Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

We focused on overvalued IPOs in 2015, including Square and Planet Fitness. This week’s Danger Zone hones in on another IPO from 2015 that may have been one of the last to capitalize on the easy money in the market. Post IPO, we believe it won’t take long for investors to realize this company is bleeding cash, has no profits, and faces stiff competition moving forward. This week’s Danger Zone is Pure Storage Inc. (PSTG: $13/share).

Look Past Revenue, Search For Profits

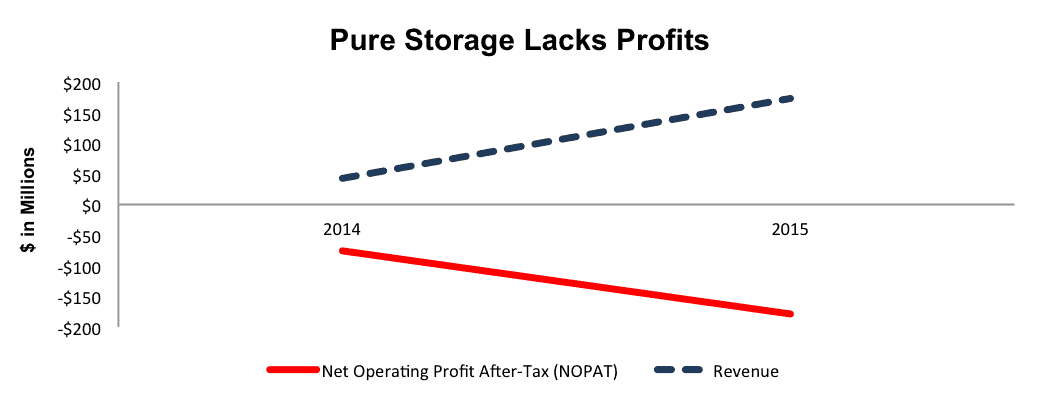

While many “unicorns” were debunked as myth in 2015, Pure Storage was able to avoid such scrutiny and went public on the strength of its revenue growth. Since 2013, Pure Storage has grown revenue by 436% compounded annually. it seems IPO investors chose to overlook the fact that profits have remained negative. Pure Storage’s after-tax profit (NOPAT) has fallen from -$77 million in 2014 to -$179 million in 2015. Figure 1 shows the disconnect between revenue and profit.

Figure 1: Pure Storage’s Increasing Losses

Sources: New Constructs, LLC and company filings

Pure Storage has the same problem as many overvalued startups: unsustainably high expenses. From 2012-2014, cost of revenues, research & development, sales & marketing, and general and administrative costs have risen 324%, 174%, 277%, and 301% compounded annually.

Unfortunately, dumping further capital into the business has been a poor investment. Pure Storage’s return on invested capital (ROIC) has declined from -42% in 2014 to -72% in 2015. Worst of all, Pure Storage needed to IPO to continue operating, at its free cash flow reached -$312 million (13% of market cap) in 2015.

Non-GAAP Metrics Are Frightfully Misleading

We’ve warned investors about the accounting practices of IPO companies as well as the over usage of non-GAAP earnings, and Pure Storage raises lots of non-GAAP red flags. Pure Storage uses numerous non-GAAP measures to paint its business in a more positive light, as can be seen below.

- Non-GAAP gross profit

- Non-GAAP gross margin

- Non-GAAP loss from operations

- Non-GAAP operating margin

- Non-GAAP net loss

- Non-GAAP net loss per share

Like most companies using non-GAAP, Pure Storage excludes all sorts of operating expenses from these metrics; for example: stock-based compensation, assumed preferred stock conversion, and a one-time charge for an equity grant to the Pure Good Foundation. So how meaningful are these exclusions?

- In 2014, Pure Storage removed $21.6 million in stock based compensation, or 50% of revenue

- In 2015, Pure Storage removed $53 million in stock based compensation, or 30% of revenue

Even after removing these large expenses, Pure Storage is unable to turn a “profit”, GAAP or non-GAAP.

Competitive Market Diminishes Growth Prospects

Pure Storage faces enormous competition in the data storage market. This market includes large storage vendors such as EMC (EMC) and NetApp (NTAP), large companies acquiring similar technology such as HP (HPQ), IBM (IBM), Dell, and Lenovo, and new startup companies offering next generation storage solutions.

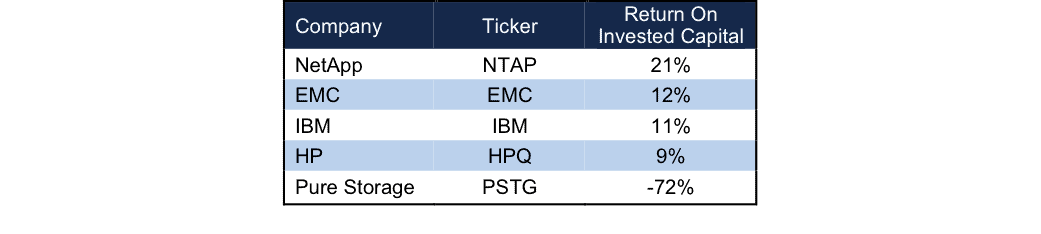

A relative latecomer to this market, Pure Storage lacks not only the resources of the larger incumbents but also lack their profitability. See Figure 2.

With so many offerings in the flash storage market , we think buyers will be very price sensitive, which makes Pure Storage’s deep level of unprofitability (ROIC of -72%) a major competitive disadvantage. How can is compete on price when it is losing so much money?

Figure 2: Pure Storage’s Poor Profitability

Sources: New Constructs, LLC and company filings

Bull Case Undermined By Competitor Strength

Pure Storage’s focus on all flash storage differs from competitors offerings, which still use hard disk based and hybrid storage. The bull case surrounding Pure Storage implies that not only are hard disk based storage solutions going to be ditched for flash, but that Pure Storage can take nearly all market share.

While Pure Storage touts that the enterprise storage market is estimated to reach $27 billion by 2018, it fails to mention that in 2014, all flash array’s, which Pure Storage specializes in, only made up $667 million of this entire market. The small size of the market notwithstanding, EMC has a large lead over Pure Storage, which means it will be rather difficult for Pure Storage to take majority share of that market.

In mid 2015, Gartner estimated that EMC had a 34% share of the all flash array market, more than that of Pure Storage and IBM combined, which placed #2 and #3 respectively. EMC’s success in this market, after acquiring ExtremeIO in 2012, further underscores its competitive strength. Moreover, because EMC operates other profitable business lines, it has more capital to invest in this market. It also has greater distribution as it reported cumulative sales passed $1 billion in less than two years, something Pure Storage has failed to achieve since launching flash array in 2012. With EMC’s large existing customer base that can be upgraded to all flash array’s, Pure Storage faces an uphill battle in taking market share from EMC. Herein lies another big problem for PTSG. The current stock price implies that Pure Storage has not only won the battle, but already conquered the storage market all together.

Valuation Is Unrealistic With or Without Acquisition

Pure Storage IPO’d at $17/share, and has already fallen well below this price. Despite this price decline, shares are still significantly overvalued. Even if Pure Storage achieves just 1% pre-tax margins (-103% in 2015), the company must still grow revenue by 50% compounded annually for the next 14 years to justify its current price. In this scenario, Pure Storage would be generating $50.1 billion in revenue 14 years from now, which is slightly more than Cisco’s (CSCO) 2015 revenue and only $4 billion less than Intel’s (INTC) 2014 revenue.

Even if we assume Pure Storage can achieve a 13% pre-tax margin (average of competition in Figure 2) and can grow revenues by 30% compounded annually for the next decade, the stock is only worth $10/share today – a 23% downside.

Could A Competitor Acquire Pure Storage?

As can happen in growing technology markets, large firms often acquire new technology rather than building it. Could acquisition hopes be driving Pure Storage’s expensive share price? Let’s take a look at stock through the lens of a potential acquirer.

Scenario 1: NetApp acquires Pure Storage. NTAP has the highest profitability of competition from Figure 2. Assuming upon acquisition Pure Storage immediately achieves NetApp’s margins and ROIC, the company would still have to grow revenue by 40% compounded annually for the next decade to justify buying Pure Storage at is current price (~$13/share). In this scenario, the value of Pure Storage’s business based on the value of the firm if it achieves NTAP’s 7% NOPAT margin in year 1 of the acquisition is still below $0, due to the large value of preferred capital and outstanding employee stock options (more on this below).

Hidden Liabilities Make Buyout Even More Unlikely

Pure Storage has some hidden liabilities that make the company even more expensive the standard accounting numbers suggest and pull its valuation below the current $13/share.

- $187 million in outstanding employee stock options (8% of market cap)

- $544 million in preferred stock (22% of market cap)

- $27 million in off balance sheet operating leases (1% of market cap)

Catalyst: Market Wakes Up To Reality

History shows that startup storage firms have a checkered history in the data storage market .

- Violin Memory (VMEM) went public in 2013 at $9/share and currently trades for $0.87/share, or 90% below IPO price.

- Fusion-io, which went public in 2011 at $19/share struggled to find a footing and was purchased by SanDisk (SNDK) for $11.25 in 2014. This purchase price was 40% below IPO price and actually 21% more than the stock price at the time.

- Nimble Storage (NMBL), which went public in 2013, has yet to turn a profit, and currently trades 64% below its IPO price of $21/share.

With negative profitability and strong competitors, we wouldn’t be surprised to see PSTG shares fall as soon as customer growth and revenues come in even slightly below expectations. With the quick success of EMC, this event could occur as soon as next quarter. However, much like the case of Netflix (NFLX), which trades solely on customer growth, if investors focus on a KPI unrelated to profits or the creation of shareholder value, it could take a few quarters before investors realize that Pure Storage business is not sustainable in its current form.

Executive Compensation Provides Little Accountability

Due to Pure Storage’s designation as an “emerging growth company,” it is not required to disclose details regarding its executive compensation. As its stands, executives receive bonuses based upon “company and individual goals.” Unfortunately, these goals are not outlined in Pure Storage’s S-1. If we were to make a recommendation, Pure Storage would be wise to adopt a plan that awards executives based upon meeting a target ROIC since ROIC has been proven to be a driver of shareholder value creation.

Impact of Footnotes Adjustments and Forensic Accounting

We have made several adjustments to Pure Storage’s S-1. The adjustments are:

Income Statement: we made $4 million adjustments with a net effect of removing $4 million (2% of revenue) million in non-operating expenses. We removed $4 million in non-operating expenses and $0 in non-operating income.

Balance Sheet: we made $105 million of balance sheet adjustments to calculate invested capital with a net decrease of $39 million. The largest adjustment was the removal of $27 million related to operating leases. This adjustment represented 9% of reported net assets.

Valuation: we made $758 million (31% of market cap) adjustments that all decrease shareholder value. There were no adjustments that increase shareholder value. The most notable adjustment to shareholder value was the removal of $544 million due to preferred stock. This adjustment represents 22% of Pure Storage’s market cap.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

5 replies to "Danger Zone: Pure Storage (PSTG)"

You have a lot to learn about the Storage market my friend. May suggest you guess less on old balance sheets and start talking to market experts and insiders.

NetApp acquired SolidFire to bolster the performance of its tier two storage, in the hopes it would strengthen its offering of their tier one storage. However, a brief review of NetApp’s product history clearly shows NetApp is always late to market – frequently last to market.

EMC, while riding high on the word of an acquisition which has yet to be properly funded, or approved, just announced its next lackluster and far too complex product offering. An offering which, at best, will achieve modest results with its partner offering, VBlock.

Meanwhile, EMC has all but stopped giving away their AFAs in order to appear more profitable prior to the due diligence of the proposed merger. Which means, EMC is losing close to 70% of its head-to-head challenges with PSTG.

While EMC is losing its footprint PSTG is steadily gaining. You do the math on how that effects the balance sheets.

You list other players, but we both know without holding firms those players would be so far in the red they would be filing Chpt. 11 every other quarter.

PSGT might not be a Day Trader’s wet dream, but it’s solid.

ProTip

Watch NMBL, that’s where the Day Trader action will be.

Massive inside buying for three straight months, more than 5 million shares held by a single outside firm….

Smell an acquisition? Well, you should.

Plenty of buy and short opportunities to be had there.

PSTG down 18% after quarterly earnings. Costs continue to rise, nearly negating any revenue growth, and operating losses grow larger.

PSTG falls nearly 12% after analyst downgrade to sell rating and strong results from competitor NetApp (NTAP).