There’s no denying COVID-19’s impact on the global economy. For those willing to see past the current upheaval, there is value to be found in the market. With less discretionary income and lowered demand for public transit, experts believe the already aging vehicle population could grow older and drive more miles after COVID-19. If so, this leading replacement parts provider should experience even stronger profit growth.

Plus, the expectations baked into its current stock price imply the economy never recovers and its profits permanently decline, which means the stock holds significant upside in conservative recovery scenarios. Standard Motor Products (SMP: $41/share) is this week’s Long Idea.

Baby Thrown Out with the Bathwater

We first made Standard Motor Products a Long Idea in May 2017 and since then the firm’s profits have improved, but its valuation has only gotten cheaper.

Before COVID-19, Standard Motor Products was leveraging its product quality and the breadth of offerings to grow its business. While the aftermarket auto repair industry will certainly face challenges in the short term, we expect the demand for these products will rebound strongly as the economy recovers.

Standard Motor Products’ History of Profit Growth

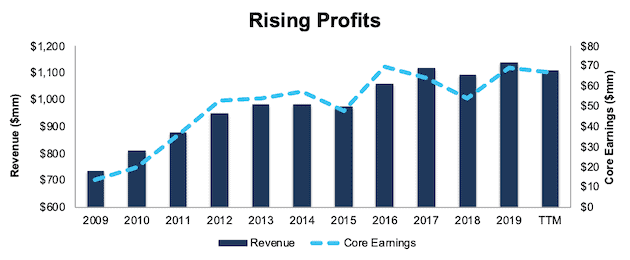

Standard Motor Products has a strong history of profit growth. Over the past decade, Standard Motor Products has grown revenue by 4% compounded annually and core earnings[1] by 18% compounded annually, per Figure 1. Core earnings provide a better measure of profitability and truer insights into valuation than similar measures of profits from legacy data providers.

Longer term, Standard Motor Products has grown core earnings by 13% compounded annually over the past two decades. The firm increased its core earnings margin from 2% in 2009 to 6% in the trailing-twelve-month period (TTM).

Figure 1: Core Earnings & Revenue Growth Over the Past Decade

Sources: New Constructs, LLC and company filings.

Standard Motor Products’s rising profitability helps the business generate significant free cash flow (FCF). The company generated positive FCF in each of the past 10 years and a cumulative $147 million (16% of market cap) over the past five years. Standard Motor Products’s $9 million in FCF over the TTM period equates to a 1% FCF yield.

Ample Liquidity to Survive the Downturn

To maintain financial flexibility, Standard Motor Products borrowed $75 million under its current revolving credit facility. The firm has $47 million more available under this facility, with an additional $50 million accordion feature. When combined with the cash on hand at the end of 1Q20, Standard Motor Products has over $185 million in available liquidity, which will allow it to weather the economic downturn.

In order to further reduce costs, Standard Motor products has also lowered production levels, reduced executive salaries by 10-25%, reduced non-employee directors’ fees by 25%, and suspended dividends and stock repurchases.

In a worst-case scenario, where Standard Motor Products generates no revenue, the firm could operate for over nine months with its available liquidity before needing additional capital. This scenario assumes Standard Motor Products maintains selling, general and administrative expenses ($56 million in 1Q20) and capex ($4 million in 1Q20) at current levels.

However, it’s highly unlikely that Standard Motor Product’s revenue would go to zero given the essential nature of the auto repair business. The firm generated $254 million in revenue in 1Q20, which included the first few weeks of the many stay-at-home orders issued across the country. Furthermore, consensus estimates expect revenue to fall just 11% in 2020 before rebounding in 2021.

Profitability Is Closing the Gap with Peers

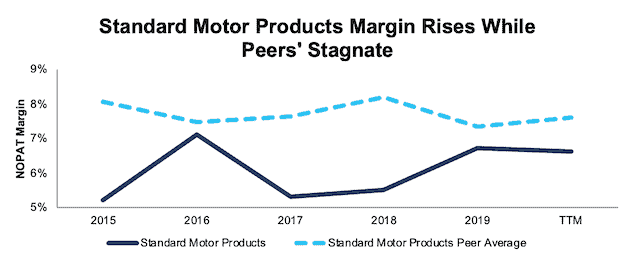

Before the current crisis, Standard Motor Products’s profitability was trending higher and at a faster pace than its competitors. This improved profitability is a testament to Standard Motor Products’s focus on efficiency, which leverages its low cost manufacturing across the globe. Improved profitability also provides Standard Motor Products with greater flexibility to adapt to reduced demand and still partake in the economic rebound as we clear the COVID-19 restraints on the economy.

Per Figure 2, Standard Motor Products’s net operating profit after-tax (NOPAT) margin has improved from 5% in 2015 to 7% TTM. Over the same time, the market-cap-weighted average of 31 other Auto, Truck, and Motorcycle Parts firms hovered around 8%. Standard Motor Products’s peer group includes Delphi Technologies (DLPH), Dorman Products (DORM), Visteon Corp (VC), Lear Corp (LEA) and more.

Figure 2: NOPAT Margin Vs. Peers

Sources: New Constructs, LLC and company filings.

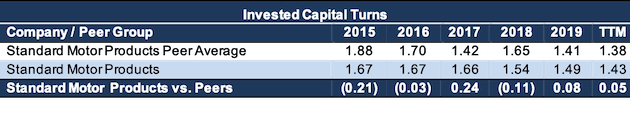

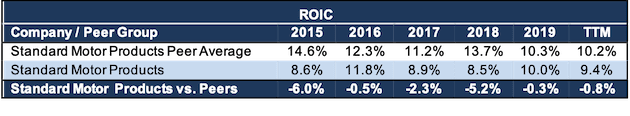

Standard Motor Products’s invested capital turns, a measure of balance sheet efficiency, have fallen from 1.7 in 2015 to 1.4 TTM. However, the peer group’s market-cap-weighted average invested capital turns have fallen even further, from 1.9 to 1.4 over the same time and now sit below Standard Motor Products’s invested capital turns.

Figure 3: Invested Capital Turns Vs. Peers

Sources: New Constructs, LLC and company filings.

Rising margins offset the falling invested capital turns and help drive Standard Motor Products’s return on invested capital (ROIC) higher. Per Figure 4, Standard Motor Products’s ROIC has improved from 8.6% in 2015 to 9.4% TTM while the market-cap weighted average of peers has fallen from 14.6% to 10.2% over the same time.

Figure 4: ROIC vs. Peers

Sources: New Constructs, LLC and company filings.

Standard Motor Products’s financial stability and profitability position the firm not just to survive the downturn, but also to expand its market share during a recovery. As the firm’s CEO, Eric Sills, pointed out during the 1Q20 earnings call, “the auto care industry is extremely resilient and tends to outperform in economic downturns. The market we serve has not changed. It has merely been idled. Cars are still out there and are essential to how our country operates.”

Unless you believe that there will be no need for aftermarket auto repair parts in a post-COVID-19 world, it’s hard to argue against Standard Motor Products’s ability to survive. And, if it survives, it’s hard to argue that the firm’s improving profitability (faster than peers) before the crisis, will not translate into market share and profit growth after the crisis.

Demand for Standard Motor Products’s Is Expected to Be Strong

There’s no denying the COVID-19 pandemic will have an adverse impact on Standard Motor Products’s business in the short-term, as auto repair shops are closed across the country and consumers are driving less. However, unlike new cars, which are expected to see a significant drop in sales, Standard Motor Products’s could see a long-term benefit from the economic crisis, as consumers keep their cars longer.

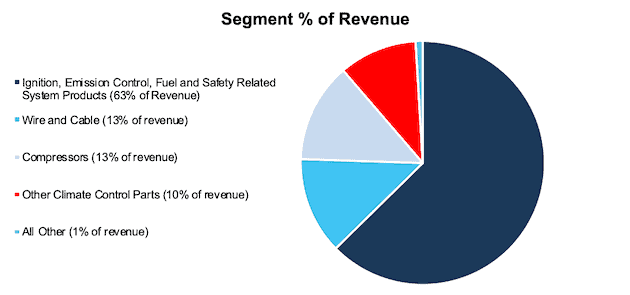

With 87% of sales to the aftermarket (see Figure 5 for a breakdown of end market sales), Standard Motor Products’s business benefits from:

- More total vehicles on the road

- Higher average age of vehicles on the road

- More miles driven per year

These key metrics have steadily increased over the past few years, and are expected to rise moving forward, which creates long-term growth runways for Standard Motor Products.

Figure 5: Standard Motor Products’s Revenue by Product Group - TTM

Sources: New Constructs, LLC and company filings.

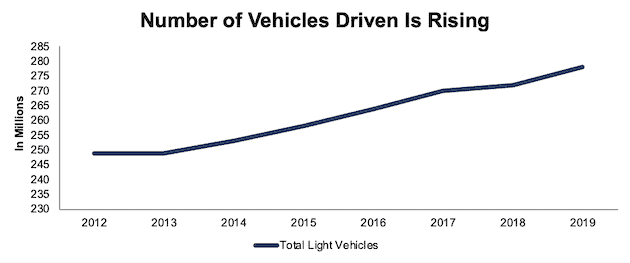

Vehicles in the U.S. Are Increasing

In 2019, registrations for light vehicles in the U.S. reached a record level of 278 million, according to IHS Markit, which represents an increase of 2.2% year-over-year (YoY). This growth in registration surpassed the 0.7% growth in 2018, and is slightly above the 2.0% compound annual growth rate since 2012. See Figure 6. More vehicles on the road provide more need for aftermarket repair industry.

Prior to the COVID-19 pandemic, Bloomberg New Energy Finance estimated that the total passenger vehicle fleet across the globe would rise from ~1.2 billion vehicles in 2019 to ~1.7 billion vehicles in 2040. Even if COVID forces a drop in this growth forecast, any increase in total vehicles presents opportunity for Standard Motor Products.

Figure 6: Light Vehicles in the U.S.

Sources: New Constructs, LLC and IHS Markit via SMP Investor Presentation.

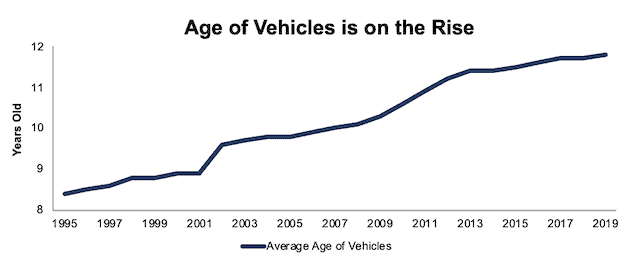

Average Age of Vehicles Is Increasing Too

In addition to the total number of vehicles rising, the average age of light vehicles in the U.S. rose to 11.8 years in 2019, up from 10.3 years in 2009, and 8.8 years in 1999, according to the U.S. Department of Transportation. See Figure 7. Data from IHS Markit finds that the number of older cars is growing quickly too. Vehicles 16 years and older are expected to grow to 74 million by 2023, up from just 35 million in 2002.

Mark Seng, director of global automotive aftermarket practice at IHS Markit notes that the growing number of older vehicles provides more repair opportunities’ for providers that focus on service repair beyond warranty coverage.

Figure 7: Average Age of Vehicles in Operation in the U.S.

Sources: New Constructs, LLC and U.S. Department of Transportation.

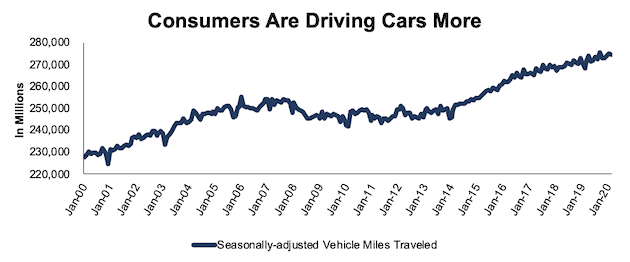

Total Number of Miles Driven is Rising

While the shift from personal car ownership to ride-share may impact auto manufacturers, taxis, and other forms of transportation, Standard Motor Products’s business benefits from increased car usage overall, regardless of form. Not only are more cars being driven, and those cars being replaced less often, more miles are being driven on those vehicles. According to the U.S. Department of Transportation, the seasonally adjusted vehicle miles traveled (VMT) increased from 227 billion in January 2000 to ~275 billion in January 2020.

Prior to the COVID-19 pandemic, the Federal Highway Administration, in its baseline growth outlook, estimated that total VMT would grow 1.1% annually through 2037, at which point seasonally adjusted VMT would be 21% higher than January 2020. Even if COVID forces a drop in this growth forecast, any increase in VMT presents opportunity for Standard Motor Products.

Figure 8: Vehicle Miles Travelled in the U.S.

Sources: New Constructs, LLC and U.S. Department of Transportation.

VMT could increase going forward, as consumers increasingly use their cars, rather than public transportation or air travel for shorter trips, to reduce potential exposure to the COVID virus. Such a scenario would benefit firms like Standard Motor Products, as vehicles require more maintenance when they accrue more miles and wear and tear. Consumer Reports finds that there are significant differences in cost between 3-, 5-, and 10-year old cars. Average maintenance costs for cars of different ages is as follows:

- 3-year old car: $83

- 5-year old car: $200

- 10-year old car: $458

These results highlight how cars need more maintenance and repair over time, which provides more demand for an aftermarket repair parts provider such as Standard Motor Products.

Furthermore, we believe a recovery is likely over the long term since the International Monetary Fund (IMF) and nearly every economist in the world believe the global economy will grow strongly in 2021. The IMF estimates the global economy will expand by 5.8%, and the U.S. economy by 4.7%, in 2021. Fitch Ratings projects global GDP growth of 5.1% in 2021, and for “pre-virus levels of GDP” to be reached in mid-2022 in the US and later in Europe. The overall growth in the economy should lead to a rebound in consumer activity, including miles driven, which should spur additional demand for car maintenance and repair products.

Electric Vehicles Are Not the Threat Many Fear – at Least Anytime Soon

Despite rapid growth in electric vehicle (EV) sales, up from 450,000 in 2015 to 2.1 million in 2019, the overall share of the global vehicle fleet is expected to remain relatively small. Bloomberg New Energy Finance estimates that EVs will make up just 8% of the total passenger vehicle fleet by 2030. While that is no small amount, it still leaves 92% of global passenger vehicles needing traditional combustion engine replacement parts, which Standard Motor Products has supplied for decades.

Additionally, the firm is making strategic investments in EV technology to build for the future. In August 2019, Standard Motor Products acquired a ~29% minority interest in Jiangsu Che Yijia New Energy Technology (CYJ), which manufactures air conditioning compressors for EVs. Standard Motor Products’s management expects the new product capabilities to allow it to manufacture compressors for electric vehicles in the U.S, including hybrids as well.

Customer Concentration is Expected, Not Worrisome

In 2019, O’Reilly Automotive (ORLY), Advance Auto Parts (AAP), NAPA Auto Parts (GPC), and AutoZone (AZO) accounted for 22%, 16%, 15%, and 11% of revenue respectively. This concentration follows these retailer’s actual share of the auto parts retail market. According to IBISWorld, the Auto Parts Stores Industry generates $62 billion in revenue. Based on TTM revenue, O’Reilly, Advance Auto Parts, Genuine Parts Company (owns NAPA Auto Parts) and AutoZone make up 16%, 15%, 31%, and 19% of industry sales respectively. In other words these retailers make up majority of the industry’s sales, so it follows that they would be large purchasers of Standard Motor Products’s inventory.

The economic trends behind the growing demand for Standard Motor Products will also provide tailwinds for automotive parts retailers. This revenue concentration would be more an issue if it were limited to fewer, or lesser-known retailers, but the current diversification among a group of some of the largest auto aftermarket retailers is of little concern.

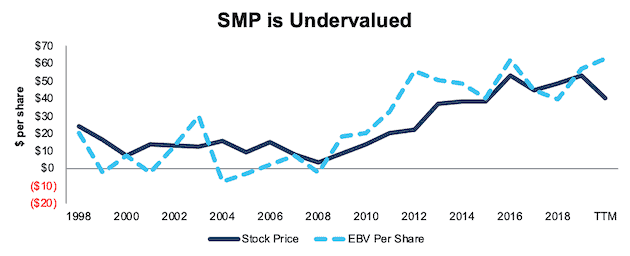

SMP Trades at Cheapest Level Since 2012

After falling 23% YTD to $41/share, SMP now trades below its economic book value, or no-growth value, and at its lowest price-to-economic book value (PEBV) ratio (0.6) since 2012. This PEBV ratio means the market expects Standard Motor Products’s NOPAT to permanently decline by 40%. This expectation seems overly pessimistic over the long term.

Standard Motor Products’s current economic book value is $63/share – a 54% upside to the current price.

Figure 9: Stock Price vs. Economic Book Value (EBV)

Sources: New Constructs, LLC and company filings.

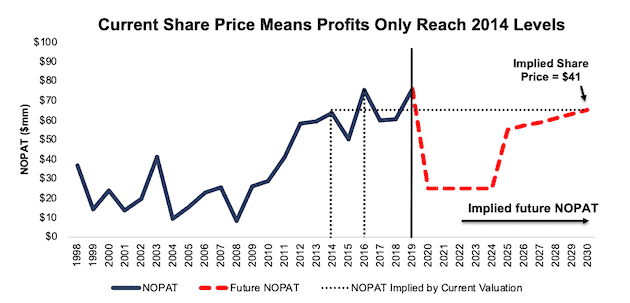

Standard Motor Products’s Current Price Implies No Economic Recovery

Despite the aftermarket auto repair market showing strong resiliency in the Great Recession, SMP is priced as if the COVID-driven economic decline is permanent. Below, we use our reverse DCF model to quantify the cash flow expectations baked into Standard Motor Products’s current stock price. Then, we analyze the implied value of the stock based on different assumptions about COVID-19’s impact on the economy and Standard Motor Products’s future growth in cash flows.

Scenario 1: Using projected revenue declines, historical margins, and average historical GDP growth rates, we can model the worst-case scenario already implied by Standard Motor Product’s current stock price. In this scenario, we assume:

- NOPAT margins fall to 2.6% (average from 2007-2009, compared to 7% TTM) in 2020-2024 and increase to 5.5% (average since 2009) in 2025 and each year thereafter

- Revenue falls 15% (in-line with McKinsey’s pessimistic scenario for the U.S. automotive aftermarket) in 2020, and does not grow until 2025

- Sales begin growing again in 2025, but only at 3.5% a year, which is equal to the average global GDP growth rate since 1961

In this scenario, where Standard Motor Products’s NOPAT declines 1% compounded annually over the next 11 years (including a 67% YoY drop in 2020), the stock is worth $41/share today – equal to the current stock price. This scenario accounts for Standard Motor Products’s drawdown on its credit facility after 1Q20 ended, which was noted earlier. We conservatively assume this capital will be used to cover operating expenses and do not treat it as excess cash See the math behind this reverse DCF scenario.

For reference, Standard Motor Products’s NOPAT declined 68% YoY in 2008, before tripling just one year later in 2009.

Figure 10 compares the firm’s implied future NOPAT to its historical NOPAT in this scenario. This worst-case scenario implies Standard Motor Products’s NOPAT eleven years from now will be 14% below its 2019 NOPAT. In other words, this scenario implies that eleven years after the COVID-19 pandemic, Standard Motor Products’s profits will have only recovered to just above 2014 levels, which Standard Motor Products surpassed in 2016 and 2019. In any scenario better than this one, SMP holds significant upside potential, as we’ll show.

Figure 10: Current Valuation Implies Severe, Long-Term Decline in Profits: Scenario 1

Sources: New Constructs, LLC and company filings.

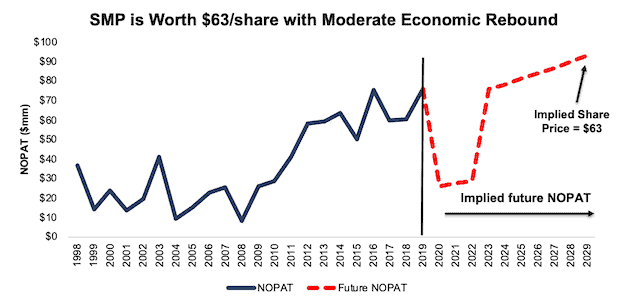

Scenario 2: Moderate Long-Term Recovery Could Be Very Profitable

If we assume, as does the IMF and nearly every economist in the world, that the global economy rebounds and returns to growth starting in 2021, SMP is undervalued.

In this scenario, we assume:

- NOPAT margins fall to 2.6% (average from 2007-2009, compared to 7% TTM) in 2020-2022 and rise to 7% (equal to TTM) in 2023 and each year thereafter

- Revenue falls 11% (equal to consensus estimates) in 2020

- Revenue grows by 6% in 2021 (consensus estimate), and 3.5% a year in 2022 and each year thereafter, which is equal to the average global GDP growth rate since 1961

In this scenario, Standard Motor Products’s NOPAT only grows by 2% compounded annually over the next decade (including a 66% YoY drop in 2020) and the stock is worth $63/share today – a 54% upside to the current price. This scenario also accounts for Standard Motor Products’s drawdown on its credit facility after 1Q20 ended, which was noted earlier. We conservatively assume this capital will be used to cover operating expenses and do not treat it as excess cash. See the math behind this reverse DCF scenario.

For comparison, Standard Motor Product’s has grown NOPAT by 11% compounded annually over the past decade and 9% compounded annually over the past two decades. It’s not often investors get the opportunity to buy an industry leader at such a discounted price.

Figure 11 compares the firm’s implied future NOPAT to its historical NOPAT in scenario 2.

Figure 11: Implied Profits Assuming Moderate Recovery: Scenario 2

Sources: New Constructs, LLC and company filings.

Sustainable Competitive Advantages Will Drive Shareholder Value Creation

Here’s a summary of why we think the moat around Standard Motor Products’s business will enable it to continue to generate higher NOPAT than the current market valuation implies. The following competitive advantages help Standard Motor Products survive the downturn and return to growth as the economy grows again:

- Strong balance sheet and liquidity to survive the dip

- Leading manufacturer of auto replacement parts critical to vehicle operation

- Rising profitability prior to COVID-19 relative to its peer group

What Noise Traders Miss with Standard Motor Products

These days, fewer investors focus on finding quality capital allocators with shareholder friendly corporate governance. Instead, due to the proliferation of noise traders, the focus is on short-term technical trading trends while high-quality fundamental research is overlooked. Here’s a quick summary of what noise traders are missing:

- Strong core earnings growth over the past two decades

- Long-term demand for automotive repair parts as cars are operated longer and driven farther

- Valuation implies the economy never recovers and profits permanently decline by 40%

Suspended Dividend Should Be Temporary

As noted above, Standard Motor Products suspended its quarterly dividend to maintain flexibility and liquidity during the current economic downturn. Prior to this suspension, Standard Motor Products’s dividend provided a 2.5% yield and the firm had grown its dividend for 10 consecutive years. Due in large part to its strong cash generation, we expect the current suspension to be temporary.

Over the past five years, Standard Motor Products has generated more in free cash flow than it has paid in dividends. Standard Motor Products generated a cumulative FCF of $147 million over the past five years and paid out $86 million in dividends over the same time. FCF exceeded dividend payments by an average of $12 million per year over this time.

Firms with cash flows greater than dividend payments have a higher likelihood to maintain and grow dividends. While Standard Motor Products suspended its dividend in the short term, investors buying at current prices should get a nice yield with upside potential as Standard Motor Products reinstates the dividend over the long term.

In addition to dividends, Standard Motor Products has returned capital to shareholders through share repurchases. Since 2017, Standard Motor Products exhausted two separate repurchase authorizations worth a total of $50 million. Prior to suspending repurchases, Standard Motor Products was authorized to repurchase an additional $11.3 million worth of shares. When the firm restarts share repurchases once the crisis is over, the yield for investors will only increase.

A Consensus Beat or Signs of Recovery Could Send Shares Higher

According to Zacks, consensus estimates at the end of January pegged Standard Motor Products’s 2020 EPS at $3.49/share. Jump forward to June 15, and consensus estimates have fallen to $2.28/share. 2021 estimates follow a similar trend. At the end of January, 2021 EPS consensus was $3.86/share, which has since fallen to $3.02/share.

Though the COVID shutdowns will diminish demand for replacement auto parts in the short-term, these lowered expectations provide a great opportunity for a strong business, such as Standard Motor Products, to beat consensus, if not this quarter, then maybe the next. Furthermore, our current Earnings Distortion Score, which is a short-term indicator of the likelihood to beat or miss expectations, for Standard Motor Products is “Beat”, and lowered expectations moving forward could make it much easier to beat earnings.

Lastly, any signs of a recovery in the global economy would send shares higher.

Executive Compensation Could Be Improved but Raises No Red Flags

No matter the macro environment, investors should look for companies with executive compensation plans that directly align executives’ interests with shareholders’ interests. Quality corporate governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Standard Motor Products’s executives receive both annual cash awards and long-term equity awards. The annual cash awards are tied to management performance goals and improvement in the firm’s weighted average earnings per share. Performance goals include operational improvements to productivity in the wire and cable business, margin improvement in product categories, and the achievement of specific growth and diversification initiatives.

Long-term equity awards, and specifically the performance share portion, are tied to earnings from continuing operations before taxes, excluding special items.

We would prefer the firm use ROIC improvement when determining executive compensation, as there is a strong correlation between improving ROIC and increasing shareholder value. Having accurate values for NOPAT and invested capital ensures investors have an apples-to-apples metric for measuring corporate performance and holds management accountable for every dollar invested into the company.

Despite not using ROIC when measuring performance, Standard Motor Products’s compensation plan has not compensated executives while destroying shareholder value. Standard Motor Products has grown economic earnings by 26% compounded annually over the past decade.

Insider Trading and Short Interest Trends

Over the past 12 months, insiders have bought a total of 47 thousand shares and sold 148 thousand shares for a net effect of 101 thousand shares sold. These purchases represent less than 1% of shares outstanding.

There are currently 355 thousand shares sold short, which equates to 2% of shares outstanding and three days to cover. Short interest is up 4% from the prior month, but still minimal.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Standard Motor Products’s 2019 10-K:

Income Statement: we made $28 million of adjustments, with a net effect of removing $18 million in non-operating expenses (2% of revenue). You can see all the adjustments made to Standard Motor Products’s income statement here.

Balance Sheet: we made $271 million of adjustments to calculate invested capital with a net increase of $120 million. One of the largest adjustments was $71 million in asset write-downs. This adjustment represented 12% of reported net assets. You can see all the adjustments made to Standard Motor Products’s balance sheet here.

Valuation: we made $161 million of adjustments with a net effect of decreasing shareholder value by $126 million. Apart from total debt, the most notable adjustment to shareholder value was $18 million in deferred compensation assets. This adjustment represents 2% of Standard Motor Products’s market cap. See all adjustments to Standard Motor Products’s valuation here.

Attractive Funds That Hold SMP

The following fund receives our Very Attractive rating and allocates significantly to Standard Motor Products:

- Royce Special Equity Fund (RSEIX) – 5.8% allocation

This article originally published on June 17, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).