Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

Just as stocks for companies with higher returns on invested capital (ROIC) performed the best during and after the financial crisis, we see stocks for companies with low ROICs performing worse in the current crisis.

Investors should avoid stocks for companies with low (and falling) ROICs.

Our Robo-Analyst[1] warns against owning these companies with falling ROICs, declining economic earnings, and overvalued stock prices: Nutanix (NTNX: $15/share), Lyft (LYFT: $24/share), Eventbrite (EB: $9/share), Wayfair (W: $39/share), and Uber (UBER: $23/share). We focus on Nutanix and Wayfair as this week’s Danger Zone picks.

Risk-Off Leaves Weak Firms Exposed

Strong top-line or subscriber growth doesn’t seem to satisfy markets anymore. When the markets get dicey, the only reliable metrics are consistent core earnings and high ROICs. Stocks for companies with poor fundamentals suffer more because, too often, their valuations were built on hope or hype. See our Danger Zone picks from the last two years for proof of how FOMO stocks perform in tough markets.

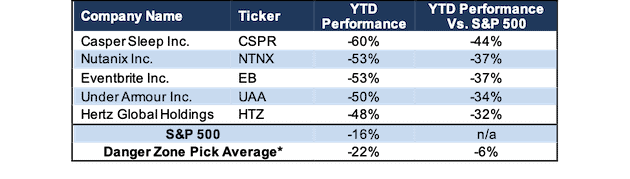

64% of our open Danger Zone picks from the past two years (excluding those that were published after the recent market crash began on February 12) have fallen more than the S&P in 2020 (based on closing prices from March 13, 2020). 87% of these picks have negative year-to-date (YTD) returns. Figure 1 shows our best-performing Danger Zone picks.

Figure 1: Danger Zone Picks Outperform as Shorts in Falling Markets

* Includes open Danger Zone picks published from the beginning of 2018 through February 12, 2020.

Sources: New Constructs, LLC and company filings.

We raised many of the same red flags for these Danger Zone picks:

- Negative and falling core earnings[2] and economic earnings

- Low/negative and declining ROICs

- Declining and/or negative economic earnings

- Unattractive or Very Unattractive ratings

Despite falling significantly more than the overall market, many of these Danger Zone picks remain overvalued. Investors trying to protect their portfolio from further downside should avoid NTNX and W.

Nutanix (NTNX) – Unattractive Rating

We first made Nutanix a Danger Zone pick in February 2018 and since then, the stock is down 68% (S&P +2%). This underperformance is warranted, as the firm’s fundamentals have only worsened. As investors bail on profitless tech stocks, NTNX could fall much further.

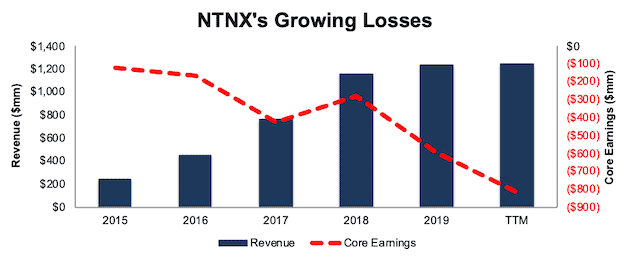

NTNX has grown revenue by 50% compounded annually since 2015. Core earnings have fallen from -$119 million in 2015 to -$814 million over the trailing twelve months (TTM), per Figure 2. The firm’s core earnings margin fell from -24% in 2018 to -65% TTM while its ROIC declined from -31% to -60% over the same time. The firm is also burning through cash in a big way with -$2.6 billion in free cash flow (92% of market cap) over the past four years.

Figure 2: NTNX’s Revenue & Core Earnings Since 2015

Sources: New Constructs, LLC and company filings

Economic Earnings Are Even Worse

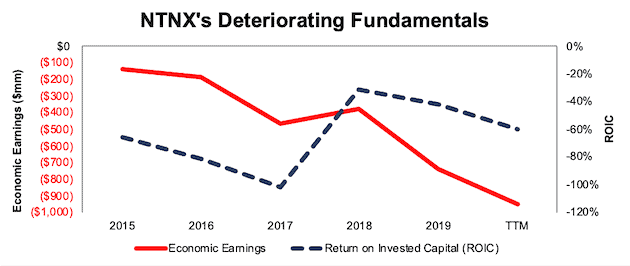

Core earnings account for unusual gains and expenses included in GAAP net income. To get the full picture of a company’s operations and hold management accountable for capital allocation, we also analyze balance sheets to calculate an accurate ROIC and economic earnings.

Some notable adjustments to NTNX’s balance sheet include:

- Added $171 million in operating leases

- Added $2 million in accumulated asset write-downs

After all adjustments, we find that NTNX’s economic earnings have fallen from -$135 million in 2015 to -$947 million TTM. NTNX has failed to create true shareholder value despite impressive revenue growth.

Figure 3: NTNX’s Economic Earnings & ROIC Since 2015

Sources: New Constructs, LLC and company filings

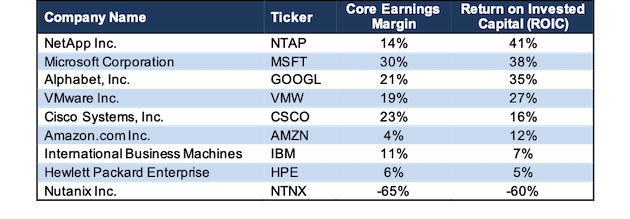

Profitability Significantly Lags Competitors

As noted in our original article, Nutanix faces competition from some of the most profitable tech firms in the world, such as Microsoft (MSFT), Alphabet (GOOGL), VMWare (VMW), Cisco Systems (CSCO), and more. Per Figure 4, Nutanix’s core earnings margin and ROIC rank well below all competitors.

Figure 4: NTNX’s Profitability Ranks Last Among Competition

Sources: New Constructs, LLC and company filings

Worse yet, NTNX is also losing market share according to International Data Corporation’s (IDC) Worldwide Quarterly Converged Systems tracker. In 3Q19, Nutanix held (as measured by revenue attributed to the owner of the software) 27% of the Hyperconverged Systems market, which was down from 34% in 3Q18. VMware grew its market share from 35% to 38% while Dell Technologies grew from 4% to 6%.

Shares Look Significantly Overvalued

With declining market share, negative profitability, and a more risk-off market, we think shares can fall much further. When we use our reverse discounted cash flow (DCF) model to analyze the expectations implied by the stock price, NTNX still appears significantly overvalued.

To justify its current price of $15/share, NTNX must immediately improve its NOPAT margin to 6% (compared to -65% in 2019), which equals HPE’s TTM NOPAT margin, and grow revenue by 16% compounded annually for the next 14 years. See the math behind this reverse DCF scenario. In this scenario, NTNX would be generating over $10.3 billion in revenue, which is over five times the entire hyperconverged systems market size in 2Q19. Furthermore, Mordor Intelligence, a market research provider, expects the HCI market to grow by 13% compounded annually through 2025.

For comparison, here’s another scenario. If we assume NTNX achieves a 6% NOPAT margin and grows revenue by 15% compounded annually for the next decade, the stock is worth only $9/share today– a 40% downside. See the math behind this reverse DCF scenario.

Each of the above scenarios also assumes NTNX is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, NTNX’s invested capital has increased by an average of $294 million (24% of TTM revenue) a year since 2016.

Compensation Plan Doesn’t Properly Incentivize Executives

Compounding the issues above, NTNX’s executive compensation plan allows management to earn bonuses and stock options with no accountability to shareholders. In its latest proxy statement, NTNX disclosed executives’ annual bonuses are awarded based on software value on bookings, new customer adds, the “rule of 40” (which is based on revenue growth and free cash flow), and personal performance.

Long-term incentives are provided in the form of restricted stock units, and, in some cases, performance restricted stock units. In 2019, NTNX awarded its CEO performance RSU’s that will vest based on the achievement of an average stock price of $80/share over a four and a half year period.

The bottom line is that executives are incentivized by metrics that have allowed them to earn bonuses while destroying shareholder value. We’ve demonstrated through numerous case studies that ROIC, not non-GAAP net income or similar metrics, is the primary driver of shareholder value creation. Without a change in executive compensation, investors should expect more of the same value destruction.

Wayfair (W) – Unattractive Rating

We first put Wayfair in the Danger Zone in March 2015, and since then, the stock is up 7% (S&P +25%). The firm’s fundamentals look worse today than then, and despite the large cut to valuation so far in 2020, W remains overvalued.

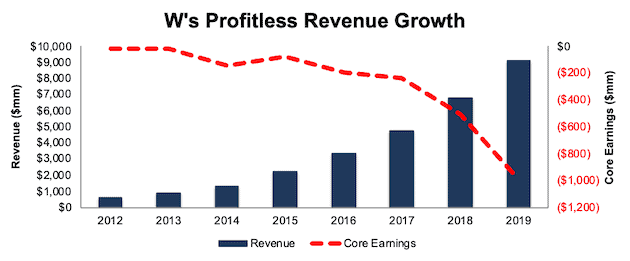

W has grown revenue by 47% compounded annually since 2012. Core earnings have fallen from -$21 million in 2012 to -$984 million in 2019, per Figure 5. The firm’s core earnings margin fell from -4% in 2012 to -11% in 2019 while its ROIC declined from -41% to -59% over the same time. The firm has burned $3.1 billion (83% of market cap) in free cash flow over the past five years.

Figure 5: W’s Revenue & Core Earnings Since 2012

Sources: New Constructs, LLC and company filings

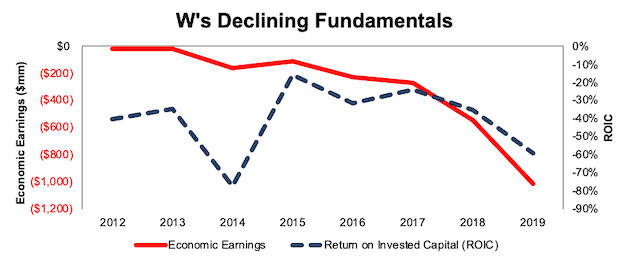

Economic Earnings Look Just as Bad

Some notable adjustments to W’s balance sheet to calculate an accurate ROIC and economic earnings include:

- Added $977 million in operating leases

- Added $1 million in accumulated other comprehensive loss

After all adjustments, we find W’s economic earnings fell from -$23 million in 2012 to -$1.0 billion in 2019.

Figure 6: W’s Economic Earnings Since 2012

Sources: New Constructs, LLC and company filings

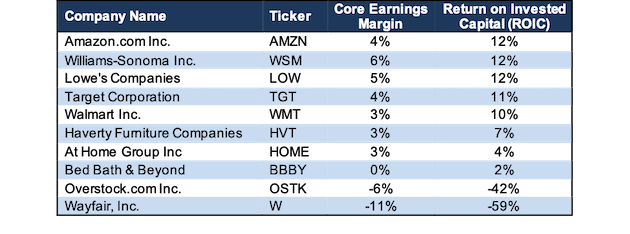

Profitability Is Only Getting Worse

In our original article we noted Wayfair faced competition from other online home goods firms, such as Overstock (OSTK), a prior Danger Zone pick[3], and the e-commerce giant Amazon (AMZN). Now, competition is even more abundant. Unfortunately for W, its lack of profitability represents a key competitive disadvantage. While others have proven a hybrid brick & mortar and e-commerce model can generate consistent profits, e-commerce-only success is much more limited.

Per Figure 7, W’s core earnings margin and ROIC rank significantly below competitors, which include AMZN, Williams-Sonoma (WSM), Target (TGT), Walmart (WMT), and more. It’s worth noting that the only other firm with a negative core earnings margin and ROIC is fellow online-only competitor Overstock.com.

Figure 7: W’s Profitability Is Significantly Lower Than Competition

Sources: New Constructs, LLC and company filings

W isn’t achieving any economies of scale as it grows. Since 2015, W’s revenue has grown 42% compounded annually. Meanwhile, its customer service and merchant fees and selling, operations, technology, general and administrative expenses have grown by a combined 55% compounded annually. Overall, total operating expenses have grown 49% compounded annually since 2015.

In other words, despite impressive top-line growth, W is actually getting further from profitability as profitable competitors enter the market and expand their offerings. Such a “growth with no regards to cost” mentality may work in a bull market, but when investors begin to care about actual cash flows, W is in trouble.

Shares Still Hold Downside Risk

Below, we use our reverse DCF model to quantify the expectations for future profit growth baked into W.

To justify its current price of $39/share, W must immediately improve its NOPAT margin to 2% (compared to -10% in 2019), which is below e-commerce giant Amazon but still above the highest margin online peer Overstock ever achieved, and grow revenue by 18% compounded annually for the next nine years. See the math behind this reverse DCF scenario. In this scenario, W would be generating nearly $42 billion in revenue, which is greater than The TJX Companies’s (TJX) TTM revenue and one-fourth of Amazon’s 2019 product sales revenue.

Even if we assume W achieves a 2% NOPAT margin and grows revenue by 14% compounded annually (nearly three times expected industry growth) for the next decade, the stock is worth only $23/share today – a 41% downside. See the math behind this reverse DCF scenario.

Executives Get Paid to Destroy Value

W’s executive compensation plan allows management to destroy shareholder value and still earn bonuses and stock awards. In its latest proxy statement, W notes that annual cash bonuses are “discretionary” and range from 0-25% of base salary.

Equity awards are given through restricted stock units at the time of hire, promotion, or “at other times at the discretion of the compensation committee.” These stock units vest over a four or five year period, subject to the executives continued employment.

Essentially, executives are incentivized to increase W’s stock price, rather than create actual shareholder value through prudent capital stewardship. Without a change in executive compensation, investors should expect more of the same value destruction.

The Importance of Fundamentals & Quantifying Expectations

In volatile markets, it pays to incorporate fundamentals into investment decision making. Fundamentals need not be 100% of your process, but they should not be 0%. And, if you’re relying on fundamentals at any level, it pays to make sure you have accurate fundamentals. Investors should not make decisions based on incomplete or less accurate data than what is available. Our Company Valuation Models incorporate all the data from financial filings to truly assess whether a firm is under or overvalued and get an accurate representation of the risk/reward of a stock. For NTNX and W, the risk/reward does not look good.

This article originally published on March 16, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Our core earnings are a superior measure of profits, as demonstrated in In Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to IBES “Street Earnings”, owned by Blackstone (BX) and Thomson Reuters (TRI), and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

[3] We put Overstock in the Danger Zone in October 2016 and since then, the stock is down 78% while the S&P is up 28%.