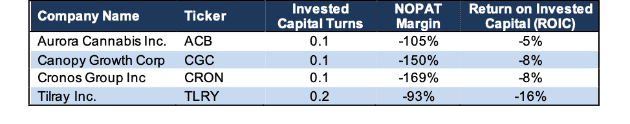

CRON’s Fundamentals[1] Lag Peers

Does the business generate a competitive level of revenue from the capital it’s investing into its business (otherwise known as invested capital turns)? Does it effectively turn that revenue into profit? Based on the revenue and profits of the business, does it generate a return on invested capital (ROIC) above its weighted-average cost of capital (WACC)?

We analyze each of these important questions below. Per Figure 3, Cronos Group has the lowest invested capital turns and NOPAT margin, and the second lowest ROIC amongst the publicly-traded cannabis cultivation/production firms under coverage. Peers include Aurora Cannabis (ACB), Canopy Growth Corp (CGC), and Tilray Inc. (TLRY).

Figure 3: Analyzing the Capital Efficiency of Cannabis Stocks – TTM as of October 4, 2019

Sources: New Constructs, LLC and company filings

Per Figure 3, Cronos Group generates just $0.10 of revenue per $1 of capital invested into its business. Peers CGC and ACB have similarly low invested capital turns.

Cronos Group has the worst profit margin of its peers. Its -169% NOPAT margin means for every $1 it earns in revenue, it loses $1.69 after accounting for all operating expenses. CRON’s TTM NOPAT margin is down from -137% in 2018.

The above analysis gives us insights into the drivers of return on invested capital (ROIC), which measures how much profit a company generates for every dollar invested into its business. It is the true measure of a company’s cash on cash returns and, most importantly, there is a strong correlation between improving ROIC and increasing shareholder value.

As Figure 3 shows, all four of the cannabis stocks in this analysis earn a negative ROIC, with Cronos ranking second to last, only above Tilray.

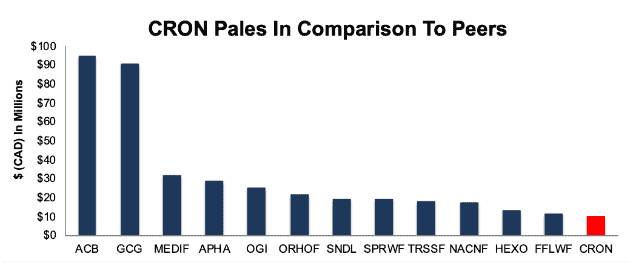

CRON’s Scale Remains a Question Mark

The largest boost to any bull case was Altria’s (MO) decision to invest $1.8 billion in Cronos Group for a 45% stake in the company. While the investment provides Cronos Group with necessary cash to grow its business, the results have not been anywhere near what one would expect to justify CRON’s valuation.

This investment cannot immediately eliminate the lack of scale in production between CRON and many of its peers. The fact remains that Cronos is one of the smaller publicly-traded players in the cannabis industry.

Cronos, and other cannabis firms, love to tout their impressive revenue growth rates in excess of 200%, and often times higher. However, while these rates are impressive, the actual dollar value of Cronos’ revenue is not impressive for a company with its market cap. Cronos generated just $10.2 million (Canadian $) in revenue in its most recent quarter, which ranks last out of 13 cannabis firms in Figure 4. For reference, the firm with the most revenue, Aurora Cannabis, generated $95 million in revenue. Canopy Growth ranks second, with $91 million in revenue. See Figure 4 for more details.

Figure 4: Quarterly Revenue – Canadian Cannabis Firms

Sources: New Constructs, LLC and company filings

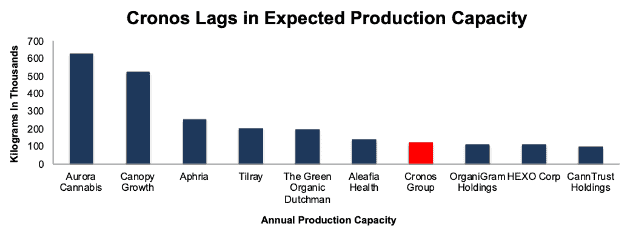

Production Restraints Could Be an Issue

Of course, revenues represent the near-term/recent past, not future potential. Bulls are betting on future growth, not the revenue base Cronos currently generates. However, Cronos is also limited moving forward due to its production capacity lagging peers. If Cronos cannot produce enough product, it simply cannot capitalize on the expected industry growth in the coming years. Not all publicly-traded cannabis firms give exact production capacity, but through publicly disclosed square footage of facilities, as well as average yield of plants, one can estimate the capacity.

Earlier this year, The Motley Fool analyzed the largest cannabis producers in Canada and found that Cronos ranked seventh, with ~20% the capacity of the industry leader. See Figure 5.

Figure 5: Cannabis Firms’ Expected Production Capacity

Sources: New Constructs, LLC, company filings, and The Motley Fool

Cronos Group’s smaller size and production capacity would be less of an issue if its market cap were not the third largest of firms listed in Figure 5. This lofty valuation makes it even harder for Cronos Group’s operations to justify the expectations baked into its stock price.

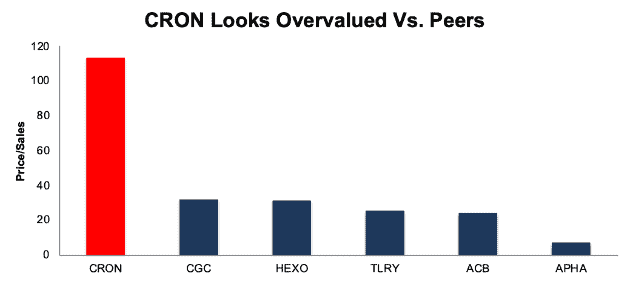

CRON Looks Overvalued Compared to Peers

CRON has been on a roller coaster in recent years. The stock nearly quadrupled from August 2018 to February 2019. Since then, it has fallen by nearly 60% and is currently down 13% over the past year. Even after the recent decline, CRON looks significantly overvalued, by both traditional metrics and through our reverse DCF model.

As Figure 6 shows, CRON’s 113 price-to-sales ratio is much higher than all of its closest competitors. This premium valuation seems dangerously high to us because CRON has the lowest margins and one of the lowest ROICs amongst the group of CRON, CGC, TLRY, and ACB, as we showed earlier.

Figure 6: Price/Sales Ratio Shows CRON is Overvalued

Sources: New Constructs, LLC and company filings

How High Can Margins Get?

The biggest question in the industry is what type of margins can cannabis firms achieve?

Over the long-term, will cannabis growers achieve margins comparable to:

- traditional agricultural firms – as production and access grows more commoditized

- consumer goods firms, like a Mondelez (MDLZ) or PepsiCo (PEP)

- tobacco firms such as Phillip Morris (PM) or Universal Corporation (UVV)

- traditional pharmaceutical firms

The answer to this question is the key to valuing many of these cannabis stocks.

The best way to answer the margin question is to use our reverse DCF model to quantify the future margins baked into the current prices of cannabis stocks. Our models enable us to analyze an infinite number of scenarios for revenue growth, margins and balance sheet efficiency to see exactly what the market already implies CRON can achieve. From there, we can narrow down to scenarios that give us a realistic sense of what CRON should be worth.

Scenario 1: Traditional Agriculture Firm – Despite the hype around cannabis, those firms growing it are not unlike those growing corn or another commoditized agriculture product. If one assumes cannabis receives widespread adoption, margins in the industry could normalize at levels similar to existing agriculture firms.

In this scenario, we assume CRON can immediately achieve 5% NOPAT margins (from -169% TTM), which represent the average of the 10 Farming stocks under coverage.[2]

To justify its current price of $9/share in the scenario, CRON must immediately achieve 5% NOPAT margins and grow revenue by 40% compounded annually for the next 20 years. See the math behind this reverse DCF scenario. For reference, Grand View Research, an industry research provider, expects the legal cannabis industry to grow by 24% compounded annually over the next six years. In this scenario, CRON would be generating nearly $9.5 billion in revenue, which is over 14% of the expected total addressable market in 2025. For comparison, CRON’s revenue represents just 0.1% of the global cannabis market in 2018.

Scenario 2: Consumer Food & Beverage Firm – While cannabis growers operate as agricultural firms, many also convert the raw materials into consumer products, such as cannabis oils, dried cannabis, or even food and drink products. In this scenario, global distribution, product placement, or direct to consumer sales channels would be key components of a firm’s value chain. These firms earn higher margins, on average, than a traditional agriculture firm.

In this scenario, we assume CRON can immediately achieve 7% NOPAT margins, which represent the average of the 55 Food & Beverage firms under coverage. To justify its current price of $9/share in this scenario, CRON must immediately achieve 7% NOPAT margins and grow revenue by 44% compounded annually for the next 17 years. See the math behind this reverse DCF scenario. In this scenario, CRON would be generating just under $5.5 billion in revenue, which is 8% of the expected total addressable market in 2025.

Scenario 3: Consolidate Using Altria’s Resources – As the cannabis industry grows and is legalized across more states and countries, it’s possible for Altria, or another larger firm, to begin to consolidate smaller producers to immediately increase capacity, production, and scale. It is possible that the industry could end up with a few, larger players, which would earn significantly higher margins, just as we see in today’s tobacco industry.

In this scenario, we assume CRON can immediately achieve 17% NOPAT margins, which represent the average of the six tobacco firms under coverage. To justify its current price of $9/share in this scenario, CRON must immediately achieve 17% NOPAT margins and grow revenue by 60% compounded annually for the next decade. See the math behind this reverse DCF scenario. In this scenario, CRON would be generating just over $1.2 billion in revenue or 2% of the expected total addressable market in 2025.

In other words, to invest in CRON at today’s prices, one must believe that it can achieve the average profitability of today’s tobacco industry, and sustain growth rates at more than double the industry average for the next decade.

The Downside Risk in Owning CRON

Given the above scenarios, it’s clear that the expectations baked into CRON’s stock price are lofty, if not unrealistic. Not often have we seen a firm sustain double digit growth rates for multiple decades, and the odds of governments and regulatory bodies allowing another “big tobacco” seem low. Additionally, as Cronos Group is not developing pharmaceutical products, we think it’s unlikely they’ll achieve some of the high margins indicative of that industry.

If we assume that CRON can achieve NOPAT margins of 12% (between the consumer food and tobacco scenario above) and grow revenue by 53% compounded annually for the next decade, the stock is worth just $4/share today. See the math behind this reverse DCF scenario. This scenario assumes CRON can grow revenue by consensus estimates for the next two years, and then by the expected industry CAGR for the next eight years.

As you can see, even in this scenario, the downside risk in CRON is large.

Acquisition Looks Unlikely

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and buys CRON at the current, or higher, share price despite the stock being overvalued. Altria’s decision in late 2018 to invest $1.8 billion into Cronos Group, in return for a 45% stake in the company has two main impacts. First, it limits the likelihood that another firm acquires Cronos because it would also have to buy out Altria, or deal with its large ownership stake in some other manner. Second, this investment values Cronos Group at ~$4 billion. Without significant improvement in the firm’s operations, it seems unlikely that another acquirer would pay much more so soon after Altria’s investment.

It seems more likely that acquirers would look at other more reasonably valued cannabis producers that are not already partly owned by a tobacco giant.

Multiple Catalysts Could Sink Shares

Legalization: As would be expected, the biggest concern in the cannabis industry is its legalization, not only in the United States, but across the globe. Without legalization, Cronos, and many of the firms noted above, are unlikely to meet the expectations baked into their stock prices, let alone surpass them.

Any setbacks in legalization trends would have a clear and immediate impact on the share prices of the cannabis industry as a whole, Cronos included.

Vaping Issues: Vaping is in the news lately for all the wrong reasons. As of October 3, 2019, the Center for Disease Control and Prevention reported 1,080 confirmed and probable cases of illnesses related to vaping, along with at least 19 confirmed deaths, and more under investigation. While not specific to cannabis, the health concerns could create new regulatory roadblocks that hinder Cronos’ growth plans.

Officials have not pinpointed a particular device, product, or ingredient behind the illnesses, but most who got sick said they vaped products containing THC, an active ingredient in marijuana.

The Trump administration recently proposed banning fruit-flavored vaping products. States such as New York, Michigan, and Massachusetts are looking to ban the sale of vaping products. Earlier this year, San Francisco effectively banned vaping products by prohibiting the sale of devices which have not been approved by the Food and Drug Administration (FDA), of which there are none.

These bans on vaping devices are not limited to the United States, either. In mid-September, India announced it was banning the sale of electronic cigarettes. In doing so, India joins Brazil, Mexico, Taiwan, Thailand, and more in banning vaping devices. Australia, Canada, Japan and others also have restrictions on vaping.

The timing of these concerns couldn’t be worse for Cronos. In May 2019, it announced it was opening a new research & development center, Cronos Device Labs, to support efforts to develop next-generation vaporizer products. Then, in September, Cronos announced it was entering a contract manufacturing agreement with MediPharm, in which MediPharm would fill and package vaporizers for Cronos’ line of cannabis products.

Should more governments introduce regulations on vaping, or even begin to focus specifically on cannabis related products, it could severely raise costs or hamper the growth prospects of the industry.

What Noise Traders Miss With CRON

In general, markets aren’t good at identifying value destroying companies that waste shareholder capital. Instead, due to the proliferation of noise traders, markets are great at amplifying volatility, and therefore risk, in popular momentum stocks, while high-quality unconflicted & comprehensive fundamental research is overlooked. Here’s a quick summary for what noise traders miss when analyzing CRON:

- Misleading earnings

- Profitability that significantly lags peers

- Stock price that is significantly overvalued compared to peers

- Less capacity than peers

Executive Compensation Adds More Risk

CRON’s executive compensation plan increases the risks of investing in this stock due to its lack of clearly defined performance goals. Executives’ incentive pay is given in the form of stock options, which often vest after five years. Per CRON’s filing, “options grants are determined on an ad hoc basis.” Not having clear performance targets is a red flag for investors and the board.

Cronos Croup Offers No Shareholder Yield

Cronos Group does not currently pay a cash dividend nor have a buyback program in place. As such, the stock offers none of the downside protection that a solid shareholder yield can provide. Given the level of risk we see in the valuation and forward expectations, this downside protection could be sorely missed.

Short Interest is High – For Good Reason

Due to differences in international filer standards, insider sales data is not readily available for CRON’s U.S. listed shares.

Short interest is currently 41 million shares, which equates to 23% of shares outstanding and just over 10 days to cover. Short interest is up 60% from a year ago as the market realizes that CRON remains overvalued.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst findings in Cronos Group’s 2018 10-K:

Income Statement: we made $16 million of adjustments with a net effect of removing $2 million in non-operating income (17% of revenue). We removed $7 million related to non-operating expenses and $9 million related to non-operating income. You can see all the adjustments made to CRON’s income statement here.

Balance Sheet: we made $83 million of adjustments to calculate invested capital with a net decrease of $27 million. The most notable adjustment was $9 million (6% of reported net assets) in asset write-downs. You can see all the adjustments made to CRON’s balance sheet here.

Valuation: we made $99 million of adjustments with a net effect of decreasing shareholder value by $98 million. The largest adjustment was $90 million in outstanding employee stock options. This adjustment represents 5% of CRON’s market value. See all adjustments to CRON’s valuation here.

Unattractive Funds That Hold CRON

There are no funds that receive our Unattractive rating and allocate significantly to Cronos Group.

This article originally published on October 8, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

[2] We exclude Calyxt (CLXT) from this average, as its NOPAT margin of -14,301% represents a significant outlier in the group.