Pension Plan Costs – NOPAT Adjustment

This report is one of a series on the adjustments we make to convert GAAP data to economic earnings and Core Earnings.

Reported earnings don’t tell the whole story of a company’s profits. They are based on accounting rules designed for debt investors, not equity investors, and are manipulated by companies to manage earnings. Only economic earnings provide a complete and unadulterated measure of profitability.

Converting GAAP data into economic earnings and Core Earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

Our unrivaled due diligence on thousands of filings enables us to deliver proven-superior research and ratings.

A pension is a fund where employers invest money on behalf of employees. The amount that an employer invests on behalf of each employee is primarily determined by the length of employment. There are two types of pension funds: defined benefit plans and defined contribution plans.

In a defined benefit plan, a fixed sum is invested on behalf of the employee and becomes available to the employee upon retirement. In a defined contribution plan, both the employee and company invest in the retirement plan, and the employee receives regular payments upon retirement.

For defined contribution plans, we consider all costs or income as operating and deduct them from revenue to calculate net operating profit after-tax (NOPAT).

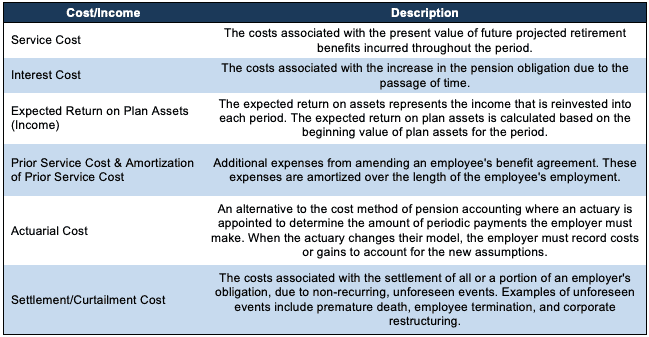

For defined benefit plans, the economics are not as simple given there are multiple costs and income to be considered. Figure 1 lists the different costs and the one income item related to defined benefit plans.

Figure 1: Defined Benefit Pension Plan Line Items

Sources: New Constructs, LLC and company filings.

Below we detail how we handle each of the costs listed in Figure 1.

-

- Service costs are recurring and operating expenses for employers with a pension program. Employers are required to report service costs within income from operations, and we treat them as an expense that reduces NOPAT and Core Earnings. Occasionally, due to a reduction in the net benefit obligation for the employer, service costs can be a net gain. In those cases, we consider the service cost gains as non-operating and exclude them from our calculation of NOPAT and Core Earnings.

- Service cost amortization is treated the same as service cost, where losses are treated as operating while gains are considered non-operating.

- Interest costs, expected return on plan assets, and actuarial losses are all operating expenses for employers. However, companies are required to report these items outside of income from operations. Therefore, to properly account for these items in our model, we must explicitly subtract losses and add gains from/to NOPAT.

- Settlement/Curtailment costs are non-recurring and non-operating expenses for employers. We exclude these values from NOPAT and Core Earnings. Because these expenses are reported outside of income from operations, we do not need to explicitly remove them from reported earnings.