We published an update on this Danger Zone pick on May 10, 2021. A copy of the associated Earnings Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

This week’s Danger Zone pick, and micro-bubble loser is Spotify Technology (SPOT: $303/share), which we pair with undervalued peer Sirius XM (SIRI: $6/share), also a future Long Idea candidate.

New Micro-Bubble Loser: Spotify Technology vs. Undervalued Peer: Sirius XM

We first put Spotify in the Danger Zone in April 2018 prior to its IPO and, again, in September 2020 based on its expensive valuation amid rising competition in an increasingly commoditized industry. In this report, we highlight the disconnects in risk/reward between the two companies and their stocks:

- Spotify’s valuation is extremely rich while its business fundamentals[1] are very poor

- Sirius XM’s valuation is cheap while its business fundamentals are strong.

Cash Burner vs. Cash Earner

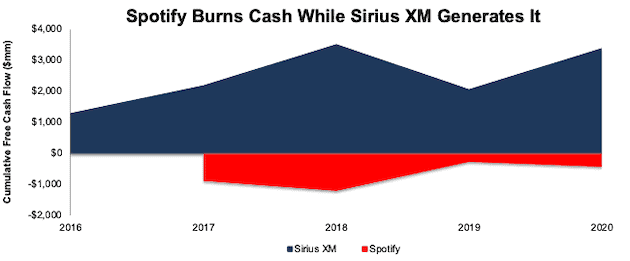

Spotify burned $432 million (1% of market cap) in cash from 2017 (earliest date in our model) through 2020. For comparison, Sirius XM generated $3.4 billion (14% of market cap) in cumulative free cash flow (FCF) from 2016 through 2020. Figure 1 compares Spotify’s cumulative FCF since 2017 compared to Sirius XM’s cumulative FCF since 2016.

Figure 1: Spotify vs. Sirius XM: Cumulative Free Cash Flow Since 2016

Sources: New Constructs, LLC and company filings.

Spotify’s Valuation Implies 3x Revenue of Sirius XM

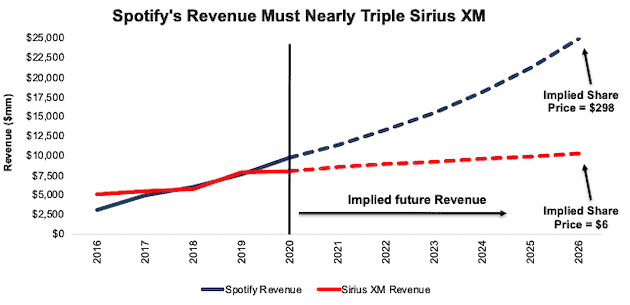

We use our reverse discounted cash flow (DCF) model to highlight the disconnect in the future revenue and profit growth expectations baked into Spotify’s and Sirius XM’s current stock prices.

To justify its current price of $303/share, Spotify must:

- immediately achieve a net operating profit after-tax (NOPAT) margin of 8% (up from its -0.3% 2020 NOPAT margin and half Netflix’s 2020 margin) and

- grow revenue by 17% (more than double industry growth rates through 2027) compounded annually through 2026.

In this scenario, Spotify’s revenue six years from now would reach $24.8 billion, or more than three times Sirius XM’s 2020 revenue. See the math behind this reverse DCF scenario.

Market expectations for Sirius XM’s revenue and profitability are much more pessimistic, and at $6/share assume:

- NOPAT margin falls to 14% (compared to 10-year average of 20% and 17% in 2020) and

- revenue grows just 4% compounded annually over the next six years.

In this scenario, Sirius XM’s revenue six years from now would be $10.2 billion, or 59% less than Spotify’s implied revenue in the scenario above. See the math behind this reverse DCF scenario.

Figure 2 illustrates the DCF scenarios above and contrasts the huge increase in revenue implied by Spotify’s valuation to the revenue implied by Sirius XM’s valuation.

Figure 2: Spotify vs. Sirius XM: Revenue Expectations vs. Historical Revenue

Sources: New Constructs, LLC and company filings.

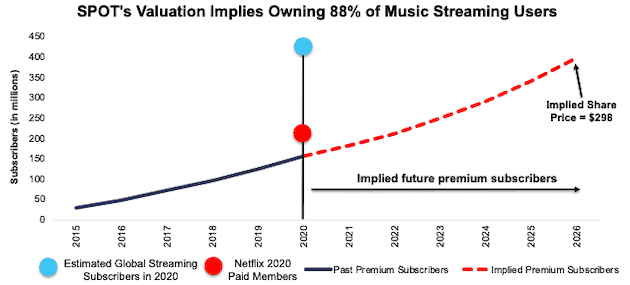

SPOT Valuation Implies It Will Own 88% of Market for Music Streaming Subscriptions

The expectations for $24.8 billion in revenue in 2026 baked into Spotify’s share price imply its premium subscribers will nearly triple, from 155 million in 2020 to 398 million by 2026[2], which would equal 88% of the current global music streaming subscriptions. 398 million is over six times Apple and Amazon’s music subscribers and nearly two times Netflix’s paid memberships. See Figure 3.

Figure 3: Spotify: Past Premium Subscribers vs. Implied Premium Subscribers

Sources: New Constructs, LLC, company filings, and Counterpoint Research

At its current conversion rate (more details below), this scenario reveals that Spotify’s total monthly active users (MAUs) in 2026 must be ~885 million to justify the current valuation. For reference, ~885 million MAUs nearly equals Instagram’s MAUs and is and more than double the MAUs of Twitter, Pinterest, and Snapchat.

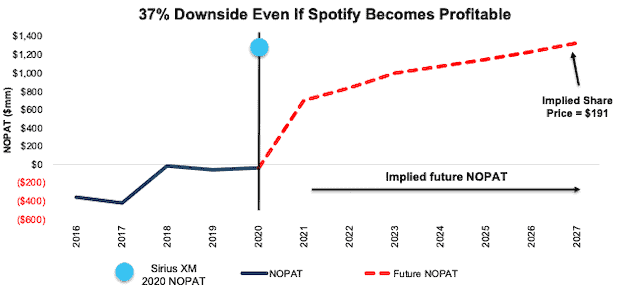

Significant Downside Even If Spotify Becomes Profitable

Spotify’s current economic book value, or no growth value, is just under $9/share or 97% below the current share price. But, let’s see what the price looks like if we give the firm credit for being able to grow into a profitable enterprise.

Even if Spotify can achieve a 6% NOPAT margin (above Amazon but below Sirius XM, which benefits from a near monopoly in satellite radio) and grow revenue by 13% compounded annually for the next seven years (in line with consensus revenue estimates from 2021-2023 and projected industry growth of 7% a year through 2027), the stock is worth just $191/share today – a 37% downside. See the math behind this reverse DCF scenario.

For reference, Spotify’s NOPAT in this scenario would reach $1.3 billion in 2027 (vs. -$34 million in 2020) or about the same as Sirius XM’s 2020 NOPAT. Figure 4 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 4: SPOT Has Large Downside Risk: DCF Scenario

Sources: New Constructs, LLC and company filings.

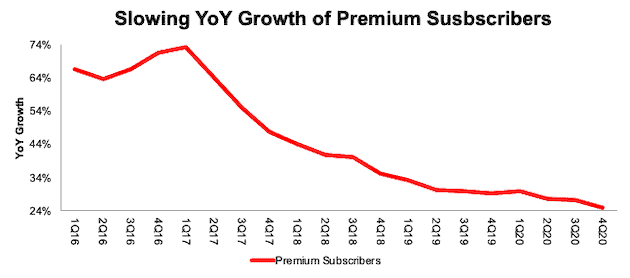

Growth of Premium Subscribers is Slowing…

There remain many obstacles to Spotify justifying the expectations implied by its stock price, starting with slowing growth of premium subscribers. While Spotify generates some revenue from advertisements, premium subscribers remain most important to the firm’s top and bottom lines. In 2020, 91% of revenue came from premium subscribers. However, per Figure 5, the year-over-year (YoY) growth rate in premium subscribers has fallen sharply from 73% in 1Q17 to 25% in 4Q20.

Figure 5: Spotify’s Premium Subscribers Growth: 1Q16 through 4Q20

Sources: New Constructs, LLC and company filings.

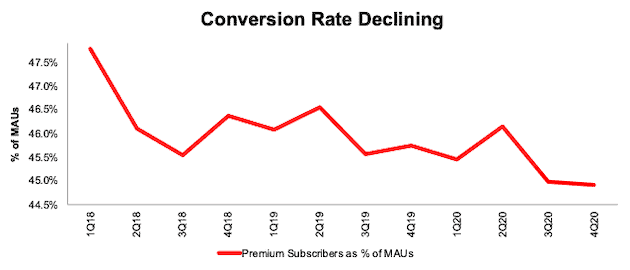

…As Spotify Converts Fewer Free Subscribers to Premium

With increased competition, not only from other audio streaming services, but any service that consumers dedicate their attention to (streaming games, streaming movies, social media, etc.), the percent of premium subscribers as a percent of monthly active users (MAUs) is in decline. In other words, Spotify is successfully signing up more users to the service, but it’s not converting them to premium subscribers as well as it has in the past.

Figure 6: Spotify’s Premium Subscribers as Percent of MAUs: 1Q18 through 4Q20

Sources: New Constructs, LLC and company filings.

Spotify Has No Scale Advantages…

The more users on Spotify, the more royalties it has to pay to the music labels. The firm achieves no scale under its contract with the labels because royalties payments are based on a percentage of revenue and/or users & usage.

To illustrate this lack of scale, we can compare Spotify’s revenue growth vs. royalty payment growth. In 2019, Spotify’s revenue increased 29% YoY while royalty payments increased by 30%. In 2020, revenue grew by 17%, the same as royalty payments.

There is no sliding scale, and the business has no economies of scale unless it can cut other operating expenses, like marketing. Cutting marketing expense will undermine its ability to acquire more paying customers and achieve the huge growth expectations baked into its current valuation.

Spotify has little leverage to negotiate lower royalty payments with the major record labels.

…And Lacks Differentiation

Not owning the majority of the content on its platform[3] means Spotify, and any other streaming service, lacks differentiation, as services offer mostly the same content. For example, Spotify offers over 50 million songs in its catalog while Apple Music, Amazon Music, and YouTube Music each offer 60 million songs.

Each of these services are heavily dependent on the Big Three labels for their music content, and apart from playlists or curation capabilities, each offer the ability to stream music through different devices. Undifferentiated businesses, like Spotify, don’t generate high margins, especially when competition can offer its product for free or as a loss leader.

Exclusive Content Could Be Another Dead End

In an attempt to distinguish itself from competition, Spotify is following in the footsteps of Netflix by offering exclusive, largely podcast content, which can be an increasingly costly strategy.

While the firm has spent big bucks to procure exclusive podcast content, this expensive content only serves a minority of its user base. In the firm’s 4Q20 earnings call, CEO Daniel Ek noted that a quarter of total users are podcast users. The firm needs a lot more paying users for exclusive content before it can get close to turning a profit on that expensive investment.

Deeper-pocketed competitors, like Amazon and Apple, are also actively expanding into podcasts, which diminishes the differentiation Spotify can achieve. Amazon launched support for podcasts through Amazon Music in September 2020 and acquired podcast company Wondery in December 2020. The firm also already owns Audible, which offers its own exclusive podcasts. In January 2021, Bloomberg reported that Apple is working on a subscription service for podcasts that would be part of a push to fund new original podcasts.

While the expansion into podcasts and exclusive content by these tech giants may support Spotify’s strategy, it also means the podcast industry is just as competitive as the music industry, where Spotify has yet to turn a profit.

Competitors’ Substitutes Crush Pricing Power

The greatest threat to Spotify’s ability to justify the valuation of its stock is competitors’ ability to offer music streaming for much cheaper or free.

Firms such as Apple (AAPL), Amazon (AMZN), and YouTube [owned by Alphabet (GOOGL)] offer cheaper streaming services as loss-leaders to acquire customers on which they can earn a profit from the other services they offer.

Spotify has only one way to monetize subscribers so it needs to charge more to make a profit.

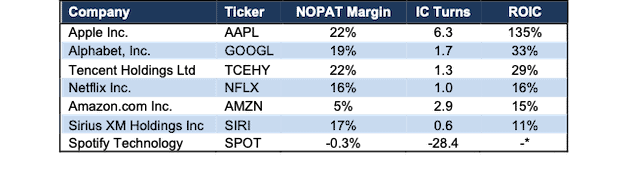

Lack of Profitability Makes It More Unlikely to Best Competition

It should come as no surprise, given above, that Spotify’s net operating profit after-tax (NOPAT) margin of -0.3% is worst among its competition and even video streaming provider Netflix. The firm earns a bottom-quintile return on invested capital (ROIC) because it earns negative NOPAT and has negative invested capital. See Figure 7.

Figure 7: Spotify’s Profitability Lags Major Competitors

Sources: New Constructs, LLC and company filings.

*Spotify’s ROIC ranks in the bottom-quintile of firms under coverage because it has negative NOPAT and negative invested capital.

Keep These Winners & Sell These Losers

Spotify isn’t the only micro-bubble loser. We believe the micro-bubble winners will outperform micro-bubble losers going forward, especially because the expectations implied by the micro-bubble winner’s valuations are much less than those of the micro-bubble losers. Figure 8 lists all of our micro-bubble winners and micro-bubble losers.

Figure 8: Micro-Bubble Winners & Micro-Bubble Stocks

| Micro-Bubble Winners | Micro-Bubble Losers | Report Date |

| General Motors Co (GM) | Tesla Inc (TSLA) | 2/18/21 |

| Kellogg Company (K) | Beyond Meat Inc. (BYND) | 2/16/21 |

| Hyatt Hotels Corp (H) | Airbnb, Inc. (ABNB) | 2/10/21 |

| Williams-Sonoma Inc. (WSM) | Wayfair, Inc. (W) | 2/3/21 |

| Sysco Corporation (SYY) | DoorDash, Inc. (DASH) | 1/27/21 |

| Alphabet, Inc. (GOOGL) | GoDaddy Inc (GDDY) | 9/26/18 |

| Microsoft Corporation (MSFT) | Dropbox Inc. (DBX) | 9/26/18 |

| The Walt Disney Company (DIS) | Netflix Inc. (NFLX) | 8/16/18 |

| Oracle Corporation (ORCL) | Salesforce.com Inc. (CRM) | 8/16/18 |

| Walmart, Inc. (WMT) | Amazon.com Inc. (AMZN) | 8/16/18 |

Sources: New Constructs, LLC and company filings.

This article originally published on March 1, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Only our “novel database” enables investors to overcome the inaccuracies, omissions and biases in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, a forthcoming paper in The Journal of Financial Economics written by professors at Harvard Business School (HBS) & MIT Sloan.

[2] We calculate the implied number of premium subscribers by dividing the implied premium revenue of $22.6 billion (or 91% of implied total revenue) by $57, which equals Spotify’s revenue per premium user (2020 premium revenue divided by premium users at the end of 2020).

[3] Music licensed to Spotify by Universal Music Group, Sony Music Entertainment, Warner Music, and Music and Entertainment Rights Licensing Independent Network accounted for 78% of music streams on Spotify in 2020.