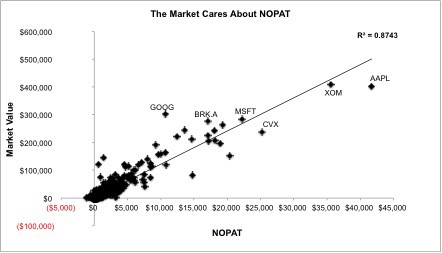

The Market Values High ROIC Companies

Last month, Fortune released its list of the top 50 businesspeople of the year. The recognition these CEO’s are receiving shows that the market cares about ROIC, even if many investors aren’t explicitly talking about it.

Sam McBride