Free Cash Flow And FCF Yield

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Here’s proof from some of the most respected public & private institutions in the world.

Free cash flow (FCF) equals the amount of cash free for distribution to all stakeholders. Think of free cash flow as the real dividend that a company could pay investors as well as a truer proxy for the profitability of a business. Not surprisingly, many of the world’s top investors focus on free cash flow when picking stocks.

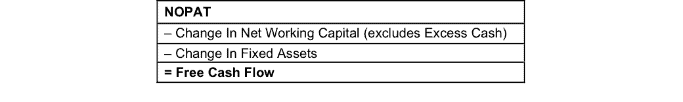

There are many ways to calculate free cash flow. Most approaches are short cuts to a more comprehensive approach to the calculation. Our formula for FCF is in Figure 1.

Figure 1: How to Calculate Free Cash Flow

NOPAT – Change In Invested Capital

Or

Sources: New Constructs, LLC and company filings

As with all things in life, building a solid investment strategy around Free Cash Flow (FCF) is not as simple as it may seem. While it is obvious that companies with larger and growing FCF should fetch higher valuations, making money with that strategy requires a bit more work.

Here are 3 rules to follow when building an investment strategy that uses FCF.

This paper compares our analysis on a mega cap company to other major providers.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on importance of ROIC and how to calculate it.

Get our report on "ROIC: The Paradigm For Linking Corporate Performance to Valuation."