Solid Investment Strategy

The key to successful Investing is maximizing upside potential and minimizing downside potential for every investment decision.

Since the future is inherently unpredictable, there are no “sure things” in the stock market (none that are legal…). Ergo, when battling against an uncertain future, the best strategy is to maximize one’s odds of success — which means “maximizing upside potential and minimizing downside potential for every investment decision”. In other words, we want to be long “good risk/reward” (low risk/high reward potential) and sell/short “bad risk/reward” (high risk/low reward potential).

Finding the best and worst risk/reward in the US stock market is what New Constructs is built to do.

That’s the theory. Here’s how we implement.

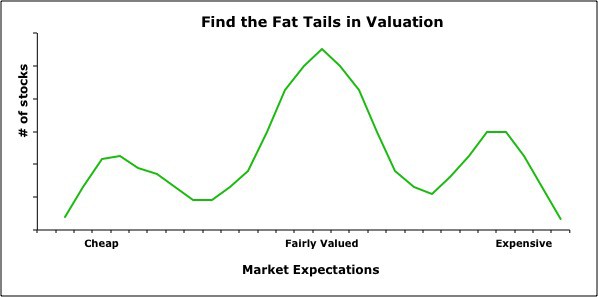

Because we cover over 3000+ of the largest and most actively-traded US stocks, our broad market perspectives are well-informed. Figure 1 highlights the pockets of inefficiency we see in the valuation of stocks across the entire U.S. equity market. The figure also shows that the market is fairly efficient on a large number of stocks as well.

Figure 1: Market Efficiency: Not Perfect

Sources: New Constructs, LLC and company filings

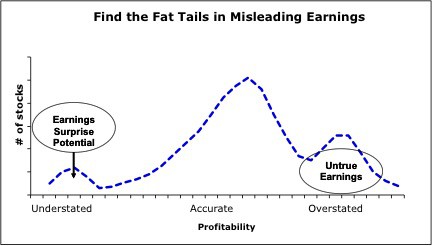

Next, we determine the true economic profitability to identify:

- Undervalued stocks with understated cash flows

- Overvalued stocks with overstated cash flows.

Figure 2 provides another illustration of our broad-market insights into how companies’ reported profits correlate to their true economic profits. It is not a very pretty picture. Most companies, in an effort to keep up with their peers, manipulate accounting rules to overstate their profitability.

Figure 2: Earnings Are Not What They Appear To Be Most Of the Time

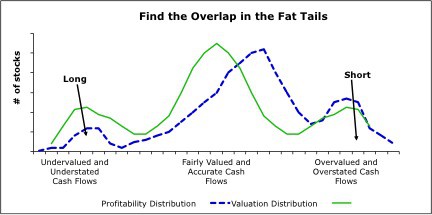

Next, we overlay valuation and economic profitability to find the best and worst stocks in the market.

Figure 3: Long = Most Attractive Stocks; Short = Most Dangerous Stocks

Sources: New Constructs, LLC and company filings

We focus on the stocks where the fat tails overlap. We want to be long stocks with the best risk/reward as measured by a very low valuation (limited downside) and understated cash flows (earnings upside).

We want to be short the stocks with the worst risk/reward as measured by a very high valuation (high downside) and overstated earnings (earnings downside). All the other stocks where valuation seems fairly efficient and earnings somewhat accurate are of limited interest to us. We think focusing on the extreme inefficiencies in the market is best.