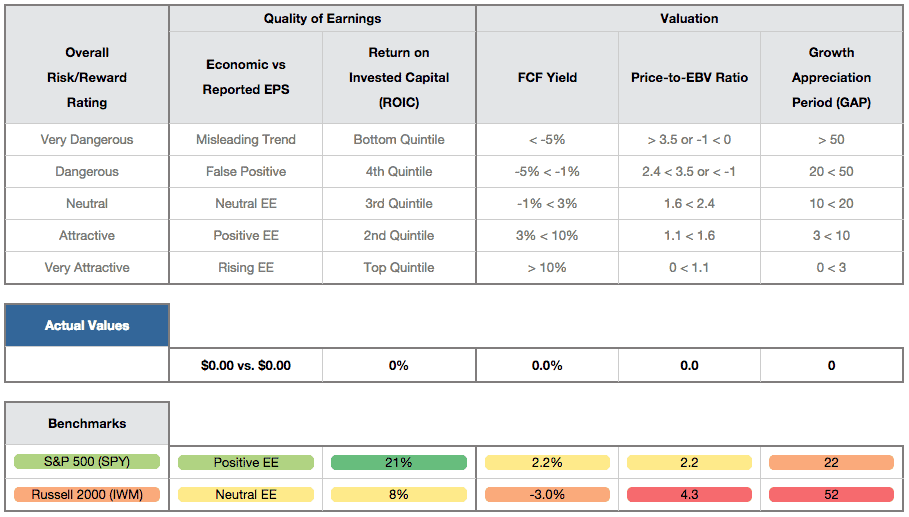

Stock Rating Methodology

New Constructs assigns a rating to every stock under coverage according to what we believe are the 5 most important criteria for assessing the risk versus reward of stocks. New Constructs’ stock ratings are regularly featured as among the best by Barron’s.

David Trainer, Founder & CEO