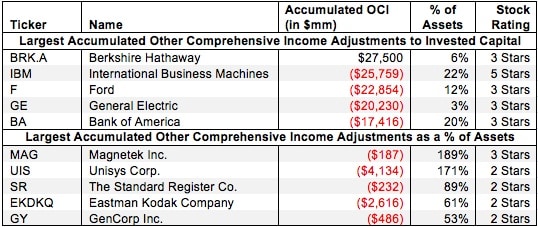

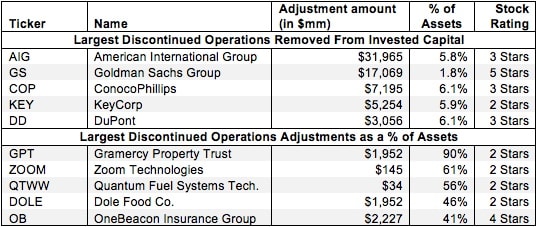

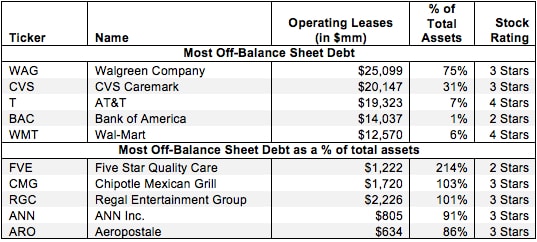

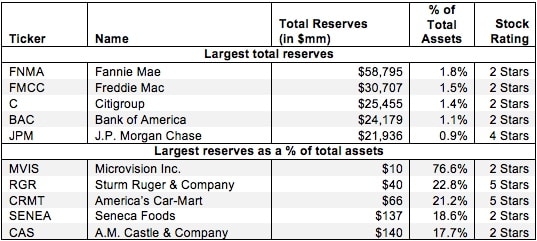

GAAP Opinion versus Economic Fact

GAAP financial statements generally fail to meet equity investors' analytical needs. We try to calculate something that does.

David Trainer, Founder & CEO