We published an update on this Danger Zone pick on May 10, 2021. A copy of the associated Earnings Update report is here.

Pandora Media once stood on top of the music streaming world with over 79 million subscribers. But then, as competition entered the market, it precipitously lost and was acquired in 2019 below its original IPO price. Today, the music streaming business is even more competitive, and the current streaming music market leader could face a similar fate.

With this cautionary tale in mind, fiduciaries should avoid the high risk of owning Spotify Technology (SPOT: $242/share), this week’s Sell Idea.

We first warned about Spotify in April 2018 and again in August 2018. Since our first report, the stock is up 63% while the S&P 500 is up just 28%. As the stock price rises, momentum investors may believe there is opportunity left in this stock. However, fiduciaries should beware of the risks in owning this stock:

- Slowing premium subscriber growth rate

- Losing market share to competitors

- Exclusive content strategy will lead to increased costs

- Doing the math: valuation implies Spotify will have twice as many premium subscribers as Netflix

Growth of Premium Subscribers Is Slowing…

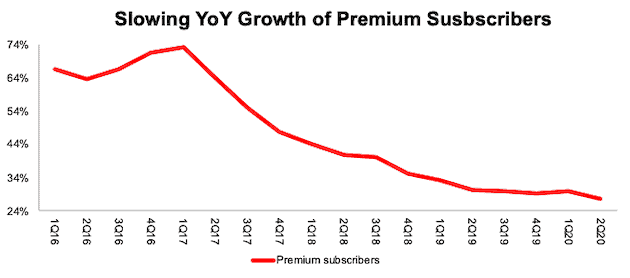

Spotify generates revenue from advertisements and subscriptions. Premium subscribers (or paid users of the service) generated 93% of Spotify’s revenue in 2Q20. Per Figure 1, the year-over-year (YoY) growth rate in premium subscribers has fallen sharply from 73% in 1Q17 to just 28% in 2Q20.

Figure 1: Spotify’s YoY Change in Premium Subscribers Since 1Q16

Sources: New Constructs, LLC and company filings

…And So Is Revenue

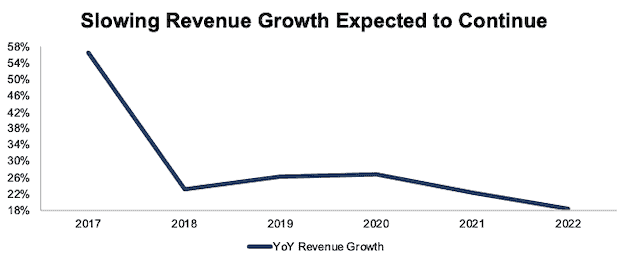

Spotify has seen a corresponding decline in its YoY revenue growth rate as its YoY premium subscriber growth rate has fallen. Compounded with slowing premium subscriber growth, Spotify’s average revenue per premium user (ARPU) has steadily declined from EUR 5.32 in 2017 to just EUR 4.41 in 2Q20. Spotify’s 2Q20 ARPU represents a 9% YoY decline.

The combination a slowing premium growth rate and falling ARPU has driven Spotify’s YoY revenue growth rate down from 57% in 2017 to 33% TTM. Per Figure 2, consensus estimates for Spotify’s revenue growth expect the decline to continue to just 18% YoY revenue growth in 2022.

Figure 2: Spotify’s YoY Revenue Growth Since 2017

Sources: New Constructs, LLC, and company filings

*Consensus estimates

Spotify Is Losing Market Share

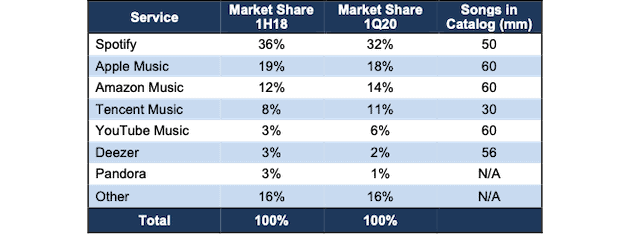

Firms such as Apple (AAPL), Amazon (AMZN), YouTube (owned by Alphabet (GOOGL), and more have recognized the large opportunity in audio streaming platforms. Competitors’ entrance into the market, along with their vast resources and marketing capabilities, coincide with Spotify losing market share. Per Figure 3, Spotify’s market share of the global streaming music subscription market fell from 36% in the first half of 2018 to 32% in 1Q20. Over the same time, Amazon Music, YouTube Music, and Tencent Music have all gained market share.

Figure 3: Spotify and Peers’ Global Music Subscription Market Share

Sources: New Constructs, LLC, company filings, and Midia Research

When we look just at the U.S., Apple Music provides a perfect case study in how quickly competition can upend the music streaming market. Apple Music launched in 2015, and by 2018 overtook Spotify as the largest on-demand music streaming subscription platform in the U.S. While Spotify may have more users than Apple Music globally, Apple’s quick success in the U.S. market proves the competitive moat of Spotify’s business is not as strong as many believe.

Not Owning Content Means No Defensible Moat

Our previous report noted how difficult it is for Spotify to grow its margins long term due to its dependency on just a few music labels known as the Big Three for much of its content. Anytime the labels think Spotify is earning too much money with their content, they can simply raise their royalty prices, which compresses Spotify’s margins.

Case in point: in 2019, Spotify’s revenue increased 26% YoY while royalty payments increased by 30%. The YoY increase in royalty payments is up from the 20% YoY increase in 2018.

Aside from margin pressure, there is another problem with not owning its content. Spotify is unable to differentiate itself from competitors who offer the exact same content. For example, Spotify offers over 50 million songs in its catalog while Apple Music, Amazon Music, and YouTube Music each offer 60 million songs. All of these services are heavily dependent on the Big Three labels for their content.

A Content Creation Strategy, A La Netflix, Is No Guarantee to Grow Market Share

In order to differentiate itself and take back some of its lost market share, Spotify is following in the footsteps of Netflix by offering exclusive content, an increasingly costly strategy that we’ve covered in the past. Spotify needs a critical mass or exclusive content to lure customers from competing platforms and pay premium prices.

However, exclusive content deals risk eliminating one of Spotify’s advantages: the low amount the firm pays per stream. Spotify pays artists just $0.0032 per stream compared to Apple Music at $0.0056 and Amazon Music Unlimited at $0.012. As Spotify moves toward more exclusive content, it will have to pay more per stream, or sign large capital intensive up-front deals, with no promise of future subscription growth.

The firm has already spent over $700 million to enter the podcast market by purchasing podcast networks such as The Ringer and signing the likes of Joe Rogan, DC Comics, Kim Kardashian, and the Obamas to exclusive podcast deals. In 1Q20 alone, Spotify launched 78 Originals and Exclusives podcasts to bring its podcast catalog to over one million, or about $700 per podcast.

While proprietary podcast content may help the firm retain and attract more podcast listeners, it does not help with the remaining 79% of monthly active users (MAUs) that do not listen to podcasts.

Making this strategy even riskier, exclusive content is no guarantee to grow market share. Ampere Analysis estimates Netflix’s share of the other-the-top subscription market, despite its massive investment in original content, has fallen from 52% in 2014 to 19% in 2019, and an estimated 18% in 2020.

Spotify Is Not the Only Service Offering Exclusive Content Either

As the music streaming competition heats up, many other services are also focused on providing their users with exclusive content.

Apple offers exclusive album releases from artists such as U2, Drake, Chance the Rapper, Taylor Swift, and Katy Perry to draw users to its service. Apple Music also features Beats One radio, which offers exclusive shows hosted by popular artists.

Apple also easily integrates Apple Music with iTunes libraries.

The popular French streaming service, Deezer, has access to plenty of exclusive content as well. Deezer is owned by Access Industries which owns Warner Music Group, one of the Big Three music labels. Deezer Originals offers users special extended play records, podcasts, and videos.

Tencent, which owns several streaming music services in China, offers original music and original video production. Tencent is also a partner in a music label with Sony Music Entertainment.

Spotify’s Falling Profitability Is a Sign of Competitive Industry

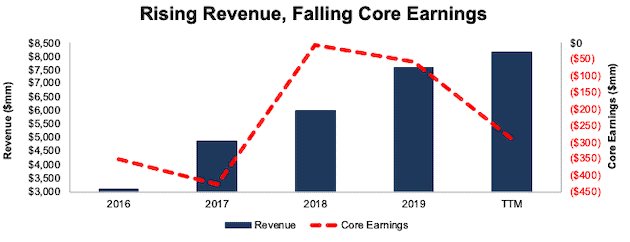

Given the competitive forces detailed above, it may not surprise you that Spotify’s profits are trending in the wrong direction, despite revenue growing 34% compounded annually from 2016 to 2019. Spotify’s core earnings[1] fell from -$8 million in 2018 to -$292 million over the TTM. Spotify has generated a cumulative -$246 million in free cash flow (FCF) over the past three years.

Figure 4: Spotify’s Revenue and Core Earnings Since 2016

Sources: New Constructs, LLC, and company filings

Spotify’s Peers Are Much More Profitable

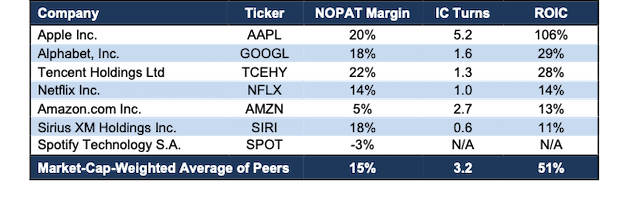

Spotify’s peer group includes other firms that provide subscription-based content services such as Apple, Alphabet, Tencent Holdings Ltd (TCEHY), Netflix, Amazon, and Sirius XM Holdings Inc. (SIRI).

Spotify’s net operating profit after-tax (NOPAT) margin of -3% is worst among its peer group and is well below the market-cap-weighted peer group average NOPAT margin of 15%.

The firm earns a bottom-quintile return on invested capital (ROIC) because it earns negative NOPAT and has negative invested capital.

Figure 5: Spotify and Peers’ NOPAT Margin, Invested Capital Turns & ROIC

Sources: New Constructs, LLC, and company filings

Spotify Is Priced to Be Bigger Than Netflix

Despite facing significant competition, declining ARPU, and a costly exclusive content strategy, Spotify is priced as if it will quickly improve profitability while increasing its revenue beyond what even Netflix generated over the TTM.

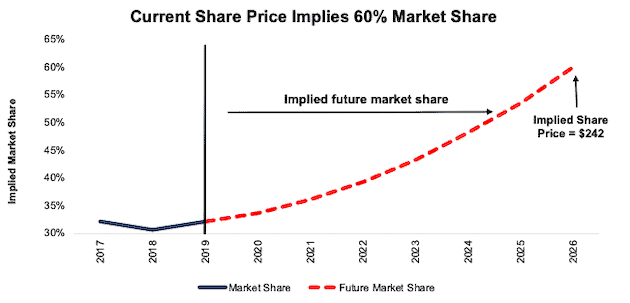

To justify its current price of $242/share, Spotify must:

- Grow revenue at 20% (equal to average consensus estimates from 2020 to 2024) compounded annually over the next seven years

- Immediately achieve a 10% (twice Amazon’s TTM margin of 5%, and less than Sirius XM’s 18%, which is boosted by its monopoly in satellite radio, vs. Spotify’s -3% TTM) NOPAT margin

See the math behind this reverse DCF scenario. In this scenario, Spotify’s revenue in 2026 would reach $27.2 billion, or 3.5 times greater than exclusive satellite radio provider SiriusXM’s (SIRI) 2019 revenue.

In this scenario, Spotify’s implied revenue in 2026 equals 60% of MIDIA’s 2026 global streaming music revenue forecast of $45.3 billion and is actually 1.2 times greater than the $22.6 billion of revenue Netflix generated over the TTM. Achieving a 60% share of the global streaming music market is a very large expectation especially considering that the firm must do so in direct competition with large, established companies such as Apple, Google, and Amazon.

Figure 6: Current Valuation Implies Huge Market Share Growth

Sources: New Constructs, LLC and company filings, and MIDIA research.

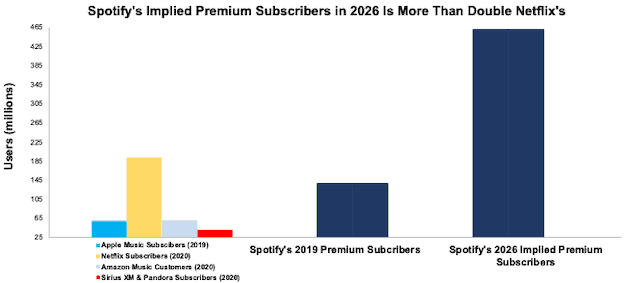

Spotify’s Premium Subscribers Will More Than Double Netflix’s

To further illustrate the extraordinarily high growth expectations embedded in Spotify’s stock price, we compare Spotify’s implied premium subscribers to the paying subscribers of its competitors. By dividing the implied revenue in 2026 of $27.1 billion by the firm’s 2Q20 ARPU of ~$59, we arrive at ~459 million implied paying users in 2026.

In other words, SPOT’s current valuation implies the company will grow its paying user base to more than 11 times Sirius XM’s, 7.5 times Apple Music’s, and two times Netflix’s.

Figure 7: Spotify’s Implied 2026 Premium Subscribers vs. Competitors

Sources: New Constructs, LLC and company filings.

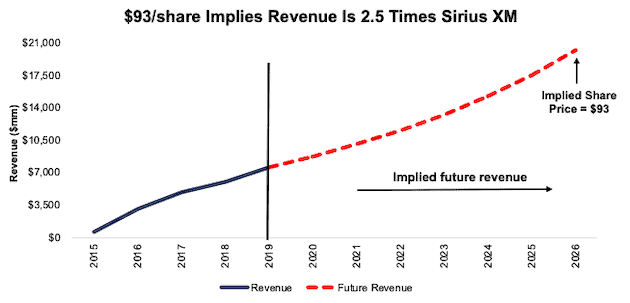

Spotify Has Significant Downside With More Realistic Growth

Spotify’s current economic book value, or no growth value, is -$13/share. But, let’s see what the price looks like if we give the firm credit for being able to grow into a profitable enterprise.

If we assume more realistic revenue and profit growth, SPOT still has significant downside.

In this scenario, we assume Spotify will:

- Grow revenue at 15% (twice Research and Markets’ industry growth forecast) compounded annually over the next seven years

- Immediately achieve a 5% NOPAT margin (equal to Amazon’s TTM margin)

See the math behind this reverse DCF scenario. In this scenario, Spotify grows NOPAT from -$50 million in 2019 to $1 billion in 2026, and the stock is worth just $93/share – a 62% downside.

Figure 8 compares the firm’s implied future revenue in this scenario to its historical NOPAT.

Figure 8: SPOT Has Large Downside Risk: DCF Valuation Scenario

Sources: New Constructs, LLC and company filings.

Each of the above scenarios also assumes Spotify is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are.

Acquisition Would Be Unwise

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and buys Spotify at the current, or higher, share price despite the stock being overvalued. Given our analysis above, the only plausible justification for SPOT trading at such a high price is the expectation that another firm will buy it. Given the stock’s extremely high valuation, we think potential acquirers would be better off leaving Spotify alone, but stranger things have happened than firms being acquired at unnecessarily high premiums to their intrinsic value.

Below, we quantify the high acquisition hopes that are priced into the stock.

Walking Through the Acquisition Math

First, investors need to know that Spotify has large liabilities that make it more expensive than the accounting numbers would initially suggest.

- $1.6 billion in outstanding employee stock options (4% of market cap)

- $695 million in total debt (2% of market cap)

After adjusting for all liabilities, we can model multiple purchase price scenarios. For this analysis, we chose The Walt Disney Company (DIS) as a potential acquirer of Spotify given Disney’s experience with creating exclusive content, history of acquisitions, and opportunity to bundle Spotify’s service with Disney+ and Hulu to create a one-stop streaming platform. While we chose Disney, analysts can use just about any company to do the same analysis. The key variables are the weighted average cost of capital (WACC) and ROIC for assessing different hurdle rates for a deal to create value.

Even in the most optimistic of scenarios, Spotify is worth less than its current share price.

Figures 9 and 10 show what we think Disney should pay for Spotify to ensure it does not destroy shareholder value. There are limits on how much Disney should pay for Spotify to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In the first scenario, we use 25% revenue growth in year one, 22% in year two, and 18% in years three through five (equal to consensus estimates of 25% in 2020, 22% in 2021, and 18% in 2022). In the second scenario, we use a revenue growth rate of 25% in years one through five. We use the higher growth rate in scenario two to illustrate a best-case scenario where we assume Spotify could grow revenue faster while being integrated within Disney’s existing business.

We optimistically assume that Disney can grow Spotify’s revenue and NOPAT without spending any working capital or fixed assets beyond the original purchase price. We also optimistically assume Spotify achieves a 9% NOPAT margin, which is above Spotify’s TTM margin of -3% and equal to Disney’s TTM margin of 9%.

Figure 9: Implied Acquisition Prices for Value-Neutral Deal

Sources: New Constructs, LLC and company filings

Figure 9 shows the implied values for SPOT assuming Disney wants to achieve an ROIC on the acquisition that equals its WACC of 5%. This scenario represents the minimum level of performance required not to destroy value. Even if Spotify can grow revenue by 20% compounded annually for five years and achieve a 9% NOPAT margin, the firm is worth less than $242/share. It’s worth noting that any deal that only achieves a 5% ROIC would not be accretive, as the return on the deal would equal Disney’s WACC.

Figure 10: Implied Acquisition Prices to Create Value

Sources: New Constructs, LLC and company filings

Figure 10 shows the implied values for SPOT assuming Disney wants to achieve an ROIC on the acquisition that equals 7% and is greater than its WACC. Acquisitions completed at these prices would be accretive to Disney’s shareholders. Even in this best-case growth scenario, the implied value is far below Spotify’s current price. Without significant increases in the margin or revenue growth assumed in this scenario, an acquisition of SPOT at its current price destroys significant shareholder value.

Catalyst – Declining EPS and Market Share Due To Heavy Competition

Spotify has missed earnings in four of the past ten quarters. Should the firm have another earnings miss, shares could go lower.

With faster growing competition, Spotify is in a difficult position to maintain its market leadership position. Should Spotify’s competitors such as Apple Music and YouTube Music take more of Spotify’s market share in the near future, investors may realize the tough road ahead for the firm and take their money elsewhere.

With Apple’s recent announcement of its Apple One bundle, the streaming service market share may shift sooner than anticipated. While no specific date has been released, Apple will bundle its existing services, such as Apple Music, Apple TV, and iCloud at a cheaper rate than purchasing all three alone. The bundle could draw existing users of one of Apple’s services further into its ecosystem and away from Spotify if users determine the savings are worth the switch.

What Noise Traders Miss With SPOT

These days, fewer investors pay attention to fundamentals and the red flags buried in financial filings. Instead, due to the proliferation of noise traders, the focus tends toward technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing SPOT:

- Slowing revenue growth rates

- Declining ARPU

- Losing market share

- Valuation implies massive premium subscriber growth

Executive Compensation Plan Is Not Creating Shareholder Value

In addition to base salaries, each of Spotify’s executives have earned long-term equity incentive compensation. These long-term incentive awards are provided upon hire as well as during employment at the firm’s discretion.

In 2019, Spotify established a new incentive mix program that allows its executives the ability to choose between a mix of cash, restricted share units (RSUs), and stock options. Each type of long-term incentive vests over a four-year period. All executives opted for either options or RSUs, thereby tying future compensation with the firm’s stock price.

According to Spotify, its long-term incentive awards are designed to align a portion of its executives’ compensation to the interests of its shareholders. However, these awards have done little to create shareholder value. Spotify has generated negative economic earnings in each of the past four years.

Instead of incentivizing executives to focus on the stock price, Spotify should link executive compensation with improving ROIC, which is directly correlated with creating shareholder value, so shareholders’ interests are properly aligned with executives’.

Insider Trading and Short Interest

Insider trading information is not available for Spotify.

There are currently 3 million shares sold short, which equates to 2% of shares outstanding and just over one day to cover. The number of shares sold short has decreased by 3% since last month.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper,"Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Spotify’s 6-Ks and 20-F:

Income Statement: we made $803 million of adjustments, with a net effect of removing $159 million in non-operating expenses (2% of revenue). You can see all the adjustments made to Spotify’s income statement here.

Balance Sheet: we made $4.3 billion of adjustments to calculate invested capital with a net decrease of $2.3 billion. One of the most notable adjustments was $300 million in asset write-downs. This adjustment represented 10% of reported net assets. You can see all the adjustments made to Spotify’s balance sheet here.

Valuation: we made $5.8 billion of adjustments with a net effect of increasing shareholder value by $1.3 billion. The most notable adjustment to shareholder value was $3.5 billion in excess cash. This adjustment represents 8% of Spotify’s market cap. See all adjustments to Spotify’s valuation here.

Unattractive Funds That Hold SPOT

The following funds receive our Unattractive-or-worse rating and allocate significantly to SPOT:

- Invesco Dynamic Media ETF (PBS) – 6.4% allocation and Unattractive rating

- Morgan Stanley Advantage Portfolio (MAPLX) – 6.4% allocation and Unattractive rating

- Global X Social Media ETF (SOCL) – 6.1% allocation and Unattractive rating

- Morgan Stanley Insight Fund (MCRTX) – 5.6% allocation and Very Unattractive rating

- Morgan Stanley Growth Portfolio (MGHRX) – 5.5% allocation and Very Unattractive rating

- Morgan Stanley Discovery Portfolio (MACGX) – 5.% allocation and Very Unattractive rating

- Transamerica Capital Growth (TFOIX) – 4.8% allocation and Very Unattractive rating

- Global X Millennials Thematic ETF (MILN) – 3.6% allocation and Unattractive rating

- Harbor Mid Cap Growth Fund (HIMGX) – 3.2% allocation and Very Unattractive rating

This article originally published on September 30, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).