The COVID-19 pandemic and ensuing economic damage dropped 2020 Core Earnings[1] for the S&P 500 to the lowest level since December 2017, as we highlighted in S&P 500 Priced for Significant Earnings Rebound.

This report focuses on the Core Earnings of each S&P 500 sector to narrow in on where the most damage was done. In this report, the most recent Core Earnings and GAAP net income values are based on the latest audited financial data, which is the 2020 10-K for most companies.

Our measure of Core Earnings leverages cutting-edge technology[2] to enable clients to overcome errors, omissions, and biases in legacy fundamental datasets and apply more reliable fundamental data in their research. Investors armed with our measure of Core Earnings have a differentiated and more informed view of the fundamentals of companies and sectors.

Within the S&P 500, only the Technology, Consumer Non-cyclicals, Telecom Services, and Healthcare sectors saw a year-over-year (YoY) rise in Core Earnings in 2020. Given consumer habits during the pandemic, Core Earnings improvement in these sectors is intuitive, as the shift to work-from-home, pantry loading, and a V-shaped recovery in healthcare spending drove growth in these sectors more than others.

Ranking the Sectors by Core Earnings Growth

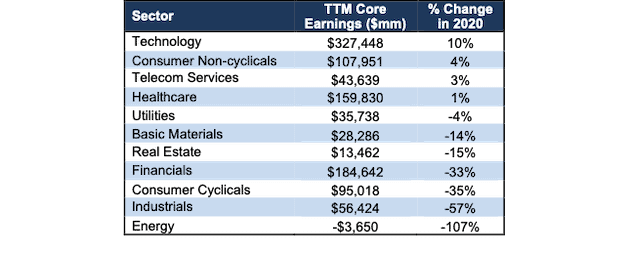

Figure 1 ranks all 11 S&P 500 sectors by the change in Core Earnings from 2019 to 2020[3].

Figure 1: 2020 Core Earnings vs. Last year by S&P 500 Sector

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents.

The Technology sector generates the most Core Earnings by far (nearly double the next closest sector) and grew Core Earnings by 10% YoY in 2020. On the flip side, the Energy sector has the lowest Core Earnings and the largest drop in 2020. Even though oil prices have recently begun to climb, the COVID-19 shutdowns across the globe hit the energy sector hardest over the past year.

Details on the S&P 500 Sectors

Figures 2-12 compare the Core Earnings and GAAP net income trends for every S&P 500 sector since 2004.

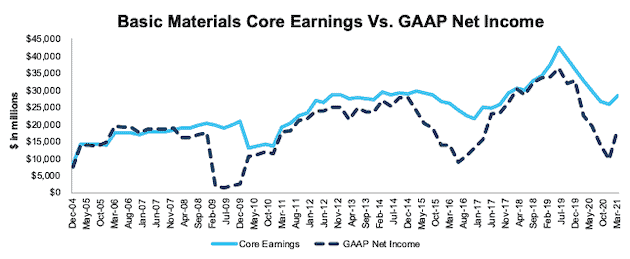

Basic Materials

Figure 2 shows Core Earnings for the Basic Materials sector peaked in mid 2019 and ended 2020 33% below the peak. Asset write-downs, which occurred at record levels through the first half of 2020, help explain the large disconnect between Core Earnings and GAAP net income.

Dupont De Nemours (DD), LyondellBasell Industries (LYB), and WestRock Company (WRK) combined for write-downs of $5.2 billion TTM, which equals 18% of the Basic Materials sector’s TTM Core Earnings.

Figure 2: Basic Materials Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

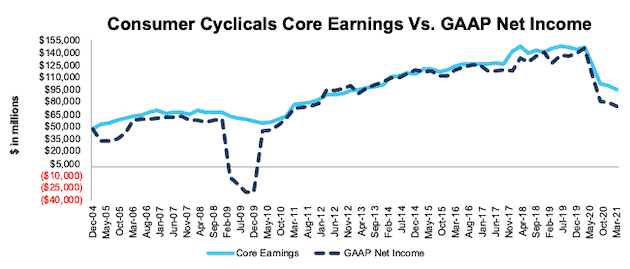

Consumer Cyclicals

Figure 3 shows that the COVID-19 pandemic impacted the Consumer Cyclicals sector differently than during the Financial Crisis, when Core Earnings were largely unchanged. Global shutdowns and depressed leisure spending caused Core Earnings to fall 35% YoY in 2020. Despite the bad results for the sector, we highlight many Consumer Cyclicals stocks that present excellent fundamental risk/reward in our “See Through the Dip” Long Ideas.

Figure 3: Consumer Cyclicals Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

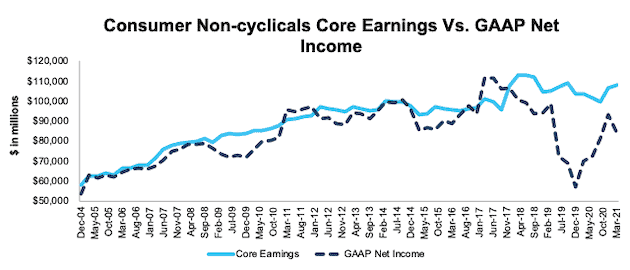

Consumer Non-Cyclicals

Figure 4 shows Core Earnings for the Consumer Non-Cyclicals sector have been relatively stable over time and rose 4% YoY in 2020. However, investors looking at GAAP net income would see a much different picture. The drastic drop in GAAP net income is partially a result of Kraft Heinz’s (KHC) ~$16 billion write-down in early 2019. Our Core Earnings remove such unusual charges, so investors get more accurate, and less volatile, views of profits.

Figure 4: Consumer Non-Cyclicals Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

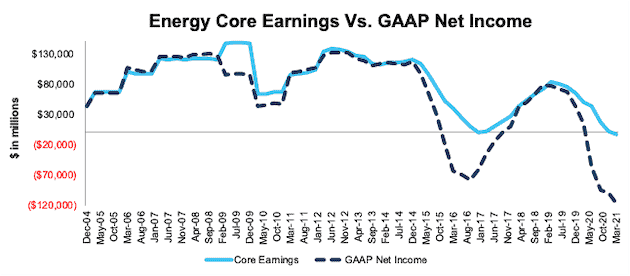

Energy

Figure 5 shows Core Earnings for the Energy sector fell 107% YoY in 2020 to levels last seen at the end of 2016. Four companies combined, Exxon Mobil (XOM), Baker Hughes (BKR), Occidental Petroleum (OXY), and Marathon Petroleum (MPC) reported over $52 billion in asset write-downs over the TTM, which explains the even larger drop in GAAP net income relative to Core Earnings.

Figure 5: Energy Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

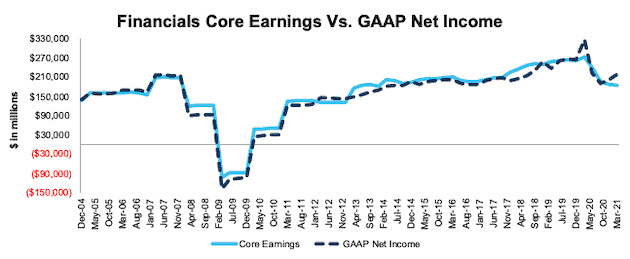

Financials

Figure 6 shows Core Earnings for the Financials sector, while down 33% YoY in 2020, have held up much better than during the Financial Crisis. The key difference between the two periods, as we pointed out in our Long Idea on JPMorgan Chase (JPM), is that many banks were the source of the problems that caused the Financial Crisis. On the other hand, in 2020, Financial firms played a key role in the recovery.

Figure 6: Financials Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

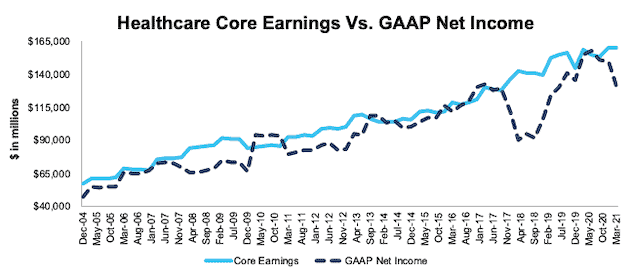

Healthcare

Figure 7 shows Core Earnings for the Healthcare sector have consistently increased since 2004 and rose <1% YoY in 2020. The consistent rise in demand for healthcare, after the initial drop in elective procedures during the onset of the COVID-19 pandemic, helps drive continued Core Earnings growth.

Figure 7: Healthcare Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

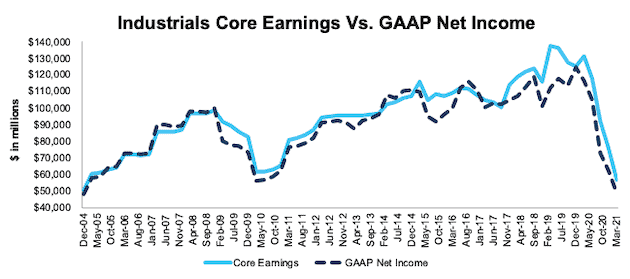

Industrials

Figure 8 shows the Industrials sector is another sector particularly impacted by COVID-19, as Core Earnings fell 57% YoY in 2020. Not surprisingly, the Industrials sector, which is most exposed to the drastic drop in airline travel and reduced capex across the globe, bore much of the brunt of the global shutdowns.

Figure 8: Industrials Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

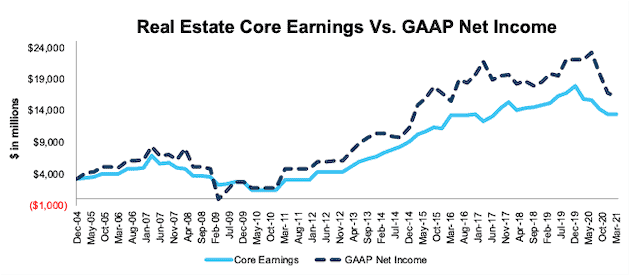

Real Estate

Figure 9 shows that after many years of consistent growth, Core Earnings for the Real Estate sector fell 15% YoY in 2020. Doomsday expectations for many REITs left some of the best operators significantly undervalued, which led us to feature Simon Property Group (SPG) as a Long Idea in mid-April and again in February 2021.

Figure 9: Real Estate Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

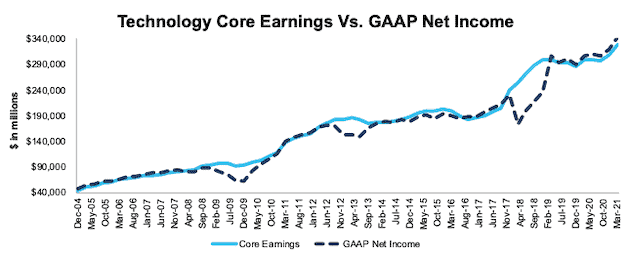

Technology

Figure 10 shows that not only did the Technology sector’s Core Earnings rise 10% YoY in 2020, but they have also consistently risen since December 2004. However, this earnings power remains unevenly distributed. Over the TTM, five of the 74 Technology companies, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Facebook (FB), and Intel Corporation (INTC) account for 59% of the sector’s total Core Earnings.

Figure 10: Technology Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

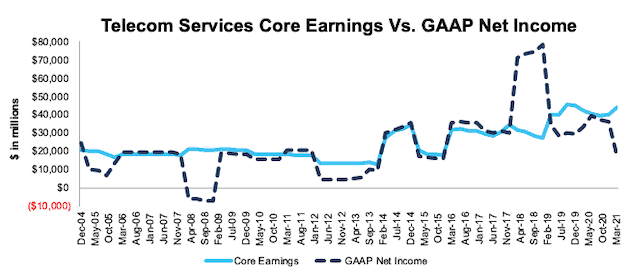

Telecom Services

Figure 11 shows Core Earnings for the Telecom Services sector rebounded in 4Q20 and rose 3% YoY in 2020 while GAAP net income fell 47% over the same time. This disconnect is driven largely by AT&T (T)’s $15.5 billion write-down of assets and goodwill related to its video business. In total, AT&T’s asset write-downs equaled 35% of the sector’s Core Earnings in 2020.

The significant jump in GAAP net income in 2018 comes from the Tax Cuts and Jobs Act. At the time, we identified Verizon (VZ) and AT&T (T) as the biggest winners of tax reform, and in 2017, they recorded nearly $25 billion in combined income tax benefits. Note how our Core Earnings adjusts for the anomalous, one-time tax effects.

Figure 11: Telecom Services Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

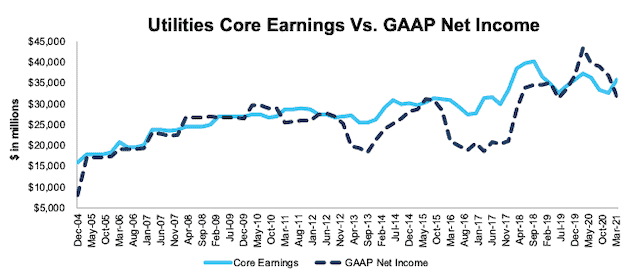

Utilities

Figure 12 shows the Utilities sector seldom sees big year-over-year changes in Core Earnings, but in 2020, Core Earnings for the Utilities sector fell 4% YoY.

Figure 12: Utilities Core Earnings Vs. GAAP: 2004 – 2020

Sources: New Constructs, LLC and company filings.

Our Core Earnings analysis is based on aggregated TTM data for the sector constituents in each measurement period.

The March 23, 2021 measurement period incorporates the financial data from 2020 10-Ks, as this is the earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.

This article originally published on April 14, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix: Calculation Methodology

We derive the Core Earnings and GAAP Net Income metrics above by summing the Trailing Twelve Month individual S&P 500 constituent values for Core Earnings and GAAP Net Income in each sector for each measurement period. We call this approach the “Aggregate” methodology.

The Aggregate methodology provides a straightforward look at the entire sector, regardless of market cap or index weighting and matches how S&P Global (SPGI) calculates metrics for the S&P 500.

[1] Only Core Earnings enable investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics written by professors at Harvard Business School (HBS) & MIT Sloan.

[2] Three independent studies prove the superiority of our data, models, and ratings. Learn more here.

[3] March 23, 2021 is earliest date for which all the 2020 10-Ks for the S&P 500 constituents were available.