We closed ORCL on April 20, 2023. A copy of the associated Position Close report is here.

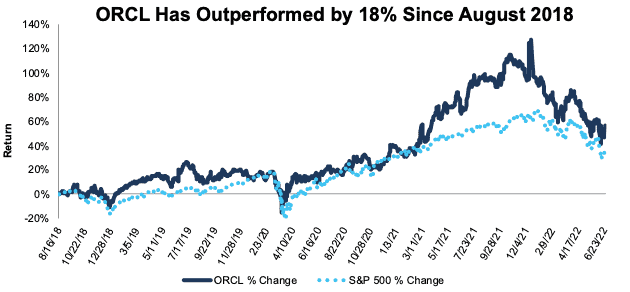

We first made Oracle (ORCL: $69/share) a Long Idea in August 2018 and reiterated it in July 2019. Since August 2018, the stock is up 46% compared to a 37% gain for the S&P 500. Looking ahead, the stock still offers investors favorable risk/reward. As we’ll show, the stock could be worth at least $95/share today – a 38%+ upside. Our last report (January 2020) on Oracle is here.

This report leverages our cutting-edge Robo-Analyst technology to deliver proven-superior[1] fundamental research and support more cost-effective fulfillment of the fiduciary duty of care.

Oracle’s Stock Has Strong Long-term Upside Based on the Company’s:

- strong, global sales team

- extensive product and service offerings

- high switching costs for customers

- competitively priced offerings

Figure 1: Long Idea Performance: From Date of Publication Through 6/27/2022

Sources: New Constructs, LLC

What’s Working

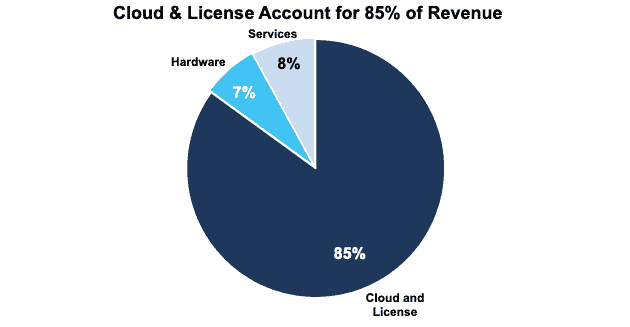

Cloud and License Segment Leads the Way: Oracle’s total revenue in fiscal 4Q22 was up 5% year-over-year (YoY), while its cloud and license business rose 6% YoY.

Over a longer timeframe revenue from the cloud and license segment, the company’s fastest-growing line of business, has increased from $29.0 billion in fiscal 2016 to $36.1 billion in fiscal 2022, or 6% compounded annually. Oracle has oriented its business for continued growth, as its largest segment is also its fastest growing segment. Per Figure 2, Oracle’s cloud and license segment generated 85% of the company’s total revenue in fiscal 2022.

Figure 2: Oracle’s Revenue Mix: Fiscal 2022

Sources: New Constructs, LLC and company filings

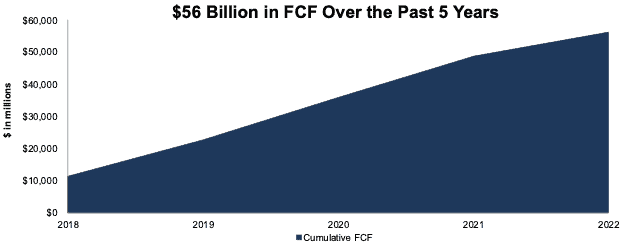

Strong Free Cash Flow with Competitive Offerings: Rather than offering off-the-shelf products, Oracle leverages its global sales force to offer business solutions in the form of customized combinations of products and services tailored to the needs of a specific client.

Oracle generates significant free cash flow (FCF) with its customer-centered approach. Oracle has generated positive FCF in each of the past five years and 13 of the past 14 years. Over the past five years, Oracle generated $56.1 billion (31% of market cap) in FCF, per Figure 3.

Figure 3: Oracle’s Cumulative Free Cash Flow Since Fiscal 2018

Sources: New Constructs, LLC and company filings

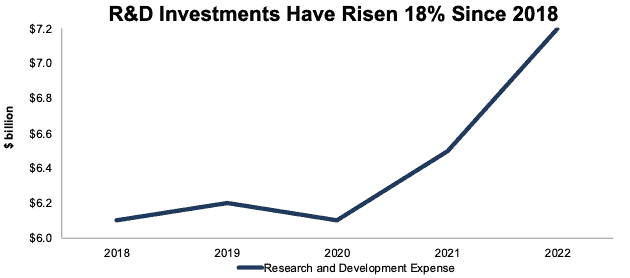

Strong FCF Funds R&D Growth: Oracle develops its own products in house, which requires the company to dedicate 31% of its full-time employees to research and development (R&D). Large R&D investment enables the company to enhance current products and develop new technologies, which is critical for Oracle to grow its business and maintain its competitive position.

Oracle’s FCF-generating business equips the company with plenty of cash to grow its R&D expense. The company’s R&D expense rose from $6.1 billion in fiscal 2018 to $7.2 billion in fiscal 2022, per Figure 4. Over the past five years, Oracle spent a cumulative $32.1 billion on R&D.

Figure 4: Oracle’s Research & Development Expense: Fiscal 2018 – 2022

Sources: New Constructs, LLC and company filings

Healthcare Is an Opportunity: The COVID-19 pandemic accelerated long-term trends in healthcare towards increased digital transformation and cloud-based computing. Oracle is actively working on creating a complete suite of applications for health care providers. If Oracle is as successful building and implementing cloud solutions for healthcare as it has been for businesses, the upside to revenue could last for decades.

GAAP Earnings Are Understated: Oracle is more profitable than investors realize, and it currently earns our Strong Beat Earnings Distortion Score, which means the company is more likely to beat its next earnings estimates. While Oracle’s GAAP earnings fell from $13.7 billion in fiscal 2021 to $6.7 billion in fiscal 2022, the company’s fiscal 2022 Core Earnings, which measure the normalized operating profits of the business, at $11.3 billion are much higher.

What’s Not Working

Oracle Faces Fierce Competition: Oracle competes against big tech giants such as Google (GOOGL), Microsoft (MFST), and Amazon (AMZN). Though other companies may be larger than Oracle on a market cap or revenue basis, Oracle’s focus and specialization provide a distinct competitive advantage. At $10.8 billion, the company earns the third highest economic earnings amongst its competitors over the trailing twelve months (TTM) [2]. Oracle’s TTM economic earnings are nearly 7x times greater than enterprise resource planning (ERP) rival SAP SE’s (SAP).

Oracle’s products and services are core components of their customers’ operations. This deep integration with customers means a switch away from Oracle comes with a potentially high cost of disruption to a customer’s operations. That creates a serious barrier to entry for competitors, especially in mission-critical sectors such as government and healthcare.

Currency Headwinds: Oracle generates 52% of its revenue internationally, which exposes the company to fluctuations in currency exchange rates. As economies around the world have struggled with pandemic-related shutdowns and supply-chain problems, the U.S. dollar has strengthened. USD to EUR has risen from 0.84 a year ago to 0.94 today, while the USD to JPY has risen from 110.82 to 135.43 over the same time.

Should global economies continue to struggle, Oracle’s international revenues could suffer a drag from exchange rate losses and worsening bargaining position against for competitors. Further dollar strength could impact the company’s overall revenue growth in fiscal 2023.

Stock Is Priced for Profit Decline

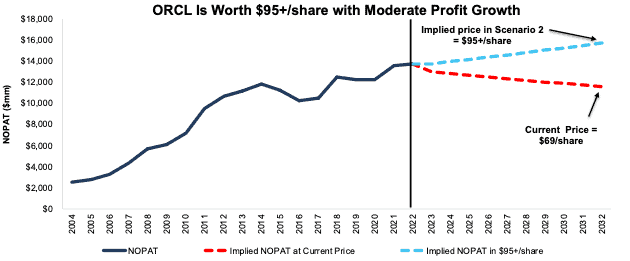

Oracle’s stock offers investors a business with consistent cash flows, a strong competitive position, and long-term growth opportunities at a steep discount. Oracle’s price-to-economic book value (PEBV) ratio is just 0.8, which means the market expects its profits to permanently fall 20% below TTM levels. Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Oracle.

In the first scenario, we quantify the expectations baked into the current price. We assume:

- net operating profit after tax (NOPAT) margin falls to its five-year low of 31% (vs. 32% in fiscal 2022) from fiscal 2023 – 2032 and

- revenue falls 1% (vs. fiscal 2023 – 2025 consensus estimate CAGR of 10%) compounded annually from fiscal 2023 to 2032.

In this scenario, Oracle’s NOPAT falls 2% compounded annually through fiscal 2032, and the stock would be worth $70/share today – nearly equal to the current price.

Shares Could Reach $95+

If we assume Oracle’s:

- NOPAT margin falls to its five-year average of 32% from fiscal 2023 – 2032,

- revenue grows at a 2% CAGR from fiscal 2023 – 2032, then

the stock would be worth at least $95/share today – 38% above the current price. In this scenario, Oracle grows NOPAT by 1% compounded annually over the next 10 years. For reference, Oracle has grown NOPAT by 3% compounded annually over the past five years and 6% compounded over the past ten years. Should Oracle’s NOPAT growth improve to historical levels, the stock has even more upside.

Figure 5: Oracle’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

This article originally published on June 29, 2022.

David Trainer, Kyle Guske II, Matt Shuler, and Brian Pellegrini receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

[2] Competitors include Google, Microsoft, Intel (INTC), Amazon, Cisco Systems (CSCO), Adobe (ADBE), SAP SE, International Business Machines (IBM), Workday (WDAY), Hewlett Packard Enterprise (HPE), and Salesforce (CRM).