We recently featured a fund with holdings that don’t align with its stated stock-picking methodology. These findings are based on our analysis of fund holdings, which drive our overall mutual fund ratings.

This week we feature a fund that successfully executes a superior stock-picking methodology: Fidelity SAI U.S. Quality Index (FUQIX) is this week’s Long Idea.

These findings are based on our diligence[1] on each fund’s holdings.

Backwards Looking Research Underrates this Fund

Investors that rely solely on past performance may overlook this quality mutual fund. Per Figure 1, FUQIX earns a 3-Star rating from Morningstar. As we know, past performance does not predict future results. Research from Morningstar itself shows there’s almost no difference in the long-term returns of 3-star vs. 5-star funds.

Instead of looking at past performance, we analyze funds based on their holdings. When viewed through our Predictive Risk/Reward Fund Rating methodology, FUQIX earns a Very Attractive rating.

Figure 1: Fidelity SAI U.S. Quality Index Fund Ratings

Sources: New Constructs, LLC, company filings, and Morningstar

FUQIX allocates significant capital to companies with high profitability and low (relative to the benchmark) profit growth expectations baked into their stock prices – something traditional fund research can’t tell you.

Holdings Research Reveals Superior Stock-Picking Methodology

Fidelity SAI U.S. Quality Index Fund managers use an investment strategy that quantifies the attractiveness of stocks based on a “quality score.” The “quality score” is based on ten variables, two of which are:

Getting ROIC right is hard. Without making dozens of adjustments to remove non-core and non-recurring items, one gets a flawed measure of ROIC[2].

Professors from HBS and MIT Sloan show in Core Earnings: New Data & Evidence that our research does a much better job of identifying unusual items than does “Special Items” from Compustat or “Street Adjustments” from IBES. This paper compares our research on a mega cap company to Bloomberg and Capital IQ (SPGI) in a detailed appendix.

Through our holdings analysis, we know this fund’s investment strategy helps management pick higher quality stocks and avoid riskier stocks compared to its style benchmark, the iShares Russell 1000 Growth ETF (IWF).

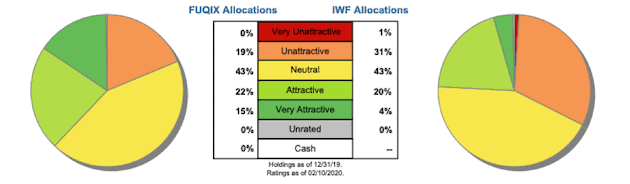

Figure 2 shows that FUQIX allocates a significantly higher percentage of its assets to Attractive-or-better rated stocks and a significantly lower percentage to Unattractive-or-worse rated stocks than its style benchmark.

Figure 2: FUQIX Allocates Capital to Superior Holdings

Sources: New Constructs, LLC and company filings

Per Figure 2, FUQIX allocates 37% of its assets to Attractive-or-better rated stocks compared to just 24% for IWF. On the flip side, FUQIX allocates 19% of its assets to Unattractive rated stocks (and 0% to Very Unattractive stocks) compared to 32% for IWF.

Given this favorable allocation relative to the benchmark, FUQIX appears well-positioned to capture more upside with lower risk. Compared to the average mutual fund, FUQIX has a much better chance of generating the outperformance required to justify its fees.

Superior Stock Selection Drives Superior Risk/Reward

By including ROIC and free cash flow in its stock-picking methodology, we would expect FUQIX’s managers to find higher-quality companies (as measured by ROIC) with lower-risk valuation.

We leverage our superior dataset, instead of the 40-year-old databases of flawed data, to find that FUQIX does allocate to stocks with significantly higher ROICs than the benchmark and overall market (S&P 500). Our research also finds that FUQIX’s holdings have lower expectations for future profit growth too.

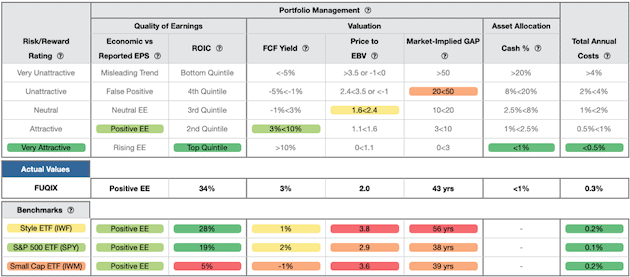

Figure 3 contains our detailed rating for FUQIX, which includes each of the criteria we use to rate all funds under coverage. These criteria are the same for our Stock Rating Methodology, because the performance of a fund’s holdings equals the performance of a fund after fees.

Figure 3: Fidelity SAI U.S. Quality Index Fund (FUQIX) Rating Breakdown

Sources: New Constructs, LLC and company filings

As Figure 3 shows, FUQIX’s holdings are superior to IWF in four of the five criteria (and equal in the other criterion) that make up our holdings analysis:

- FUQIX’s return on invested capital (ROIC) is 34%, which is greater than the 28% earned by IWF and 19% by the S&P 500 (SPY).

- FUQIX’s free cash flow yield of 3% is triple that of IWF (1%) and greater than SPY at 2%.

- The price to economic book value (PEBV) ratio for FUQIX is 2.0, which is less than the 3.6 for IWF holdings and the 2.9 of SPY holdings.

- Our discounted cash flow analysis reveals an average market implied growth appreciation period (GAP) of just 43 years for FUQIX’s holdings compared to 56 years for IWF.

In other words, the stocks held by FUQIX generate superior cash flows and have lower valuations compared to IWF. The market expectations for stocks held by FUQIX imply profit growth (measured by PEBV ratio) that is nearly half the profit growth expectations embedded in IWF’s holdings. Higher historical profits and lower expectations for future profits are an attractive combination.

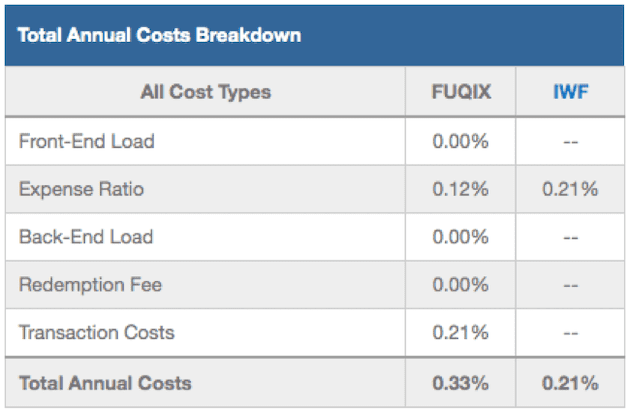

Below Average Costs Benefit Investors

Not only does Fidelity SAI U.S. Quality Index Fund offer high-quality stock selection, it does so at a reasonable price. Its total annual costs (TAC), at 0.33%, are below 97% of funds in our coverage universe. Furthermore, FUQIX’s TAC are well below the Large Cap Growth mutual fund average of 1.57% and asset-weighted average of 1.24%. Most importantly, its TAC are nearly in line with its benchmark, IWF, at 0.21%. Figure 4 shows our breakdown of FUQIX’s total annual costs, which is available for all of the 7,000+ mutual funds under coverage.

Figure 4: Fidelity SAI U.S. Quality Index Fund Total Annual Costs Breakdown

Sources: New Constructs, LLC and company filings

Deep Dive on a Quality Holding

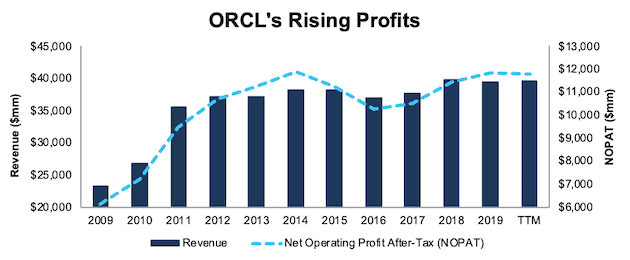

Oracle Corporation (ORCL: $55/share) is one of FUQIX’s many quality holdings. We first made ORCL a Long Idea in August 2018, and while the stock has slightly underperformed the market (+15% vs. S&P 500 +19%), it remains highly profitable and undervalued.

Per Figure 5, ORCL has grown revenue by 5% compounded annually, and after-tax profit (NOPAT) by 7% compounded annually over the past decade. NOPAT over the trailing twelve month (TTM) period is up 4% over the prior TTM period. ORCL currently earns a top-quintile ROIC of 20% and has generated $35.5 billion (20% of market cap) in free cash flow over the past five years.

Figure 5: ORCL’s Revenue & Profit Growth Over Past Decade

Sources: New Constructs, LLC and company filings

At its current price of $55/share, ORCL has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects ORCL’s NOPAT to never grow from current levels. This expectation seems overly pessimistic for a firm that has grown NOPAT by 7% over the past decade and 12% over the past two decades.

If ORCL can maintain fiscal 2019 NOPAT margins of 30% and grow NOPAT by just 3% compounded annually for the next decade, the stock is worth $68/share today – a 24% upside. See the math behind this reverse DCF scenario.

FUQIX’s Methodology Isn’t Perfect

With just 19% of assets allocated to stocks with an Unattractive-or-worse rating, and an overall ROIC of 34%, it’s difficult, but not impossible, to find a low-quality holding, such as Intuitive Surgical Inc. (ISRG: $585/share).

We featured ISRG in our December 2019 article, “Two Stocks That Should Miss Earnings Expectations.” The stock is down 1% (S&P 500 +5%) since our article. While the stock didn’t miss estimates this past quarter, we recently parsed its 2019 10-K which revealed its earnings distortion increased year-over-year. Rising earnings distortion means reported earnings are even more overstated, thereby increasing the likelihood ISRG will miss expectations moving forward.

In 2019, ISRG had over $223 million in net earnings distortion that caused earnings to be overstated. The largest unusual gain stemmed from $128 million in interest and other income generated by higher interest rates and higher cash and investment balances. In other words, 9% of ISRG’s reported GAAP net income was due to rising interest rates, not the actual operations of the business.

In addition, we made a $96 million adjustment for income tax distortion. This adjustment normalizes reported income taxes and removes the impact of unusual or less persistent items on the taxes applied to core earnings.

In total, we identified $1.87/share (16% of reported EPS) in net unusual income in ISRG’s 2019 GAAP results. After removing this earnings distortion from GAAP net income, we see that ISRG’s 2019 core earnings of $9.68/share are significantly lower than GAAP EPS of $11.54.

Expensive Valuation Adds to Risk of Owning ISRG

With a P/E ratio of 51, it’s clear, even by traditional metrics, that ISRG is overvalued. The Healthcare sector has an average P/E ratio of 30 and the S&P 500 average sits at 23.

We use our reverse discounted cash flow (DCF) model to more rigorously assess the valuation of this stock by quantifying the expectations for future profit growth baked into the stock price.

To justify its current price of $585/share, ISRG must achieve a 35% NOPAT margin (compared to 26% in 2019 and a company high of 29% in 2012) and grow NOPAT by 15% compounded annually for the next 14 years. See the math behind this reverse DCF scenario.

In this scenario, ISRG would be generating nearly $24 billion in revenue (14 years from now). For reference, Global Market Insights, an industry research provider, expects the entire surgical robots market to be worth $24 billion in 2025. Simply put, ISRG must capture huge market share gains in the coming years to justify its current stock price.

Even if ISRG achieves a 29% NOPAT margin (company best in 2012) and grows NOPAT by 11% compounded annually for the next decade, the stock is worth $322/share today, a 45% downside to the current stock price. See the math behind this reverse DCF scenario.

Each of the above scenarios also assume ISRG is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, ISRG’s invested capital has increased by an average of $334 million a year, or 24% compounded annually, since 2014.

Luckily for investors, ISRG appears to be an outlier in what is largely a strong portfolio.

The Importance of Holdings Based Fund Analysis

Smart fund (or ETF) investing means analyzing the holdings of each mutual fund. Failure to do so is a failure to perform proper due diligence. Simply buying a mutual fund or ETF based on past performance does not necessarily lead to outperformance. Only through holdings-based analysis can one determine if a fund’s managers are sticking to their stated methodology and are allocating to high-quality stocks, as FUQIX does.

However, most investors don’t realize they can already get the sophisticated fundamental research that Wall Street insiders use. Our Robo-Analyst technology analyzes the holdings of all 647 ETFs and mutual funds in the Large Cap Growth style and 7,000+ ETFs and mutual funds under coverage to avoid “the danger within.” The number of holdings in these Large Cap Growth ETFs and mutual funds varies from just 21 stocks to 556 stocks in a given fund. Our diligence on holdings allows us to cut through the noise and find mutual funds, like Fidelity SAI U.S. Quality Index Fund, with a portfolio and methodology that suggests future performance will be strong.

This article originally published on February 12, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our Robo-Analyst research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] This paper compares our analytics on a mega cap company to Bloomberg and Capital IQ (SPGI) in a detailed appendix.