We closed this position on May 15, 2018. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This firm moved to boost sagging growth by acquiring a key competitor in late 2015. In addition to overpaying, the expected synergies have not materialized and the profitability of the combined firm has suffered. Market-implied expectations for the firm’s future profits remain high despite disappointing post-merger results. The level of execution required to generate the cash flows expected by the market looks even higher. DENTSPLY SIRONA, Inc. (XRAY, $56/share) is in the Danger Zone this week.

Update: On the Monday morning after our Friday Danger Zone interview, prior to the publication of this report, XRAY announced that its Chairman, CEO and COO had all resigned. After reading this report, readers will understand the need for the sweeping leadership change.

Pre-Deal Performance was Unspectacular but Steady

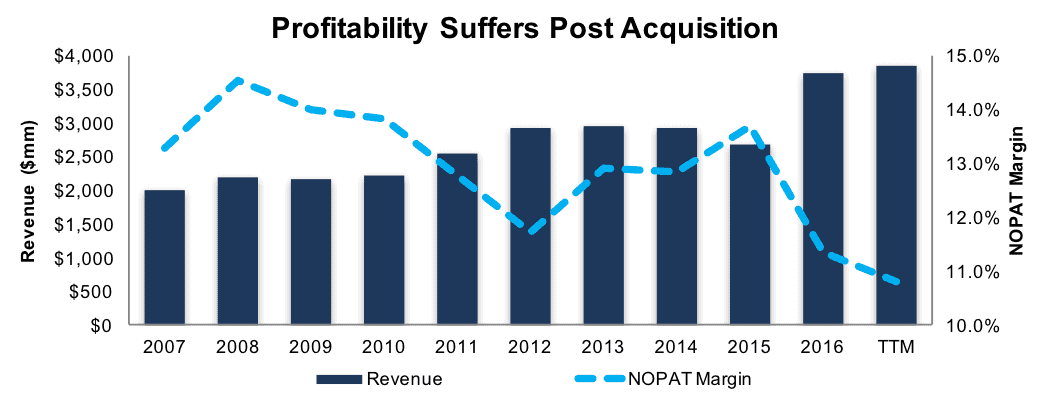

During the ten-year period prior to the Sirona Dental acquisition (2005-2015), XRAY’s revenue grew by 5% compounded annually. Over the same period, after-tax profit (NOPAT) also grew by 5% compounded annually as XRAY operated with a consistent NOPAT margin of 13%. XRAY earned an average return on invested capital (ROIC) of 10% during the period and generated positive economic earnings every year.

There were signs, however, that the company’s acquisitive ways warranted investor caution. Invested capital grew twice as fast as revenue (9% compounded annually) from 2005-2015. XRAY’s balance sheet efficiency, or invested capital turns (revenue/invested capital), declined from a below average 0.8 in 2005 to a well-below average 0.6 in 2015. XRAY had been imprudently investing capital and sacrificing the balance sheet to drive growth for years. However, its boldest and most damaging move was yet to come.

Paying the Price for Overpaying

In late 2015, XRAY announced the acquisition of Sirona Dental in an all-stock deal valued at $5.5 billion. Based on Sirona’s $205 million trailing-twelve-month (TTM) after-tax profit and XRAY’s 5.3% cost of capital (WACC) at the time of the acquisition, a value-neutral price for Sirona would have been closer to $4 billion. To justify the extra $1.5 billion of consideration, the combined firm’s synergies needed to create $80 million of additional combined NOPAT. Including XRAY’s 2015 NOPAT of $367 million, the combination needed to generate $650 million NOPAT just to make the purchase price neutral, much less accretive, to XRAY’s shareholder value.

Figure 1: XRAY’s Revenue Growth and NOPAT Margin

Sources: New Constructs, LLC and company filings

XRAY remains well short of this hurdle based on current NOPAT of $415 million (TTM) through the first half of 2017. Even assuming no synergies, XRAY’s current NOPAT is $157 million lower than the sum of the two firms pre-deal NOPAT. Further, to reach $650 million of NOPAT on the current $3.8 billion revenue base, XRAY needs to improve its current 11% NOPAT margin to 17%. XRAY’s peak profitability going back to 1998 was a 15% NOPAT margin, which has generally drifted lower since then.

Misaligned Executive Comp Plans Lead to Bad Outcomes

We favor executive compensation plans that use ROIC to measure performance to ensure executives’ interests are aligned with shareholders’ interests. Revenue and non-GAAP performance targets can be an incentive to sacrifice profitability for volume, or worse, engage in acquisitions that destroy shareholder value. XRAY’s executive compensation plan is weighted heavily towards variable incentive compensation, which made up 79% of the CEO’s 2016 total compensation and an average of 62% for the top seven executives listed in the Proxy statement. XRAY incentive compensation is based on revenue growth (40%), non-GAAP EPS targets (40%), and “meeting strategic goals” (20%).

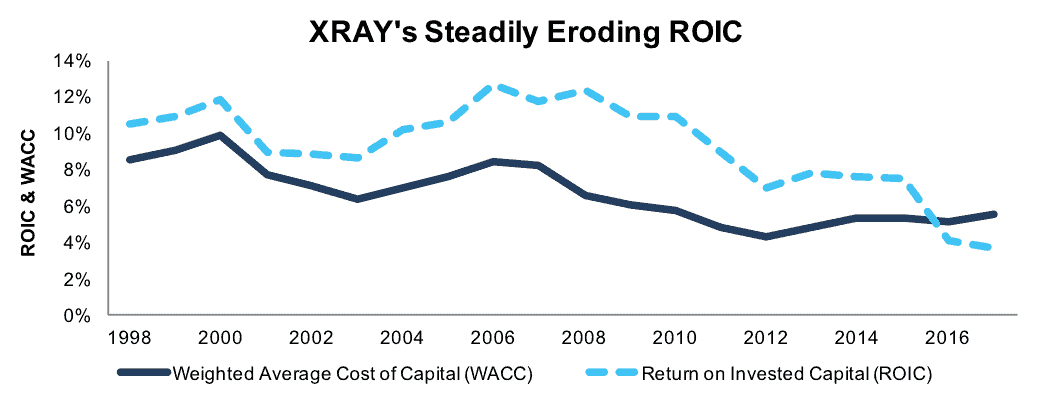

The perils of a misaligned executive compensation plan are evident in Figure 2. Company executives have pocketed tens of millions of dollars in compensation over the past decade while ROIC has been in steady decline. Further, while XRAY averaged $130 million per year in economic earnings from 2010-2015, economic earnings declined to -$115 million in 2016 and -$204 million TTM. Until the company aligns its compensation plans with financial goals that actually constitute profits, we are not optimistic that shareholder value destruction will come to an end on its own.

Figure 2: XRAY Swings to Economic Losses

Sources: New Constructs, LLC and company filings

The Importance of ROIC and Getting It Right

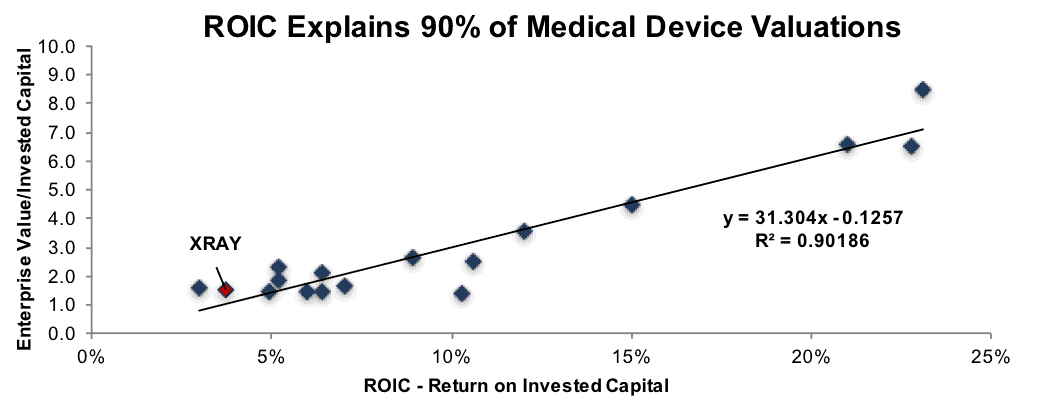

We know from numerous case studies, and Figure 3 below, that changes in ROIC and market value are directly correlated. As such, getting ROIC right is an important part of the investment decision making process. A recent white paper published by accounting firm, Ernst & Young, validates our efforts. Getting ROIC Right shows material differences between the accuracy of our forensic accounting research and largest research providers.

How important is ROIC to the valuation of XRAY and its peers? Per Figure 3 below, ROIC explains 90% of the valuation difference between XRAY and 15 of the top medical device stocks listed as comps in XRAY’s Proxy statement. As shown by its position above the regression trend line, XRAY is overvalued based on its low ROIC of 4% (10% average for peers) and its enterprise value/invested capital multiple of 1.5. If XRAY stock were at parity with the peer group, it would trade at $37/share – 34% below the current price.

Figure 3: XRAY is Overvalued Based on ROIC/Valuation Regression Analysis

Sources: New Constructs, LLC and company filings

Margin Trends Reflect Competitive Challenges

The DENSTPLY/Sirona combination was advertised as being full of competitive synergies. However, XRAY’s NOPAT margin ranks near the bottom of the peer group outlined in XRAY’s annual Proxy statement, per Figure 4. Further, the firm’s margin disadvantage relative to peers has widened significantly following the Sirona Dental acquisition. These margin trends call into question the entire rationale for the merger, much less its pricing.

Below average margins limit XRAY’s capacity to counter aggressive price competition or invest for future growth without further impacting the firm’s already low ROIC. As outlined previously, XRAY must now achieve a 17% NOPAT margin on its current revenue base just to earn its cost of capital. A 17% NOPAT margin would be the fifth highest among peers and higher than any NOPAT margin XRAY has generated since at least 1998.

Figure 4: XRAY’s Widening Margin Disadvantage vs. Peers

Peer Group Constituents: BDX, BSX, COO, EW, HOLX, HSIC, ISRG, MTD, PDCO, PKI, RMD, SNN, SYK, VAR, ZBH

Sources: New Constructs, LLC and company filings

Bulls Left Waiting on Deal Synergies to Materialize

The Bull case for XRAY relies on the unfulfilled promise of what DENTSPLY and Sirona Dental could earn on a combined basis. In addition to the margin headwinds outlined above, the deal has also not resulted in the combined revenue momentum that was advertised. 2Q17 provided the first full quarter of comparison for the combined company. Revenues were down 3% year-over-year. Given the current revenue headwinds, investor focus will shift to the cost savings side of the equation. Based on the NOPAT margin compression experienced since the deal was closed, there appear to be meaningful challenges to extracting targeted cost savings as well. Today’s announcement of sweeping leadership changes may give bulls new hope that the deal’s synergies will be realized. However, we are more apt to wonder if they were ever possible.

What’s the Catalyst? More of the Same

We are under no illusions that we can routinely identify, or time, the exact catalyst(s) that will cause a stock’s price to rise or decline. Our approach is based on risk/reward trade-off, which we believe is unfavorable for investors in the case of XRAY. Specifically, XRAY’s financial results appear unlikely to measure up to the high level of market-implied expectations embedded in the stock price. These high expectations are likely to result in disappointing quarterly earnings and downward estimate revisions by Wall Street analysts. Investors will eventually scale back their expectations for the earning power of the combined company and the stock will be revalued lower as a result.

High Expectations Embedded in the Valuation

XRAY shares are down 5% over the past year and down 2% YTD, despite market expectations (as defined by “consensus” estimates) for 2017 revenue and EPS declining 6% and 13%, respectively, over the past year. Based on the divergence between price and expectations it appears investors have yet to fully sour on the Sirona acquisition. As a result, we believe XRAY’s valuation embeds a high-risk level of market expectations due to the chasm between current financial performance and the expected performance implied by its market value.

XRAY trades at a price-to-economic book value (PEBV) ratio of 3.0. This ratio means the market expects XRAY’s NOPAT to grow to three times current levels. For XRAY to generate the $1.2 billion of implied NOPAT at its current 11% NOPAT margin, revenues would have to grow from $4 billion (TTM) to $12 billion. At the peer-level NOPAT margin of 16%, revenues would have to double to $8 billion.

To justify its current price of $56/share, XRAY must maintain current NOPAT margins of 11% and grow NOPAT by 5% compounded annually for the next 26 years. This scenario assumes XRAY grows revenue and NOPAT at a pace equal to the decade preceding the Sirona acquisition (2005-2015). In this scenario, XRAY would be generating $13 billion in annual revenue in 2042 compared to $4 billion TTM.

Even if we assume XRAY can immediately improve its NOPAT margin to 15% (the company’s prior peak) and grow NOPAT by 6% annually for the next decade, the stock is still worth only $37 today – a 37% downside risk. This scenario assumes XRAY grows revenues to $6 billion in ten years from $4 billion (TTM), or 5% compounded annually.

This scenario also assumes that XRAY is able to grow revenue, NOPAT and free cash flow while growing invested capital (i.e. increasing working capital or investing in fixed assets) at a fraction of the rate it has historically. This scenario is highly unlikely but allows us to illustrate how high expectations truly are. For reference, this scenario assumes invested capital grows by just 2% compounded annually over the next decade vs. 15% compounded annually since 1998.

Assessing Acquisition Risk

Due to XRAY’s size, there are a limited number of firms in the medical instrument and supply business that would be capable (from a market capitalization perspective) of acquiring XRAY. The largest such firm, Becton Dickinson (BDX), is currently tied up with the pending acquisition of C.R. Bard (BCR) and likely will be for several years. The next largest firm, Baxter (BAX), specializes in hospital supplies and has no history of, or stated interest in, the dental business.

Mettler-Toldeo International (MTD) and Waters Corporation (WAT) make highly specialized medical instruments unrelated to the dental business. Other large medical device makers, ranging from Medtronic (MDT) at $105 billion market cap to Smith & Nephew (SNN) at $16 billion market cap all specialize in non-dental products such as cardiac, orthopedic and spinal implants.

Walking Through the Acquisition Math

In addition to the lack of a readily apparent strategic match, it is difficult to model a scenario where a larger firm could acquire XRAY at near its current valuation on terms that make sense from an ROIC perspective. However, a key risk to our Bear thesis is what we call “stupid money risk”, which means a strategic buyer acquires XRAY at a higher price despite the stock already being overvalued.

We begin assessing acquisition value by adjusting for liabilities that would make an acquisition more expensive than accounting numbers suggest. For XRAY, these liabilities equal 10% of market cap:

- $783 million in deferred tax liabilities

- $332 million in pension net funded status

- $161 million in outstanding stock options.

- $118 million in off-balance-sheet operating leases

After adjusting for hidden liabilities, and baking in meaningful revenue growth and margin synergies, XRAY is worth less than its current share price even in the most optimistic scenario. As shown below, an acquisition of XRAY above the current price is possible only if the acquirer is willing to destroy shareholder value.

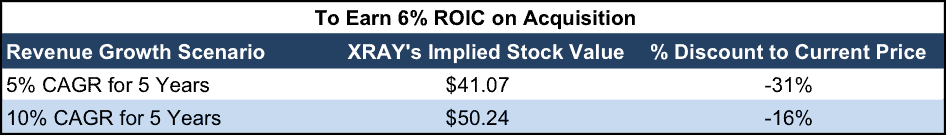

Figure 5 assumes that Baxter (BAX) were to expand into the dental business via the acquisition of XRAY. The scenario assumes BAX’s ROIC hurdle for an acquisition is 6%, which would create modest shareholder value based on BAX’s weighted average cost of capital (WACC) of 5%. Even if BAX can immediately improve XRAY’s NOPAT margin to 15% and grow XRAY’s revenue 5% compounded annually for five years, XRAY’s stock is 31% overvalued. Assuming revenue growth of 10% for five years, XRAY is still overvalued by 16%.

Figure 5: Implied Acquisition Prices to Achieve 6% ROIC

Sources: New Constructs, LLC and company filings

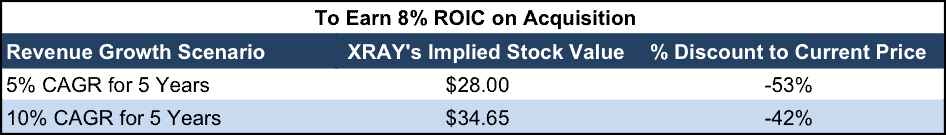

Figure 6 assumes BAX’s ROIC hurdle in an acquisition of XRAY is 8%. An acquisition of XRAY at these prices could be meaningfully accretive to a firm with a 5% WACC, such as BAX, assuming revenue and margin synergies come to pass. Even in the best-case scenario, BAX would destroy nearly $6 billion in shareholder value purchasing XRAY at its current price. The most BAX should pay for XRAY, assuming the best-case scenario, is $35/share (42% downside).

Figure 6: Implied Acquisition Prices to Achieve 8% ROIC

Sources: New Constructs, LLC and company filings

XRAY Provides a Modest Shareholder Yield

XRAY pays an annual dividend $0.35/share which equates to a minimal 0.6% yield at the current stock price. During 1H17, the company repurchased 2.4 million shares (1% of outstanding) at an average price of $63/share, or 5% above current price levels. The current repurchase authorization allows for up to 39 million shares of treasury stock. Treasury stock amounted to 35 million shares as of June 30, 2017, allowing for the repurchase of 4 million additional shares. Assuming the 4 million shares were repurchased at current prices equates to a shareholder yield of 1.8%, or 2.4% when combined with the current dividend yield.

Insider Sales and Short Interest

Insiders have little skin in the game and own less than 1% of outstanding shares. Further, recent insider activity has been universally on the sell side. Insiders have sold 506,000 shares YTD and purchased none. The largest transaction was a 147,000-share sale by now former CEO Wise.

Short interest is not particularly high at 8.2 million shares, which equates to 3% of outstanding and 4 days to cover. Short interest is down 14% from year-end levels, but is up 50% from the low point of the year in May. It’s too early to say that short sellers have XRAY in their sights, but the recent trend bears watching.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to DENTSPLY SIRONA’s 2016 10-K:

Income Statement: we made $260 million of adjustments with a net effect of removing $4 million in non-operating income (<1% of revenue). We removed $128 million related to non-operating expenses and $132 million related to non-operating income. See all adjustments made to XRAY’s income statement here.

Balance Sheet: we made $3 billion of adjustments to calculate invested capital with a net decrease of $445 million. The most notable adjustment was $1.3 billion (12% of reported net assets) related to mid-year acquisitions. See all adjustments to XRAY’s balance sheet here.

Valuation: we made $3.2 billion of adjustments with a net effect of decreasing shareholder value by $2.8 billion. The largest adjustment to shareholder value was $2.5 billion in total debt, which includes $274 million of off-balance sheet operating leases. This debt adjustment represents 15% of XRAY’s market value. Despite the decrease in shareholder value, XRAY remains undervalued.

Unattractive Funds That Hold XRAY

The following funds receive our Unattractive-or-worse rating and allocate significantly to XRAY.

- Neuberger Berman Guardian Fund (NGDAX) – 3% allocation and an Unattractive rating.

- Eaton Vance Atlanta Cap SMID-Cap Fund (EAASX) – 3% allocation and an Unattractive rating.

- Delaware US Growth Fund (DEUIX) – 3% allocation and an Unattractive rating.

- Jackson Square Large-Cap Growth Fund (DPLGX) – 3% allocation and an Unattractive rating.

- CRM Large Cap Opportunity Fund (CRMGX) – 2% allocation and an Unattractive rating.

This article originally published here on October 2, 2017.

Disclosure: David Trainer, Kenneth James and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Flickr (Perfect-Weapon)