We published an update on this Long Idea on January 12, 2022. A copy of the associated Earnings Update report is here.

First movers are overrated. This established incumbent is making all the right moves to be a market leader as the automotive industry shifts focus to electric vehicles (EV). This week’s Long Idea is General Motors (GM: $53/share) which is a micro-bubble winner in the auto industry. We also compare it to the micro-bubble loser, Tesla (TSLA: $798/share), one of the Most Dangerous stocks for 2021.

Even after its share price soared ~92% over the past six months, General Motors’ stock remains undervalued just as its business enters the next phase of growth. GM presents quality risk/reward given:

- The firm enters the EV market with scale that first movers may not ever achieve

- Incumbent market share gains in Europe bode well for General Motors’ fast follower strategy

- Tesla's weaknesses are General Motors’ strengths

- Expectations for GM and TSLA remain disconnected from fundamentals.

Death of OEMs Is Exaggerated

We first featured General Motors as a Long Idea in March 2018 when we noted the EV market presented large opportunities for future growth. The prevailing narrative was, and remains, that the automobile industry is permanently disrupted, and traditional internal combustion engine (ICE) auto manufacturers will decline in concert with a long-term consumer demand shift toward EVs. Today, General Motors is leveraging its 100+ years of history of manufacturing expertise to build EVs and enter the market when there’s enough demand to justify the number of EVs it needs to sell to be profitable, an achievement that escapes the “first-movers” in EVs.

Global sales of EVs in 2020 surpassed 3 million vehicles, or ~46% of the total number of vehicles General Motors sold in 2020. For a large company like General Motors, or any of the incumbents, it doesn’t make financial sense to enter a niche market when there’s not enough demand to realize its manufacturing, marketing and distribution scale advantages. It’s better to wait and enter the market when it can exercise its scale advantages to generate superior profits.

Now, with the EV market more mature and demand driven by regulations around the world, BloombergNEF expects the market to grow to 26 million vehicles sold in 2030. For comparison, worldwide car sales in 2020 were 64 million. Now is the time for incumbents to enter the EV market with unrivalled scale.

General Motors Is Entering the Market With Scale

General Motors is investing billions to convert more plants to EV production and enter the EV market with scale that the first movers have yet to achieve.

Details: General Motors aims to eliminate tailpipe emissions from its light-duty vehicles by 2035. As part of that goal, the firm is committed to launching 30 new electric vehicles (compared to Tesla’s four models) by 2025 in addition to the Chevy Bolt, which is already in production. A few examples of planned launches are the 2022 Chevy Bolt Electric Utility Vehicle, the EV Hummer truck, and the Cadillac Lyriq. These models show the firm’s willingness to integrate EV technology into existing brands across three of its largest categories: trucks, SUVs, and crossovers.

General Motors manufacturing, marketing, and distribution scale advantages give it the ability to produce and sell a higher volume of cars with lower cost and higher quality, and, as a result, realize much higher profit margins than first movers.

Europe & China Are Leading Indicators

Bears argue that incumbents will die because they cannot produce ICE and electric vehicles at the same time. Volkswagen Group (VWAGY) has already proven that argument wrong.

In 2020, Volkswagen had the most popular ICE model in Europe, the Golf, and the most popular EV in Europe, the ID.3, while slightly expanding its overall market share.

Volkswagen shows what, at least, a fair number of incumbents are capable of. In 2018, the firm sold just 40 thousand EVs. In 2020, Volkswagen’s EV sales topped 212 thousand. Volkswagen now has 24% of the fully electric market across 27 EU countries while Tesla’s market share is just 13%.

A similar story is playing out in China with General Motors. General Motors’ joint venture in the country launched a new EV in July 2020, which sold 53% more units than the Tesla Model 3 in November 2020.

Tesla’s first-mover advantage is waning. Steep market share losses in Europe and China portend market share losses for Tesla across the world. Incumbent ICE manufacturers, such as General Motors and Volkswagen, have the necessary manufacturing scale to bring large numbers of high-quality EVs to market that they can sell at a profit.

Tesla’s Weaknesses Reveal General Motors’ Strengths

While General Motors’ EV technology may have lagged behind Tesla in the early stages, it is quickly catching up. Tesla’s preoccupation with adding more capital intensive manufacturing capacity means that General Motors can spend more time and capital on developing EV technology.

Tesla is having an increasingly difficult time trying to improve quality, it recently issued a recall of 135 thousand vehicles, or ~11% of the total number of vehicles it has produced since 4Q15, as it increases production.

On the other hand, General Motors’ strengths enable the firm to compete and succeed in a more mature EV market. Competitive advantages include:

- An existing cash generating business which:

- Helps funds $27 billion of EV and autonomous driving investment

- Allows the firm to invest in its own battery cell manufacturer, which gives “access to the cells and work on cost improvements and technology advancements”, as CEO Mary Barra noted.

- Existing production capacity – Can be efficiently converted to produce EVs at scale.

- Manufacturing expertise – Provide higher quality vehicles and use new technologies, such as Ultium Drive, the firm’s EV drivetrain system, to quickly scale manufacturing of all of its next generation EVs.

- EV technological advancement – Trusted by Honda to build two of its EV crossovers.

- Self-driving technology – Microsoft (MSFT) is collaborating with General Motors’ Cruise, behind which Tesla’s Autopilot ranks “a distant second”.

- Battery-technology – Ultium battery pack will offer 400 miles of range to help eliminate concerns over EV range restrictions.

- Quality – Top Automotive Corporation in J.D. Power’s 2020 Initial Quality Study.

These competitive advantages allow General Motors to produce quality EVs in large scale without the growing pains and stumbles along the way of a competitor such as Tesla.

General Motors’ Strong Cash Flows Versus Tesla’s Losses

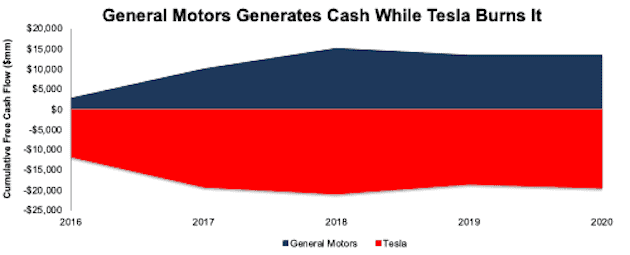

Given the competitive advantages above, it should come as no surprise that General Motors generates significant free cash flow (FCF) while Tesla destroys it. Over the past five years, General Motors generated a cumulative $13.3 billion in FCF (17% of market cap) and Tesla burned $19.5 billion (2% of market cap). See Figure 1.

Figure 1: General Motors vs. Tesla: Cumulative Free Cash Flow Since 2016

Sources: New Constructs, LLC and company filings.

Expectations for General Motors’ Production vs. Tesla’s

Given General Motors’ inherent advantages over Tesla, the expectations implied by General Motor’s stock price are extremely low, especially relative to those embedded in TSLA.

We use our reverse discounted cash flow (DCF) model to highlight the disconnect in the future revenue and profit growth expectations baked into General Motors’ and Tesla’s current stock prices.

To justify General Motors’ current price of $53/share, we assume:

- net operating profit after-tax (NOPAT) margin falls to 5.8% (equal to its five-year average and compared to 6.3% TTM) and

- revenue falls 5% compounded annually over the next decade. For reference, average consensus estimates expect General Motors’ revenue to grow 6.8% compounded annually from 2021 to 2023.

In this scenario, General Motors’ revenue ten years from now is $73.3 billion, or 40% below its 2020 revenue. See the math behind this reverse DCF scenario.

On the other hand, to justify its current price of ~$798/share, Tesla must:

- immediately achieve a NOPAT margin of 6.2% (equal to Toyota’s TTM margin and compared to 1.9% TTM) and

- grow revenue by 42% compounded annually over the next ten years. For reference, average consensus estimates expect Tesla’s revenue to grow 31% compounded annually from 2021 to 2025.

In this scenario, Tesla’s revenue ten years from now is $1 trillion, or greater than the combined TTM revenue of Amazon (AMZN), Apple (AAPL), Microsoft, and Facebook (FB), some of the largest firms in the world. See the math behind this reverse DCF scenario.

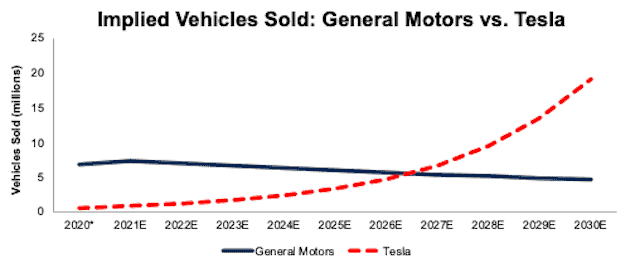

In 2020, General Motors sold ~6.8 million vehicles and generated $109 billion in automotive revenue[1], or ~$16 thousand per vehicle sold. Assuming General Motors generates the same amount of revenue per vehicle sold in 2030, the implied number of vehicles its sells in 2030 is 4.6 million.

In 2020, Tesla sold[2] ~500 thousand vehicles and generated $27.2 billion in automotive revenue[3], or ~$55 thousand per vehicle sold. Assuming Tesla generates the same amount of revenue per vehicle sold in 2030, the implied number of vehicles it sells in 2030 is 19.2 million or more than double Toyota’s 2020 production and over two-and-a-half times GM’s 2020 production.

Figure 2 compares the number of vehicles sold implied by General Motors’ and Tesla’s stock prices from 2020 to 2030.

Figure 2: Share Prices Imply Tesla Sells Over 4X the Vehicles of General Motors in 2030

Sources: New Constructs, LLC and company filings.

*Actual Vehicles Sold

Despite Recent Gains in GM, Market Expectations for Future Cash Flows Are Too Low

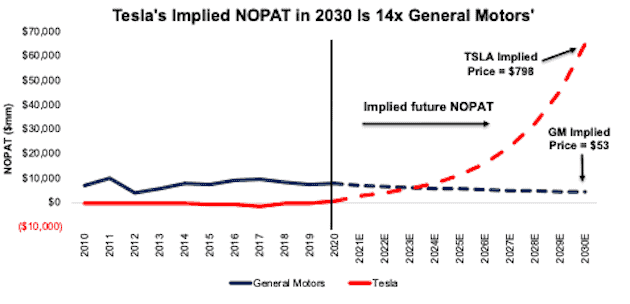

In the above scenario, General Motors’ NOPAT a decade from now is 45% below its 2020 NOPAT and just 10% higher than its lowest level since 2012.

On the other hand, Tesla’s share price in the above scenario implies huge NOPAT growth. The firm’s NOPAT in 2030 would be $65.2 billion compared to just $600 million in 2020. For reference, the combined TTM NOPAT of General Motors, Ford (F), Toyota Motors, Honda Motor Co (HMC), Mazda Motor Corp (MSDAY), Nissan Motor Co (NSANY), and Tata Motors (TTM) is just $25.3 billion, or 61% below Tesla’s implied NOPAT in 2030.

Figure 3 compares General Motors’ and Tesla’s historical NOPAT with the NOPAT implied by each firm’s respective stock price.

Figure 3: General Motors Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

This scenario (and the one above) also assume Tesla is able to grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Tesla’s invested capital increased an average of $3 billion year-over-year over the past five years.

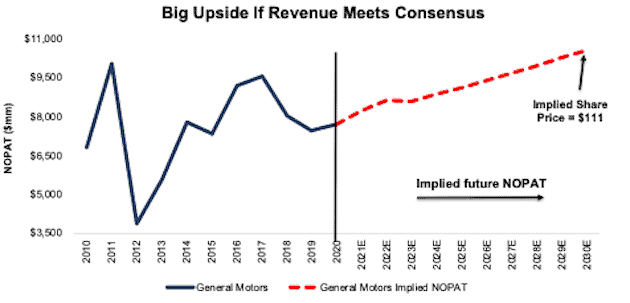

GM Has Significant Upside if Revenue Grows at Consensus Estimates

Given the disconnect in valuation between the two automakers, the upside potential in owning GM is much larger than TSLA. If we assume General Motors’:

- NOPAT margin falls to 5.8% (equal to its five-year average margin and compared to 6.3% TTM) and

- the firm grows revenue by 4% compounded annually for the next decade (which equals consensus average of 6.8% compounded annually from 2021-2023 and 3% compounded annually each year thereafter), then

The stock is worth $111/share today – a 109% upside to the current stock price. See the math behind this reverse DCF scenario. Figure 4 compares General Motors’ historical NOPAT with the implied NOPAT in this scenario.

Figure 4: General Motors: Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

General Motors’ Profitability Sits Atop Peers’

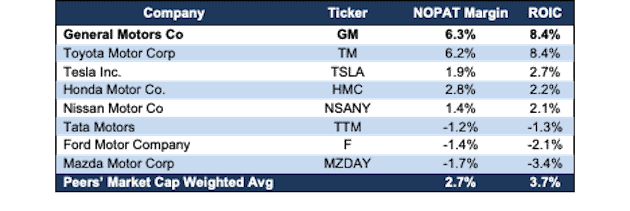

As noted above, more scale means more profits. General Motors’ scale and manufacturing efficiency helps drive the firm’s leading profitability. Its TTM NOPAT margin of 6.3% and return on invested capital (ROIC) of 8.4% is tops among its peers, Toyota, Tesla, Honda, Nissan, Tata Motors, Ford, and Mazda. On the other hand, Tesla’s ROIC of 2.7% is much lower and is below peers’ market-cap-weighted average ROIC of 3.7%, per Figure 5. As General Motors transitions to selling more EVs, we expect its scale advantage to continue to drive superior profitability.

Figure 5: General Motors vs. Peers: NOPAT Margin & ROIC

Sources: New Constructs, LLC and company filings.

General Motors’ Executive Compensation Plan Is Another Plus for Shareholders

Not only is General Motors more profitable and better positioned for long-term success in the EV market than Tesla, but its corporate governance is better, too. We prefer firms that tie executive compensation to improving ROIC, as there is a strong correlation between improving ROIC and increasing shareholder value.

General Motors rewards its managers with a long-term incentive plan that is comprised of 25% stock options and 75% PSUs. PSUs are tied to Relative ROIC-adjusted performance and total shareholder return. PSUs are capped if the firm fails to create economic earnings, by achieving an ROIC greater than its weighted-average cost of capital (WACC).

Tesla, on the other hand, which does not tie executive compensation to ROIC or economic earnings, and instead creates dangerous incentives.

The disconnect in corporate governance further reveals itself in the firm’s respective economic earnings. General Motors has generated a cumulative $15.2 billion (20% of market cap) in economic earnings over the past five years. while Tesla has generated a cumulative -$9.7 billion in economic earnings over the same time.

Keep These Winners & Sell These Losers

We originally paired General Motors and Tesla in our Micro-Bubble Winners report in August 2016. This pair isn’t the only micro-bubble winner and loser we’ve found. See Figure 6 for a list of all of our micro-bubble winners and losers. We believe the micro-bubble winners will outperform micro-bubble losers going forward, especially because the expectations implied by the micro-bubble winner’s valuations are much less than those of the micro-bubble losers.

Figure 6: Micro-Bubble Winners & Micro-Bubble Stocks

| Micro-Bubble Winners | Micro-Bubble Losers | Report Date |

| Kellogg Company (K) | Beyond Meat Inc. (BYND) | 2/16/21 |

| Hyatt Hotels Corp (H) | Airbnb, Inc. (ABNB) | 2/10/21 |

| Williams-Sonoma Inc. (WSM) | Wayfair, Inc. (W) | 2/3/21 |

| Sysco Corporation (SYY) | DoorDash, Inc. (DASH) | 1/27/21 |

| Alphabet, Inc. (GOOGL) | GoDaddy Inc (GDDY) | 9/26/18 |

| Microsoft Corporation (MSFT) | Dropbox Inc. (DBX) | 9/26/18 |

| General Motors Co (GM) | Tesla Inc (TSLA) | 8/16/18 |

| The Walt Disney Company (DIS) | Netflix Inc. (NFLX) | 8/16/18 |

| Oracle Corporation (ORCL) | Salesforce.com Inc. (CRM) | 8/16/18 |

| Walmart, Inc. (WMT) | Amazon.com Inc. (AMZN) | 8/16/18 |

Sources: New Constructs, LLC and company filings.

This article originally published on February 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] General Motor’s automotive revenue excludes revenue from GM Financial to measure only the revenue derived directly from automobile sales.

[2] Tesla reports vehicles delivered instead of vehicles sold. Throughout this report, we use vehicles sold in lieu of vehicles delivered.

[3] Tesla’s automotive revenue excludes revenue from its services and energy generation/storage segments to measure only the revenue derived from automobile sales.

2 replies to "This Auto Manufacturer Is Worth the Wait"

I noticed at FSLEX, a fairly well known and “attractive” one according to your own Newconstructs, has Tesla as its top holding. So what’s the deal here? And do you recommend a better alternative energy ETF/fund?

While Tesla is FSLEX’s largest holding, 56% of the fund’s assets are allocated to holdings that are ranked neutral-or-better. At the time of this report, only 36% of FSLEX’s funds were allocated to Unattractive-or-worse-rated stocks. The Tesla position is nearly half of that amount. We categorize FSLEX as an Industrial sector fund. PKB is an Industrial sector ETF that allocates 83% of its funds to neutral-or-better rated holdings and has lower Total Annual Costs compared to FSLEX. Thanks for your question.