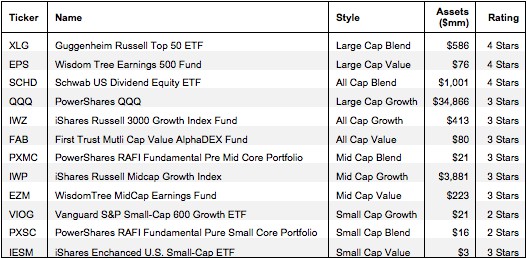

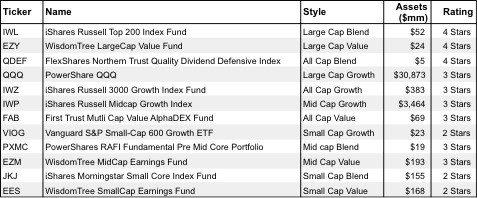

Steady Income in a Volatile Market

Our forward-looking research found an ETF filled with companies that generate steady cash flows and have undervalued stock prices.

Matt Shuler, Investment Analyst II