How to Value a Stock Step 3: Economic Earnings

This article is the third in a four part series that walks readers through how to rate and value a stock. For this article, we will continue the process of valuing chemical manufacturer DuPont (DD). We began by calculating operating profit (NOPAT) and then calculating Invested Capital. Our third step to gauge the value of a company is to determine its economic earnings. Economic earnings are very different from accounting earnings. As we have shown in the previous steps, a lot of homework goes into scouring footnotes and making numerous adjustments to ensure proper calculation of economic earnings.

Must Calculate WACC First

After NOPAT, Invested Capital, and return on invested capital (ROIC), we need one more calculation to derive economic earnings: the weighted average cost of capital (WACC). WACC represents the cost of all funding sources (mostly debt and equity capital) used to operate the business. The primary components of WACC are the cost of equity and the cost of debt. For the cost of equity, we use the standard capital asset pricing model (CAPM). We analyzed and even tried many other models, but none offered enough additional accuracy to justify their often-immense complexity. The weakest link in CAPM is beta. We use a normalized beta so that it never hijacks our WACC for any of the 3000 stocks we cover. We use 5-yr zero-coupon STRIPS for the risk-free rate and we keep a consistent assumption for the equity risk premium, which is 4.83%. For the cost of debt, our calculation is 5-yr zero-coupon STRIPS risk-free rate plus a spread based on the company’s credit rating. We are looking to measure the company’s marginal cost of debt for inclusion in WACC. When determining the weighting of the cost of debt and equity, we use market values where possible. Most of the time the debt values are book value, but the equity values are always market values. The WACC for DD is 7.97%. This 7.97% represents the minimum level of ROIC the company must achieve to prevent investors from taking their money out and putting it into a company with similar risk.

Economic Earnings = (ROIC – WACC)*Invested Capital or NOPAT – WACC*Invested Capital

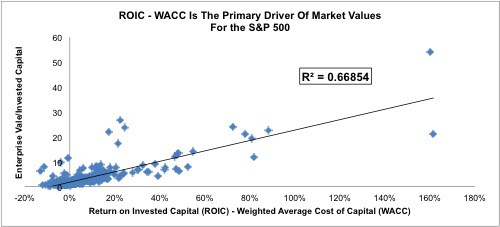

Figure 1: The Economics, Not Accounting, of A Business Drive its Valuation

Sources: New Constructs, LLC and company filings.

Note that the above regression analysis is based on the 489 companies in the S&P 500 that we cover except for Lorillard (LO). Because of its super high ROIC, including LO in the regression drives the r-squared up to 94%. The correlation in Figure 1 is strong because economic earnings are the true cash flows available to equity investors. Accounting rules can be exploited by management and are not always applied. However, the basic economics of business never change because all for-profit companies have one purpose: generate as much cash flow (i.e. NOPAT) while employing as little capital (i.e. invested capital) as possible. Because of all the work we do to calculate the best NOPAT, Invested Capital and WACC possible, our research is free of accounting distortions, management bias, or Wall Street spin.

A Better Measure

DuPont’s economic earnings for 2013 were $337 million, much lower than the $868.18 million in 2012. DD’s economic earnings declined due to the narrowing spread between its ROIC and WACC, also known as the economic earnings margin. DD’s WACC increased in 2013 due to the 45% increase in its market cap, which increased the weight of its more expensive equity capital in our calculation. DD’s ROIC declined from 8.7% to 8.5% due to its declining NOPAT. Figure 1 shows just how important calculating economic earnings can be. The economic earnings margin explains 67% of the difference in valuations between stocks in the S&P 500. Researchers have found that earnings per share growth is not nearly as powerful a driver of stock valuations. Step 4 can be found here. To learn more about all the adjustments we make, visit our Accounting Loopholes section.