We closed HSY on April 27, 2023. A copy of the associated Position Close report is here.

We published an update on PKG on February 1, 2023. A copy of the associated Earnings Update report is here.

We published an update on MTH on November 2, 2022. A copy of the associated Earnings Update report is here.

After 2Q21 earnings, long-term tailwinds give these three Long Ideas excellent opportunities to grow profits. This week’s Long Ideas are Meritage Homes Corp (MTH: $111/share), The Hershey Company (HSY: $180/share), and Packaging Corporation of America (PKG: $140/share).

We leverage more reliable fundamental data, proven in The Journal of Financial Economics[1], with qualitative research to highlight these firms whose stocks present excellent risk/reward.

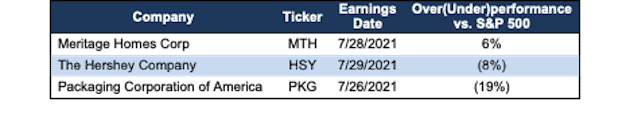

Figure 1: Long Idea Performance: From Date of Publication Through 8/3/2021

Sources: New Constructs, LLC

Performance measured from the date of publication of first Long Idea report for each stock. Dates can be seen in each company section below. Performance represents price performance and is not adjusted for dividends.

Meritage Homes Has 73%+ Upside

We made Meritage Homes a Long Idea in June 2020 as part of our “See Through the Dip” thesis. Since then, the stock has outperformed the S&P 500 by 6% and still has more upside.

What’s Working: The firm’s 2Q21 gross margin of 27% was the highest in company history. Even as the availability of lots ready for home construction continues to fall, Meritage Homes expanded its community count from 203 at the end of 1Q21 to 226 at the end of 2Q21. In 2Q21, the firm increased its total lots controlled from 43 thousand to 63 thousand, or 48% year-over-year (YoY).

The firm continues to focus on entry-level housing. 81% of the firm’s total orders in 2Q21 were company-defined entry-level homes, which is up from 70% in 2Q20. Meritage Homes typically aims to keep the average sales price (ASP) of entry-level homes within Federal Housing Administration (FHA) mortgage limits which vary by county and can range from $356 thousand to $822 thousand across the U.S. The focus on the lower end of the market has been prudent for the firm. According to the Census Bureau, ~73% of homes sold in 1H21 were priced between $200-$500 thousand. The firm’s ASP on homes closed in 1H21 was $380 thousand.

The COVID-19 pandemic accelerated the migration of people from urban centers to the suburbs, which contributes to long-term demand for entry-level housing. As the firm continues to shift its business to serve this segment of the market, demand for its homes is likely to remain strong over the medium term.

We also expect the influx of institutional investors buying single-family homes to continue driving growth in the housing market.

What’s Not Working: Meritage Homes is struggling to meet elevated comps from 2020 as the number of home orders fell by 2% YoY in 2Q21. However, the firm’s ASP on orders is up 18% YoY in 2Q21, which drove a 16% YoY increase in home order value.

The monthly supply of houses, a ratio of houses for sale to houses sold rose from 3.8 months of supply in December 2020 to 6.3 in June 2021. While the current monthly supply ratio is in line with the historic average since 1963, should the supply of houses continue to rise, Meritage could have a more difficult time selling its inventory without a drop in prices.

Despite Recent Gains, MTH Is Still Priced for Permanent Profit Decline: Meritage Homes’ price-to-economic book value (PEBV) ratio is 0.4. This ratio implies that the market expects Meritage Homes’ profits will permanently decline by 60%.

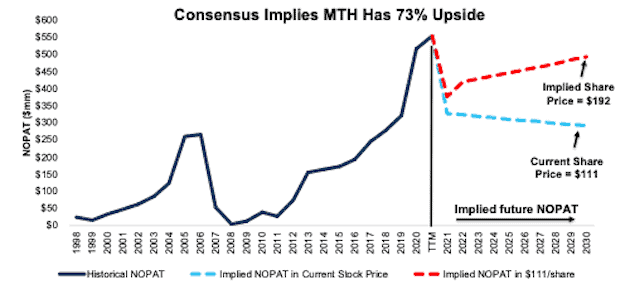

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for Meritage Homes.

In the first scenario, we assume Meritage Homes’:

- net operating profit after-tax (NOPAT) margin falls to 7.4% (ten-year average vs. 13% TTM) from 2021 through 2030, and

- revenue grows at a <1% CAGR from 2021 to 2030 (vs. consensus CAGR of 17% for 2021-2022)

In this scenario, Meritage Homes’ NOPAT falls by 6% compounded annually over the next decade and the stock is worth $111/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Meritage Homes grew NOPAT by 25% compounded annually over the past five years.

Shares Could Reach $192 or Higher: If we assume Meritage Homes’:

- NOPAT margin falls to 7.5%, (average from 2015-2019 vs 13% TTM) from 2021 through 2030, and

- revenue grows at a 12% CAGR through 2022 (below consensus CAGR of 17% for 2021-2022), and

- revenue grows 2% a year from 2023 - 2030, which is below the average annual global GDP growth rate of 3.5% since 1961, then

the stock is worth $192/share today – 73% above the current price. See the math behind this reverse DCF scenario. In this scenario, Meritage Homes NOPAT falls <1% compounded annually over the next decade. For reference, Meritage Homes grew NOPAT by 15% compounded annually since 2000.

Should Meritage Homes grow profits closer to historical levels, the upside in the stock is even greater.

Figure 2: Meritage Homes’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

The Hershey Company Has 37%+ Upside

We made The Hershey Company a Long Idea in August 2020, which was featured in Barron’s. Though the stock has underperformed the S&P 500 since, we believe it still provides attractive risk/reward.

What’s Working: The firm’s sales in 2Q21 grew 17% YoY, and in light of its strong revenue performance in the quarter, the firm increased its sales growth outlook for 2021 from 4%-6% to 6%-8%.

While the pandemic elevated at-home consumption of its products, the firm saw a decline in away-from-home consumption as people traveled less and frequented convenience stores less often. However, 2Q21 shows that The Hershey Company is sustaining its elevated at-home consumption sales while also recovering from previously declining away-from-home consumption sales.

In addition to a recovery in its North America away-from-home consumption, the firm saw international sales grow 70% YoY improvement in the quarter. The firm’s international segment generated only 10% of total sales in 2Q21, but it is a growth driver.

Longer-term, The Hershey Company’s large distribution network enables it to launch innovative products quickly and efficiently in an ever-changing snacking market. The Hershey Company’s acquisition of Lily’s in 2Q21 will help the company expand its growing “better-for-you” portfolio, which is focused on meeting the rising demand for healthier snacking options. Unlike Scharffen Berger, Dagoba, and Krave, which the company divested in 2020, Lily’s is a much larger operation that The Hershey Company can further scale with its leading marketing, manufacturing, and distribution network.

Long-term tailwinds of increased snack food consumption and global candy demand provide the firm with opportunity for continued profit growth. For instance, Mordor Intelligence expects the global candy industry to grow by 4% compounded annually through 2026.

What’s Not Working: The Hershey Company reported its share of the U.S. candy, mint, and gum (CMG) market fell 105 basis points in the quarter as the firm was unable to sustain all the market share gains from 2020. However, over the last two years, the firm gained 135 basis points of CMG market share.

While much of the firm’s product lines continue to see revenue growth, elevated baking sales in 2020 do not appear sustainable. The firm’s baking sales fell nearly 18% YoY in 2Q21 as people spent less time at home.

Rising ingredient costs will likely continue to pressure the firm’s gross margin, which declined 50 basis points YoY in 2Q21. While the firm increased prices in its confectionary segment in 1H21 to alleviate its rising costs, consumers will only eat price increases for so long before The Hershey Company risks losing market share, profits, or both.

HSY Is Still Priced for Permanent Profit Decline: The Hershey Company’s price-to-economic book value (PEBV) ratio is 0.8. This ratio implies that the market expects The Hershey Company’s profits will permanently decline by 20%.

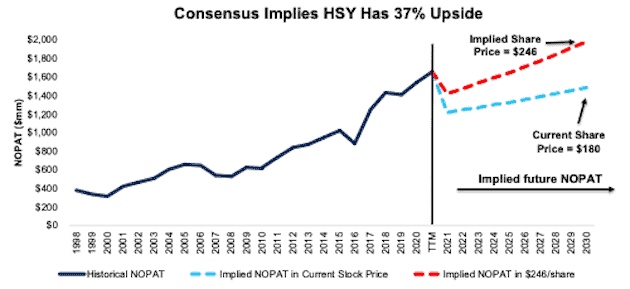

Below, we use our reverse discounted cash flow (DCF) model to analyze the expectations for future growth in cash flows baked into a couple of stock price scenarios for The Hershey Company.

In the first scenario, we assume The Hershey Company’s:

- NOPAT margin falls to 15% (ten-year average vs. 19% TTM) from 2021 through 2030, and

- revenue grows at a 2% CAGR from 2021 to 2030 (vs. consensus CAGR of 4% for 2021-2023)

In this scenario, The Hershey Company’s NOPAT falls by <1% compounded annually over the next decade and the stock is worth $180/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, The Hershey Company grew NOPAT by 9% compounded annually over the past decade.

Shares Could Reach $246 or Higher: If we assume The Hershey Company’s:

- NOPAT margin falls to 17%, (five-year average vs 19% TTM) from 2021 through 2030, and

- revenue grows at a 4% CAGR through 2023 (same as consensus), and

- revenue grows 4% a year from 2024 - 2030 (equal to 10-year average CAGR), then

the stock is worth $246/share today – 37% above the current price. See the math behind this reverse DCF scenario. In this scenario, The Hershey Company grows NOPAT by 3% compounded annually over the next decade. For reference, The Hershey Company grew NOPAT by 8% compounded annually over the past two decades.

Should The Hershey Company grow profits closer to historical levels, the upside in the stock is even greater.

Figure 3: The Hershey Company’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Packaging Corporation of America Looks Undervalued With 35%+ Upside

We made Packaging Corporation of America a Long Idea in March 2019. Though the stock has underperformed the S&P 500 since that report, we continue to see upside for this stock.

What’s Working: Packaging Corporation of America’s net sales improved 27% YoY in 2Q21 and are 7% above 2Q19’s pre-pandemic levels. An all-time company record for total box shipments in 2Q21 drove the firm’s strong sales performance in the quarter.

Demand for packaging and paper should remain strong in the second half of 2021 as the firm’s bookings and billings for 3Q21 are 7% higher YoY.

Longer term, the firm is well positioned to grow revenue and profits as it meets the packaging needs from the growth in packaged snacks and ecommerce, which accelerated in 2020. Industry research firm, eMarketer, projects a nearly 18% YoY increase in U.S. ecommerce in 2021. Longer-term, eMarketer expects ecommerce sales to account for 24% of total sales in 2025 compared to just 11% in 2019.

While Packaging Corporation of America competes with larger revenue-generating peers, International Paper (IP) and WestRock (WRK), on a national level, 70% of the firm’s corrugated product sales are to regional and local accounts. This focus on regional accounts enables the firm to better compete against even smaller regional producers and deliver best-in-class profitability. Even after falling from 13% in 2019 to 11% over the TTM, the firm’s return on invested capital (ROIC) remains far superior to International Paper and WestRock’s 3% ROIC over the same time.

What’s Not Working: School and office closures throughout the pandemic negatively impacted Packaging Corporation of America’s paper segment, as 2Q21 revenue from this segment is 40% below 2Q19 levels. However, long before the pandemic, the firm steadily reduced its exposure to paper. The paper segment accounted for just 8% of the firm’s total revenue in 2Q21, down from 21% in 2014.

The firm is experiencing rising costs and, to offset, is implementing price increases in both its Packaging and Paper segments. A poorly executed/received price increase could force some of its customers to source their packaging and paper needs elsewhere.

Complicating the challenge of rising inflation, the firm faces logistical difficulties with a lack of availability of certain materials and chemicals, a tight transportation market, and a tight labor market in 2Q21.

Priced for No Profit Growth: Packaging Corporation of America’s PEBV ratio of 1.0 means the market does not expect Packaging Corporation of America’s profits to grow from current levels over the life of the firm. This expectation seems overly pessimistic for a firm that has grown NOPAT by 11% compounded annually over the past decade.

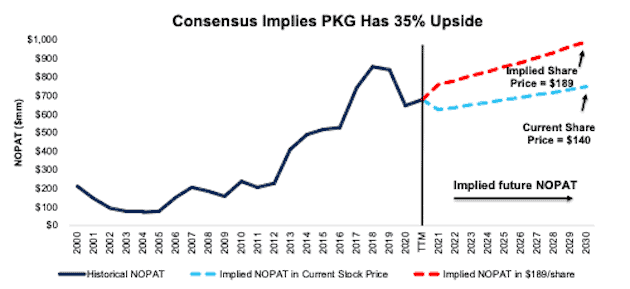

Below, we use our reverse DCF model to quantify the expectations for future growth in cash flows baked into a couple different stock price scenarios for Packaging Corporation of America.

In the first scenario, we assume Packaging Corporation of America’s:

- NOPAT margin falls to 9% (five-year low, compared to 10% TTM) from 2021 through 2030 and

- revenue grows at a 2% CAGR from 2021-2030 (vs. consensus estimate CAGR of +8% through 2022)

In this scenario, Packaging Corporation of America’s NOPAT grows by just 2% compounded annually over the next decade and the stock is worth $140/share today – equal to the current price. See the math behind this reverse DCF scenario. For reference, Packaging Corporation of America grew NOPAT by 11% compounded annually in the five years before COVID-19 and 11% compounded annually over the past decade.

$189/Share If Consensus Is Right, and we assume Packaging Corporation of America:

- maintains TTM NOPAT margin of 10% (vs. five-year average of 11%) from 2021 through 2030 and

- grows revenue at an 8% CAGR through 2022 (equal to consensus estimates) and

- venue grows 3% a year from 2023-2030, which is below the average annual global GDP growth rate of 3.5% since 1961, then

the stock is worth $189/share today, or 35% above the current price. See the math behind this reverse DCF scenario. In this scenario, Packaging Corporation of America’s NOPAT grows by 4% compounded annually over the next decade. Should Packaging Corporation of America’s NOPAT grow in line with historical growth rates, the stock has even more upside.

Figure 4: Packaging Corporation of America’s Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings

Other Long Ideas That Recently Reported

Figure 5 shows other Long Ideas that have recently reported calendar 2Q21 earnings along with their relative performance.

Figure 5: More Long Ideas That Recently Reported Earnings: Through 8/3/2021

| Company | Ticker | Earnings Date | Out (under)performance vs. S&P 500* |

| MasTec Inc. | MTZ | 7/29/21 | 104% |

| Simon Property Group, Inc. | SPG | 8/2/21 | 84% |

| Cummins Inc. | CMI | 8/3/21 | (4%) |

| McDonald's Corporation | MCD | 7/28/21 | (22%) |

| Amgen Inc. | AMGN | 8/3/21 | (34%) |

| Colgate-Palmolive Company | CL | 7/30/21 | (42%) |

Sources: New Constructs, LLC

Performance measured from the date of publication of first Long Idea report for each stock. Performance represents price performance and is not adjusted for dividends.

This article originally published on August 4, 2021.

Disclosure: David Trainer owns SPG. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, proven by professors at Harvard Business School & MIT Sloan.