We published an update on this Long Idea on February 23, 2022. A copy of the associated Earnings Update report is here.

Investors and analysts love to make dramatic pronouncements based on quarterly earnings reports. One quarterly earnings “miss” or decline in revenue can overshadow years of steady profit growth.

We first made this stock a Long Idea in November 2017, and it has outperformed the S&P 500 (up 13% vs. S&P up 8%) since then. However, the company’s revenue and GAAP earnings have been hit by currency headwinds and non-recurring expenses over the past year. CNBC recently declared the company “in turnaround mode.” Despite these short-term concerns, this company’s long-term profit growth remains strong. Kimberly-Clark (KMB: $128/share) is this week’s Long Idea.

Accounting Earnings Hide Profit Growth

When we made KMB a Long Idea in 2017, we focused on the company’s steady profit growth. KMB has grown after-tax operating profit (NOPAT) by 2% compounded annually over the past 15 years.

2% growth might not be exciting, but the reliability of the company’s cash flows makes it appealing. Even in the midst of a recession in 2008, KMB’s NOPAT declined by less than 5%. No matter the health of the economy, people always need tissues and diapers, and KMB makes money.

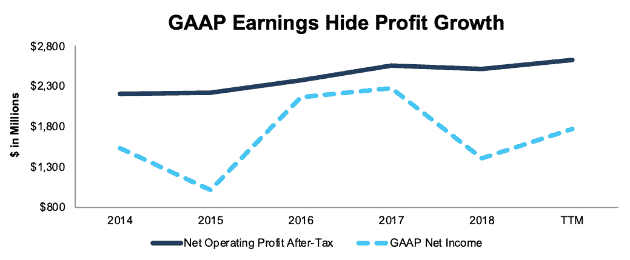

Investors who only look at accounting earnings might not appreciate the reliability of this company’s profits. As Figure 1 shows, GAAP net income has been volatile in recent years even as NOPAT has continued its steady upward trend.

Figure 1: KMB’s GAAP Net Income and NOPAT Since 2014

Sources: New Constructs, LLC and company filings

Four main items account for the disconnect between GAAP earnings and NOPAT in 2018:

- $735 million (4% of revenue) in one-time charges due to the company’s cost-saving program, mostly related to layoffs

- $238 million (1% of revenue) in write-downs

- $36 million in charges due to tax reform

- $15 million in increased LIFO reserves

All told, these unusual items led to a 38% decline in GAAP net income in 2018 even though NOPAT declined by just 2%.

Organic Sales Growth Looks Strong

As Figure 1 shows, GAAP earnings bounced back in Q1 2019, but investors are still concerned over the company’s 2% year-over-year (YoY) revenue decline. Cost cutting can only drive so much profit growth if revenues are shrinking.

However, a deeper dive into KMB’s 10-Q shows that the underlying trends in the company’s business still look good. Organic sales actually increased by 3%, driven largely by price increases. The revenue decline came entirely from a 5% foreign exchange headwind as currencies in Latin America depreciated against the dollar.

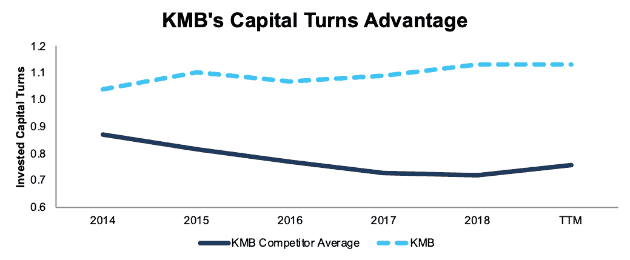

Longer-term, the company’s increasing invested capital turns (revenue/average invested capital) show that KMB is improving its asset efficiency. Figure 2 shows KMB has a significant and growing advantage over the peer group listed in its proxy statement when it comes to capital turns.

Figure 2: KMB’s IC Turns Vs. Peers Since 2014

Sources: New Constructs, LLC and company filings

Looking at capital turns over several years helps to strip out the noise and reveal KMB’s steady growth.

Executive Compensation Plan Is an Underappreciated Strength

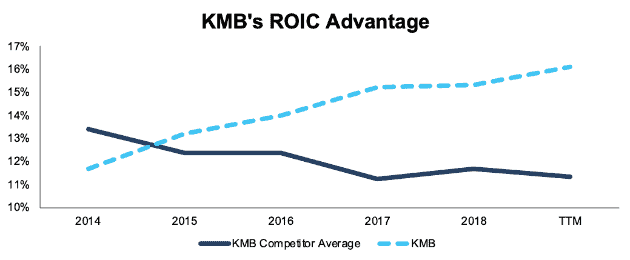

KMB’s improving capital turns is no coincidence. The company’s executive compensation plan aligns executives’ interests with shareholders’ interests by tying compensation to return on invested capital (ROIC). Apart from base salary and annual cash bonuses, KMB executives receive long-term equity compensation in the form of performance based restricted stock units. These awards are tied to the achievement of two goals, 3-year average return on invested capital and annual net sales growth, each weighted at 50%.

The focus on improving ROIC helps to ensure prudent stewardship of capital. KMB has averaged a 13% ROIC since 1998 and currently earns a 16% ROIC over the last twelve months. In addition, KMB has grown economic earnings 3% compounded annually over the last 15 years. The ability to grow economic earnings faster than NOPAT is not only rare, but also a direct result of KMB’s focus on improving ROIC and properly incentivizing executives to create shareholder value.

Figure 3 shows how KMB’s focus on ROIC has helped it surpass its peers in terms of profitability in recent years. KMB’s ROIC improved from 12% in 2014 to 16% TTM while its peer group average declined from 13% to 11%.

Figure 3: KMB’s ROIC Vs. Peers Since 2014

Sources: New Constructs, LLC and company filings

Capital Efficiency Makes KMB a Cash Cow Yielding 5%

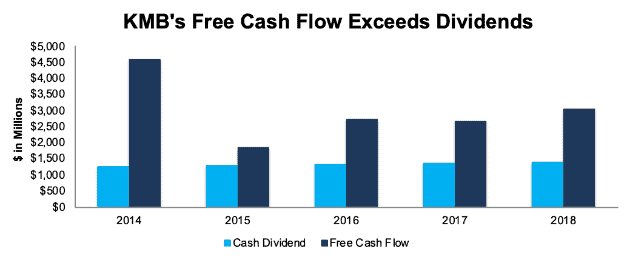

KMB’s rising ROIC means the company can grow profits while shrinking its invested capital, which frees up more capital to return to shareholders via dividend and buybacks. Over the past five years, KMB has generated nearly $15 billion (33% of market cap) in free cash flow.

KMB’s strong free cash flow allowed the company to increase its quarterly dividend from $0.84/share in 2014 to $1.03/share in 2019, a 4% compound annual growth rate. Longer-term, KMB has increased its dividend for 46 consecutive years, and the stock currently offers a dividend yield of 3.2%. Figure 4 shows that KMB generates more than enough free cash flow to keep growing its dividend for the foreseeable future.

Figure 4: KMB’s Dividend vs. Free Cash Flow Since 2014

Sources: New Constructs, LLC and company filings

In addition to dividends, KMB returns capital to shareholders via buybacks. In 2018, KMB bought back $800 million (2% of market cap) worth of shares, and the company is targeting a similar level of buyback activity in 2019. Combined, KMB’s dividend and buybacks give the company a reliable 5% yield.

Amazon’s Vendor Purge Could Benefit KMB

While investors shouldn’t expect high growth from KMB, the company has some incremental growth opportunities in the near-term. Most notable is e-commerce.

Bloomberg recently reported that Amazon (AMZN) will be cancelling bulk orders from thousands of small suppliers and focusing on bigger name brands in an effort to cut costs. This shift should advantage KMB’s major brands such as Kleenex, Huggies, and Kotex, which will no longer face as much competition from smaller competitors.

Currently, online sales account for ~10% of KMB’s revenue, so there’s significant opportunity for the company to grow revenue through this channel.

Bear Case: Amazon Basics Threat Is Overhyped

KMB’s e-commerce opportunity runs counter to the narrative that Amazon’s private label brands would kill margins and growth for consumer products companies.

While Amazon’s private label brands have quickly established a dominant market share in certain categories like batteries and cleaning supplies, they’ve struggled to gain as much traction in other categories. Over the past two years, Amazon has introduced private label diaper and tissue brands that compete with KMB, but so far these don’t appear to have had a noticeable impact on margins.

In addition, KMB actually manufactures some of Amazon’s brands, such as its Mama Bear diapers, so if these private labels do take market share, the company will still earn a cut of the profits. KMB earns lower margins on these products than it does on its own brands, but they at least offer some cushion.

Finally, KMB is proactively addressing any potential pricing pressure it might face by engaging in a global cost-cutting program. The company is cutting overhead, streamlining its supply chain, and exiting lower margin businesses in an effort to realize ~$1 billion in annual savings by the end of 2021. These steps, along with the continued strength of its well-established brands and superior capital efficiency compared to peers, position KMB to remain highly profitable in a competitive market.

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up. The technology that enables this research is featured by Harvard Business School.

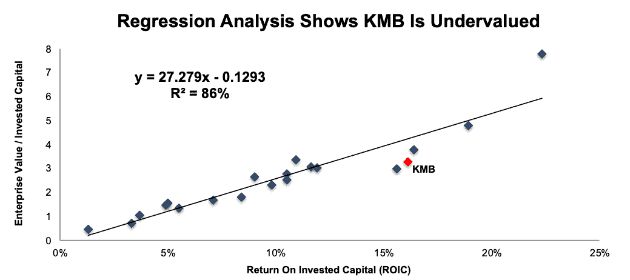

Per Figure 5, ROIC explains 86% of the difference in valuation for the 20 companies KMB lists as peers in its proxy statement. KMB’s stock trades at a discount to peers as shown by its position below the trend line.

Figure 5: ROIC Explains 86% Of Valuation for KMB Peers

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peers, it would be worth $178/share – 36% above the current stock price. KMB’s current stock price of $128/share implies that the company’s ROIC will decline to 12%. This expectation seems overly pessimistic for a company with a consistent track record of profit growth and superior capital allocation.

Traditional Metrics Miss KMB’s Value

KMB appears overvalued by traditional metrics. Due to its misleadingly low GAAP net income, KMB has a price to earnings (P/E) ratio of 25, which is above the Consumer Non-cyclicals sector average of 22. In addition, KMB has a negative accounting book value due to its history of returning capital to shareholders rather than engaging in overpriced acquisitions. These misleading metrics mean that KMB would not pass many traditional value screens, even though it is an excellent value stock.

At its current price of $128/share, KMB has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects no meaningful growth in KMB’s NOPAT over the remaining life of the firm. This expectation seems overly pessimistic for a firm that has grown NOPAT by 2% compounded annually over the past 15 years.

Our reverse DCF model quantifies the potential upside in this stock. If KMB can simply maintain 2018 NOPAT margins (14%) and grow NOPAT by just 2% compounded annually for the next 15 years, the stock is worth $156/share today – a 22% upside. See the math behind this dynamic DCF scenario.

We might hesitate to project a 15 year growth appreciation period (GAP) for most companies, but KMB’s long history (the company was founded in 1872) makes it a safe bet to remain profitable and growing for many years to come. After all, it’s not as if people will stop needing diapers and tissues anytime soon.

Sustainable Competitive Advantages That Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Kimberly Clark’s business will enable the company to generate higher profits than the current valuation of the stock implies. This list of competitive advantages helps KMB offer better products/services at a lower price and prevents competition from taking market share.

- Well established brands that literally define the category in some spaces (i.e. Kleenex)

- Superior capital efficiency compared to peers

- Streamlining the supply chain and SG&A that will enable the company to remain competitive on costs

What Noise Traders Miss with KMB

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus tends toward technical trading tends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing KMB:

- Understated earnings due to restructuring and other one-time expenses

- Superior corporate governance drives superior capital allocation

- Private label competition is less in KMB’s categories than in consumer staples market as a whole

- Traditional valuation metrics look expensive, but cash flow expectations in the stock are minimal

Catalyst: Cost-Cutting Initiatives Could Boost Shares

As noted at the beginning of this piece, KMB has outperformed the market since our original article. The stock is also up 13% year to date, so it appears that some investors are starting to recognize the value in this company.

As the company’s cost-cutting efforts begin to bear fruit over the next year, more investors should start to see the company’s superior cash flow. This will be especially true once the restructuring program ends and the company’s GAAP earnings improve, bringing its P/E back down to reflect how cheap the stock is.

Insider Trading and Short Interest Trends are Minimal

Insider activity has been minimal over the past 12 months, with 170 thousand shares purchased and 594 thousand shares sold for a net effect of 424 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 6.4 million shares sold short, which equates to 2% of shares outstanding and 4.3 days to cover. There doesn’t appear to be much appetite to bet against this stock.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in Kimberly-Clark’s 2018 10-K:

Income Statement: we made $1.8 billion of adjustments, with a net effect of removing $1.1 billion in non-operating expense (6% of revenue). We removed $370 million in non-operating income and $1.5 billion in non-operating expenses. You can see all the adjustments made to KMB’s income statement here.

Balance Sheet: we made $9.3 billion of adjustments to calculate invested capital with a net increase of $8.4 billion. The most notable adjustment was $3.3 billion in other comprehensive income (loss). This adjustment represented 41% of reported net assets. You can see all the adjustments made to KMB’s balance sheet here.

Valuation: we made $10.2 billion of adjustments with a net effect of decreasing shareholder value by $10.2 billion. You can see all the adjustments made to KMB’s valuation here.

Attractive Funds That Hold KMB

The following funds receive our Attractive-or-better rating and allocate significantly to Kimberly-Clark:

- Beutel Goodman Large-Cap Value Fund (BVALX) – 4.3% allocation and Very Attractive rating.

- Segall Bryant & Hamill Workplace Equality Fund (WEQIX) – 4.2% allocation and Attractive rating

- Matrix Advisors Dividend Fund (MADFX) – 4.1% allocation and Very Attractive rating

- SkyBridge Dividend Value Fund (SKYIX) – 3.8% allocation and Very Attractive rating.

This article originally published on May 29, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts