We closed the KEYS position on September 24, 2024. A copy of the associated Position Close report is here.

We closed the UAA position on May 13, 2022. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

After a tumultuous end to 2018, the market (S&P 500) has rebounded nicely, rising over 17% since its late December lows. However, the volatility and entrance into bear market territory has many arguing that stocks remain overvalued.

Our message to investors remains the same: there are pockets of both undervalued stocks and overvalued – or Micro-Bubble – stocks. In order to avoid these high risk bubbles, investors need to look beyond the widely-available and misleading accounting results (noise) on which most people focus. Investors need to “get back to the basics” of reading footnotes and focusing on economic earnings and return on invested capital (ROIC), the true drivers of valuation.

To that end, we leveraged Robo-Analyst[1] technology to scour the S&P 500 to find companies with deteriorating cash flows, low returns on invested capital (ROIC), and overvalued stock prices. Under Armour (UAA: $22/share) and Keysight Technologies (KEYS: $79/share) are in the Danger Zone.

Using ROIC to Identify Risk

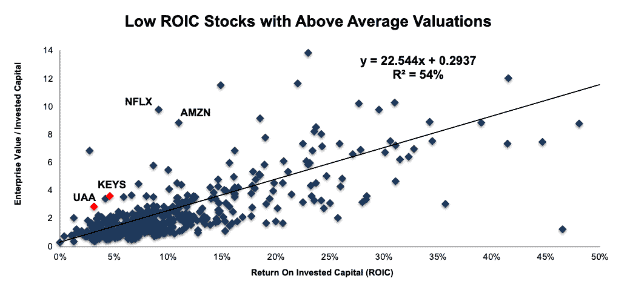

We’ve long argued (and proven empirically) that there is a strong correlation between ROIC and shareholder value. Figure 1 shows that differences in ROIC explain 54% of the differences in enterprise value divided by invested capital (a cleaner version of price-to-book) for the S&P 500. It highlights two stocks trading well above their fair value based on ROIC. It also highlights Netflix (NFLX) and Amazon (AMZN), both of which we’ve covered in the past, as two of the most overvalued stocks in the S&P 500.

Figure 1: Three Overvalued S&P 500 Stocks

Sources: New Constructs, LLC and company filings.

UAA and KEYS are not only overvalued relative to the S&P 500, but they also share a few other traits, such as:

- ROIC in a downward trend

- Negative or declining economic earnings

- An Unattractive or Very Unattractive rating

Under Armour (UAA)

We first noted that Under Armour provided poor risk/reward in June 2016 in an interview on CNBC. Since then, the stock is down 42% while the S&P 500 is up over 31%. Despite the underperformance, UAA once again looks overvalued, especially given the 24% year-to-date (YTD) rise while the firm’s fundamentals have worsened.

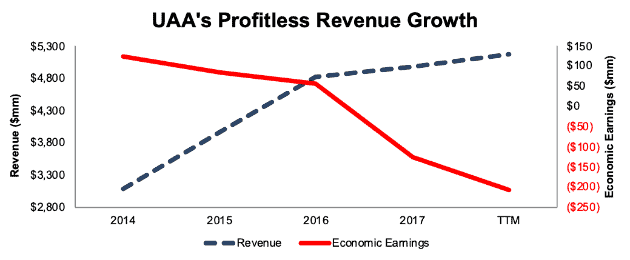

Deteriorating Fundamentals: From 2014-2017, Under Armour grew revenue an impressive 17% compounded annually. However, trailing twelve months (TTM), revenue is up just 5% over the prior period. In addition to this slowing growth, economic earnings, the true cash flows of the business, have fallen from $123 million in 2014 to -$208 million TTM, per Figure 2.

Figure 2: UAA’s Revenue & Economic Earnings Since 2014

Sources: New Constructs, LLC and company filings.

UAA’s profitability has fallen due to margin contraction and poor capital allocation. NOPAT margins have declined from 7% in 2014 to 3% TTM. Average invested capital turns, a measure of balance sheet efficiency, have fallen from 2.3 in 2014 to 1.2 TTM. Invested capital has more than doubled since 2014, largely due to long-term debt and off-balance sheet operating leases more than tripling. Meanwhile, after-tax operating profit (NOPAT) has almost halved since 2014.

Falling margins, inefficient capital use, and lack of NOPAT growth have driven UAA’s ROIC from a once impressive 17% in 2014 to a bottom-quintile 3% TTM.

Making matters worse, Under Armour appears to be losing market share, not only from the industry leading Nike (NKE), but also from smaller brands such as Puma and New Balance. In mid 2018, Wedbush estimated that Puma had surpassed Under Armour as the third largest athletic brand (by sales). More recently, UAA reported that North American sales, which represent nearly three fourths of total sales, fell 2% in 2018. Meanwhile, Nike saw its North American sales rise 3% over the prior TTM period.

Overvalued Shares: Given the issues above, one would expect UAA to have significantly underperformed the market instead of rising 24% YTD (S&P up 9%) and 23% over the past year (S&P up 1%). This rise in UAA has left shares significantly overvalued when assessing the cash flow expectations baked into the stock price.

To justify its current price of $22/share, UAA must achieve NOPAT margins equal to Nike (11% vs 3% TTM) and grow NOPAT by 20% compounded annually for the next 11 years. See the math behind this dynamic DCF scenario. Such an optimistic expectation seems unlikely for a firm that has failed to improve margins or profits in recent years.

Even if UAA more than doubles it NOPAT margin to 7% (average of last decade) and grows NOPAT by 15% compounded annually for the next decade, the stock is worth just $11/share today – a 50% downside. See the math behind this dynamic DCF scenario.

If UAA traded at the level implied by the trend line in Figure 1, it would be worth $5/share today, 78% below its current price.

Keysight Technologies (KEYS)

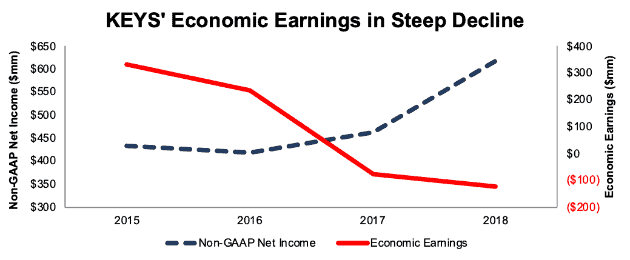

Keysight Technologies, a provider of electronic testing equipment and software, has seen its stock soar recently. KEYS is up 27% YTD (S&P +9%) and up 74% over the past year (S&P +1%). This price appreciation has come on the back of impressive non-GAAP profit growth. We’ve warned in the past about the dangers of non-GAAP earnings. When we remove accounting loopholes, we see that KEYS’ fundamentals are actually in decline, which leaves its stock significantly overvalued.

Deteriorating Fundamentals: Since 2015, Keysight Technologies’ non-GAAP net income has grown an impressive 13% compounded annually. In 2018, KEYS removed net $453 million in expenses from GAAP net income to calculate its non-GAAP net income. Expenses removed included $709 million (over 4x GAAP net income) in goodwill impairment and $59 million (36% of GAAP net income) in share-based compensation expense.

While non-GAAP portrays rising profits, economic earnings have fallen from $331 million in 2015 to -$124 million in 2018, per Figure 3.

Figure 3: KEY’s Non-GAAP Net Income Masks True Losses

Sources: New Constructs, LLC and company filings.

KEYS’ profitability remains depressed since its overpriced acquisition of Ixia in 2017. For a purchase price of $1.6 billion, KEYS acquired just $13 million in NOPAT, which means the deal earned a <1% ROIC. Any deal that does not earn an ROIC greater than a firm’s weighted average cost of capital (6% for KEYS in 2017) can be considered a destruction of shareholder value.

In addition to poor capital allocation, margin contraction has also weighed on KEYS’ profitability. NOPAT margins have declined from 16% in 2014 to 6% in 2018, thereby causing NOPAT to fall by 55% since 2014.

Falling margins and poor use of capital have driven KEYS’ ROIC from 28% in 2014 to a bottom-quintile 5% in 2018.

Overvalued Shares: Companies can only hide behind misleading non-GAAP income growth for so long. As volatility returns to the market, and stocks stop moving straight up or down in lockstep, fundamentals matter more. Unfortunately, KEYS’ fundamentals simply cannot justify the expectations baked into the stock price.

To justify its current price of $79/share, KEYS must achieve 11% NOPAT margins (average since 2014 vs. 6% in 2018) and grow NOPAT by 15% compounded annually for the next 15 years. See the math behind this dynamic DCF scenario. In this scenario, KEYS would be generating over $16 billion in revenue. For reference, KEYS management estimates the total addressable market for their products is worth ~$15.5 billion. Essentially, to even justify the expectations baked into the current stock price, KEYS must control >100% of its current addressable market.

Even if KEYS more than doubles it NOPAT margin to 11% and grows NOPAT by 13% compounded annually for the next decade, the stock is worth just $40/share today – a 49% downside. See the math behind this dynamic DCF scenario.

If KEYS traded at the level implied by the trend line in Figure 1, it would be worth $25/share today, 68% below its current price.

This article originally published on February 19, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.