This report updates our previous report (published December 2, 2020) to reflect DoorDash’s latest price range disclosed in an amended S-1 on December 4, 2020.

The latest IPO price range ($90-$95) values DoorDash (DASH: $92.50/share midpoint of IPO price range) at ~$29.4 billion, the midpoint of its new range and up from $25.4 billion, the midpoint of its prior price range. Such a valuation is well above the firm’s last private valuation of $16 billion. We still think this proposed public equity offering holds no value, $0, beyond bailing out private investors before unsuspecting public investors realize the business is not viable in its current form. Making an overpriced IPO more expensive only creates more downside risk for investors.

DoorDash’s updated valuation implies it will:

- Immediately improve its net operating profit after-tax (NOPAT) margin to 8% compared to -67% in 2019 and an estimated -12% over the trailing-twelve months – unchanged from prior valuation

- Grow revenue by 37% compounded annually for the next 11 years – up from 35% CAGR at prior valuation

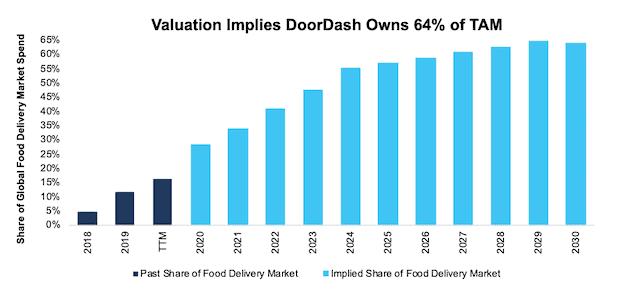

- Grow its share of global food delivery app market to 64% from ~16% over the trailing twelve months (TTM) – up from 56% market share at prior valuation.

Additional details can be found in the section titled “Doing the Math: Valuation Implies DoorDash Captures 64% of Global Food Delivery Spend.”

Is it a coincidence that DoorDash (DASH) filed for its IPO so soon after vaccines for COVID-19 were announced? We think DoorDash’s current investors and bankers recognize that the window of opportunity to IPO this terrible business closes quickly when the threat of COVID-driven lockdowns no longer drives growth in food delivery demand.

This IPO reminds us of WeWork’s attempted IPO, which we called The Most Ridiculous IPO of 2019, because DoorDash’s business is similarly disadvantaged. The fact that this company made it to the pre-IPO stage reflects the overblown fervor of the work-from-home theme. It is not a good idea to invest in businesses that have:

- no moat

- no profits in the best-possible environment

- competition that can offer the same service for free.

Worse yet, to justify a $29 billion valuation, the company needs to grow its share of global food delivery app market to 64% from ~16% over the trailing twelve months (TTM) while also raising margins from -12% to 8% in an intensely competitive business. Throw in the auditor’s reports of weak internal controls, and investors could be holding stock in a business that might not be around in a few years.

Greater Fool Strategy Looms Large

We think the only chance for investors in this IPO to see any gain comes from a greater fool willing to pay a higher price for no economically justifiable reason. For that matter, the stupid money risk of a company overpaying for DASH to ride the work-from-home fad or follow Uber’s Uber Eats strategy is real.

Nevertheless, the ceiling for the price rational investors could pay for DoorDash is $1.4 billion, which equals ~$2.5 billion in capital the company has raised to date less the ~$1.1 billion in cash on its books. Why should anyone pay more than the costs to build the business, especially when it hasn’t come close to generating consistent profits and may never?

Not Profitable Yet, Really?

It took a global pandemic to drive the firm’s one quarter (ended June 30, 2020) of GAAP profitability. The firm has not been profitable since, and we think it may never be.

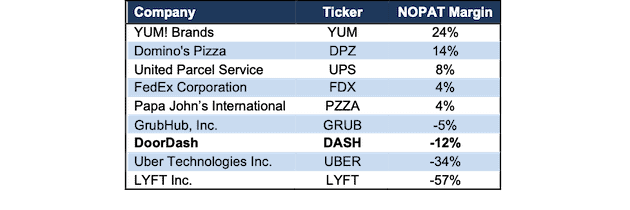

The only firms with worse TTM net operating profit after-tax (NOPAT) margins than DoorDash’s are Uber and Lyft. If DoorDash can’t do better than a -12% margin in this environment, perhaps the best-possible environment for food delivery, then when will it ever be consistently profitable?

Figure 1 compares TTM margins for United Parcel Service and FedEx (FDX), as well as Pizza Hut’s parent company YUM! Brands (YUM), Domino’s Pizza (DPZ), and Papa John’s International (PZZA).

Figure 1: DoorDash’s Profitability vs. Peers: TTM Period

Sources: New Constructs, LLC and company filings

*DoorDash’s TTM NOPAT margin is estimated assuming the firm’s NOPAT improved at the same rate as the firm’s income from operations from 2019 to the TTM period. We make this assumption as there is not enough information in the S-1 to definitively calculate NOPAT over the TTM period.

Low Switching Costs Make Profits Unlikely

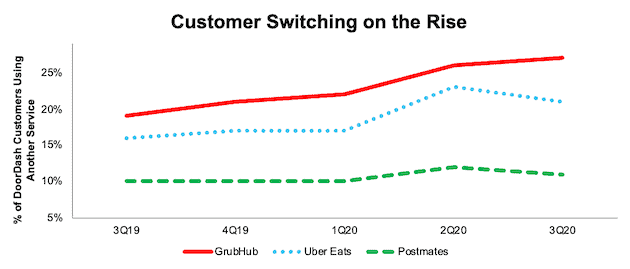

The food delivery market is filled with competitors offering the same service: cheap food delivery. They deliver at about the same speed. Without any other differentiating factors, switching costs are very low. Figure 2 demonstrates that consumers are increasingly exploiting the low switching costs.

Second Measure found that the percentage of DoorDash customers also using competitors’ service rose strongly since 3Q19:

- GrubHub rose from 19% to 27%

- Uber Eats rose from 16% to 21%

- Postmates rose from 10% to 11%.

When accounting for customer overlap, Second Measure’s data reveals that the percentage of DoorDash customers who use DoorDash exclusively fell from 63% in 3Q19 to 53% in 3Q20. With nearly half of customers using other services, it is clear switching costs are very low.

Figure 2: DoorDash Customers Using Other Delivery Services: 3Q19 Through 3Q20

Sources: New Constructs, LLC and Second Measure

DoorDash acknowledges the lack of differentiation and inability to retain customers without price incentives in its S-1:

“…within our industry, the cost to switch between offerings is low. Consumers have a propensity to shift to the lowest-cost provider and could use more than one local logistics platform, independent contractors who provide delivery services could use multiple platforms concurrently as they attempt to maximize earnings, and merchants could prefer to use the local logistics platform that offers the lowest commission rates and adopt more than one platform to maximize their volume of orders.”

You don't have to be a business expert to understand that businesses without differentiated offerings struggle to charge prices above the cost of the service. In other words, they never turn a profit.

Damned If You Do, Damned If You Don’t

The only competitive disadvantage that may be worse for DoorDash than low switching costs is competing with your suppliers. Before the standalone food delivery services entered the market, Pizza Hut’s parent company YUM! Brands (YUM), Domino’s Pizza (DPZ), and Papa John’s International (PZZA) delivered food to customers for free. Now, most of the time, they charge for delivery albeit at prices usually far below the pure-play food delivery firms. The point is that these restaurants can offer delivery for a much lower price or even free because they have core businesses that generate profits.

If DoorDash or any other pure-play food delivery firm becomes meaningfully profitable, why wouldn’t more food providers move into the delivery side of the business?

When suppliers can take away your product because they want your profits, they usually do – at least in competitive markets.

Even if there are not large profits to be made in food delivery, the restaurants might still take it over in order to protect and control their relationships with consumers. The interests of the food delivery drivers and the restaurants are not perfectly aligned. Since most food delivery drivers get a fee that accounts for time, distance, and desirability of the delivery, they probably care more about maximizing the volume of deliveries rather than the quality of them.

Since consumers tend to blame the restaurant, not the drivers, for quality issues (regardless of fault), drivers have less accountability for ensuring a good customer experience. Accordingly, restaurants may feel they need to deliver food themselves to protect the lifetime value of their customers even if they cannot make money on the delivery service.

Does Anyone Actually Believe Food Delivery Will be Profitable?

Given the competitive nature of the business, and ongoing pricing wars, we think the answer is no.

Given how unprofitable DoorDash and all of its competitors are today, perhaps, the only hope for future profitability comes from the potential to scale. Well, not even the CEO of GrubHub believes in that potential:

“A common fallacy in this business is that an avalanche of volume, food or otherwise, will drive logistics costs down materially.” From the 3Q19 letter to shareholders.

DoorDash notes in its S-1 that the firm anticipates increasing expenses in the future and may not be able to maintain or increase profitability.

If management of these companies do not believe their firms will be profitable, why should investors?

Can We Trust the Financials?

Investors also need to know that they should take DoorDash’s GAAP numbers with a grain of salt. The company disclosed a material weakness in its internal control over financial reporting in its S-1. This disclosure means DoorDash didn’t have adequate technology and processes in place to ensure the accuracy of its financial statements and increases the odds that DoorDash will need to restate its financials in the future.

As an emerging growth company, DoorDash is not required to have its auditor give an opinion on its internal controls. We applaud the company for disclosing this risk factor in its S-1, but investors should know that this disclosure is voluntary and could disappear from future filings even if the problem persists.

And Non-GAAP Is No Better

DoorDash tries to present a more profitable view of its operations by highlighting Adjusted EBITDA, every unprofitable company’s favorite metric. In the nine months ended September 30, 2020, this metric excludes $115 million in legal, tax, and regulatory settlements, reserves, and expenses, including charges related to DoorDash’s lobbying in California against reclassifying drivers as employees. Adjusted EBITDA also removes $11 million in stock-based compensation expense.

In total, DoorDash’s adjusted EBITDA excludes $244 million (13% of revenue during the same period) in expenses and turns a GAAP net loss of $149 million to a gain of $95 million over the nine months ended September 30, 2020.

In addition to adjusted EBITDA, DoorDash also uses contribution profit, another misleading non-GAAP metric.DoorDash’s contribution profitrefers to the gross profit of its business, excluding sales and marketing expense, depreciation and amortization, stock-based compensation included in cost of revenue and sales and marketing expenses, and allocated overhead included in cost of revenue and sale and marketing expenses.

In other words, contribution profit shows a measure of “profitability” that excludes the costs of operating DoorDash’s business.

Surprise? Public Shareholders Have No Rights

If you need another reason to question the merit of this IPO, how about the fact that the shares sold provide little to no say over corporate governance?

DoorDash’s multi-class share structure ensures the founders retain majority voting control in the company. DoorDash’s IPO is only for class A shares, with one vote per share. Class B shares have 20 votes per share and are held entirely by the firm’s co-founders. In addition, as part of a voting agreement between the co-founders, DoorDash’s co-founder and CEO, Tony Xu, will have the authority to vote the shares held by the other two co-founders, Andy Fang and Stanley Tang.

DoorDash notes in its S-1 that this arrangement means Mr. Xu:

“…will be able to determine or significantly influence any action requiring the approval of our stockholders, including the election of our board of directors, the adoption of amendments to our certificate of incorporation and bylaws, and the approval of any merger, consolidation, sale of all or substantially all of our assets, or other major corporate transaction.”

After IPO, the three co-founders will hold ~69% of the voting power in the firm, which will only increase as the executives’ equity awards vest. If all equity awards get exercised or vest, the co-founders would control ~79% of the voting power in the firm. In other words, a few executives will control the firm, which gives investors little recourse.

Doing the Math: Valuation Implies DoorDash Captures 64% of Global Food Delivery Spend

When we use our reverse discounted cash flow (DCF) model to analyze the expectations implied by the midpoint of the IPO price range, DASH appears significantly overvalued with expectations for huge improvement in both market share and profit margins, two metrics that rarely improve simultaneously in competitive markets.

To justify a $29 billion valuation, DoorDash must:

- Immediately improve its NOPAT margin to 8% compared to -67% in 2019 and an estimated -12% over the trailing-twelve months

- 8% NOPAT margin is equal to United Parcel Service’s (UPS) 2019 and TTM NOPAT margin

- Grow revenue by 37% compounded annually for the next 11 years.

See the math behind this reverse DCF scenario. In this scenario, DoorDash would earn over $27 billion in revenue in 2030. At its TTM take rate, this scenario equates to ~$233 billion in marketplace gross order volume for DoorDash in 2030. Take rate measures the percentage of marketplace gross order volume (GOV) DoorDash captures as revenue.

For reference, UBS estimates the global food delivery market will be worth $365 billion in 2030, and the average NOPAT margin of peers in Figure 1 is -5%.

In other words, to justify the midpoint of its IPO price range, DoorDash must capture over 64% of the projected 2030 global food delivery spend, compared to ~16% TTM. See Figure 3.

Importantly and even more challenging, DoorDash must capture this market share while also improving margins from -12% to 8%, well above peers’ average.

To illustrate the difficulty in maintaining market share and high margins in an industry competing on price, look no further than GrubHub. In 2017, GrubHub held ~55% of the U.S. food delivery app market (excludes restaurants that deliver their own food) and earned a NOPAT margin of 10%. As competition flooded the market, GrubHub’s market share fell to 18% in October 2020, and its TTM NOPAT margin is -5%.

Given the high level of competition in the food delivery app market, we think it is highly unlikely, if not impossible, for DoorDash to achieve anything close to the market share growth and NOPAT margin improvements baked into its projected IPO valuation. Hence, we’re calling this IPO the “Most Ridiculous of 2020”.

Figure 3: Implied Marketplace GOV Grows From 5% to 64% of Food Delivery Market

Sources: New Constructs, LLC, company filings, and UBS

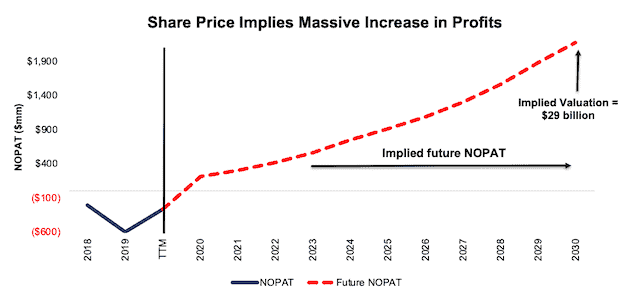

Figure 4 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT. In any scenario worse than this one, DASH holds significant downside risk, as we’ll show.

Figure 4: Current Valuation Implies Profits Reach 69% of FedEx’s TTM NOPAT

Sources: New Constructs, LLC and company filings.

Significant Downside Even if COVID-19 Permanently Changes How We Eat

Even if we assume that consumers increasingly choose food delivery as a means to eat restaurant food after COVID-19, and DoorDash’s revenue growth remains elevated for years to come, the stock holds significant downside from the midpoint of its IPO price range.

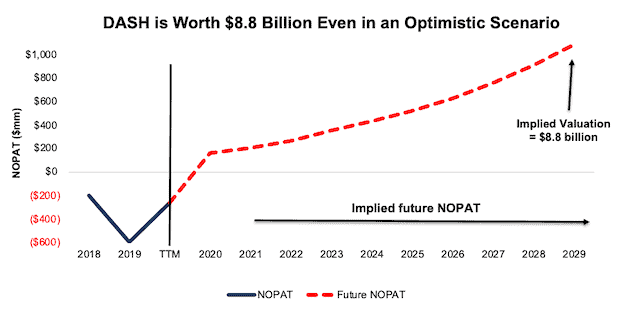

If we assume DoorDash can achieve a 6% NOPAT margin (average of United Parcel Service and FedEx’s TTM NOPAT margin) and grow revenue by 30% compounded annually for the next decade, the stock is worth just $8.8 billion today – a 70% downside to the midpoint of its IPO price range. See the math behind this reverse DCF scenario.

Figure 5 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 5: DoorDash Has Large Downside Risk: DCF Valuation Scenario

Sources: New Constructs, LLC and company filings.

Each of the above scenarios also assumes DoorDash is able to grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, DoorDash’s invested capital increased $813 million (92% of 2019 revenue) year-over-year in 2019.

Catalyst: Declining Revenue Growth

DoorDash and its bankers want to get this deal done as soon as possible – before the COVID-19-driven tailwinds subside. Demand for food delivery soared earlier this year, as in-restaurant dining was shut down across the country. As the largest food delivery service in the United States, DoorDash greatly benefited from this increased demand.

The firm’s revenue grew 172%, 214%, and 268% YoY in 1Q20, 2Q20, and 3Q20 respectively. What better time to IPO than when revenue is tripling YoY? However, such rapid revenue growth is expected to decline by the company’s own admission. Plus, the emergence of multiple highly-effective COVID-19 vaccines will likely bring food delivery back to levels where no one would consider trying to IPO a food-delivery company. The firm notes in its S-1:

“The circumstances that have accelerated the growth of our business stemming from the effects of the COVID-19 pandemic may not continue in the future, and we expect the growth rates in revenue, Total Orders, and Marketplace GOV to decline in future periods.”

Investors should not expect such breakneck revenue growth rates moving forward, especially if COVID-19 vaccine efforts produce meaningful vaccination in the coming months, which would allow consumers to once again return to a more normal dining routine.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper,"Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in DoorDash’s S-1:

Income Statement: we made $114 million of adjustments, with a net effect of removing $72 million in non-operating expenses (3% of revenue). You can see all the adjustments made to DoorDash’s income statement here.

Balance Sheet: we made $755 million of adjustments to calculate invested capital with a net decrease of $332 million. One of the most notable adjustments was $343 million related to midyear acquisitions. This adjustment represented 25% of reported net assets. You can see all the adjustments made to DoorDash’s balance sheet here.

Valuation: we made $2.9 billion of adjustments with a net effect of decreasing shareholder value by $2.9 billion. There were no adjustments that increased shareholder value. The most notable adjustment to shareholder value was $2.5 billion in outstanding employee stock options. This adjustment represents 9% of DoorDash’s valuation at the midpoint of its IPO price range. See all adjustments to DoorDash’s valuation here.

This article originally published on December 7, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

1 Response to "DoorDash’s New Valuation Is Even More Ridiculous"

Post the big jump in DASH post IPO, we present analysis on what such a high valuation implies.

The take away – the current value ~$180/share implies DoorDash owns over 120% of the global food delivery app market. Now – that is ridiculous.

DoorDash’s $200/share implies it will:

– Immediately improve its net operating profit after-tax (NOPAT) margin to 8% compared to -67% in 2019 and an estimated -12% over the trailing-twelve months – unchanged from prior valuation

– Grow revenue by 46% compounded annually for the next 11 years – up from 37% CAGR at $92.5/share and 35% at $80/share

– Grow its share of global food delivery app market to 138% from ~16% over the trailing twelve months (TTM) – up from 64% market share at $92.5/share and 56% at $80/share