We rarely like acquisitions and are often left disappointed by how much the acquiring company overpays. Overpayment greatly benefits the shareholders of the acquired firm at the expense of the acquirer’s investors. However, this deal actually looks good for both firms, including the shareholders. We not only like the economics of this deal, but also the strategic direction that both firms take by consummating this deal.

AT&T (T: $36/share) recently announced plans to acquire media giant Time Warner (TWX: $89/share) for $109 billion including net liabilities. While we’ve taken issue with many of the large acquisitions in 2016, this deal not only passes the economics test, but also creates a combined firm well positioned for the future of media.

Overpriced Acquisitions Throughout 2016

2016 has brought on numerous acquisitions that greatly benefit shareholders of the acquired firm at the expense of the acquirer’s investors. Here some examples along with links to our analysis:

- Comcast (CMCSA) acquires DreamWorks Animation (DWA) for $3.8 billion

- Salesforce (CRM) acquires Demandware (DWRE) for $2.8 billion

- Microsoft (MSFT) acquires LinkedIn (LNKD) for $26.2 billion

- Tesla (TSLA) acquires SolarCity (SCTY) for $2.6 billion

Each of these acquisitions fail to earn the acquiring company a quality return on invested capital (ROIC), a key hurdle to clear, as improving ROIC is directly correlated with creating shareholder value. In too many instances, acquirers’ shareholders are left bailing out a struggling firm while executives walk away with significant bonuses. However, the proposed deal between AT&T and Time Warner flips this script.

Economics of The Deal: Acquisition Earns a 5% ROIC

At ~$108/share, the value of this acquisition totals $109 billion, including net liabilities, and transforms AT&T from a telecom provider into a media conglomerate, especially after its acquisition of DirecTV in 2016. At this price, AT&T would be paying $109 billion to acquire $5.1 billion in NOPAT. The ROIC earned is 4.7%, which is a marginal improvement to AT&T’s current ROIC of 4.6% and equal to its weighted average cost of capital (WACC) of 4.7%. This deal would slightly improve AT&T’s overall ROIC, unlike other deals that appear to be accretive due to the high-low fallacy.

AT&T Gets Ability to Produce High Quality Original Content Consistently and Profitably

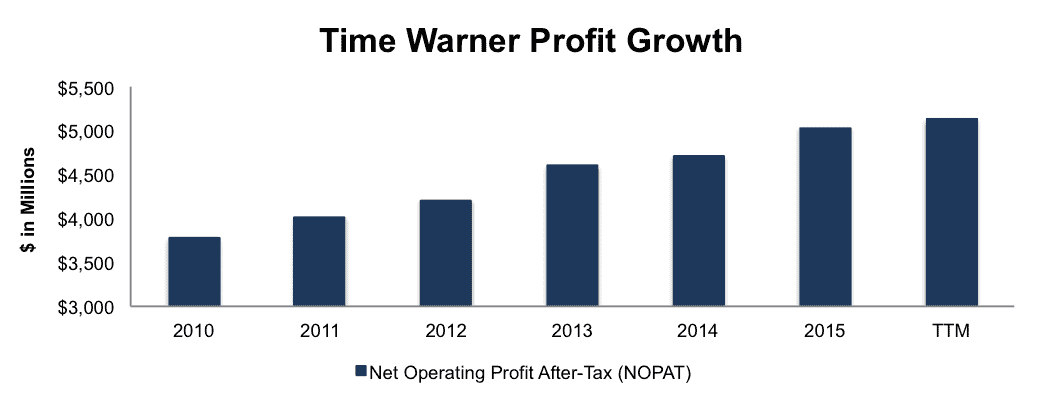

In 2016, content is king. Original content is the only differentiator in a media industry where there’s an overabundance of content delivery platforms and an overall shift away from traditional media sources. In this changing market, Time Warner has been able to leverage its brands, such as CNN, TNT, HBO, TBS and Warner Bros to deliver high quality content while growing profits. Per Figure 1, Time Warner has grown after-tax profit (NOPAT) by 6% compounded annually since 2010.

Figure 1: Time Warner’s NOPAT Growth

Sources: New Constructs, LLC and company filings

AT&T Needed to Expand Beyond Telecom

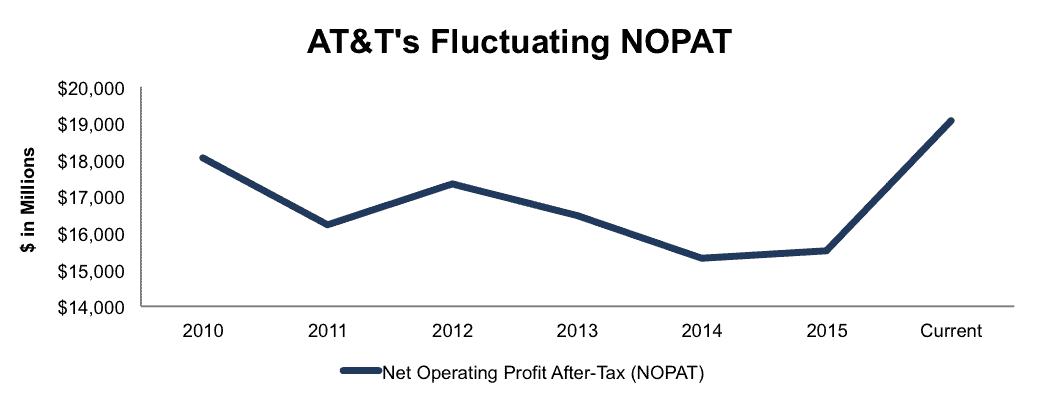

AT&T, on the other hand, like many other traditional telecom or cable providers, has been looking for ways to diversify and return to profit growth. Since 2010, AT&T’s NOPAT has declined 3% compounded annually to $15.5 billion in 2015, before rebounding over the last twelve months in large part due to its acquisition of DirecTV. Moving forward, profits in the telecom space will be achieved through increased data usage, and with the infrastructure already in place, AT&T looks to leverage its network with the acquisition of Time Warner.

Figure 2: AT&T’s Dwindling NOPAT Growth

Sources: New Constructs, LLC and company filings

Acquisition Leverages AT&T’s Existing Network Infrastructure

The proposed acquisition only strengthens the thesis we outlined when we featured Verizon (VZ) as a Long Idea in September 2015. In this report, we noted that Verizon was essentially the bridge between the content creators and the content consumers. AT&T’s acquisition of Time Warner takes this relationship one step further by bridging the last gap between the content creators and the content consumers and bringing them under one roof.

A combined firm would offer multiple content delivery platforms, from DirecTV, HBO Now, and even NBA League Pass, (all direct competitors with Netflix and other streaming services) with some of the largest consumers of content, mobile users. AT&T can use these platforms to spur growth in its traditional telecom space (data usage), while creating new platforms such as a TV streaming bundle that appeals to “cord-cutters.” AT&T recently announced details on “DirecTV Now” a slimmed down online TV service with 100 channels. The acquisition of Time Warner can greatly improve this service by bringing high quality content from cable channels such as CNN to a streaming bundle. At the same time, AT&T can bring TV streaming costs down across the industry as it can provide TWX content at significant scale or even bundled with traditional mobile phone contracts, as is commonly done now with Internet, TV, and Phone bundles.

Meanwhile, each new consumer AT&T can attract to its service, whether it is wireless, DirecTV, or Internet can lead to increased usage of its existing network. Not only does AT&T collect the fee to use the network, it can now optimize what is being sold, and how it’s being sold to increase the value of the AT&T network.

Current Deal A Steal?

We’ve noted earlier that the current proposed deal would earn AT&T a 5% ROIC based on the profits at Time Warner over the last twelve months. Moving forward, one would expect such a merger to increase profits as content is deployed to a large distribution network. To get a sense of how much Time Warner could be worth, we can create scenarios for how much AT&T could improve Time Warner’s business.

Figures 3 and 4 show the implied stock prices that AT&T could pay for Time Warner without overpaying and destroying shareholder value. Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In each scenario, the estimated revenue growth rate in year one and two equals the consensus estimate for 2016 (3.3%) and 2017 (5.7%). For the subsequent years we use 5.7% in scenario one because it represents a continuation of 2017 expectations. We use 8.7% in scenario two because it assumes the merger could create higher revenue through an expanded delivery platform, bundled products, and increased advertising on the platform. Each scenario also assumes Time Warner maintains its 2015 NOPAT margin of 17.9%.

Figure 3: Implied Acquisition Prices For T To Achieve 5% ROIC

The first ‘goal ROIC’ is 5%, which is equal to AT&T’s WACC and ROIC. The big takeaway from Figure 3 is that if Time Warner grows revenue by 7% compounded annually and maintains 18% NOPAT margins for the next five years, AT&T could pay $149/share, or 39% above the proposed price and still earn a ROIC equal to WACC. Under this scenario, AT&T’s purchase price of ~$108 actually undervalues TWX. However, it’s worth noting that any acquisition that earned a 5% ROIC would be value neutral, and neither destroy nor create shareholder value.

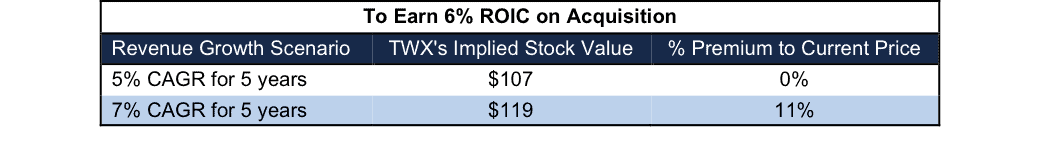

Figure 4: Implied Acquisition Prices For T To Achieve 6% ROIC

Sources: New Constructs, LLC and company filings

The next ‘goal ROIC’ is 6%, which is slightly above AT&T’s current ROIC. In Figure 4, we see that if the acquisition leads to increased revenue growth (completely ignoring potential margin expansion) of 7% compounded annually for the next five years, AT&T could pay $119/share, or 11% above the proposed price and still earn a 6% ROIC. Any deal that earns a ROIC greater than the company’s current ROIC is truly accretive to shareholders.

The bottom line is that it appears AT&T has done its homework when putting together a deal to acquire Time Warner. As it stands, the deal appears fairly valued, and could even undervalue TWX if we believe the combined firms will achieve meaningful synergies.

Regulatory Risk Remains

While it’s clear that the deal makes sense from an economic standpoint, a tie up of one of the largest telecom providers and media networks is sure to garner regulatory scrutiny. Presidential candidate Donald Trump has already voiced displeasure at the deal and Vice President nominee Tim Kaine was quoted as saying “pro-competition and less concentration is helpful in media.” At the same time, the Department of Justice is sure to look at the merger on anti-trust grounds. The Federal Communications Commission could get involved were the deal to involve broadband licenses.

Ultimately, the biggest concern about a merger between AT&T and Time Warner is the increased power the firm would have over content distribution. Theoretically, AT&T could distribute Time Warner content only on the AT&T network, thereby eliminating consumer choice and destroying competition that already licenses such content. Not only would such an action be a blatant abuse of power, and warrant regulatory scrutiny, it would also not be a wise business decision. Restricting access would ultimately diminish the reach of Time Warner’s content, thereby limiting its licensing value and value of new original content. At the same time, AT&T benefits from increased data usage across its network, even if the end user is streaming from an outside service. Restricting content to AT&T only would risk limiting data usage if consumers chose not to adopt AT&T’s streaming service.

On the flip side, AT&T can use the Time Warner acquisition to increase competition across the already competitive streaming landscape. As noted earlier, the announced DirecTV Now service will compete directly with Sling TV, Hulu, Netflix, Amazon Video and the many other offerings available. Integrating Time Warner’s TV offerings into a streaming bundle only increases the competitiveness of the offering and forces others to enhance their service to stay competitive.

Conclusion: AT&T Time Warner Deal Makes Sense

At the end of the day, the combination of Telecom and Media/Content makes sense given the current landscape of the industry. There’s no denying that traditional cable television and traditional mobile networks are no longer in a rampant profit growth phase. We’ve seen Verizon acquire Huffington Post, AOL, and more recently Yahoo in an effort to spur online content growth. Twitter is streaming NFL games in an attempt to attract viewers to its service and Facebook is looking to capitalize on content with its Facebook Live service. This deal provides AT&T the content needed to move into the future of media consumption, streaming and mobile, while providing Time Warner the platform of millions of mobile and pay-tv users with which it can sell to.

Most importantly, the deal, as its constructed, is not a blatant misallocation of capital, contrary to what we’ve seen in the past. In fact, we’d like to believe the AT&T deal, coming on the heels of the (possibly) failed Twitter acquisition, represents a change in market sentiment. Management teams need to realize that investors are losing patience and are no longer comfortable accepting an overpriced acquisition to mask other issues. Firms must present a clear reason as to why an acquisition makes sense, and more importantly, whether the prices paid can be justified.

This article originally published here on October 26, 2016.

Disclosure: David Trainer, Kyle Guske II, and Kyle Martone receive no compensation to write about any specific stock, style, or theme.

Click here to download PDF of this report.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

Photo Credit: Rafael Gonzalez