We closed this Long Idea on April 19, 2024. A copy of the associated Position Close report is here.

This company saw large market share gains throughout the pandemic and is positioned for years of more profit growth, but its stock has fallen 30% year to date and is trading at pre-pandemic levels. The company is mischaracterized as a restaurant chain when it is really more of a supply chain operator and consumer marketing firm. Domino’s (DPZ: $390/share) is this week’s Long Idea.

Domino’s stock presents quality risk/reward given the company’s:

- position as the world’s largest pizza chain

- consistent market share gains

- efficiencies from its integrated delivery system that third parties cannot replicate

- ability to overcome current labor shortages over the long term

- superior profitability to peers

- valuation implies the company’s profits will permanently fall 10% from current levels

Cheapest PEBV Ratio Since 2013

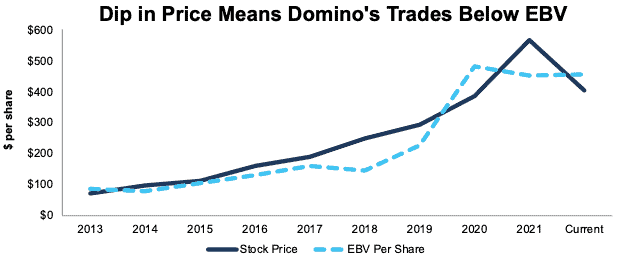

Like many companies that grew sales during the pandemic, Domino’s Pizza’s stock price soared ~50% above pre-pandemic levels. Then, as traders unwound their pandemic trades, the stock has tumbled 30% year-to-date and now trades below its price-to-economic book value (PEBV) ratio (0.9) for just the second time since 2013. See Figure 1.

A PEBV ratio of 0.9 means the stock is priced for profits to immediately fall and permanently stay 10% below 2021 levels, which as we’ll show below, is highly unlikely. For more details about the upside embedded in Domino’s stock price, see the scenarios analyzed using our reverse discounted cash flow (DCF) model in the valuation section.

Figure 1: Stock Price and Economic Book Value per Share: 2013 – Current

Sources: New Constructs, LLC

Proven International Force

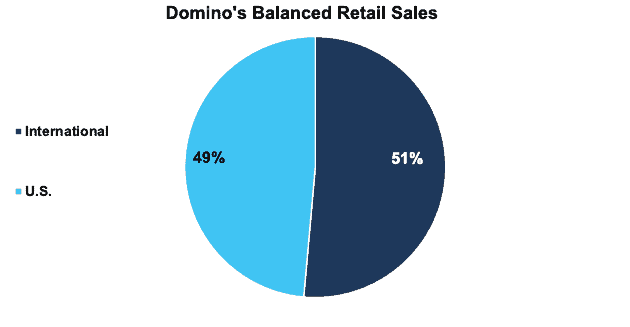

Domino’s has more than 18,800 locations in 90 different markets around the world. Domino’s U.S. and international retail sales have each grown by 10% compounded annually over the past 10 years. Per Figure 2, Domino’s international segment accounted for 51% of its global retail sales in 2021.

Global reach exposes the company to geopolitical risks but a wide geographic dispersal limits exposure to individual countries outside the United States. For example, Domino’s risk from rising tension between China and the international community is limited as just 5% of its international stores are in China.

Figure 2: International and U.S. Retail Sales: 2021

Sources: New Constructs, LLC and company filings

Franchise Model Drives Store Count Growth

Domino’s is thought of as a restaurant chain, but the company owns just 2% of its stores. The company generates revenue from franchise royalties and its supply chain operations in the United States. Dominos is more of a supply chain operator and consumer marketing firm than it is a restaurant chain.

This franchise model is beneficial to investors because it enables the company to efficiently manage its capital while having the flexibility to pursue strong growth opportunities. For potential franchisees, the company offers a streamlined operating model, national marketing campaigns, and a cash-on-cash return of investment in three years or less.

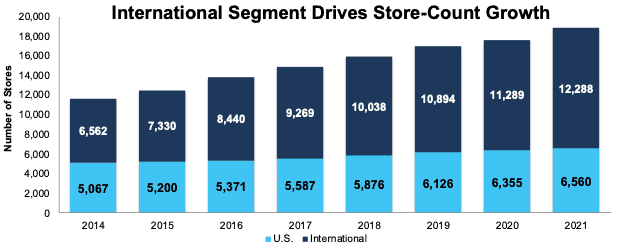

Clearly the opportunity is attractive to franchisees globally because the international market has been the main driver of store growth. Per Figure 3, Domino’s grew its store count from 11,629 in 2014 to 18,848 in 2021.

Figure 3: International and U.S. Store Count: 2014 – 2021

Sources: New Constructs, LLC and company filings

Continued growth in the global Quick Service Restaurant (QSR) market will support Domino’s global retail sales growth. Research and Markets expects the global QSR market to grow at a 4.9% CAGR from 2022 – 2027.

Domino’s continues to see opportunities for profitable store growth. The company believes the U.S. market has the potential to grow to 8,000 stores, compared to 6,560 at the end of 2021, and its top 14 international markets could add an additional 10,000 stores, which would nearly double its international store count.

Taking Control from Start to Finish

A key contributor to Domino’s success as a franchisor is the control exerted over its product quality and customer experience, from end-to-end. Here’s how the company maintains that control:

- Supply chain: Supply chain operations provide quality-assured ingredients at competitive costs, freeing time for franchisees to manage other parts of the business. For example, Domino’s delivers mixed dough to stores, saving operators a time-consuming preparation step.

- Franchisee selection: Over 95% of the company’s U.S. franchisees started as drivers or in-store employees. The company requires franchisees to have extensive Domino’s and management experience. By being selective, Domino’s protects its brand with franchisees who understand its business model and culture.

- Delivery: Domino’s operates an efficient delivery system that ensures customers gets a hot, quality product delivered in a timely fashion.

By taking ownership over the entire process, Domino’s eliminates cost inefficiencies and maintains a consistent quality level across its entire business.

Digital Business Enhances Customer Experience and Profitability

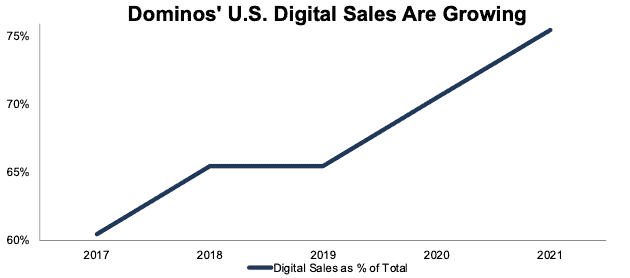

Domino’s digital capabilities enrich the customer experience by offering quick and easy ordering options, a rewards program, exclusive digital-only deals, and a voice ordering application. Digital orders create more customer engagement, ensure a more consistent customer experience, and drive higher sales against lower costs. Domino’s carryout tickets that are ordered online are 25% higher than those ordered over the phone, and are less labor-intensive, which is helpful in a tight labor market.

Domino’s digital capabilities paid off when customers relied upon ecommerce channels during the pandemic. Per Figure 4, retail sales generated through Domino’s digital channel rose from 60% of total sales in 2017 to 75% in 2021. For comparison, McDonald’s systemwide sales from digital channels in 2021 were ~25% of systemwide sales in its top 6 markets.

Figure 4: U.S. Digital Retail Sales as a Percent of Total U.S. Retail Sales: 2017 – 2021

Sources: New Constructs, LLC and company press releases

Equipped to Navigate Pandemic Disruption

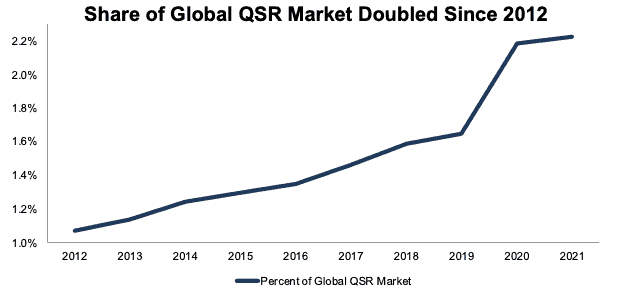

Domino’s large digital presence, integrated supply chain, robust delivery service, and carry out capabilities made the company ideally situated to strengthen its market position during the COVID-19 pandemic. While weaker competitors struggled to reach customers during the pandemic, Domino’s market share soared from 1.6% of the global quick service restaurant (QSR) market in 2019 to 2.2% in 2021.

Far from being a recent anomaly, Domino’s strong business model was taking market share long before the pandemic. Per Figure 5, Domino’s grew its share of the global QSR market from 1.1% in 2012 to 1.6% in 2019. A strong business model positioned the company to benefit when other businesses were retreating. This is ground won that Domino’s will not likely give back post-pandemic.

Figure 5: Share of Global QSR Market: 2012 – 2021

Sources: New Constructs, LLC and IBISWorld

Industry-Leading Profitability

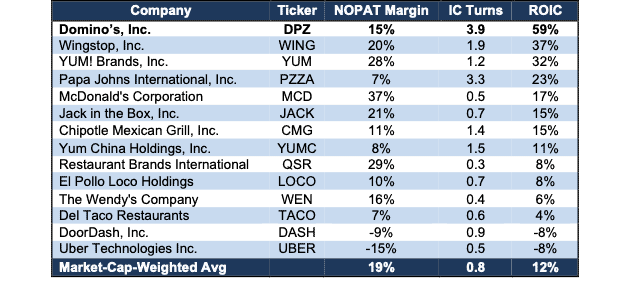

Domino’s business model not only generates impressive top-line growth, but it also industry-leading invested capital turns and return on invested capital (ROIC). At 59%, Domino’s trailing-twelve-month (TTM) ROIC is 1.6x its closest competitor. See Figure 6.

The company’s high ROIC isn’t just the result of a one-time pandemic boost either. The company’s 5-year average ROIC is actually slightly higher at 60%. Looking at the entire S&P 500 reveals that only four companies have a higher 5-year average ROIC than Domino’s.

Figure 6: Domino’s Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings

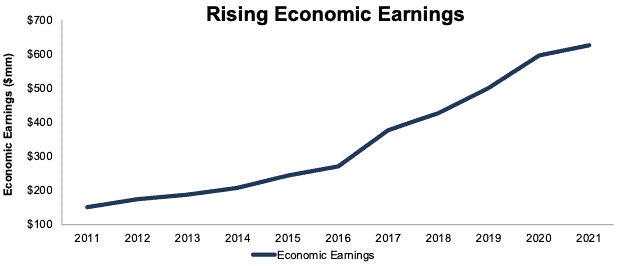

Steady Economic Earnings Growth

Domino’s continues to create shareholder value as it expands its business. The company has generated positive economic earnings every year since going public in 2004. More recently, Domino’s economic earnings grew from $151 million in 2011 to $627 million in 2021.

Figure 7: Economic Earnings Since 2011

Sources: New Constructs, LLC and company filings

Healthier Eating Is Not a Big Risk

The company’s operation is specifically configured to the mass production of quality pizza, which limits direct competition from most other QSRs. However, such dependence on one product means the company’s success is also tied to the popularity of pizza.

The rise of health consciousness poses a threat to the industry that serves loads of highly caloric carbs, fats, and processed meats. A change in dietary habits toward healthier options could pose a long-term headwind for the industry and its largest supplier. However, this threat is not likely to keep the pizza market from growing. Despite an ever-increasing array of diet and healthy eating options, the American QSR pizza market grew from $35.9 billion in 2016 to $40.6 billion in 2021.

Furthermore, Domino’s experience with innovation means that it can offer better-for-you options, such as gluten-free crust, should consumer preferences shift away from traditionally made pizza.

Rising Costs Could Hurt Margins But Drive More Market Share Gains

Management noted in its 4Q21 earnings call that it expects Domino’s U.S. stores to see up to a 10% increase in its food supply costs. These rising costs will have an immediate impact on stores’ profitability. The company will also feel the negative effects of rising costs as a decline in store profitability will have a “trickle-up” effect on the franchisor. Stores may be forced to promote higher margin items to offset the impact of rising costs, reduce operating hours, or less aggressively acquire staff members which could lead to lower retail sales.

Staffing shortages which will likely continue to be a headwind to store count growth and running sales promotions. The company is more cautious about offering promotions that drive more traffic amidst the present challenges. Stores may not be able to keep up with more business while maintaining quality standards, and Domino’s is hesitant to actively acquire more customers, who may have a less than ideal experience with understaffed stores.

However, all other QSR operators face these same challenges. Domino’s extensive store network, supply chain efficiencies and best-in-class ROIC provide it with strong advantages that will likely drive more market share gains as they did during COVID.

Delivery Service: Long-Term Advantage but Short-Term Problem

The current labor shortage is directly impacting Domino’s ability to execute operations that are heavily dependent on delivery service. A lack of delivery drivers has led some stores to reduce operating hours as the company struggles to provide the delivery capacity to meet demand. The company is leaning on its digital channel and carryout business to assist with navigating these challenges by offering more incentives.

Over the long term, Domino’s delivery capabilities are a major competitive advantage for the company, which we expect will continue to drive more growth, despite current capacity constraints.

Uber Eats and Door Dash Reduce Domino’s Delivery Advantage

We have long argued that third-party delivery services such as Uber Eats (UBER) and DoorDash (DASH) operate broken business models that will fail in the long run, but they still pose a threat to Domino’s in the short-term. DoorDash’s rapid market share gains in the U.S. food delivery market have slowed Domino’s ability to acquire new customers.

The third-party food delivery market has grown remarkably over the past two years. However, leading names in the market - such as DoorDash – achieved their growth unprofitably, which means those market share gains are not sustainable. Eventually, third-party delivery services will need to either increase fees or exit the market. Either way, Domino’s integrated delivery service will be ready to take back lost market share.

Domino’s also offers more ways to fulfill customer orders beyond traditional at-home delivery. Domino’s Pizza’s contactless pickup, which guarantees orders will be placed in the vehicle within two minutes of arrival, and delivery hotspots, offer customers the convenience of multiple fulfillment options.

Over the long term, Domino’s is looking to create autonomous delivery solutions. The company’s partnership with Nuro enabled it to test autonomous pizza delivery vehicles in Houston in 2021. These automated delivery systems would make Domino’s highly efficient business model even more efficient.

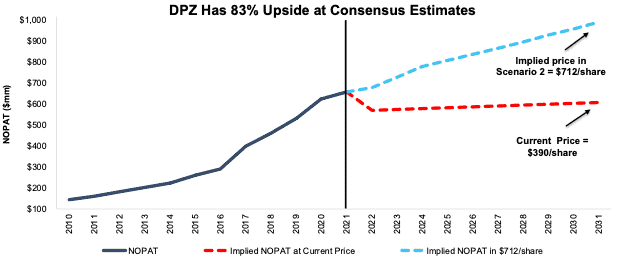

DPZ Has 83% Upside If Consensus Is Correct

Domino’s stock is priced for profits to fall from current levels despite its history of growth, superior profitability, industry-leading market share, and numerous growth opportunities. Below we use our reverse discounted cash flow (DCF) model to analyze two future cash flow scenarios to highlight the upside in Domino’s current stock price.

DCF Scenario 1: to Justify the Current Stock Price of $390/share.

If we assume Domino’s:

- NOPAT margin falls to 13% (10-year average vs. 15% in 2021) in 2022 through 2031 and

- revenue grows at just a 1% CAGR (vs. 2022 – 2024 consensus estimate CAGR of 7%) from 2022 – 2031, then

the stock is worth $390/share today – equal to the current stock price. In this scenario, Domino’s earns $610 million in NOPAT in 2031, which is 8% below 2021.

DCF Scenario 2: Shares Are Worth $712+.

If we assume Domino’s:

- NOPAT margin falls to 14.6% (five-year average) from 2022 through 2031, and

- revenue grows at consensus estimates of 7% in 2022, 8% in 2023, and 7% in 2024, and

- revenue grows at a 3.5% CAGR from 2025 – 2031 (below its 10-year revenue CAGR of 10% from 2011 – 2021), then

the stock is worth $712/share today – an 83% upside to the current price. In this scenario, Domino’s NOPAT grows just 4% compounded annually for the next decade, less than one-third of the company’s 15% NOPAT CAGR from 2011 – 2021, and below Research and Markets’ estimated 4.9% CAGR of the global QSR market from 2022 – 2027. Should Domino’s NOPAT grow in line with historical growth rates or even the global QSR market expectations, the stock has even more upside.

Figure 8 compares Domino’s historical NOPAT to its implied NOPAT in each of the above DCF scenarios.

Figure 8: Domino’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

We think the moat around Domino’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. Factors building Domino’s moat include:

- strong brand awareness

- large digital business that increases revenue and decreases labor costs

- superior supply chain efficiency

- integrated delivery service that third party providers cannot replicate

- superior profitability

What Noise Traders Miss With Domino’s

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while more reliable fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Domino’s is better positioned to manage the labor shortage

- Research and Markets expects the global QSR market to grow at a 4.9% CAGR through 2027

- valuation implies 83% upside if the company grows at consensus estimates

Earnings Beats or Alleviation of Labor Constraints Would Be Welcome News

According to Zacks, Domino’s has beat earnings estimates in eight of the past 12 quarters. Doing so again could send shares higher.

Should Domino’s manage the challenging labor environment better than expected, revenue and profits could soar and send its stock price with them.

Dividends and Share Repurchases Could Provide 6.0% Yield

Domino’s has increased its quarterly dividend in every year since 2012. Since 2017, Domino’s has paid $544 million (4% of current market cap) in cumulative dividends. The firm’s current dividend, when annualized, provides a 1.1% yield.

Domino’s also returns capital to shareholders through share repurchases. From 2017 to 2021, the firm repurchased $4.0 billion (28% of current market cap) worth of stock. The firm has $704 million remaining on its current repurchase authorization. If the company uses its remaining repurchase authorization in 2022, the buybacks will provide an annual yield of 4.9% at its current market cap.

Executive Compensation Plan Needs Improvement

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Domino’s compensates executives with salaries, cash bonuses, and long-term equity awards. Domino’s performance stock units (PSUs) are tied to adjusted total segment income and its global retail sales targets.

Instead of adjusted total segment income or global retail sales, we recommend tying executive compensation to ROIC, which evaluates a company’s true return on the total amount of capital invested and ensures that executives’ interests are aligned with those of shareholders. There is a strong correlation between improving ROIC and increasing shareholder value.

Despite room for improvement in compensation structure, Domino’s executives have delivered shareholder value. Domino’s has grown economic earnings from $270 million in 2016 to $627 million in 2021.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have bought 14 thousand shares and sold 133 thousand shares for a net effect of ~118 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 2 million shares sold short, which equates to 6% of shares outstanding and just over four days to cover. Short interest increased 20% from the prior month.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide more reliable fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data & Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Domino’s 10-K:

Income Statement: we made $258 million of adjustments, with a net effect of removing $150 million in non-operating expenses (3% of revenue). Clients can see all adjustments made to Domino’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $187 million of adjustments to calculate invested capital with a net increase of $41 million. One of the largest adjustments was $35 million in operating leases. This adjustment represented 7% of reported net assets. Clients can see all adjustments made to Domino’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $5.6 billion of adjustments to shareholder value for a net effect of decreasing shareholder value by $5.6 billion. Apart from total debt, one of the most notable adjustments to shareholder value was $108 million in outstanding employee stock options (ESO). This adjustment represents <1% of Domino’s market cap. Clients can see all adjustments to Domino’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

Attractive Fund That Holds DPZ

The following fund receives our Attractive rating and allocates significantly to DPZ:

- O’Shaughnessy Market Leaders Value Fund (OFVIX) – 2.2% allocation

This article originally published on March 16, 2022.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "Delivering a Superior Business Model"

A fleet of electric delivery vehicles could be purchased and rented to franchisees to reduce their costs.