Two new stocks make July’s Exec Comp Aligned with ROIC Model Portfolio, available to members as of July 14, 2023.

Recap from June Picks

Our Exec Comp Aligned with ROIC Model Portfolio (+5.6%) outperformed the S&P 500 (+0.8%) from June 15, 2023 through July 12, 2023. The best performing stock in the portfolio was up 19%. Overall, 13 out of the 15 Exec Comp Aligned with ROIC Stocks outperformed the S&P from June 15, 2023 through July 12, 2023.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

This Model Portfolio includes stocks that earn an Attractive or Very Attractive rating and align executive compensation with improving ROIC. This combination provides a unique list of long ideas as the primary driver of shareholder value creation is return on invested capital (ROIC).

New Stock Feature for July: AutoZone Inc. (AZO: $2,505/share)

AutoZone (AZO) is the featured stock in July’s Exec Comp Aligned with ROIC Model Portfolio. We originally made AutoZone a Long Idea in February 2014 and reiterated it in January 2022, and the stock remains undervalued.

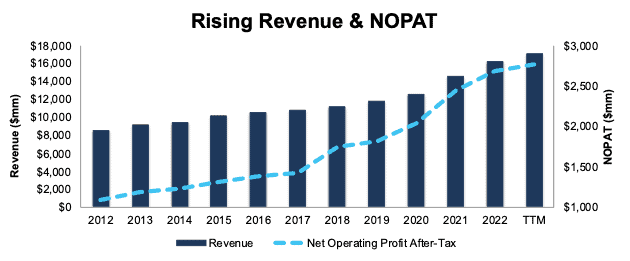

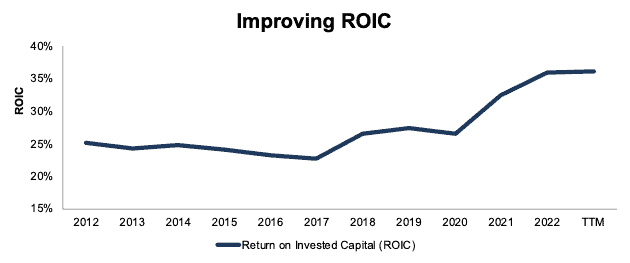

AutoZone has grown revenue and net operating profit after tax (NOPAT) by 7% and 10% compounded annually, respectively, since 2012. The company’s NOPAT margin improved from 13% in 2016 to 16% in the trailing twelve months (TTM), while invested capital turns rose from 1.8 to 2.2 over the same time. Rising NOPAT margins and invested capital turns drive the company’s return on invested capital (ROIC) from 23% in 2016 to 36% in the TTM.

Figure 1: AutoZone’s Revenue & NOPAT: 2012 – TTM

Sources: New Constructs, LLC and company filings

Executive Compensation Properly Aligns Incentives

AutoZone’s executive compensation plan aligns the interests of executives and shareholders by tying its annual incentive awards to economic profit, which, similar to our economic earnings, is driven by NOPAT and ROIC. According to AutoZone’s proxy statement, the company uses economic profit because it “ensures that growth, as well as the cost of growth, are balanced and achieved in a manner that maximizes the long-term interests of our shareholders.”

The company’s inclusion of economic profit, which is primarily driven by ROIC, as a performance goal has helped create shareholder value by driving higher ROIC and economic earnings. When we calculate ROIC using our superior fundamental data, we find that AutoZone’s ROIC has increased from 25% in 2012 to 36% in the TTM. Economic earnings rose from $963 million to $2.3 billion over the same time.

Figure 2: AutoZone’s ROIC: 2012 – TTM

Sources: New Constructs, LLC and company filings

AZO Has Further Upside

At the current price of $2,505/share, AZO has a price-to-economic book value (PEBV) ratio of 1.3. Though the company’s PEBV ratio is higher than other Long Ideas, we believe AutoZone’s competitive moat positions it for further growth and the stock still holds upside potential.

Even if AutoZone’s NOPAT margin falls to 14% (10-year average, compared to 16% in the TTM) and the company’s revenue grows 7% compounded annually over the next decade (equal to compound annual growth rate over past decade), the stock would be worth $3,016/share today – a 20% upside. See the math behind this reverse DCF scenario. In this scenario, AutoZone’s NOPAT grows 6% compounded annually through 2032.

For reference, AutoZone has grown NOPAT by 10% compounded annually since 2012. Should the company grow NOPAT more in line with historical growth rates, the stock has even more upside.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Below are specifics on the adjustments we made based on Robo-Analyst findings in AutoZone’s 10-Qs and 10-K:

Income Statement: we made $411 million in adjustments with a net effect of removing $253 million in non-operating expenses (1% of revenue). Clients can see all adjustments made to AutoZone’s income statement on the GAAP Reconciliation tab on the Ratings page on our website.

Balance Sheet: we made $1 billion in adjustments to calculate invested capital with a net increase of $332 million. One of the largest adjustments was $301 million (4% of reported net assets) in other comprehensive income. Clients can see all adjustments made to AutoZone’s balance sheet on the GAAP Reconciliation tab on the Ratings page on our website.

Valuation: we made $12.1 billion in adjustments, with a net effect of decreasing shareholder value by $12 billion. Apart from total debt, the most notable adjustment to shareholder value was $1.4 billion in value of outstanding ESO’s after tax. This adjustment represents 3% of AutoZone’s market value. Clients can see all adjustments to AutoZone’s valuation on the GAAP Reconciliation tab on the Ratings page on our website.

This article was originally published on July 20, 2023.

Disclosure: David Trainer, Kyle Guske II, Hakan Salt, and Italo Mendonça receive no compensation to write about any specific stock, style, or theme.

Questions on this report or others? Join our Society of Intelligent Investors and connect with us directly.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.