We closed this Long Idea on June 12, 2025. A copy of the associated Position Close report is here.

This firm overcame a decline in dental services and supply chain challenges to take market share in 2020. Despite its larger presence in a market projected for continued growth, its current valuation implies profits will never surpass 2019 levels. Henry Schein (HSIC: $78/share) is this week’s Long Idea.

HSIC presents quality risk/reward given Henry Schein’s:

- leading share (37%) of the global dental supply market

- growth in medical supply and software segments

- vast sales and distribution network

- differentiated, value-added service offering

- current valuation implies profits will take a decade to regain pre-COVID levels

Henry Schein’s High-Touch Business Serves Two Markets

Henry Schein leverages its extensive sales, distribution, and service network to supply dental practices, physician-owned practices, urgent care centers, and ambulatory surgical centers. Additionally, the firm offers a dental practice management software.

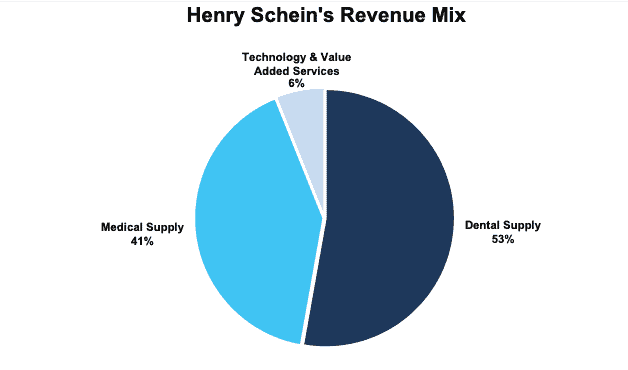

The firm’s high-touch offering focuses on smaller practices, which have small staffs, to provide assistance in managing dental and medical supply inventories, technical equipment service, and education on clinical, technological, and business solutions. These smaller firms benefit from Henry Schein’s scale and expertise in sourcing supplies, managing inventory, and maintaining relationships with manufacturers. Per Figure 1, Henry Schein’s dental and medical supply segments account for 94% of the firm’s revenue in 2Q21.

Figure 1: Henry Schein’s Dental and Medical Segments Make Up 94% of Revenue – 2Q21

Sources: New Constructs, LLC and company filings

The Dental Segment Took Market Share in 2020

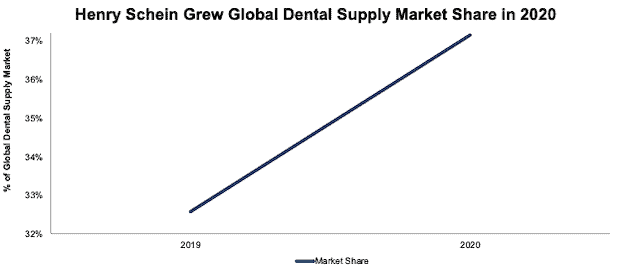

Henry Schein is the largest global dental supplier in the world, by market share, and it extended its lead during the pandemic. Even though the firm’s dental revenue fell year-over-year (YoY) in 2020, it grew its share of the global dental equipment and supplies market from 33% in 2019 to 37% in 2020, per Figure 2.

As dental demand recovers, Henry Schein is positioned to leverage its expanded market presence and grow beyond pre-pandemic levels.

Figure 2: Henry Schein’s Global Dental Supply Market Share: 2019 – 2020

Sources: New Constructs, LLC, company filings, and ResearchAndMarkets

The Medical Segment Took Market Share Too

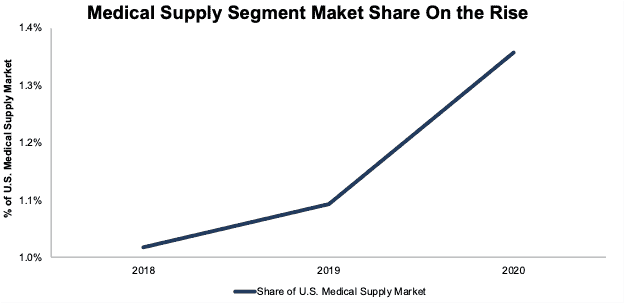

While the firm’s share of the U.S. medical supply market is much smaller than its share of the dental supply market, medical supply is Henry Schein’s fastest growing segment. Medical supply revenue grew 11% compounded annually from 2014 to 2019 before the pandemic, and the firm’s ability to supply COVID testing and vaccinations help drive segment growth of 22% year-over-year (YoY).

By focusing on smaller physician-owned practices, urgent care centers, and outpatient surgical centers, Henry Schein is taking market share from larger medical supply distributors who do not focus on the smaller buyers. Per Figure 3, Henry Schein’s share of the U.S. medical supply market rose from just 1.0% in 2018 to 1.4% in 2020.

Figure 3: Share of U.S. Medical Supply Market: 2018 - 2020

Sources: New Constructs, LLC, company filings and IBIS World

Plenty of Room for More Dental Supply Growth

Henry Schein serves 90% of U.S. dental practices and 80% of dental labs in North America. Such a high penetration rate may lead some bears to think the firm has limited growth opportunities in the dental supply industry. However, Henry Schein has achieved excellent growth despite having 90% share of U.S. dental practices since 2015. For reference, the firm’s dental segment revenue grew from $5.3 billion in 2015 to $6.4 billion in 2019 (before the pandemic), or 5% compounded annually. The firm’s extensive customer base gives its sales force plenty of opportunities to cross sell and deepen its relationship with current customers.

Additionally, with such a strong market position, we expect Henry Schein’s dental segment to grow, at least, in line with the dental supply market in the coming years. ResearchAndMarkets forecasts the dental supply market to grow 7% compounded annually from 2021 to 2025.

Furthermore, the firm has a proven international business (15% share of the global market) with plenty of growth potential. Henry Schein’s international dental sales as a percent of its total dental sales grew from 39% in 2018 to 41% in 2020.

Rise of Alternative Care Further Drives Medical Supply Demand

Henry Schein’s high-touch business adds considerable value to smaller dental and medical operations that have limited administrative staff and inventory storage, which is why the firm is the #2 physician and alternate care medical supply distributor in the U.S.

Alternate care firms like urgent care facilities and ambulatory surgical centers make up a large part of Henry Schein’s medical supply business. The rise of the urgent care center market, which doubled in size from 2017 to 2021, drives additional demand for the firm’s medical supplies.

Like the urgent care market, the U.S. outpatient surgical center market rose from $21.4 billion in 2014 to $31 billion in 2019 before the pandemic. ResearchAndMarkets expects this market will continue to grow as it projects outpatient surgical center market to grow by 6% compounded annually from 2021 to 2025.

Aging Population Is a Long-Term Tailwind

Henry Schein is well-positioned to benefit from the long-term rise in the age of the U.S. population. The Census Bureau expects the population of those 65 and older to comprise of 21% of the population by 2030, up from 17% in 2020. The aging population will drive rising demand in the dental and medical industries over the long term, as dental and medical expenditures increase with age.

Henry Schein Adds More Value Than Pure Ecommerce Competitors

Bears may argue the rise of ecommerce will hurt Henry Schein’s market share. But, that has not happened so far as the firm has enjoyed excellent growth up to this point.

Henry Schein fulfillment capabilities are keeping customers happy with great selection (over 300 thousand products) and, apart from the current global supply-chain problem, the firm ships 99% of its orders on the same day it receives the order.

Furthermore, the firm’s 3,400 sales consultants and 2,000 service technicians enable Henry Schein to offer a level of service and support that general ecommerce platforms cannot match.

Industry Consolidation Fears Are Overstated

Investors may also fear that the rise of consolidation of dental practices will hurt the firm’s ability to compete going forward, as larger organizations have more support staff that can manage supplies directly with manufacturers. However, this consolidation trend is decades old, so far, not material as the percent of dental practices with 20 or more employees has risen from just 16% in 2002 to nearly 30% in 2021.

Meanwhile, Henry Schein has grown its dental revenue from $1.2 billion in 2002 to $6.6 billion over the trailing-twelve-months (TTM). In other words, consolidation doesn’t appear to be much of a threat to Henry Schein, as the firm continues to grow.

Risk of Expanding Medicare and Medicaid to Include Dental Coverage

The American Dental Association believes expanding Medicare and Medicaid programs to cover dental care would force dentists to take below-cost reimbursement rates, which could force them to cut costs by using fewer supplies and not updating older equipment as frequently, which could slow Henry Schein’s growth potential.

However, private practices can continue to refuse to take Medicare and Medicaid as many already do because of low reimbursements and red tape. If the U.S. government wants to temper concerns and get private practice dentists onboard with accepting Medicare and Medicaid, it will need to offer competitive reimbursements and/or processing for services rendered.

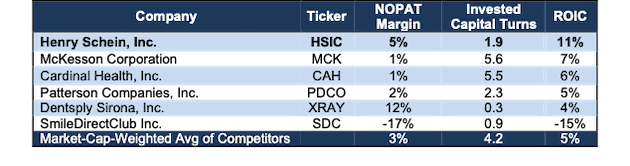

Leading Market Share Drives Superior Profitability

Henry Schein’s growing market share and high-touch value-added service drive comparatively high margins and industry-leading profitability. Figure 4 compares the net operating profit after tax (NOPAT) margin, invested capital turns, and return on invested capital (ROIC) of Henry Schein and its major competitors. Competitors include McKesson Corporation (MCK), Cardinal Health (CAH), Patterson Companies (PDCO), Dentsply Sirona (XRAY), and SmileDirectClub (SDC).

Per Figure 4, Henry Schein earns the second-highest NOPAT margin, and when coupled with high invested capital turns, the highest ROIC of its competition.

Figure 4: Henry Schein’s Profitability Vs. Competitors: TTM

Sources: New Constructs, LLC and company filings

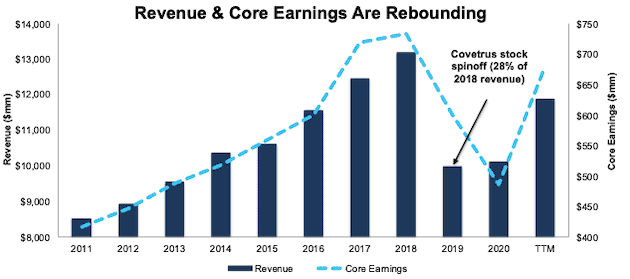

Core Earnings Are Rising Once Again

Henry Schein consistently grew Core Earnings[1] year-over-year before it spun off Covetrus (CVET), its animal health business in 2019. Animal health accounted for 28% of Henry Schein’s revenue in 2018, so the decline in Core Earnings from $652 million in 2018 to $541 million in 2019 was expected.

Due to the challenging environment for the firm’s dental business throughout the COVID-19 pandemic, Core Earnings fell further to $427 million in 2020. Since 2020, the firm’s Core Earnings have risen to $615 million over the TTM, or just 6% below previous highs of 2018, per Figure 5.

Figure 5: Henry Schein’s Revenue & Core Earnings Since 2011

Sources: New Constructs, LLC and company filings.

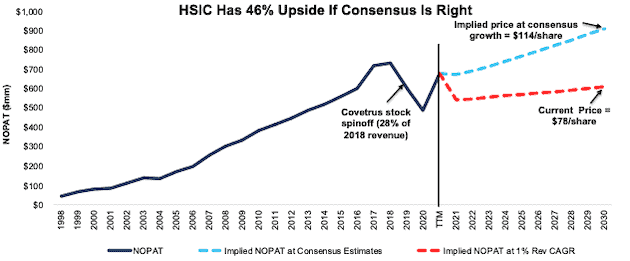

HSIC Is Priced for Profits to Never Fully Recover

When we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Henry Schein’s stock price, we can provide clear mathematical evidence that the current valuation implies profits will only surpass 2019 levels by 1%. We also provide an additional scenario to highlight the upside potential in shares if Henry Schein grows at consensus rates.

In the first scenario, we assume Henry Schein’s:

- NOPAT margin falls to 5% (equal to 10-year average vs. 6% TTM) in 2021 through 2030 and

- revenue grows just 1% compounded annually from 2021 to 2030

In this scenario, Henry Schein’s NOPAT grows just 2% compounded annually for the next decade and the stock is worth $78/share today – equal to the current price. In this scenario, NOPAT reaches $608 million in 2030, which is just 1% above pre-COVID NOPAT of $601 million. For reference, the dental supply market is expected to grow 7% compounded annually from 2021 to 2025.

DCF Scenario 2: Shares Could Reach $114 or Higher: If we assume Henry Schein’s:

- NOPAT margin remains at 6% (equal to TTM) from 2021 to 2030 and

- revenue grows by 10% (equal to consensus) compounded annually in 2021 and 2022 and

- revenue grows by 3.5% each year thereafter through 2030, then

Henry Schein is worth $114/share today – a 46% upside to the current price. See the math behind this reverse DCF scenario.

Figure 6: Henry Schein’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Henry Schein’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages also help Henry Schein grow its market share over the long term:

- high-touch business adds value by removing operational challenges for small practices

- extensive inventory creates a “one-stop shop” with ecommerce-like fulfillment speed

- superior profitability compared to peers

- current market share leader serving 90% of U.S. dental practices

What Noise Traders Miss With Henry Schein

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- the firm’s large market share gains throughout the pandemic

- Henry Schein’s consistent improvement in profitability year-over-year before the pandemic, and rebound since 2020

- valuation implies profits will not meaningfully grow from 2019 levels

Earnings Beats, Legislative Changes, or Strategic Acquisitions Could Send Shares Higher Long Term

According to Zacks, Henry Schein beat EPS estimates in each of the past 12 quarters and doing so again could send shares higher.

Furthermore, if Congress does not include expanded dental coverage in its latest spending bill, market fears over compressed margins in the dental industry might be relieved. On the flip side, if Congress does include, but puts in provisions that improve the experience for dental providers, Henry Schein could reap benefits.

Lastly, Henry Schein has recently taken stakes in eAssist Dental Solutions, a virtual dental billing service, and Jarvis Analytics, a business analytics provider to dental practitioners. While small compared to its larger dental and medical supply business, these types of investments bolster Henry Schein’s technology and value-added services segment and position it in faster growth areas of the dental market.

Share Repurchases Could Provide 4.8% Yield

Henry Schein historically does not pay a dividend on its stock and does not plan on doing so in the foreseeable future.

However, Henry Schein has traditionally returned capital to shareholders through share repurchases. The firm’s repurchase program, which was suspended during the pandemic, was reinstated in March 2021. From 2016 to 2020, the firm repurchased $1.8 billion (16% of current market cap) of stock. Henry Schein has already repurchased $201 million in 1H21 and has $400 million remaining for future repurchases under its current authorization. If the firm repurchases an additional $324 million in shares, which would make 2021 repurchase activity in line with 2019 levels of $525 million, the repurchases would yield 4.8% at Henry Schein’s current market cap.

The firm’s strong free cash flow (FCF) supports its share repurchases, and since 2016, Henry Schein has generated $2.5 billion in cumulative FCF.

Executive Compensation Could Be Improved

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Henry Schein compensates executives with salaries, annual bonuses, and long-term equity awards. Annual bonuses and long-term incentives are tied to the firm’s EPS goal.

Henry Schein should instead tie performance compensation to improvement in ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value. Tying executive compensation to ROIC also ensures that executives’ interests are actually aligned with shareholders’ interests.

Despite not using ROIC when measuring performance, Henry Schein’s compensation plan has not compensated executives while they destroyed shareholder value. Henry Schein grew economic earnings by 5% compounded annually from 2010 through 2019 (pre-pandemic). Economic earnings over the TTM are 62% above 2019 levels.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have bought 231 thousand shares and sold 293 thousand shares for a net effect of 61 thousand shares sold. These sells represent less than 1% of shares outstanding.

There are currently 3.8 million shares sold short, which equates to 3% of shares outstanding and just over 5 days to cover. Short interest is down 6% from the prior month. The lack of short interest reveals not many are willing to bet against this well-established firm’s post-pandemic rebound.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide more reliable fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Henry Schein’s 10-K and 10-Qs:

Income Statement: we made $180 million of adjustments, with a net effect of removing $84 million in non-operating expenses (<1% of revenue). You can see all the adjustments made to Henry Schein’ income statement here.

Balance Sheet: we made $865 million of adjustments to calculate invested capital with a net increase of $437 million. One of the largest adjustments was $211 million related to goodwill. This adjustment represented 4% of reported net assets. You can see all the adjustments made to Henry Schein’s balance sheet here.

Valuation: we made $2.3 billion of adjustments to shareholder value, all of which decrease shareholder value. One of the most notable adjustments to shareholder value was $1.3 billion in minority interests. This adjustment represents 12% of Henry Schein’s market cap. See all adjustments to Henry Schein’s valuation here.

Attractive Funds That Hold HSIC

There are no funds that receive our Attractive-or-better rating and allocate significantly to HSIC.

This article originally published on September 29, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.