Net Operating Profit Before-Tax (NOPBT) & NOPBT Margin

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Here’s proof from some of the most respected public & private institutions in the world.

Net operating profit before-tax (NOPBT) is the unlevered, before-tax operating cash generated by a business. It represents the true, normal and recurring before-tax profitability of a business. GAAP earnings or, even worse, non-GAAP earnings, are highly unreliable and are subject to misleading management manipulation.

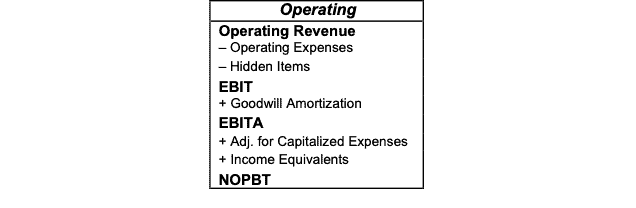

NOPBT is a very important value because it is the pre-tax version of net operating profit after-tax (NOPAT), which is the numerator in our return on invested capital (ROIC) calculation, Figure 1 provides the simplified formula for calculating NOPBT.

Figure 1: How to Calculate NOPBT – Simplified

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Figure 2 shows how we calculate NOPBT margin. NOPBT margin measures the amount of NOPBT generated from a firm’s total operating revenue and provides insights into the operating efficiency of a business.

Figure 2: How to Calculate NOPBT Margin

NOPBT / Total Operating Revenue = NOPBT Margin

Sources: New Constructs, LLC and company filings

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on importance of ROIC and how to calculate it.

Get our report "ROIC: The Paradigm For Linking Corporate Performance to Valuation."