How We Use Earnings Press Releases In Our Models

Our Company Valuation Models integrate Earnings Press Release data that is filed with the SEC prior to a company’s 10-K or 10-Q.

Benefits of Using Press Release Data

Earnings press releases often include unaudited financial information and highlight key financial metrics for the recently completed quarter, along with commentary from management.

These releases can provide an early look at financial results since they are generally available a few days in advance of the official 10-K or 10-Q filings, coinciding with the earnings call.

Drawbacks of Using Press Release Data

There are no required disclosures for press releases as there are for 10-K or 10-Q filings. Consequently, you never know what you’re going to get from a press release. The disclosures range from as little as a few line items such as revenue and EPS to being virtually identical to the official SEC filing the press release precedes.

The unique insights that we glean from footnotes are not available in press releases because there are no footnotes. Nevertheless, we aim to include relevant data from press releases in our models in a way that provides insight without compromising the integrity of our models.

How We Treat Press Release Data in Our Models

Because press releases are not required to provide a complete picture of the financials of the company, we have to be careful about how much we rely on them in our models. Accordingly, we suspend both the Stock Rating and Credit Rating for companies when the most recent data comes from a press release. Get more information on Suspended Ratings here.

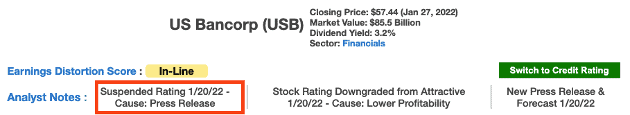

We clearly display whenever we have Suspended a Rating. We are also clear about the cause of the suspension as you can see in Figure 1 below. As soon as the next 10-Q or 10-K is filed and incorporated into our model, we will lift the suspensions due to Press Releases.

Figure 1: Press Release Data and Subsequent Suspended Rating

Sources: New Constructs, LLC and company filings

How to Access Press Release Data

Press release data will be available for a limited number of companies, starting with Bank of America (BAC) and US Bank (USB) in January 2022. Additional companies are being added in the future. All members can access this data in the same way they access our existing research, whether through the Portfolios page, Ratings page, or Company Reports.

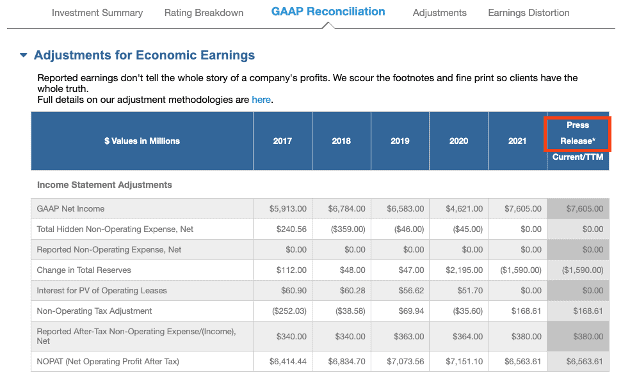

We will mark analytics reliant upon a press release with a special column header “Press Release*”. Additionally, the column will be highlighted in gray.

Figure 2: Press Release Sourced Data & Analysis on the GAAP Reconciliation Tab

Sources: New Constructs, LLC and company filings

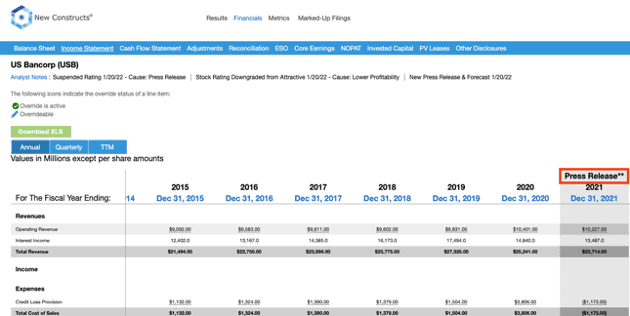

Institutional members can also view press release data in our Company Models for a limited number of companies.

Figure 3: Press Release Data in our Company Models

Sources: New Constructs, LLC and company filings

This paper compares our analysis on a mega cap company to other major providers.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on importance of ROIC and how to calculate it.

Get our report on "ROIC: The Paradigm For Linking Corporate Performance to Valuation."