Norway’s Sovereign Wealth Fund’s CEO Yngve Slyngstad recently told the Financial Times that the fund is looking to restructure compensations plans at certain companies in its portfolio.

“We have so far looked at this in a way that has focused on pay structures rather than pay levels…We think, due to the way the issue of executive remuneration has developed, that we will have to look at what an appropriate level of executive remuneration is as well.”

As the fund looks for a company it can target, we offer a candidate: Lions Gate Entertainment (LGF).

How Reforming Executive Compensation Creates Value For Investors

We applaud the fund for looking at both the structure and the size of executive compensation packages. Many of the fund’s 9,000 holdings overpay their executives for hitting targets that don’t create shareholder value.

Over the past several months, we’ve written a number of articles about the risks that excessive and misaligned executive compensation plans pose to investors. We’ve dissected examples of poor compensation plans leading to significant shareholder value destruction, from Valeant (VRX) to Men’s Wearhouse (TLRD).

When boards of directors pay executives based on misleading and easily manipulated performance metrics, they harm investors in two ways.

- Immediate wasted money: the compensation going to executives, in the form of cash or equity, decreases the amount of cash flows available to investors.

- Long-term value destruction: poorly designed compensation plans incentivize behavior that leads to poor operational and strategic decisions with respect to the long-term interests of shareholders.

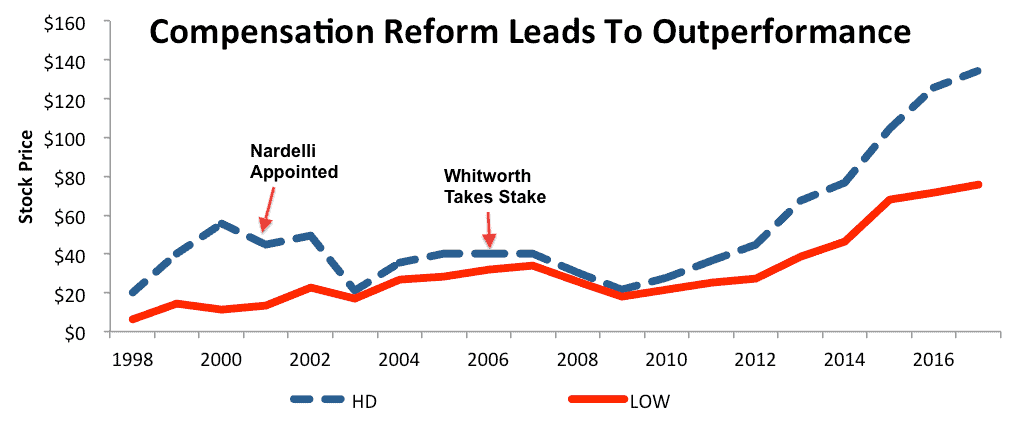

For more evidence of the outsized impact of compensation plans on a business, look no further than Home Depot (HD). From 2001-2006, CEO Robert Nardelli earned $240 million in compensation. For comparison, his counterpart at Lowe’s (LOW) made around $30 million over that same time, about 1/8th of Nardelli’s compensation despite Lowe’s being between 1/4th to 1/3rd Home Depot’s size.

In addition, Nardelli’s compensation was heavily tied to EPS—which he boosted by buying back billions of dollars of shares every year—and sales growth, which he accomplished by investing heavily in the company’s low margin, low return on invested capital (ROIC) wholesale business.

These moves helped Nardelli’s bonus, but they created little value for investors. During Nardelli’s tenure, Home Depot’s stock was essentially flat. In the midst of a bull market and a housing bubble, Home Depot delivered almost no returns to shareholders!

In 2006, activist Ralph Whitworth took a 1.2% stake in Home Depot and began agitating for a change to the company’s executive compensation practices. He was able to force Nardelli out, significantly reduce CEO pay to less than $10 million a year, and institute a compensation plan with long-term incentives for increasing ROIC.

Figure 1: Stock Prices Move In Line With Return On Invested Capital

Sources: New Constructs, LLC and company filings

Figure 1 shows how Home Depot significantly underperformed Lowe’s stock during Nardelli’s tenure. It also shows how it significantly outperformed after Whitworth’s reforms, gaining more than 200%.

This link between stock prices and ROIC is intuitive and well-known among more diligent investors. Increasing ROIC is the best way to create long-term value for shareholders. Linking executive compensation to ROIC has helped companies such as AutoZone (AZO) outperform the market for many years.

Don’t just take our word for it either. S&P Capital IQ recently released a study showing a significant statistical link between ROIC improvement and outperformance.

Finding A Target: Lions Gate Entertainment (LGF)

Lions Gate turned heads when it handed CEO Jon Feltheimer over $60 million in equity awards as part of a new five-year contract. The board lauded the company’s strong performance in 2014 as justification for the large stock award, but our numbers show that ROIC actually fell from 12.1% to 11.1% that year.

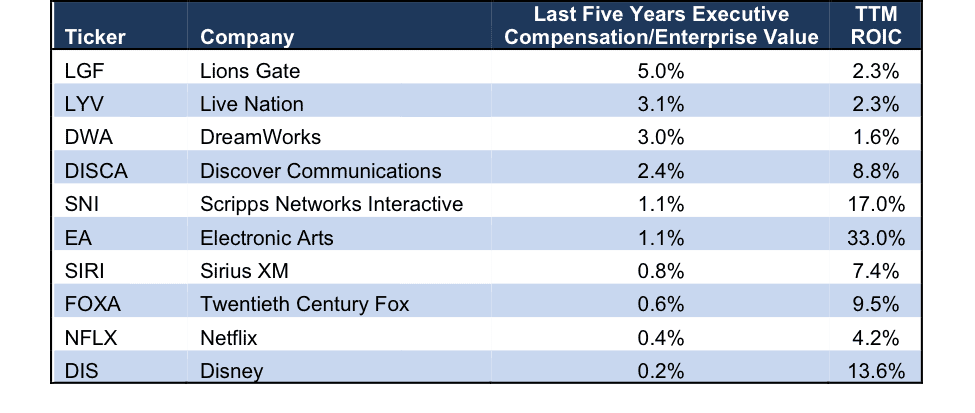

As Figure 2 shows, the problem goes far beyond just 2014. Over the past five years, Lions Gate has spent a larger portion of its enterprise value on executive compensation than any of the companies in its self-identified peer group for which we have five years of data.

Figure 2: High Executive Compensation + Poor Return On Invested Capital = Bad News For Investors

Sources: New Constructs, LLC and company filings. “TTM” = Trailing Twelve Months.

Figure 2 also shows that Lions Gate’s ROIC has dropped to just 2.3%, putting it near the bottom of its peer group. That’s due in part to disappointing results from several films this year. It also reflects a compensation plan that does a poor job aligning executive incentives with shareholder interests.

Both annual and long-term incentive bonuses are tied to a non-GAAP metric called “adjusted EBITDA.” This metric does a poor job of measuring shareholder value creation for several reasons:

- Excluding depreciation and amortization means that executives are not held accountable for capital allocation. They can boost adjusted EBITDA by investing heavily in low return projects and excluding the costs.

- Adjusted EBITDA excludes stock-based compensation, which is a real expense and should be accounted for. Since executives are largely paid in stock, they get to largely exclude their own compensation when calculating profitability.

- Adjusted EBITDA makes a number of adjustments for purchase accounting, start-up losses, and backstopped expenses. These are real costs, and executives have a high degree of discretion when it comes to calculating these numbers so they can hit their targets.

Tying executive compensation to such a flawed metric is a recipe for low ROIC and significant shareholder dilution. Sure enough, going back to 2005 Lions Gate has earned an ROIC below its cost of capital (WACC) in every year except 2013-2015, when it was buoyed by the success of the (now-ended) Hunger Games franchise. Over that time, its share count increased by 47%.

Succeeding through creating original content is tough. It’s even tougher when management is not a responsible steward of capital. It should come as no surprise that the most successful company in the industry, Disney (DIS), is also one of the few that links executive compensation directly to ROIC.

If Lions Gate wants to have any hope of creating long-term value for shareholders, it needs to cut back on executive compensation and better align compensation incentives with investors’ best interests.

Norway’s Sovereign Wealth Fund should consider Lions Gate as its first target in its campaign against excessive executive compensation.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit: Arek Olek (Flickr)