We published an update on SFM on Nov 10, 2021. A copy of the associated Earnings Update report is here.

There’s no doubt grocery stores benefitted from COVID-19 and the resulting changes in consumer behavior. Last month industry sales were up 10% year-over-year (YoY). However, with the recent news of an effective vaccine for COVID-19, investors are cycling their money away from many stocks that have outperformed over the past several months. With future expansion plans, a strong brand, and a competitive position in a niche market, investors would be mistaken to move away from this growing grocer.

Sprouts Farmers Market, Inc. (SFM: $20/share) is this week’s Long Idea.

This stock offers excellent risk/reward based on Sprouts’:

- Strong growth opportunities for same stores and new stores

- Sharp focus on its target customers and expanding margins

- Successful execution of its ecommerce strategy

- “Fresh, healthy, and natural” offering that conventional grocers struggle to replicate

- Stock trading as if profits will permanently decline by 20% from TTM levels

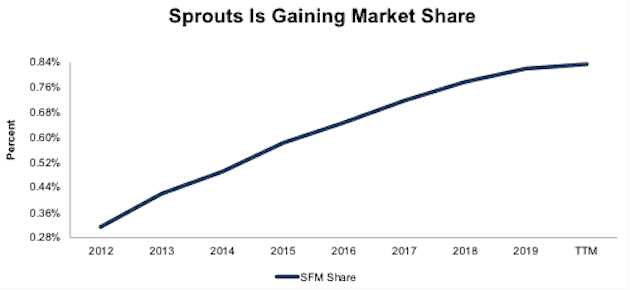

Gaining Market Share in a Competitive Industry

In spite of ample competition, Sprouts has grown revenue faster than the industry. The firm’s market share improved from just 0.3% total U.S. grocery sales in 2012 to 0.8% TTM.

Figure 1: Sprouts’ Market Share of U.S. Grocery Stores Market

Sources: New Constructs, LLC, company filings, and FRED.

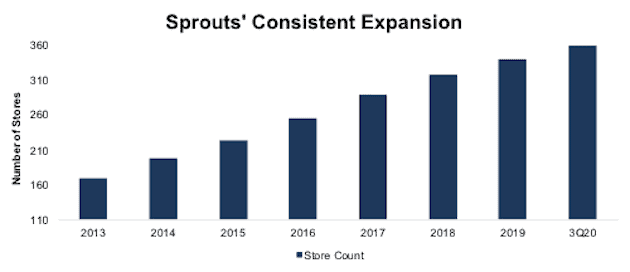

Sprouts’ market share gains come from aggressively opening new stores. Per Figure 2, the firm has more than doubled its store count from 170 in 2013 to 360 in 2020. Sprouts opened 20 stores in 2020 and expects to open two more before the end of the year.

Expansion opportunities are plentiful moving forward as well, which provide additional runway for revenue and profit growth. The firm currently operates in only 23 states, with 70% of stores in four states, California, Texas, Arizona, and Colorado at the end of 2019.

In 2021, the firm expects to open ~20 stores and two new distribution centers (DCs) that will support further growth. Over the next five years, the firm plans to expand its store count 10% per year on the way to 300 to 400 new stores in its primary expansion markets of California, Texas, Georgia, Florida, and the Mid-Atlantic.

Figure 2: Sprouts’ Store Count Since 2013

Sources: New Constructs, LLC and company filings.

Sprouts’ smaller stores position it to more cheaply and easily enter markets too small for the larger format stores. While most of the firm’s growth has been in the West, the South and the Southwest, the smaller store format should work even better in the more densely-populated areas where it plans to expand, such as Georgia, Florida and the Mid-Atlantic market.

Sprouts’ same store sales are also a consistent driver of revenue growth, as the company has grown its same store sales for 54 consecutive quarters.

In fact, since 2015, Sprouts has grown its same store sales YoY by an average of 2.9%. For comparison, Publix, Kroger (KR), and Albertsons (ACI) grew same store sales YoY by an average of 2.7%, 2.1%, and 1.2% respectively over the same time.

Healthy Eating Tailwinds Will Push Sales Higher

While the boost in grocery sales due to COVID-19 may not last forever, consumers’ eating habits are moving toward fresher, healthier, and more natural foods over the long term. Global market research firm Technavio expects the global health and wellness food market to grow by 6% compounded annually from 2020 to 2024. Additionally, the global organic foods market is projected to grow nearly 11% compounded annually from 2019 to 2025.

The rise in popularity of health and organic foods is a long-term tailwind for Sprouts growth.

Ecommerce Sprouts Profit Growth Too

Before the pandemic, online grocery sales accounted for 4.3% of total U.S. grocery sales. During the pandemic, the share of online grocery sales has increased to 10%. While Walmart (WMT) and Amazon (AMZ) are the online grocery share leaders, Sprouts is doing more than holding its own. The firm’s 3Q20 ecommerce sales increased 337% YoY and now comprise of 11% of the firm’s total sales.

In addition to providing curbside and delivery service from orders made through its app and website, Sprouts used the pandemic as an opportunity to accelerate its plan to shift from print ads to digital ads. Digital ads help the firm reach more customers in a more targeted fashion than it can with print flyers. In 3Q20, Sprouts’ weekly digital ads generated 70 million confirmed views compared to the 21 million printed flyers it was previously distributing on a weekly basis. The shorter lead time required for creating digital ads also means the firm can be more dynamic in packaging offers and build more profitable promotions. More effective advertising helps Sprouts promote its differentiated value proposition, be more profitable, and grow faster.

A Healthy Strategy Attracts More Customers

Even though Sprouts’ share of the $166 billion natural foods market is just 4%, many fear that the increase in conventional grocers' health-centric products might prove to be too much competition for Sprouts, as it was for smaller natural foods-focused grocers, Lucky’s Market and Earth Fare. Both firms filed for bankruptcy at the beginning of the year. However, even with the rise of healthier options in conventional grocery stores, Sprouts has grown and taken market share because conventional stores are unable to match it’s “fresh, healthy, and natural” value proposition.

Sprouts summarizes its strategy as providing “healthy living for less” and creates an atmosphere that appeals to health-conscious customers looking for fresh, natural food. Sprouts achieves this “healthy living” environment by devoting ~20% of its floorspace to produce at the center of its stores. Being known for superior for produce attracts more traffic to Sprouts stores.

One of the major scale advantages conventional grocers seek to achieve comes from supplying a wide variety of products to appeal to as much of the general population as possible. Sprouts’ focused approach, which leaves the aisles of Coca-Cola and Pepsi products to other stores, enables it to truly deliver a more “healthy living” environment for its target customers.

In 2019, Sprouts generated 58% of its revenue from perishable foods. For comparison, 32% of Kroger’s and 49% of Albertsons’ food-related revenue was generated from perishable foods over the same time. The disparate needs to which conventional stores must cater undermines their ability to replicate a health-focused, clean food atmosphere.

Hybrid Sourcing Model

A survey from a local food procurement firm, Forager, found that 80% of respondents were more likely to change where they shop if more local food were made available. The same survey also found that respondents were willing to pay up to 20% more for locally sourced food.

Sprouts uses a hybrid sourcing model that allows it to enjoy the cost benefits of scale while also delivering locally-sourced produce. It buys the bulk of its produce in large quantities from traditional outlets while sourcing specialty produce items locally. Sprouts’ smaller, more focused store models enable it to offer certain specialty items at quantities too small for more conventional grocers and deliver a uniquely fresh and local experience for shoppers.

Higher Margins

While customers are attracted to affordable, quality produce, Sprouts uses its “healthy living” brand to cross sell other higher margin products, many of which are not carried by conventional grocers, such as vitamins, oils, and natural beauty products that many conventional grocers do not carry. Sprouts has launched 3,500 of these unique new products already in 2020.

The firm’s higher-margin products make Sprouts’ more profitable than conventional grocers. In 2019, the firm’s net operating profit after-tax (NOPAT) per square foot was $22. For comparison, conventional grocer Kroger generated ~$13 of NOPAT/sq ft. Albertson’s generated between $8 and $11 of NOPAT/sq. ft in 2019 (Albertson’s provides a range of store sizes and does not reveal its total square footage).

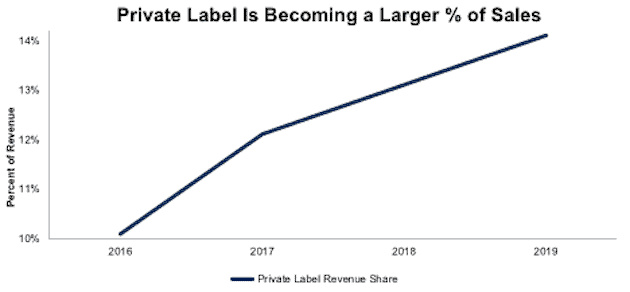

Sprouts’ private label business further differentiates its offerings from other grocers and contributes to higher margins. Per Figure 3, private label products accounted for 14% of all sales in 2019, up from 10% in 2016.

Figure 3: Sprouts’ Private Label Share of Revenue Since 2016

Sources: New Constructs, LLC and company filings.

Focus on Customer Experience and Efficiency Drives Further Margin Expansion

In light of increased competition, Sprouts’ management team recognizes the need to improve its customer service, brand, and operational efficiency as it grows into a larger organization. As the firm expands geographically, distribution challenges can hinder the delivery of perishable food items and harm its “fresh” brand. Currently, the firm’s distribution centers (DCs) are located up to 500 miles away from some of its stores. Sprouts plans to open three additional DCs by the end of 2022 and reduce the distance from DC to store to within 250 miles for a majority of stores.

In addition to expanding the number of DCs, the firm plans to run its stores more efficiently. Sprouts is shrinking the size of its new stores from a current 30,000 square foot layout to a 21,000 to 25,000 square foot layout. If the firm can drive the same level of sales from the smaller format, then Sprouts’ profit growth should be even better.

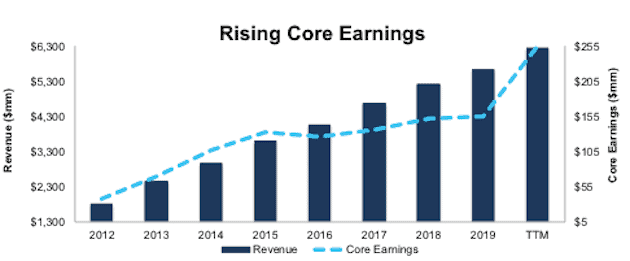

Sprouts’ History of Profit Growth

We noted Sprouts’ history of same store sales growth above, and that track-record translates to profit growth as well. Since 2012, Sprouts grew revenue by 16% compounded annually and core earnings[1] by 23% compounded annually, per Figure 4. The firm increased its core earnings margin from 2% in 2012 to 4% TTM.

Figure 4: Core Earnings & Revenue Growth Since 2012

Sources: New Constructs, LLC and company filings.

Sprouts rising profitability helps the business generate significant free cash flow (FCF). The company generated a cumulative $226 million (9% of market cap) in FCF over the past five years. Sprouts’ $232 million in FCF over the TTM period equates to a 6% FCF yield, which is higher than the Consumer Non-cyclicals sector average of 4%.

Sprouts’ Profitability Is Already Near the Top of Industry

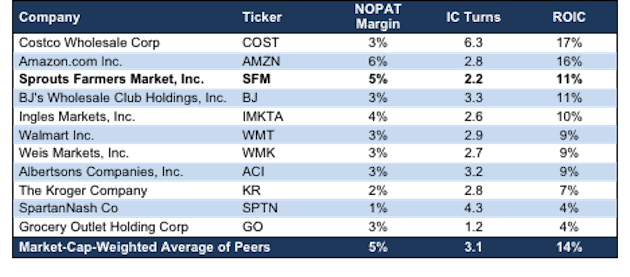

While Sprouts aims to improve its profitability in the future, through improved advertising, private label products, and more efficient stores, it already ranks near the top of peers: Amazon, Walmart Inc., Costco Wholesale Corp (COST), The Kroger Company, Albertsons Companies, Inc., BJ's Wholesale Club Holdings, Inc. (BJ), Grocery Outlet Holding Corp (GO), Weis Markets, Inc. (WMK), Ingles Markets, Inc. (IMKTA), and SpartanNash Co (SPTN).

While Sprouts’ invested capital turns of 2.2 is below the peer group average of 3.1, the firm’s 5% NOPAT margin ranks second to only Amazon, whose business extends well beyond groceries and ecommerce. Per Figure 5, Sprouts’ 11% return on invested capital (ROIC) is among the best and higher than conventional grocery stores.

Figure 5: Sprouts’ NOPAT Margin, IC Turns & ROIC vs. Peers

Sources: New Constructs, LLC and company filings.

SFM Is Undervalued

Despite the growth tailwinds and leading profitability, SFM now trades at a price equal to its three-year average[2] economic book value (EBV), the lowest in the history of our model (which goes back to 2012). With a three-year average price-to-economic book value (PEBV) ratio of 1.0, the market is giving Sprouts’ no credit for future growth. This expectation seems overly pessimistic since Sprouts has grown NOPAT by 16% compounded annually since 2012.

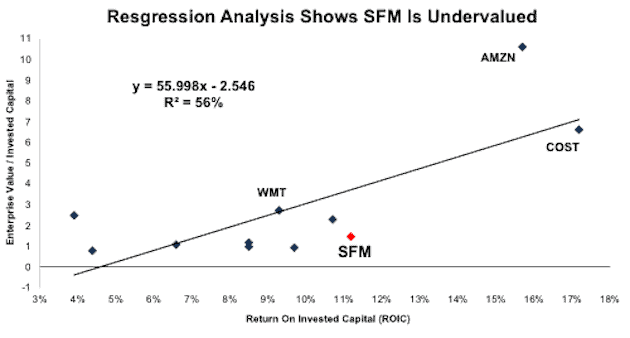

SFM is not only cheap compared to its past economic book value, but also relative to industry peers. Per Figure 6, ROIC explains 56% of the difference in valuation for 11 different grocers. SFM trades at a huge discount to the group as shown by its position below the trend line.

Figure 6: ROIC Explains 56% of Difference in Valuation for Grocers

Sources: New Constructs, LLC and company filings.

If the stock were to trade at parity with its peers, it would be worth $75/share – 273% above the current stock price.

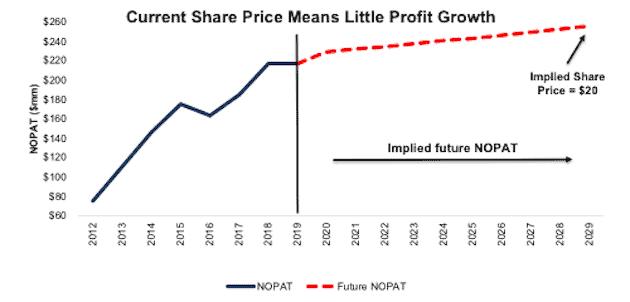

SFM’s Current Price Implies 20% NOPAT Decline from TTM Levels

Below, we use our reverse DCF model to quantify the cash flow expectations baked into Sprouts’ current stock price. Then, we analyze the implied value of the stock based on different assumptions about Sprouts’ future growth in cash flows.

Scenario 1: In this worst-case scenario, we assume:

- NOPAT margin falls to 4%, its three-year average (vs 5% over the TTM) and

- Revenue grows 1% compounded annually for ten years (compared to consensus estimate of 8% annual revenue growth from 2020 to 2023).

In this scenario, Sprouts’ NOPAT grows by just 2% compounded annually over the next 10 years, and the stock is worth $20/share today – equal to the current stock price. See the math behind this reverse DCF scenario.

Figure 7 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT. This worst-case scenario implies Sprouts’ NOPAT a decade from now will be just 18% above its 2019 NOPAT. For reference, the firm’s TTM NOPAT is 46% above the 2019 level shown in Figure 7. In other words, this scenario implies the increase in grocery sales due to COVID-19 will disappear, despite sales remaining elevated after states around the country re-opened. In any scenario better than this one, SFM holds significant upside potential, as we’ll show below.

Figure 7: Current Valuation Implies Lower Than Consensus Growth: Scenario 1

Sources: New Constructs, LLC and company filings.

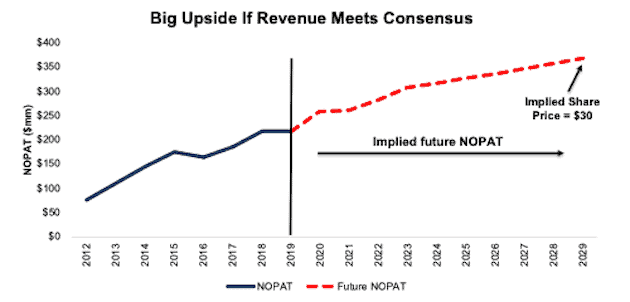

Scenario 2: Big Upside With Consensus Growth Rates

If Sprouts grows revenue at the rate of consensus estimates, the stock is worth much more than its current price. In this scenario we assume:

- NOPAT margin falls to 4%, its three-year average (vs 5% over the TTM) and

- Revenue grows at consensus estimates from 2020 to 2023 (8% per year) and grows at 3% a year thereafter.

In this scenario, Sprouts’ NOPAT grows by just 5% compounded annually over the next 10 years, and the stock is worth $30/share today – a 50% upside to the current stock price. See the math behind this reverse DCF scenario.

Figure 8 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 8: Significant Upside With Consensus Revenue Growth: Scenario 2

Sources: New Constructs, LLC and company filings

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Sprouts’ business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help Sprouts grow its market share over the long term:

- “Healthy living” image is difficult to replicate

- Sourcing relationships with small, local growers

- Smaller, more efficient stores that can serve areas unreachable by competitors

What Noise Traders Miss With Sprouts

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Significant tailwinds for healthy and locally-sourced foods

- Revenue growth from same stores and new stores

- Successful e-commerce strategy

- Valuation implies profits permanently decline by 20% from TTM levels

Catalysts: A Consensus Beat & Successful Strategy Execution

Sprouts beat EPS estimates in 10 of the past 12 quarters and doing so again could send shares higher, especially in the current economic environment.

According to Zacks, consensus estimates for the firm’s 2020 EPS on November 6, 2020 are $2.26/share. Jump forward to 2021, and EPS estimates are just $1.75/share. Should the firm exceed EPS expectations in 2021, investors could see there is plenty of room left for this firm to grow and send shares higher.

If Sprouts is successful in executing the next stage of its growth strategy, then investors may be convinced that the firm has plenty of runway ahead and increase their allocation to the stock accordingly.

Additionally, Sprouts’ relatively small size in the industry and success in a profitable and growing niche market make it a prime acquisition target for larger grocers.

Executive Compensation Could Be Improved

Sprouts compensates executives with cash bonuses and long-term equity awards. 75% of cash bonuses are tied to adjusted EBITDA targets while 25% are linked to comparable store sales growth performance.

In addition to cash bonuses, Sprouts’ executives receive performance shares linked to the firms’ EBIT.

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

On a positive note, the firm recognizes the importance of NOPAT and ROIC and reports these numbers in its financial filings. Management has stated that one of the firm’s goals is growing earnings while “expanding ROIC”. We commend Sprouts’ recognition on ROIC, but believe the firm should take it one step further, and tie ROIC (instead of adjusted EBITDA, revenue, and EBIT) to executive compensation, as there is a strong correlation between improving ROIC and increasing shareholder value.

Despite not using ROIC when rewarding performance, Sprouts’ compensation plan has not compensated executives while destroying shareholder value. Sprouts has grown economic earnings from $4 million in 2013 to $150 million TTM.

A Return of Share Repurchases Could Provide a Nice Yield

Sprouts neither pays a dividend nor has plans to pay one in the future.

Sprouts has returned capital to shareholders through share repurchases. Since 2015, Sprouts has repurchased $958 million (40% of market cap) worth of shares. As of 3Q20, Sprouts’ has no authorization available for further repurchases. Should the firm resume repurchases, shareholders could see a significant yield.

Insider Trading is Minimal and Short Interest is High

Over the past twelve months, insiders have bought a total of 221 thousand shares and sold 135 thousand shares for a net effect of 86 thousand shares purchased. These purchases represent less than 1% of shares outstanding.

There are currently 17.8 million shares sold short, which equates to 15% of shares outstanding and just under eight days to cover. Short interest is up 10% from the prior month. Positive results moving forward, as Sprouts continues its expansion plans, could send shares higher and result in a short squeeze.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Sprouts’ fiscal 10-Q’s and 10-K:

Income Statement: we made $111 million of adjustments, with a net effect of removing $68 million in non-operating expenses (1% of revenue). You can see all the adjustments made to Sprouts’ income statement here.

Balance Sheet: we made $202 million of adjustments to calculate invested capital with a net increase of $187 million. One of the largest adjustments was $176 million for operating leases. This adjustment represented 8% of reported net assets. You can see all the adjustments made to Sprouts’ balance sheet here.

Valuation: we made $1.8 billion of adjustments with a net effect of decreasing shareholder value by $1.8 billion. There were no adjustments that increased shareholder value. Apart from total debt which includes the operating leases noted above, one of the most notable adjustments to shareholder value was $55 million in deferred tax liabilities. This adjustment represents 2% of Sprouts’ market cap. See all adjustments to Sprouts’ valuation here.

Attractive Funds That Hold SFM

The following funds receive our Attractive-or-better rating and allocate significantly to SFM:

- First Trust Consumer Staples AlphaDEX Fund (FXG) – 3.3% allocation and Attractive rating

- BMO Low Volatility Equity Fund (MLVEX) – 2.5% allocation and Very Attractive rating

- Invesco Dynamic Food & Beverage ETF (PBJ) – 2.5% allocation and Very Attractive rating

- Shelton Core Value Fund (EQTKX) – 2.0% allocation and Attractive rating

This article originally published on November 11, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme. Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

[2] We utilized the override capability in our DCF model and replaced the TTM NOPAT value with the three-year average NOPAT to smooth out the impact of the TTM NOPAT growth caused by the COVID-19 pandemic. Doing so provides a more normalized measure of the firm’s profitability from which to analyze the firm’s no-growth value.