The market had a surprisingly good week last week. Indices and most stocks trended higher, but there’s no guarantee they will continue to go up.

As more reports emerge of a pending supply chain crisis, investors need to be increasingly cautious of stocks that can hurt their portfolios. Our superior fundamental research can be your guide in these times of high volatility and help you avoid the stocks that can blow up a portfolio.

This week’s Danger Zone pick is especially dangerous. The company is burning cash at zombie stock levels, yet its valuation implies massive profit growth.

As a personal protective equipment (PPE) manufacturer, this company saw a massive boost in both its top- and-line during COVID. Since then, the company’s fundamentals have deteriorated dramatically. While multiple acquisitions have artificially boosted revenue, they only accelerate the destruction of shareholder value. Add in lagging market share and an Unattractive Credit Rating to boot, and Lakeland Industries (LAKE: $16/share) is this week’s Danger Zone.

Lakeland Industries’ stock provides bad Risk/Reward based on:

- declining profits amidst rising revenue,

- value destroying acquisitions,

- more profitable competitors,

- large cash burn, and

- a stock valuation that implies the company will grow profits to levels only seen during a global pandemic.

Profits Declining Despite Revenue Growth

Lakeland Industries’ revenue soared 47% year-over-year (YoY) in fiscal 2021 (Feb 2020 through Jan 2021) as it was able to take advantage of the peak demand for PPE driven by COVID. In fact, the company’s disposables segment sales nearly doubled from $53 million in fiscal 2020 to $104 million in fiscal 2021.

Alongside soaring sales, Lakeland Industries benefited from higher prices, which drove the company’s net operating profit after-tax (NOPAT) to $32 million, the highest for the company in any year of our model (dates back to fiscal 1996).

However, the business looks much different now. While the company has been able to increase revenue through acquisitions, its NOPAT has declined YoY in each of the past four years.

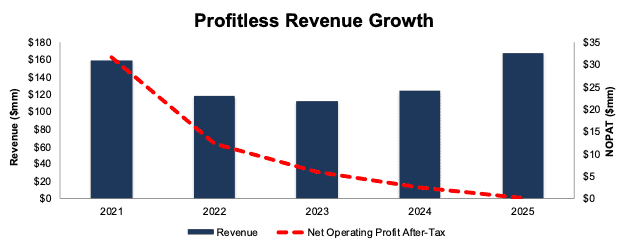

Specifically, Lakeland Industries’ revenue rose from $159 million in fiscal 2021 to $167 in fiscal 2025, while its NOPAT fell from $32 million to less than $1 million over the same time. See Figure 1.

Figure 1: Lakeland Industries’ Revenue and NOPAT: Fiscal 2021 – 2025

Sources: New Constructs, LLC and company filings.

Acquisitions Boost Sales, But Destroy Shareholder Value

Lakeland Industries’ revenue increased 34% YoY in fiscal 2025, which might have growth investors salivating. However, a deeper look into the source of revenue growth and how well it translates into profits will leave investors unsatisfied . Excluding acquisitions, Lakeland Industries’ organic revenue growth was just 7% YoY in fiscal 2025. In other words, without costly acquisitions, Lakeland Industries’ “high-growth” story is less appealing.

A company can buy revenue via acquisitions, and if it does so at a bad price, it destroys shareholder value in the process. We’ve long highlighted the issues with overpaying for acquisitions, and since late 2023, Lakeland Industries has acquired:

- Pacific Helmets NZ Limited for $6 million,

- Jolly Scarpe S.p.A. and Jolly Scarpe Romania S.R.L. for $9 million,

- Fire and rescue business of LHD Group Deutschland GmbH for $15 million, and

- Veridian Limited for $26 million.

Since fiscal 3Q24 (quarter end October 2023), right before the first acquisition, Lakeland Industries’ TTM revenue increased from $122 million to $167 million in the TTM ended fiscal 4Q25. However, the company’s NOPAT declined from $4.3 million to $0.2 million over the same time.

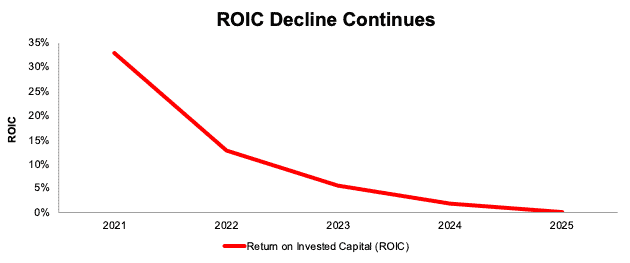

Worse yet, the company’s return on invested capital (ROIC), which measures how much profit a company generates for every dollar invested into the business, has fallen from 3.5% in the TTM ended fiscal 3Q24 to 0.1% in the TTM ended fiscal 4Q25. See Figure 2.

In other words, the acquisitions did more damage than good to the business. ROIC has been falling since fiscal 2022, even as the top-line increased.

Figure 2: Lakeland Industries’ ROIC: Fiscal 2021 – 2025

Sources: New Constructs, LLC and company filings.

Acquisitions Dilute Existing Investors and Increase Debt Burden

Not only did the acquisitions sink the company’s ROIC, but they were also financed through debt, mainly the company’s revolving credit facility.

After drawing down on its credit facility to pay for the acquisition, Lakeland Industries issued over 2 million shares in January 2025, which after expenses, raised $46 million for the company. This cash was used to pay down the company’s revolving credit facility, though not in its entirety. All told, these transactions:

- increased shares outstanding from 7.4 million in fiscal 2024 to 9.5 million in fiscal 2025

- increased total debt from $13 million in fiscal 2024 to $33 million in fiscal 2025

Meanwhile, cash and equivalents on the company’s balance sheet declined from $25 million in fiscal 2024 to $17 million in fiscal 2025.

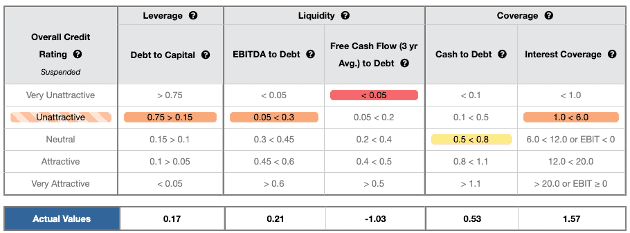

With an increase in total debt and a decrease in cash on hand (more on that later), Lakeland Industries currently earns an Unattractive overall Credit Rating, with an Unattractive-or-worse rating in four of the five credit rating criteria. See Figure 3.

Figure 3: Lakeland Industries’ Credit Rating Details

Sources: New Constructs, LLC and company filings.

Even After Acquisitions, Still a Small Player in the Fire Market

Each of the businesses noted above manufacture firefighter protective equipment and showcase Lakeland Industries’ focus on growing its fire business. Lakeland Industries’ management believes firefighter safety equipment provides strong growth opportunities because it is:

- highly fragmented, with only one competitor having more than 10% market share according to the company,

- a higher-margin business, and

- less subject to economic cycles as municipal budgets require annual spending and replenishment.

To its credit, Lakeland Industries has grown it fire related revenue from $9 million (8% of revenue) in fiscal 2020 to $63 million (38% of revenue) in fiscal 2025. The growth in the segment is driven by the acquisitions noted above.

However, Lakeland Industries has a long way to go to become one of the major players in the fire services market. Based on the size of the firefighter PPE market in 2024, Lakeland Industries, with $67 million in fire related revenue in fiscal 2025, holds just 3% market share.

The highly fragmented nature of the market, while certainly creating a growth opportunity, also means companies are in constant competition with one another. Serving municipal governments, with limited budgets, can also mean a race to the bottom when bidding for potential contracts. Both factors make it more difficult to improve margins while also growing the business. Unfortunately for investors, Lakeland Industries’ stock price already embeds expectations for both margin improvement and huge revenue growth, as we’ll show below.

Already Lagging Competitors

Lakeland Industries’ biggest competition comes from larger companies that have more financial resources to spend on product innovations and technological advancements. More specifically, many possess a more comprehensive PPE lineup and/or other business segments that generate significant cash flows. This cash is an advantage and can be reinvested to enhance or scale competing PPE products and make it that much more difficult for a smaller player, like Lakeland Industries, to complete. The company specifically notes in its 10-K, that the barriers to entry in the disposable and reusable garments and glove market are relatively low.

Some of the largest competitors include:

- Dupont De Nemours (DD)

- Ansell (ANSLY)

- MSA Safety (MSA)

- 3M (MMM).

It’s worth noting that other large firms have recently exited the PPE business. Kimberly-Clark (KMB) sold its PPE business to Ansell in 2024, while Honeywell (HON) reached an agreement to sell its PPE business to Protective Industrial Products (owned by private equity firm Odyssey Investment Partners), with the deal expected to close in the first half of 2025. Companies tend not to exit businesses when they are good.

Lakeland Industries also faces competition from more specialized manufacturers including Bullard, Fire-Dex, Seyntex, Iturri Group, and Lion Protects.

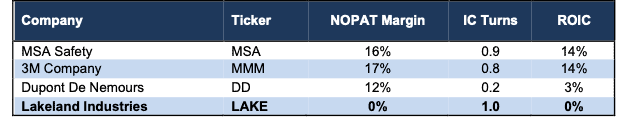

In other words, taking share while improving margins will remain a challenge moving forward in such a competitive industry. Over the TTM, the company already has the lowest NOPAT margin and ROIC out of its publicly traded peers. See Figure 4.

The company’s NOPAT margin fell from 20% in fiscal 2021 to 0% in fiscal 2025, while its invested capital turns fell from 1.7 to 1.0 over the same time. Falling NOPAT margins and invested capital turns drive Lakeland Industries’ ROIC from 33% in fiscal 2021 to 0% in fiscal 2025.

Figure 4: Lakeland Industries’ Profitability Vs. Peers: TTM

Sources: New Constructs, LLC and company filings.

Lack Of Scale

Lakeland Industries has built a name in the global PPE market, with operations, including manufacturing and distribution, around the globe, but it remains a small player in a large market. Most of the segments within the broader PPE industry are highly fragmented, with no one single company that dominates in all segments.

Overall, Lakeland Industries fiscal 2025 revenue accounts for just 0.2% market share in the global PPE market.

For comparison, 3M’s PPE business accounts for 3.8% and MSA Safety accounts for 2.1% of the global PPE market.

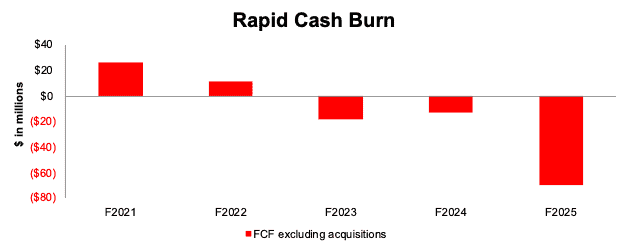

Cash Burn Is Getting Worse

Lakeland Industries generated an all-time high (dating back to fiscal 1996) free cash flow (FCF) of $26 million in fiscal 2021. However, recent years have seen record lows.

Lakeland Industries’ FCF has been negative on an annual basis over each of the last three fiscal years. From fiscal 2021 through fiscal 2025, Lakeland Industries has burned through a cumulative $64 million (36% of enterprise value) in FCF excluding acquisitions. See Figure 5.

Figure 5: Lakeland Industries’ Free Cash Flow: Fiscal 2021 – Fiscal 2025

Sources: New Constructs, LLC and company filings.

Nearing Zombie Status

Lakeland Industries doesn’t qualify as a Zombie Stock because it has a positive interest coverage ratio. However, the company is burning cash at a Zombie Stock-like rate. The company can only support its fiscal 2025 FCF burn for less than three months from January 2025, based on its cash on hand at the end of fiscal 2025.

It could only support its 2-year average FCF burn for five months from the end of January 2025.

Without a large turnaround in the business, additional share issuances or capital raises could be necessary.

Weak Internal Controls Are Another Big Red Flag

Even after we adjust the company’s numbers to get the truth about its profits, we don’t know if we can trust the financials because the company’s auditor identified a material weakness in internal control over financial reporting in fiscal 2025.

Specifically, the weakness in internal controls related to Lakeland Industries’ “controls over the completeness and accuracy of the company’s foreign reporting packages which are the basis preparation of our consolidated financial statements”.

The company’s management is enacting multiple solutions to remediate the weakness in internal control, including the implementation of an enterprise resource planning (ERP) system, establishing a technology committee, and migrating substantially all of the company’s operations to a common accounting system and utilizing a common chart of accounts.

Management has not completed and tested all of these remediation efforts to determine if the weakness in internal controls has in fact been remediated.

Investors should be wary of this disclosure, because weaknesses in internal controls increase the risk that the company’s financials are fraudulent and/or misleading.

Risk of Manufacturing in China Is Growing

The majority of Lakeland Industries’ products are manufactured in Vietnam and China, which could spell trouble as the ongoing tariff/trade war continues.

Lakeland Industries discloses in its fiscal 2025 10K that it has operations in 16 foreign countries, and that the risks of doing business in foreign countries “could affect our ability to manufacture or sell our products, obtain products from foreign suppliers, or control the costs of our products.”

The good news for the company is that 60% of its sales in fiscal 2025 were in geographies outside the U.S. However, that leaves potentially 40% of sales caught up in the ongoing trade war, which could have material consequences for global manufacturers like Lakeland Industries.

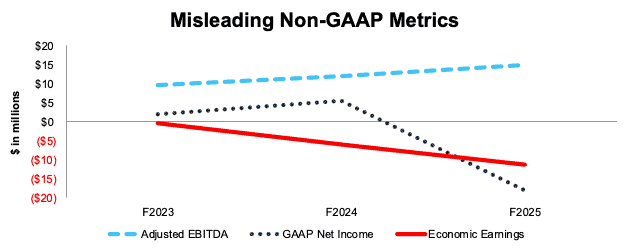

Don’t Fall for the Non-GAAP Metrics Either

Lakeland Industries’ preferred metrics are misleading, especially in the last three fiscal years. From fiscal 2023 to fiscal 2025 the company’s Adjusted EBITDA improved from $10 million to $15 million, while its GAAP net income fell from $2 million to -$18 million. Over the same time, the company’s economic earnings, the true cash flows of the business, fell from $0 million to -$11 million.

It is a big red flag when the company’s preferred non-GAAP metric is rising while its economic earnings and GAAP net income are both declining.

Figure 6: Lakeland Industries’ GAAP Net Income vs. Economic Earnings vs. Adjusted EBITDA

Sources: New Constructs, LLC and company filings.

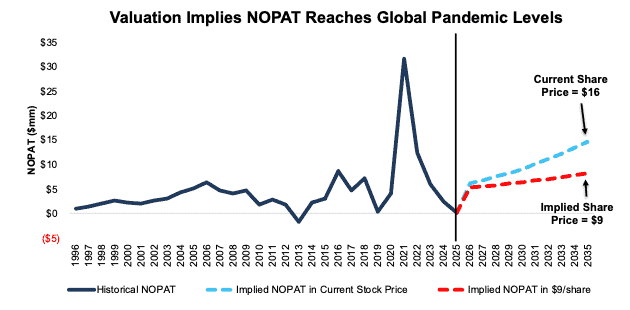

Valuation Implies Lakeland Industries Will Grow Twice as Fast as the Industry

Below, we use our reverse discounted cash flow (DCF) model to analyze the future cash flow expectations baked into Lakeland Industries’ stock price. Lakeland Industries’ stock is priced as if it will more than double its record high revenue and grow profits to levels only seen during a global pandemic. We also present an additional DCF scenario to highlight the downside risk in the stock if Lakeland Industries fails to achieve these overly optimistic expectations.

To justify its current price of $16/share, our model shows Lakeland Industries would have to:

- improve its NOPAT margin to 3.4% (equal to the 10-year average prior to COVID and above Lakeland Industries’ 0.1% fiscal 2025 and 1.9% fiscal 2024 NOPAT margin) and

- grow revenue by 10% compounded annually (2x projected PPE industry growth through 2033 and 2x projected firefighter PPE industry growth through 2032) for the next decade.

In this scenario, Lakeland Industries would generate $434 million in revenue in fiscal 2033, which is 2.6x the company’s all-time high revenue from fiscal 2025. The company would also grow revenue faster than its organic revenue growth rate in fiscal 2025.

This scenario also implies Lakeland Industries’ NOPAT grows 55% compounded annually over the next decade to reach $15 million in fiscal 2035, which would be the company’s second highest NOPAT (dating back to 1996) compared to $0.2 million NOPAT in fiscal 2025. Contact us for the math behind this reverse DCF scenario.

For context, prior to COVID (fiscal 2021) the highest NOPAT the company had achieved was $9 million in fiscal 2016. In other words, in order to justify its current stock price, Lakeland needs to grow profits to levels only achieved during a global pandemic.

44%+ Downside If Revenue Grows at Projected Industry Growth Rate

If we instead assume Lakeland Industries:

- immediately improves NOPAT margin to 3% (still above Lakeland Industries’ 0.1% fiscal 2025 and 1.9% fiscal 2024 NOPAT margin) and

- grows revenue by 5% (projected industry growth) compounded annually each year through fiscal 2035, then

the stock would be worth $9/share today – a 44% downside to the current price. Contact us for the math behind this reverse DCF scenario.

In this scenario, Lakeland Industries would grow revenue to $272 million in fiscal 2035, which would be 1.6x the company’s fiscal 2025 revenue. This scenario also implies Lakeland Industries grows NOPAT 47% compounded annually over the next decade to the company’s fourth highest NOPAT in its history.

Figure 7 compares Lakeland Industries’ implied future NOPAT in these scenarios to its historical NOPAT.

Figure 7: Lakeland Industries’ Historical and Implied NOPAT: DCF Valuation Scenarios

Sources: New Constructs, LLC and company filings.

Stock Is Not Worth $1

Each of the above scenarios assumes Lakeland Industries grows revenue, NOPAT and FCF while invested capital grows just 1% compounded annually. This assumption is highly unlikely but allows us to create best-case scenarios that highlight the unrealistically high expectations embedded in the current valuation.

For reference, Lakeland Industries’ invested capital grew 18% and 10% compounded annually in the last five and ten years, respectively. If we assume Lakeland Industries’ invested capital increases at a similar rate in the DCF scenarios above, the downside risk is even larger.

Given that the performance required to justify its current price looks overly optimistic, we dig deeper to see if Lakeland Industries is worth buying at any price. The answer is no.

The company has $33 million in total debt and only $9 million excess cash. Lakeland Industries has an economic book value, or no-growth value, of -$2/share. In other words, we do not think equity investors will ever see $1 of economic earnings under normal operations, which means the stock would be worth $0 today.

Stupid Money Risk is the Best Hope

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and buys Lakeland Industries at the current, or higher, share price despite the stock being overvalued. Given our analysis above, the only plausible justification for LAKE trading at its current price is the expectation that another firm will buy it.

However, we think potential acquirers would need a significant discount from current prices to consider acquiring Lakeland Industries.

Stranger things have happened than firms being acquired at unnecessarily high premiums to their intrinsic value. Below, we quantify how high the acquisition hopes priced into the stock are.

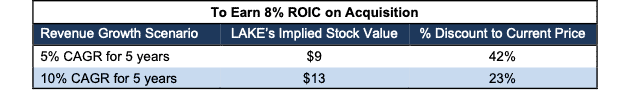

Walking Through the Acquisition Math

First, investors need to know that Lakeland has $33 million (21% of market cap) in total debt that makes it more expensive than the accounting numbers would initially suggest.

After adjusting for all liabilities, we can model multiple purchase price scenarios. For this analysis, we chose MSA Safety as a potential acquirer of Lakeland, given its existing presence in the firefighting equipment market. While we chose MSA Safety, analysts can use just about any company to do the same analysis. The key variables are the weighted average cost of capital (WACC) and ROIC for assessing different hurdle rates for a deal to create value.

Even in the most optimistic of acquisition scenarios, Lakeland is worth less than its current share price if MSA Safety cares about shareholder value.

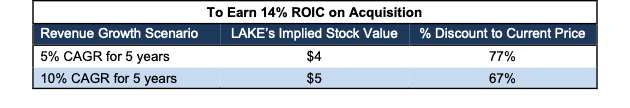

Figures 8 and 9 show what we think MSA Safety should pay for Lakeland Indsustries to ensure it does not destroy shareholder value. There are limits on how much MSA Safety should pay for Lakeland Industries to earn a proper return, given the NOPAT or free cash flows being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In the first scenario, we use 5% revenue growth in each year through fiscal 2030, or the projected industry growth rate. In the second scenario, we use 10% revenue growth in each year through fiscal 2030, or two times the projected industry growth rate. We use the higher estimates in scenario two to illustrate a best-case scenario where we assume Lakeland Industries could grow organic revenue faster while being integrated within MSA Safety’s existing larger business.

We optimistically assume Lakeland Industries achieves a 4% NOPAT margin, which is above its pre COVID 10-year average of 3.4%.

We also optimistically assume that MSA Safety can grow Lakeland Industries’ revenue and NOPAT without spending any working capital or fixed assets beyond the original purchase price.

Figure 8: Implied Acquisition Prices for Value-Neutral Deal – Scenario 1

Sources: New Constructs, LLC and company filings

Figure 8 shows the implied values for Lakeland Industries assuming MSA Safety wants to achieve an ROIC on the acquisition that equals its WACC of 8%. This scenario represents the minimum level of performance required not to destroy value. Even if Lakeland Industries can grow revenue by 10% compounded annually for five years and achieve a 4% NOPAT margin, the company would still be worth less than the current share price. However, it’s worth noting that any deal that only achieves an 8% ROIC would not be accretive, as the return on the deal would equal MSA Safety’s WACC.

Figure 9: Implied Acquisition Prices to Create Value – Scenario 2

Sources: New Constructs, LLC and company filings

Figure 9 shows the implied values for Lakeland Industries assuming MSA Safety wants to achieve an ROIC on the acquisition that equals 14%, its current ROIC. Acquisitions completed at these prices would be accretive to MSA Safety’s shareholders. Even in this best-case growth scenario, the implied value is far below Lakeland Industries’ current price. Without significant increases over the margin and/or revenue growth assumed in this scenario, an acquisition of Lakeland Industries at its current price is value neutral at best and destroys significant shareholder value at worst.

Earnings Misses Could Send Shares Falling

Lakeland Industries has missed earnings estimates in each of the past five quarters, and 7 of the past 10 quarters. Doing so again, especially after acquiring numerous businesses and revenue sources could send shares even lower.

Furthermore, additional clarity on tariffs, particularly that negatively impact products from China and Vietnam, could have an adverse impact on the company’s business, and therefore its stock price.

What Noise Traders Miss with LAKE

These days, fewer investors pay attention to fundamentals and the red flags buried in financial filings. Instead, due to the proliferation of noise traders, the focus tends toward technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary for noise traders when analyzing Lakeland Industries:

- it is running out of cash,

- intense competition that has greater resources,

- already lagging market share in its key markets,

- valuation that implies profits reach global pandemic levels.

Executive Compensation Plan is Not Creating Shareholder Value – Though it Should Be

Lakeland Industries’ executives receive both short-term cash incentives and long-term equity awards. The short-term incentives are tied to revenue growth, EBITDA margin, and free cash flow margin goals.

Long-term equity awards are tied to revenue growth, EBITDA margin, and return on invested capital. Despite using ROIC as an incentive to long-term awards, management still undertook the value destructive acquisitions noted above, likely because revenue growth and EBITDA margin are more heavily weighted when determining bonuses.

Using revenue growth and EBITDA margin diminishes the positive impact of including ROIC in compensation plans. Putting more emphasis on ROIC would ensure that executives’ interests are more aligned with shareholders’ interests as there is a strong correlation between improving ROIC and increasing shareholder value.

Despite including ROIC in its executive compensation plan, Lakeland Industries’ ROIC fell from 33% in fiscal 2021 to 0% in fiscal 2025.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have bought ~163,000 shares and have sold ~21,000 shares for a net effect of ~142,000 shares purchased.

There are currently 162,000 shares sold short, which equates to 2% of shares outstanding and around two days to cover.

Unattractive Funds That Hold LAKE

There are no funds that receive our Unattractive-or-worse rating and allocate significantly to LAKE.

This article was originally published on April 28, 2025.

Disclosure: David Trainer, Kyle Guske II, and Hakan Salt receive no compensation to write about any specific stock, sector, style, or theme.

Questions on this report or others? Join our online community and connect with us directly.