We closed this position on August 14, 2019. A copy of the associated Position Update report is here.

Many stocks were punished in the recent market selloff and saw their share prices fall much more than the overall market. This firm, which provides retirement planning, asset management, and insurance products, was unjustly knocked despite its strong fundamentals. After the selloff, the opportunity to buy the dip has arrived.

With a long history of growing assets under management, improving profitability, and delivering superior investment products to clients, Principal Financial Group (PFG: $63/share) is this week’s Long Idea.

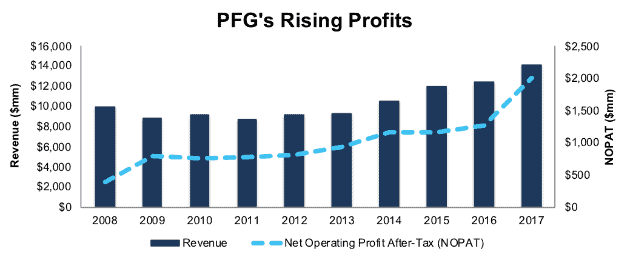

PFG’s Profits Trending Higher

PFG has grown revenue by 4% compounded annually since 2008 while after-tax profit (NOPAT) has grown 20% compounded annually, per Figure 1. Longer term, PFG has grown NOPAT by 11% compounded annually since 2001.

Figure 1: PFG’s Revenue & Profit Growth Since 2008

Sources: New Constructs, LLC and company filings

Improved profit growth has been fueled by rising NOPAT margins, which have improved from 10% in 2013 to 14% in 2017. At the same time, average invested capital turns, a measure of balance sheet efficiency, have increased from 0.5 in 2013 to 0.8 in 2017. Rising margins and efficient capital use have improved PFG’s return on invested capital (ROIC) from 5% in 2013 to 11% in 2017.

Rising AUM In a Falling Tide

PFG’s rising profitability is all the more impressive given the recent flow of assets out of actively managed mutual funds, a significant part of its business. Since 2012, assets under management in the Principal Global Investors segment have risen from $98 billion to $137 billion, a 40% increase.

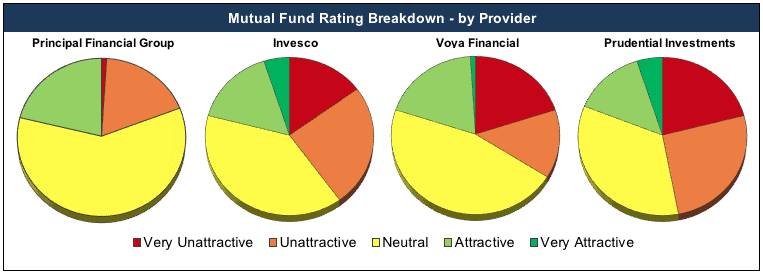

Superior Funds Management Drives Competitive Advantage

PFG has been able to grow AUM in tough market for active management by offering funds with superior holdings and lower costs. Figure 2 shows how the portfolios of PFG funds are of higher quality than its competitors. More of its funds earn Attractive-or-better ratings and fewer get Unattractive-or-worse ratings. Our Robo-Analyst technology allows us to analyze the holdings of all 160 Principal Financial mutual funds (along with its competitors) to provide a forward-looking investment rating.

Figure 2: PFG Funds Offer Higher Quality Holdings

Sources: New Constructs, LLC and company filings.

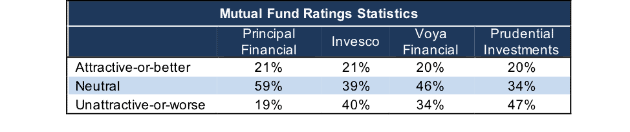

Per Figure 3, we find that 80% of Principal mutual funds earn a Neutral-or-better rating compared to 70% for the 7,000+ mutual funds we cover. Meanwhile, 60%, 66%, and 54% of Invesco, Voya Financial, and Prudential Investments mutual funds earn a Neutral-or-better rating respectively. On the flip side, only 19% of Principal mutual funds earn an Unattractive-or-worse rating compared to 40%, 34%, and 47% for Invesco, Voya Financial, and Prudential Investments respectively.

Figure 3: PFG & Competitors’ Fund Rating Breakdown

Sources: New Constructs, LLC and company filings.

Value-Added Active Management at Lower Costs

On the cost side, Principal funds have an average total annual cost of 1.5% compared to 1.8% for the broader universe of funds. High-quality holdings and lower costs make Principal mutual funds more appealing to investors than the average fund.

AI Creates Value: Working with Machines Is Key

Part of Principal’s success has come from its embrace of technology. Rather than view artificial intelligence as a threat to human analysts, the company uses AI to automate research processes to make its analysts smarter and more efficient. As we noted in our recent article “Working with Intelligent Machines”, combining human knowledge with machine strengths is paramount to creating useful AI technology. CIO Mustafa Sagun wrote in a blog post from last year that the company is developing a “virtual analyst” (sound familiar?) that will free up its investment professionals to focus on higher-order tasks.

By freeing its employees from working on menial tasks, PFG can cut costs and deliver a higher level of service, which enables it to earn superior margins. Technology has helped PFG increase efficiency beyond just its asset management business. 15 years ago, 70% of its employees were “transactional” workers that performed administrative tasks like organizing paper files, handling customer requests, or entering data. Today, only 30% of its employees perform those tasks, while 70% are knowledge workers.

PFG’s ability to leverage technology to provide superior investment products at a lower cost give it an advantage over its peers.

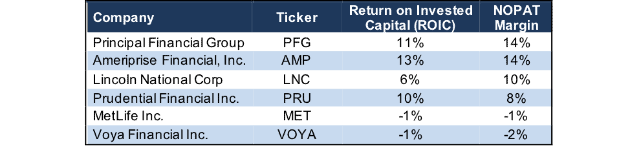

PFG Earns Superior Margins Across the Business

We focused largely on mutual funds above, but Principal Financial Group offers a wide range of financial products including retirement planning, asset management, and insurance. The company offers a comprehensive portfolio of retirement services such as defined contribution plans, employee stock ownership plans, life insurance contracts, and IRAs, as well as asset management for global investors. Competitors include asset managers, insurers, and broker dealers such as MetLife (MET), Prudential Financial (PRU), Ameriprise Financial (AMP), Lincoln National Corp (LNC), and Voya Financial (VOYA), among others.

Per Figure 4, PFG’s ROIC and NOPAT margin rank at or near the top of its peer group. PFG’s high margins give it greater operational flexibility in a low interest rate environment to better manage the spread on life insurance products. It also allows the firm to invest in technology or sales & marketing to help growth business while maintaining profitability.

Figure 4: PFG’s NOPAT Margin Tops Competition

Sources: New Constructs, LLC and company filings.

Bear Case Overstates Passive Concerns and Ignores Growth in Retirement Plans

Bears will argue that the rise of passive investing is the beginning of the end for asset managers. Though its business is well diversified beyond asset management, PFG is certainly not excluded from this group. No one can argue that the shift to passive investing has negatively impacted weaker links in the industry. Meanwhile, PFG has proven its staying power, by not only surviving, but growing AUM during this time. Furthermore, providing a full-service platform (retirement, asset management, and insurance) provides PFG with additional growth opportunities that bears are ignoring.

It’s no secret that passive/ETF investing is on the rise. The percent of passively managed assets as a percent of total assets was 12% in 2000 and increased to 37% in 2017. However, since 2008, PFG has grown AUM from $247 billion to $669 billion in 2017, or 8% compounded annually. Growing assets under management is key to increasing fee-based revenue and ultimately growing PFG’s business.

Beyond asset management, PFG’s insurance and retirement segments provide the company ample growth opportunities. The company focuses on providing benefits and insurance to small and medium sized business, which it believes is an underserved market.

In 2016, the Economic Policy Institute reported that “nearly half of families have no retirement savings at all.” According to LIMRA, a financial services research provider, and Life Happens, a nonprofit financial education provider, 41% of American’s carried no life insurance. In May 2017, One America, an insurance and financial services company, found that 66% of Americans had no disability insurance. PFG’s success in expanding into these underserved markets can be seen in its financials.

- 2017 retirement and income fee revenue grew 9% YoY

- 2017 specialty benefits premium and fee revenue grew 8.5% YoY

- 2017 individual life insurance revenue grew 8.6% YoY

Perhaps more important to the long-term bull case is the growth in retirement plans, including defined contribution plans, both domestically and abroad. According to Willis Towers Watson, pension assets reached a record in 2017.

Countries traditionally focused on defined benefit plans, often run by state and local governments, are shifting toward adopting private sector defined contribution plans. Not only does this shift provide PFG an expansion opportunity, it decreases the risks to the benefit provider. Defined contribution plans don’t require a set payment in a specified number of years even if the market crashes. Willis Towers Watson projects that defined contribution assets will become larger than benefit assets within the next two years. This increase continues a long-term trend where defined contribution assets have grown from 33% of total assets in 1997 to 49% in 2017.

To maximize the growth in retirement plans around the globe, PFG has significant AUM in countries, including Brazil, Chile, Mexico, China, Hong Kong, and India. Per Willis Towers Watson again, the fastest growing pension markets over the past 10 years were Hong Kong and Chile, followed by Australia, Switzerland, and Mexico. Given the growth in these key markets, it’s not surprising that PFG reported net revenue in its International segment grew 20% in 4Q17 over the prior quarter.

Even without the rising adoption of retirement plans, the underserved market in which PFG operates, or its ability to grow AUM, the bear case is weakened by PFG’s valuation. Not only does the stock look cheap when analyzed against peers, but the stock’s valuation also implies profits will immediately and permanently fall, as we’ll show below.

Improving ROIC is Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC.

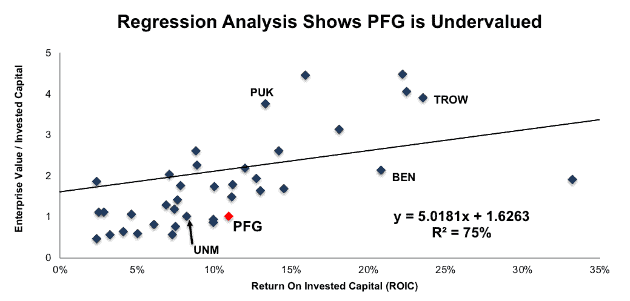

Per Figure 5, ROIC explains 75% of the difference in valuation for the 50 Life Insurance & Investment Management stocks under coverage. PFG’s stock trades at a significant discount to peers as shown by its position below the trend line in Figure 5. If the stock were to trade at parity with its peers, it would be worth $138/share – a 120% upside to the current stock price. Given the firm’s improving margins, ROIC, and assets under management, one would think the stock would garner a premium valuation. Below, we’ll use our DCF model to quantify just how high shares could rise assuming conservative profit growth.

Figure 5: ROIC Explains 75% Of Valuation for Life Insurance & Investment Management Stocks

Sources: New Constructs, LLC and company filings

PFG’s Recent Drop Presents Buying Opportunity

PFG is up nearly 66% over the past two years while the S&P is up 40%. However, PFG dropped significantly more (-19% vs S&P -10% from Jan 26 to Feb 8) than the market in the recent selloff and has been slower to bounce back. With a lowered valuation, PFG presents an excellent buying opportunity. PFG’s current P/E ratio of 8 is well below the Financials sector average of 17.6. When we analyze the expectations baked into the stock price, we also find that PFG offers significant upside potential.

At its current price of $63/share, PFG has a price-to-economic book value (PEBV) ratio of 0.8. This ratio means the market expects PFG’s NOPAT to permanently decline by 20% from current levels. This expectation seems overly pessimistic for a firm that has grown NOPAT by 20% compounded annually since 2012 and 11% compounded annually since 2001.

If PFG can maintain 2017 NOPAT margins of 14% and grow NOPAT by just 5% compounded annually for the next decade, the stock is worth $99/share today – a 57% upside. Given the rise of defined contribution plans abroad, and a growing U.S. economy, such a scenario could prove conservative, which would give PFG even greater upside potential.

Share Repurchases and Dividend Provide Quality Yield of Nearly 5%

A long streak of dividend increases is widely considered to be a sign of a company’s strong competitive advantage. PFG has increased its dividend in nine consecutive years, or each year since the 2008 recession. PFG’s annual dividend has grown from $0.98/share in 2013 to $1.87/share in 2017, or 18% compounded annually. The current dividend equals a 3.1% dividend yield.

In addition to dividends, PFG has returned capital to shareholders via share repurchases. PFG has repurchased $301 million, $277 million, and $220 million in 2015, 2016, and 2017 respectively. At the end of 2017, PFG had $275 million worth of repurchases left under its current authorization. If PFG management purchases shares in line with the averages of the past three years, it would repurchase $266 million next year. A repurchase of this size equates to 1.5% of the current market cap. When combined with the 3.1% dividend yield, the total yield to shareholders could reach 4.6%.

Rising Rates Could Spur Earnings Beats and Send Shares Higher

The low interest rate environment of the past decade has created a difficult landscape for insurance providers and those investing in traditionally “safe” investments. Life insurance providers earn income based on the spread between interest they must pay out and the premiums charged to clients. Similarly, investing in bonds and treasuries has yielded little in the past decade as real interest rates have remained near 0 for quite some time.

More recently, the Federal Reserve began increasing the fed funds rate, and interest rates as a whole have followed suit. The Federal Funds rate now sits at 1.5%, up from 0.25% in December 2015, and the Fed has signaled plans to increase the rate multiple times in the coming years. A rising interest rate environment allows insurers to earn a greater spread, without having to increase premiums on clients, essentially a win-win for both.

Should interest rates continue rising, PFG could see its insurance business, along with other “low-yield” investments begin to pay off. This scenario, along with growth in the other business segments could lead to the firm beating consensus expectations, and ultimately sending shares higher. We’re not alone in believing 2018 could be an excellent year for PFG. Consensus EPS estimates for 2018 have risen from $5.30/share in early 2017 to $5.77/share today.

Executive Compensation Plan Could be Improved but Hasn’t Led to Value Destruction

PFG’s executive compensation plan, which includes base salary, annual incentive compensation, long-term performance-based equity awards, and stock options, is based on reaching target financial, corporate, and divisional goals. Annual incentive goals include measures such as operating earnings, EPS, capital levels, and the minimization of credit loss. Long-term performance share award goals include three-year average operating ROE, and pretax operating income. Metrics such as those in PFG’s executive compensation plan are better than commonly used non-GAAP metrics but could still be improved. We’ve previously highlighted some of the shortcomings of ROE here.

We would prefer to see executive compensation tied directly to value creation, specifically to ROIC, since there is a strong correlation between improving ROIC and increasing shareholder value. However, PFG’s current exec comp plan has not led to executives getting paid while destroying shareholder value. The company has grown economic earnings, the true cash flows of the business, from -$956 million in 2008 to $345 million in 2017.

Insider Trading and Short Interest Trends Are Minimal

Insider activity has been minimal over the past twelve months with 117 thousand shares purchased and 1.1 million shares sold for a net effect of one million shares sold. These sales represent less than 1% of shares outstanding. There are currently 3.7 million shares sold short, which equates to 1% of shares outstanding and 2 days to cover. Short interest is down 15% from the prior month, which could signal a bullish change in sentiment regarding PFG.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to Principal Financial Group’s 2017 10-K:

Income Statement: we made $738 million of adjustments, with a net effect of removing $298 million in non-operating income (2% of revenue). We removed $518 million in non-operating income and $220 million in non-operating expenses. You can see all the adjustments made to PFG’s income statement here.

Balance Sheet: we made $4.9 billion of adjustments to calculate invested capital with a net decrease of $1 million. The most notable adjustment was $2.9 billion in other comprehensive income. This adjustment represented 15% of reported net assets. You can see all the adjustments made to PFG’s balance sheet here.

Valuation: we made $1.1 billion of adjustments with a net effect of decreasing shareholder value by $638 million. The largest adjustment to shareholder value was $254 million in underfunded pensions. This adjustment represents just 1% of PFG’s market cap. Despite the decrease in shareholder value, PFG remains undervalued.

Attractive Funds That Hold PFG

The following funds receive our Attractive-or-better rating and allocate significantly to Principal Financial Group.

- Mount Lucas U.S. Focused Equity Fund (BMLEX) – 3.8% allocation and Very Attractive rating.

- Neiman Large Cap Value Fund (NEIMX) – 2.8% allocation and Very Attractive rating.

- iShares Edge MSCI Multifactor Financials ETF (NFCF) – 2.4% allocation and Attractive rating.

This article originally published on February 22, 2018.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Click here to download a PDF of this report.

Photo Credit: Negative Space (Pexels)