How to Value a Stock Step 2: Invested Capital

This is the second article in a four part series that will walk readers through how to rate and value a stock. For this article, we will continue to walk you through the process of valuing chemical manufacturer DuPont (DD), which we began by calculating NOPAT. The second step to gauge the value of a company is to determine the sum of all cash that has been invested in a company over its life without regard to financing form or accounting name. We call this Invested Capital.

Why Invested Capital is the Correct Measure of A Balance Sheet

To truly know how profitable a company is, investors must understand how much money (i.e. NOPAT) a company is making relative to how much money has gone into it (i.e. invested capital). For example, if investors put $100 into a company that generated $75 per year, that investment would generate a 75% return on invested capital (ROIC) and would more than pay itself off in two years. On the other hand, if investors put $100 into a company that generated $3 in NOPAT per year, that investment would generate an ROIC of just 3% and would take more than 33 years to pay itself off, not counting the time value of money. Under GAAP rules, companies are provided numerous loopholes to hide the true amount of capital invested in a business. However, our calculation of Invested Capital accounts for these loopholes and provides a true picture of the capital invested in a company. Firms should be held accountable for all money invested in the over the life of the company and Invested Capital does just that. DD had total invested capital of $46.44 billion in 2013.

8 Adjustments We Make To Balance Sheets

Add Back Off-Balance Sheet Reserves: $539 million

Reserves are contra asset accounts that reduce asset values for probable future losses (in the case of inventory reserves or loan-loss provisions) or resolve the difference in accounting treatments (in the case of LIFO reserves). Reserves are for probable rather than actual losses. Since probable losses are calculated at management’s discretion, companies can use reserve accounts to manipulate earnings and the carrying values of the assets to which the reserves apply. Inventory reserves are included in our calculation of invested capital. Doing so holds management accountable for all capital in the company. DD’s LIFO reserve was $539 million in 2013, which gets added back to invested capital.

Add Back Off-Balance Sheet Debt Due to Operating Leases: $1,316 million

Operating leases are not recognized on the balance sheet. Current accounting rules provide lots of freedom for companies to classify a lease as operating instead of capital. These different accounting methods do not reflect operational differences, so we convert all operating leases to capital leases to ensure comparability despite different accounting. We make this adjustment by adding the discounted present value of all required operating lease payments to our calculation of invested capital. DD currently has $1.5 billion in outstanding lease commitments, or the equivalent of $1.3 billion in off-balance sheet debt when we discount those future commitments to their present value. We include this amount in our calculation of invested capital.

Remove Discontinued Operations: -$228 million

Assets from discontinued operations are assets that are held for sale by a company. These assets are disclosed on a separate line item on the balance sheet. We remove discontinued operations assets from invested capital for a more accurate picture of how much operating capital a business has on hand. Discontinued operations can distort GAAP numbers by over-stating assets on balance sheets and distorting the company’s ability to generate a return on capital. In 2013, DD had $228 million in assets held for sale, which was removed from invested capital.

Remove Accumulated Other Comprehensive Income (OCI): $5,441 million

OCI are gains and losses that have yet to be recognized and are excluded from net income. Accumulated OCI distorts GAAP numbers by raising or lowering reported assets, thereby distorting an assessment of a business’ ability to generate a return on capital. We remove OCI from invested capital to better represent the actual capital on hand for management to generate a return on and avoid the noise from fluctuations of OCI. In 2013 DD had accumulated OCI of -$5.4 billion, which was removed from invested capital.

Add Back Accumulated Asset Write-Downs: $9,589 million

Asset write-downs are reductions in the book value of an asset that occur when the fair value of an asset has declined below its carrying value. The value of the asset is reduced on the balance sheet, and the write down is charged against income. Write downs allow management to effectively erase equity from the balance sheet and inflate any return on asset/capital metric. We add back asset write-downs after tax to invested capital. This ensures that companies are held accountable for all the capital invested in their business. DD recorded an asset impairment charge of $129 million to write-down the carrying value of a group within the Electronics and Communications segment. After adjusting for negative charges, $105 million in asset write-downs was added back to invested capital. This value is added to the accumulated asset write-downs, which totaled $9.6 billion in 2013.

Remove Deferred Tax Assets and Liabilities: -$3,128 million

Deferred tax assets (DTAs) arise when reported income is less than taxable income. DTAs are like pre-paid taxes and represent expected reductions of future reported taxes. DTAs artificially increase reported assets while not helping to generate operating profits. We remove all DTAs from invested capital. In 2013, DD recorded $775 million in current deferred tax assets, and $2.4 billion in long-term deferred tax assets. When combined, $3.1 billion was removed from invested capital.

Remove Excess Cash: -$7,299 million

All companies require a certain amount of cash on hand to pay bills, buy materials, pay employees, etc. As a general rule, we estimate that most companies need to hold 5% of their annual revenue in cash in order to meet regular operating expenses. For highly profitable companies, this number can sometimes be lower. DD had $9.1 billion in cash and cash equivalents in 2013. It had $36 billion in revenue, which means that 5%, or $1.8 billion, was required. This leaves nearly $7.3 billion in excess cash that we remove from invested capital.

Prior to 2002: Add Back Unrecorded and Accumulated Goodwill: $359 million

Goodwill arises when one company pays more than the market price for another company. Prior to 2002, the recognition of goodwill could be avoided using the “pooling of interests method” of accounting for mergers and acquisitions. This method allowed firms to avoid goodwill amortization expenses. Prior to the introduction of SFAS 142 in 2001, goodwill was amortized using straight-line depreciation. After SFAS 142, the system of goodwill impairment is used to value intangible assets and reduce their value via an annual test. Goodwill amortization no longer takes place, but we add back the accumulated goodwill amortization prior to 2002 to a company’s invested capital. DD’s accumulated goodwill amortization was $359 million. This value was added back to invested capital.

Using Invested Capital

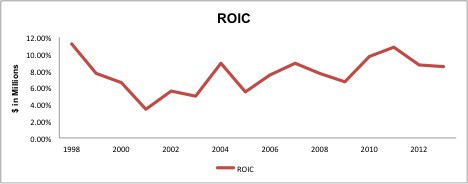

Now that we have discussed the items that must be adjusted to get a true picture of invested capital in DuPont, it is possible to calculate the company’s return on invested capital (ROIC). ROIC is the truest measure of a company’s cash on cash returns and of company profitability. To calculate ROIC, one must simply divide NOPAT by Average Invested Capital, which averages the total invested capital amounts from the beginning and end of the year. Average Invested Capital also accounts for midyear acquisitions, but DD did not make any acquisitions in 2013. Figure 1 shows the ROIC for DD over the past 14 years

Figure 1: DuPont Return on Invested Capital

Sources: New Constructs, LLC and company filings

Conclusion

When we total up all these adjustments, we find that our average invested capital measure for DD was $47.6 billion in 2013. When calculating ROIC, using this $47.6 billion gives DD an ROIC of 8%. However, if we remove these adjustments, DD’s reported net assets are much lower, at $38.1 billion. Using this number gives DD a ROIC of 11%. By not holding management accountable for all the operating capital invested in the business, DD appears to generate a greater return. As this article shows, accounting loopholes allow management to artificially decrease the amount of capital that appears to be invested in a company, thereby increasing their generated return. It takes a great deal of meticulous work to comb through all the filings and get all the key details, but it is more than worth it when investors can see the true return being generated by all aspects of invested capital. Diligence pays. Step 3 can be found here. To learn more about the adjustments we make to calculate Invested Capital, visit our Accounting Loopholes section.