We closed this position on March 30, 2020. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Companies with long histories of profit losses often attempt to sell investors on their plans to “reach scale.” But, what happens when a company reaches scale and profits remain elusive? Profitless since going public, Cornerstone OnDemand (CSOD: $34/share) lands in the Danger Zone this week.

Decelerating Revenue And Accelerating Losses

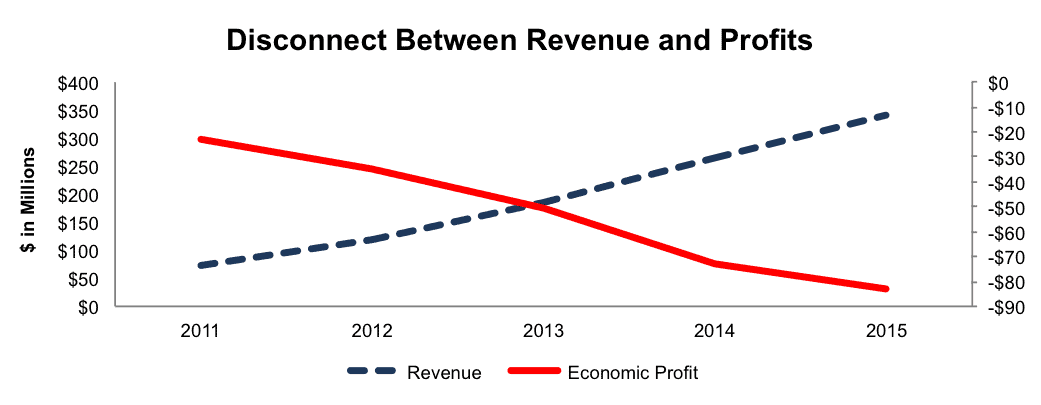

Cornerstone has rapidly grown revenue but failed to generate profits in any year since going public in 2011. Over this time, revenue has grown by 45% compounded annually, while economic earnings, the true cash flows, have declined from -$23 million to -$83 million – per Figure 1.

While revenue growth has been consistent, it is decelerating. In 2012, revenues grew 62% year over year (YOY) but in 2015, revenue growth more than halved to only 29% YOY. See the reconciliation of Cornerstone’s GAAP net income to economic earnings here.

Figure 1: Revenues Fail To Generate Profits

Sources: New Constructs, LLC and company filings

The lack of profits is no surprise when you examine the cost of operating Cornerstone’s software-as-as-service (SaaS) business. Since 2011, cost of revenues have grown 51% compounded annually, sales & marketing costs have grown 46% compounded annually, and research & development costs have grown 42% compounded annually. Expenses are growing faster than revenues and are creating larger losses each year.

The company’s return on invested capital (ROIC) is also in decline, dropping from -19% in 2011 to -38% in 2015.

Non-GAAP Metrics Detract From Reality

The fall of Valeant and other Danger Zone picks make the dangers of non-GAAP metrics clear. How can a company better represent operations by removing a significant amount of standard operating costs? Below are the non-GAAP metrics that Cornerstone uses to explain its business to investors:

- Bookings – revenue plus the change in deferred revenue for the period

- Non-GAAP revenue – adds back acquisition-related deferred revenue

- Non-GAAP cost of revenue – removes amortization of intangible assets, stock based compensation, and employer-related taxes.

- Non-GAAP Operating Income/Loss – operating income/loss that removes stock based compensation costs, amortization of intangibles, and acquisition costs.

- Non-GAAP Net Income/Loss – includes adjustments to non-GAAP revenue and excludes stock-based compensation, employer-related payroll taxes, amortization of intangible assets, adjustments to taxes related to acquisition adjustments, acquisition related costs, accretion of debt discount, amortization of debt issuance costs, other amortization costs, and unrealized fair value adjustment on strategic investments.

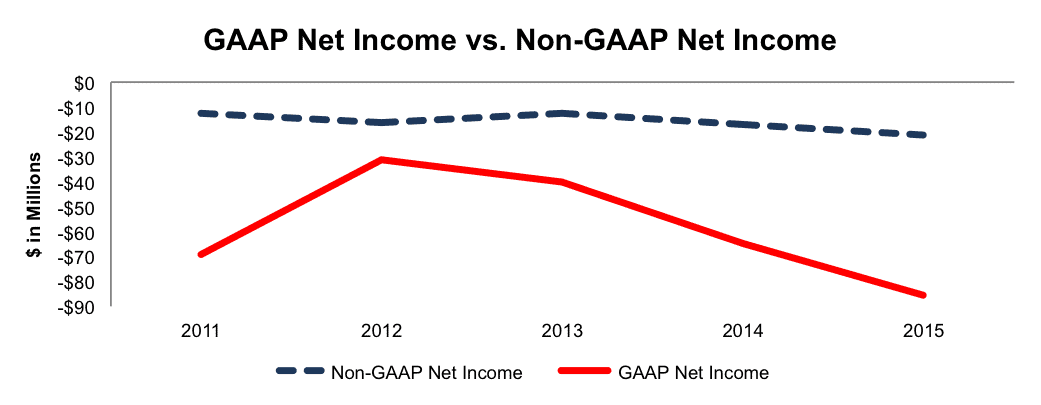

In 2015, Cornerstone’s non-GAAP net loss was only -$21 million, compared to -$85 million GAAP net loss. Similarly, bookings were 18% higher than revenue. Figure 2 shows the discrepancy between GAAP and non-GAAP losses since 2011.

Figure 2: Cornerstone’s Non-GAAP Minimizes Losses

Sources: New Constructs, LLC and company filings

Negative ROIC Hurts Cornerstone’s Competitiveness

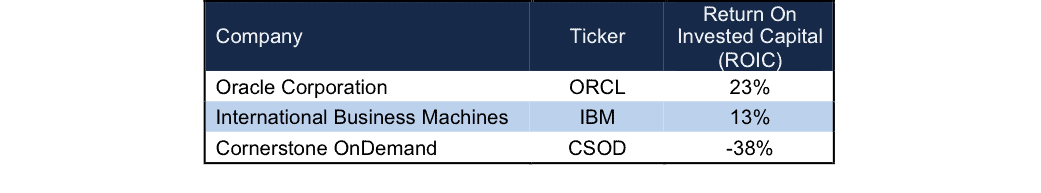

As a SaaS business, Cornerstone operates in an industry that is highly competitive. Focusing on the talent management/employee lifecycle market certainly eliminates some competitors, but that doesn’t mean Cornerstone operates with a significant advantage in terms of profitability. Cornerstone competes against Oracle (ORCL) and IBM (IBM) with their recruiting and onboarding tools. Oracle, SAP (SAP) SkillSoft Corp, and Saba Software, which was taken private for only $300 million in 2015, compete with CSOD in their enterprise segments, and numerous competitors including Oracle and SAP compete with CSOD in the performance management segment. At every turn, Cornerstone competes with large, multinational companies that are more profitable and, therefore, have significant competitive advantages related to pricing, product development and sale/distribution. Figure 3 highlights the large gap in ROIC between its two largest competitors and CSOD.

Figure 3: Comparing Cornerstone’s ROIC

Sources: New Constructs, LLC and company filings

Hope Of “Reaching Scale” Has Already Passed

In the past, we have covered SaaS firms whose sole bull “hope” rested on the company “reaching scale.” Often times, these firms, for instance Marketo (MKTO), Demandware (DWRE) or even ServiceNow (NOW), attract smaller, less profitable, unknown clients, or some combination of the three. The bull case in these situations rests on the belief that once the company reaches scale and attracts the correct/large enough client bases, it can scale back its costs and begin serving its customers profitably for now and forever.

In the case of Cornerstone, this argument doesn’t hold water. Cornerstone already provides services to some of the largest organizations across the globe, including BMW, Ohio State University, BNP Paribas, Deutsche Bank (DB), Darden Restaurants (DRI), McKesson Corporation (MCK), and the American Red Cross among others. Cornerstone provides service to organizations with over 350,000 users and claims 23.8 million users overall. And yet, though the company’s expense growth is decelerating, it is still higher than revenue growth, and, as noted above, profit losses are only getting worse.

Further undermining the bull case, irrationally exuberant future cash flow expectations are already baked into CSOD’s current valuation. As a result, the stock has limited upside and large downside risk, that we think will be triggered as soon as investors acknowledge the cash flow issues.

Acquisition Hopes Are Not Justification For Valuation

As a company with a $1.9 billion market cap, we recognize that many investors may own CSOD with the goal of being acquired. However, Cornerstone is not as attractive an acquisition target as many think.

First, Cornerstone has hidden liabilities that make it more expensive than the accounting numbers would initially suggest.

- $102 million in outstanding employee stock options (6% of market cap)

- $21 million in off-balance sheet debt (1% of market cap)

After adjusting for these hidden liabilities, we can model a scenario in which IBM purchases CSOD, Modeling different scenarios allows us to show you just how expensive CSOD is. Based on this analysis, we see that even in a best case scenario, CSOD is worth less than where it trades today.

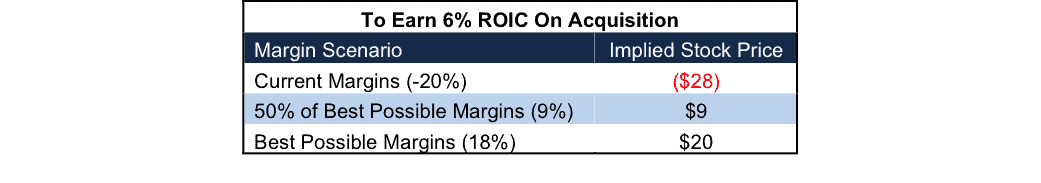

Figures 4 and 5 show the implied stock prices that IBM should pay for CSOD to achieve different “Goal ROICs” assuming different levels of profit margins. There are limits on how much IBM should pay to earn a proper return, given the NOPAT or cash flows being acquired. For each scenario, we show the max price IBM can pay and still achieve the “goal ROICs”.

Figure 4: Implied Acquisition Prices For IBM To Achieve 6% ROIC

The first “goal ROIC” is IBM’s weighted average cost of capital (WACC) or 6%. Figure 4 shows the prices IBM should pay for CSOD assuming different levels of profit margin achieved post acquisition. We feel it is highly unlikely that Cornerstone’s business would ever earn the same high margin as IBM’s existing business, and it is included in our analysis only to show the best case scenario. Without significant margin improvement for CSOD, IBM should pay nothing for the firm’s equity. Even in the “best case scenario”, the most IBM should pay is $20/share (38% downside). At 6% ROIC, this deal would be “value neutral”, as the ROIC on the deal would equal IBM’s WACC.

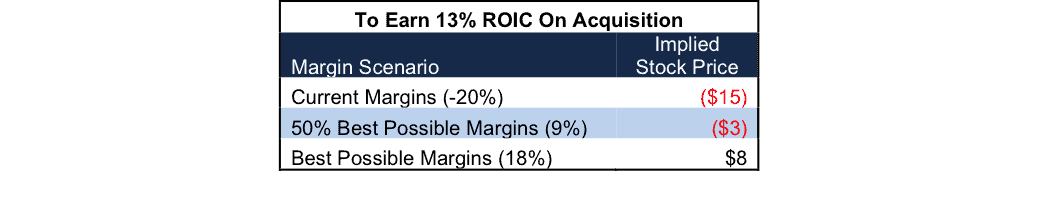

Figure 5: Implied Acquisition Prices For IBM To Achieve 13% ROIC

Figure 5 shows the next “goal ROIC” of 13%, which is IBM’s current ROIC. Any deal that doesn’t earn a return of 13% or above is bad for shareholders as it signals to the market that IBM’s ROIC will decline. Assuming management doesn’t want to drive down its ROIC, the most IBM should pay for CSOD is $8/share (75% downside). This purchase price assumes CSOD can immediately achieve IBM’s 18% NOPAT margin. Any other margin scenario results in a negative implied stock price.

Organic Growth Doesn’t Justify Valuation

To justify its current stock price ($34/share) via organic growth, Cornerstone must immediately achieve positive margins (over -20% in 2015) and grow revenue by 30% compounded annually for 20 years. In this scenario, 20 years from now, Cornerstone would be generating $64 billion in revenue, which is greater than Intel’s (INTC) 2015 revenue and nearly double Oracle’s 2015 revenue. Are those not irrationally exuberant expectations?

In a more realistic, yet still optimistic scenario, where we give Cornerstone credit for 5% NOPAT margins and 21% compounded annual revenue growth for the next decade, the stock is worth only $15/share today – a 56% downside.

Economy Woes Could Create Earnings Miss

With Cornerstone OnDemand providing talent/employee management services, the business is inextricably tied to the labor market. In the United States, despite persistently low economic growth, the unemployment rate has been falling since 2011. In an economy with such employment, one would expect Cornerstone to prosper, as corporations require more onboarding, training, and compensation solutions for a larger amount of employees. However, as we have shown, the company has failed to make any money despite this major tail wind. In fact, one must wonder how much lower the unemployment rate can fall, as it currently sits at 5%. Any slowdown in the labor market, especially in the United States, where Cornerstone derives 67% of revenue, could quickly coincide with revenue growth slowing even faster, profits falling deeper into negative territory, and investors’ patience with non-GAAP metrics dissipating.

Given the companies inability to create profits since going public, it seems unlikely that CSOD can reverse course and meet the lofty expectations already baked into the stock.

Insider Sales and Short Interest Remain Low

Over the past 12 months 158,000 shares have been purchased and 233,000 shares have been sold for a net effect of 75,000 insider shares sold. These purchases represent <1% of shares outstanding. Additionally, there are 3.7 million shares sold short, or just over 6% of shares outstanding.

Executive Compensation Focuses On Wrong Metrics

Cornerstone executives’ compensation incentives are misaligned with creating shareholder value. Bonuses are awarded for meeting revenue, non-GAAP operating cash flow, and non-GAAP net loss targets. As it has for many other Danger Zone picks, the Compensation Committee has failed investors as CSOD executives are paid to grow revenue by any means. Similarly, two executives largely involved in sales of products receive equity awards for achieving sales goals in their respective territories. Meeting sales goals with no expectation of profits does not align executives with shareholders. We would much prefer executive compensation be based upon ROIC, which has a clear correlation between ROIC and shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Cornerstone’s 2015 10-K:

Income Statement: we made $20 million of adjustments with a net effect of removing $18 million in non-operating expenses (5% of revenue). We removed $19 million related to non-operating expenses and $1 million related to non-operating income. See all adjustments made to Cornerstone’s income statement here.

Balance Sheet: we made $370 million of adjustments to calculate invested capital with a net decrease of $78 million. The most notable adjustment was $21 million (8% of net assets) related to off-balance sheet operating leases. See all adjustments to Cornerstone’s balance sheet here.

Valuation: we made $597 million of adjustments with a net effect of decreasing shareholder value by $149 million. One of the largest adjustments was the removal of $102 million (5% of market cap) in outstanding employee stock options.

Dangerous Funds That Hold CSOD

The following funds receive our Dangerous-or-worse rating and allocate significantly to Cornerstone OnDemand.

- Stonebridge Small-Cap Growth Fund (SBSGX) – 3.1% allocation and Very Dangerous rating.

- TCW SMID Cap Growth Fund (TGSDX) – 3.0% allocation and Dangerous rating.

- TCW Small Cap Growth Fund (TGSNX) – 2.7% allocation and Dangerous rating

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.