Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

No matter how flashy the service, when the provider cannot turn a profit, one must question the viability of the business. With losses piling up, a weak competitive position, and expectations of tremendous profitability already embedded in the stock price, PROS Holdings (PRO: $21/share) is in the Danger Zone this week.

Losses Are Only Getting Worse

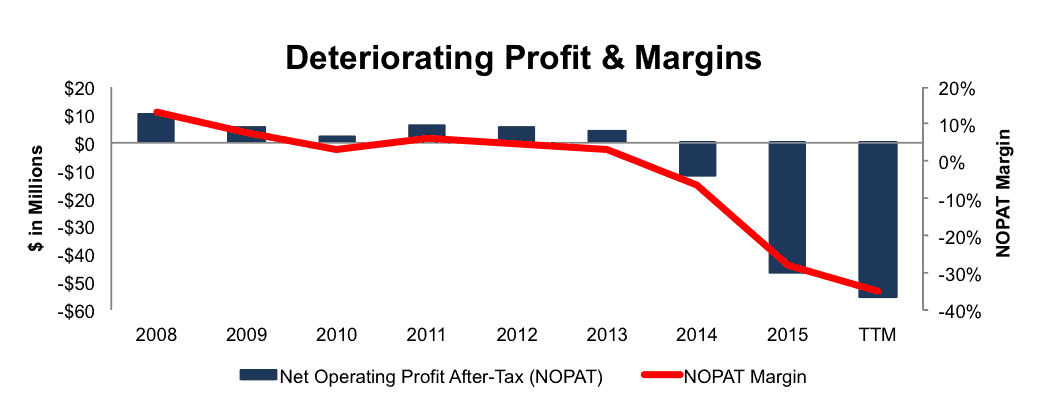

PROS’ after-tax profit (NOPAT) has declined from $10 million in 2008 to -$47 million in 2015, and even further, to -$55 million over the last twelve months (TTM). The company’s NOPAT margin has fallen from 13% in 2008 to -35% TTM, per Figure 1. Such drastic deterioration in PROS’ profitability comes despite revenue growing 12% compounded annually from 2008-2015.

Figure 1: PRO’s Accelerating Losses

Sources: New Constructs, LLC and company filings

PROS Holdings’ return on invested capital (ROIC) has fallen from a once impressive 47% in 2010 to a bottom-quintile -68% TTM. Compounding the above issues, PROS Holdings has burned through $104 million in free cash flow over the past five years.

Compensation Plan Misaligns Executive Interests

Annual cash bonuses are paid out based upon the achievement of numerous non-GAAP goals, including bookings, annual recurring revenue, annual contract value, free cash flow and other discretionary goals. By using multiple non-GAAP metrics, management has significant leeway in determining “business success,” while ignoring the underlying economics of the business. Equity awards are earned based on the company’s total shareholder return in relation to the Russell 2000. In both cases, executives are incentivized by metrics that do little to create shareholder value, and it should come as no surprise that economic earnings, the true cash flows of the business, have declined from $10 million in 2008 to -$62 million TTM. Until executive interests are aligned with those of shareholders, expect further shareholder value destruction. The best way to create shareholder value, and align executives with the best interest of shareholders, is to tie performance bonuses to ROIC, as there is a clear correlation between ROIC and shareholder value.

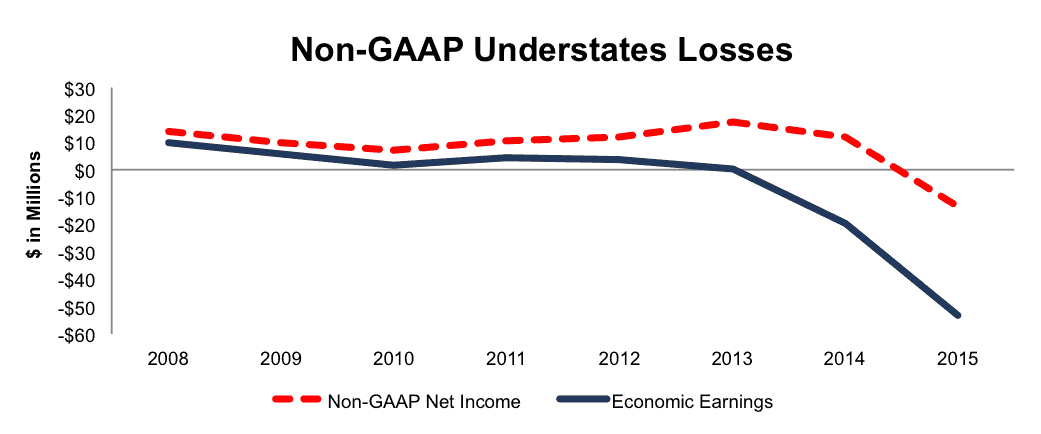

Non-GAAP Metrics Understate Losses

Discretion over which items are removed to calculate non-GAAP metrics gives executives the ability to understate losses and mislead investors into believing a company is profitable. See the dangers of non-GAAP metrics for more. Regarding PROS Holdings, here are some of the expenses PRO has removed in the past or still currently removes to calculate its non-GAAP metrics such as non-GAAP operating income, non-GAAP net income, and adjusted EBITDA:

- Share-based compensation expense

- Acquisition related expense

- Amortization of intangible assets

The removal of these items has a significant impact on the disparity between economic earnings and PRO’s non-GAAP metrics. In 2014 PROS removed just over $22 million in share-based compensation expense (12% of 2014 revenue). Through the removal of this equity-based compensation and other expenses, PRO reported a non-GAAP net income of $12 million compared to GAAP net income of -$37 million. In 2015, the company removed nearly $28 million in share-based compensation expense (17% of 2015 revenue) and reported a non-GAAP net income of -$13 million compared to a GAAP net income of -$66 million. Long-term, PROS’ non-GAAP metrics present the business in a much better light than economic reality. From 2008-2015, non-GAAP net income declined from $14 million to -$13 million. Meanwhile, economic earnings declined from $10 million to -$53 million over the same time frame, per Figure 2.

Figure 2: Discrepancy Between Non-GAAP & Economic Earnings

Sources: New Constructs, LLC and company filings

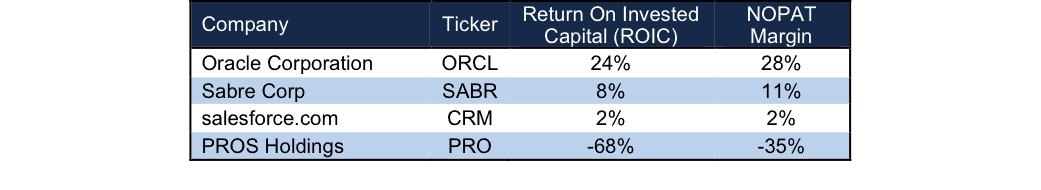

Weak Competitive Position: Negative Profitability In A Highly Competitive Market

PROS Holdings’ solutions for providing pricing and revenue management pit it against some of the largest tech firms in the world, including Oracle (ORCL), Salesforce.com (CRM), and SAP. At the same time, PROS faces competition from smaller firms such as Sabre Corp (SABR), Vendavo, Zilliant, and Apptus. The data analytics market provides plenty of opportunity for a firm to carve out a niche segment. However, with highly negative margins, amidst much more profitable competition, PROS Holdings faces an uphill battle. Per Figure 3, PROS earns an ROIC and NOPAT margin well below three of its main competitors. PROS is at a competitive disadvantage when it comes to pricing power and the ability to reinvest in its operations. With such low margins, it will also have a hard time reaching the lofty expectations baked into its stock price, as we’ll detail later.

Figure 3: PROS Holdings’ Profitability Ranks Well Below Competitors

Sources: New Constructs, LLC and company filings

Bull Hopes Imply Cloud Can Cure All

The market loves a good growth story, particularly a software and/or cloud growth story. Look no further than prior Danger Zone reports on companies such as Box (BOX), Splunk (SPLK), of FireEye (FEYE) for examples of how irrational the market can get when valuing tech firms. PROS Holdings, despite operating since 1985, only recently joined the ranks of cloud companies when it switched its business to a primarily software-as-a-service model rather than a licensing model in mid 2015.

With this switch came a shift in market sentiment, and the stock began trading on non-GAAP metrics such as annual recurring revenue or contract value, while the fundamentals of the firm got pushed to the side. At the same time, bulls will argue this shift to a SaaS model has resulted in the negative profitability. However, this argument ignores the fact that the profitability issues began long before the shift to SaaS and don’t appear to be coming to an end anytime soon.

To make the argument that a shift to SaaS business model is causing near term profitability issues, one must show that profits had been growing prior to 2015. However, per Figure 1 above, PROS Holdings’ NOPAT and NOPAT margin has declined each year since 2011, and only gotten worse over the last twelve months. Furthermore, the costs of running the business are consistently growing faster than revenues. Since 2012, revenue has grown 13% compounded annually. Cost of revenue, selling & marketing, general & administrative, and research & development costs have grown by 22%, 35%, 28%, and 19% compounded annually over the same time. Worst yet, in 2015, when revenue declined 9%, each of these costs continued to grow grew year-over-year. The fact remains that PROS Holdings is unprofitable, whether it operates a licensing model or a SaaS model.

Market expectations for PROS Holdings are to not only grow revenue at impressive rates (as with many SaaS firms) but also immediately achieve profitability. Anything less would fail to meet the lofty expectations implied by the current stock price.

The largest risk to the bear case is what we call “stupid money risk”, which is higher in today’s low (organic) growth environment. Another firm could step in and acquire PRO at a value that is much higher than the current market price. However, we see an acquisition as possible only if a firm is willing to destroy shareholder value.

Is PRO Worth Acquiring?

The biggest risk to any bear thesis is that an outside firm acquires PRO at a value at or above today’s price. If the negative profitability and weak competitive position noted above are not enough, we’ll show below that PRO is not an attractive acquisition target unless a buyer is willing to destroy shareholder value.

To begin, PRO has liabilities of which investors may not be aware that make it more expensive than the accounting numbers suggest.

- $7 million in outstanding employee stock options (<% of market cap)

- $5 million in off-balance-sheet operating leases (1% of market cap)

After adjusting for these liabilities we can model multiple purchase price scenarios. Even in the most optimistic of scenarios, PRO is worth no more than the current share price.

At the same time, the chances of another firm acquiring PROS would seem minimal. To provide quoting solutions, Oracle has acquired Big Machines while Salesforce has acquired SteelBrick to compete in the same market. Furthermore, PRO Holdings solutions are already available on many common enterprise platforms from Microsoft, Dell, IBM, and Oracle.

Nonetheless, to illustrate just how overvalued PROS Holdings is to any potential acquirer, we can analyze difference scenarios to determine what a firm should pay for PRO to ensure it does not destroy shareholder value. As with any acquisition, there are limits on how much a firm would pay for PRO to earn a proper return, given the NOPAT or free cash flows being acquired.

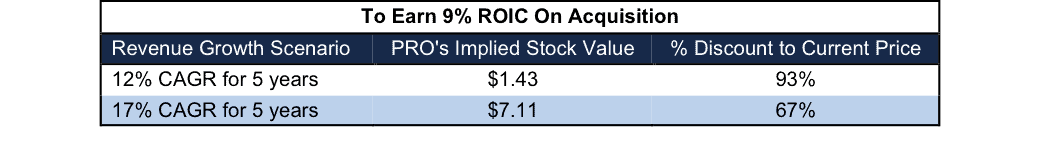

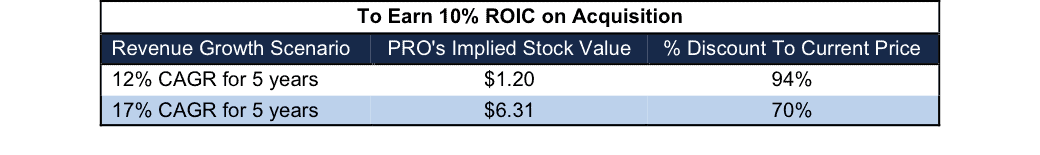

Figures 4 and 5 provide details on how much salesforce should pay for PRO to ensure no shareholder value destruction.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In scenario one, the estimated revenue growth in each year equals 12%, which is the average revenue growth rate since 2012 and above consensus estimates. In scenario two, the estimated revenue growth rate in each year equals 17% because it assumes a merger with salesforce could create additional revenue growth through increased cross-selling opportunities.

We conservatively assume that salesforce can grow PRO’s revenue and NOPAT without spending on working capital or fixed assets. We also assume PRO achieves a 2.1% NOPAT margin, which is CRM’s current margin. For reference, PROS Holdings’ TTM NOPAT margin is -35%, so this assumption implies immediate and drastic improvement and allows the creation of a truly best case scenario.

Figure 4: Implied Acquisition Prices For CRM To Achieve 9% ROIC

Sources: New Constructs, LLC and company filings.

Figure 4 shows the ‘goal ROIC’ for CRM as its weighted average cost of capital (WACC) or 9%. Even if PROS Holdings can grow revenue by 12% compounded annually with a 2% NOPAT margin for the next five years, the firm is not worth more than its current price of $21/share. It’s worth noting that any deal that only achieves a 9% ROIC would be only value neutral and not accretive, as the return on the deal would equal CRM’s WACC.

Figure 5: Implied Acquisition Prices For CRM To Achieve 10% ROIC

Sources: New Constructs, LLC and company filings.

Figure 5 shows the next ‘goal ROIC’ of 10%, which is well above CRM’s current ROIC of 2%, and above its WACC, which ensures the deal would be truly accretive to shareholders. Even in the best-case growth scenario, the most CRM should pay for PRO is $6.31/share (70% downside). Even assuming this best-case scenario, CRM would destroy $484 million if purchasing PRO at its current valuation. Any scenario assuming less than 17% CAGR in revenue would result in further capital destruction for CRM.

Standalone Valuation Implies Significant Profit Growth

PRO is up over 100% in the past six months alone as investors have been drawn to the “cloud growth story.” This significant price increase coupled with continued deterioration of business fundamentals leaves PRO overvalued. To justify the current price of $21/share, PRO must immediately achieve 6% NOPAT margins (last achieved in 2011 and compared to -35% TTM) and grow revenue by 18% compounded annually for the next 13 years. For reference, consensus estimates expect -10% revenue growth in EY1 and only 6% in EY2.

Even if we assume PRO can immediately achieve a 6% NOPAT margin and grow revenue by 12% compounded annually (average since 2008) for the next decade, the stock is only worth $9/share today – a 57% downside. Each of these scenarios also assumes the company is able to grow revenue and NOPAT/free cash flow without spending on working capital or fixed assets. This assumption is unlikely but allows us to create a very optimistic scenario. For reference, PROS’ invested capital as grown on average $8 million (5% of 2015 revenue) per year since 2008.

Market Doesn’t Overlook Losses Forever

Many unprofitable firms have seen their valuations soar and PRO is no different. After rising 100% over the past six months, the implications of the valuation defy even the best case scenarios. Barring an acquisition, which we believe would be ill-advised, PRO faces significant downside risk with little to no incremental upside potential.

In order to reach the expectations embedded in the stock price, PROS Holdings needs to drastically improve margins while also growing revenue at impressive rates. Maintaining exceptional revenue growth often comes at the expense of margins, as the costs to grow revenue merely grow alongside revenue growth, as alluded to above. On the flip side, to increase margins, PROS Holdings needs to cut costs, and risk a slowdown in revenue growth.

The market will support firms that face this predicament only for so long. At the end of the day, fundamentals matter and either the fundamentals catch up to the valuation, or the valuation corrects to a level more rational when compared to the fundamentals. We’ve seen this before at firms such as SolarCity (SCTY), Twitter (TWTR), and Box (BOX), down 60%, 54%, and 32% respectively since being placed in the Danger Zone. While non-GAAP metrics to continue to mask the losses of the business, any crack in the façade could provide the catalyst to send shares downward.

Insider Action Is Low While Short Interest Is Notable

Over the past 12 months, 35 thousand insider shares have been purchased and 72 thousand have been sold for a net effect of 37 thousand insider shares sold. These sales represent under 1% of shares outstanding. Additionally, there are 2.1 million shares sold short, or just under 7% of shares outstanding.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to PRO’s 2015 10-K:

Income Statement: we made $19 million of adjustments with a net effect of removing $19 million in non-operating expenses (11% of revenue). There were no adjustments related to non-operating income and we removed $19 million related to non-operating expenses. See the adjustments made to PRO’s income statement here.

Balance Sheet: we made $137 million of adjustments to calculate invested capital with a net decrease of $107 million. The most notable adjustment was $122 million (69% of net assets) related to excess cash. See all adjustments to PRO’s balance sheet here.

Valuation: we made $238 million of adjustments with a net effect of decreasing shareholder value by $27 million. Apart from debt, one notable adjustment was $8 million related to outstanding employee stock options. This adjustment represents 1% of PRO’s market cap.

Dangerous Funds That Hold PRO

The following funds receive our Dangerous-or-worse rating and allocate significantly to PROS Holdings.

- DF Dent Small Cap Growth Fund (DFDSX) – 2.4% allocation and Dangerous rating.

- Nationwide Small Company Growth Fund (NWSAX) – 1.8% allocation and Very Dangerous rating.

This article originally published here on October 24, 2016.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Scottrade clients get a Free Gold Membership ($588/yr value) as well as 50% discounts and up to 20 free trades ($140 value) for signing up to Platinum, Pro or Unlimited memberships. Login or open your Scottrade account & find us under Quotes & Research/Investor Tools.

1 Response to "Danger Zone: PROS Holdings (PRO)"

Hello,

I joined your membership on Oct. 13, 2016 and received an email stating that an email would follow shortly providing login credentials. I never received that particular email. However, I am able to pull up your letters on my email site. Please resend my login credentials to waspandover @comcast.net