We’re excited for our CEO, David Trainer, to join Business Insider editor, Joseph Ciolli, on Clubhouse later today to discuss the Reddit day-trader phenomenon and the recent GameStop stock frenzy.

We think the meme stock frenzy underscores the dearth of reliable fundamental research for self-directed investors. The absence of reliable fundamental research creates a vacuum, which elevates sources like Reddit to undue levels of influence and leads investors to lose perspective on the real risks they are taking.

No better evidence of the lack of reliable fundamental research exists than the recent meme-stock phenomenon. As our CEO, David Trainer, has asserted on Fox Business and the TD Ameritrade Network, mis-information is at an all-time high in the stock market.

Figure 1: Mis-Information for Self-Directed Investors Is At an All-Time High

Image Source: Everipedia

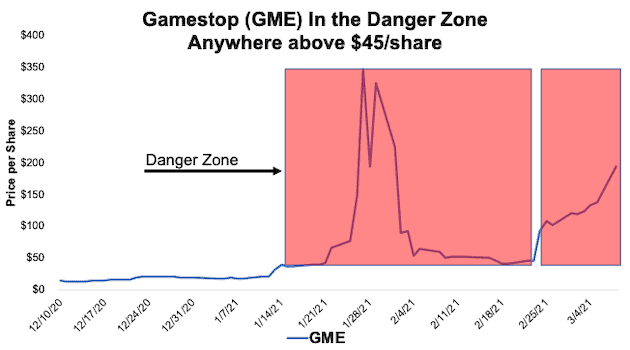

As we noted when we closed our Focus List Stocks: Long position in GameStop (GME) in late January, owning this stock at anywhere close to $200/share presents too much risk versus reward. The bottom line is that fundamentals, even under the most optimistic assumptions, hardly support a price over $45/share.

Figure 2: Fundamental Radar To Navigate Misinformation

Sources: New Constructs, LLC and company filings.

Yet, who raises a red flag for self-directed investors when a meme stock goes on the run or when trading frenzies push stocks to, what we all now know are, unsustainable heights?

We have identified several other meme stocks, which, of course, Wall Street loves because those companies generate significant investment banking revenues. See our reports on the original meme stocks Netflix (NFLX) and Tesla (TSLA) as well as recent reports on DoorDash (DASH), Airbnb (ABNB), Uber (UBER), Carvana (CVNA), Spotify (SPOT), Beyond Meat (BYND), Casper (CSPR), Wayfair (W) Snap (SNAP), Pinterest (PINS), Peloton (PTON), and Shopify (SHOP).

Only independent research firms are free to warn investors, provide unconflicted advice, and navigate Wall Street conflicts and analyst biases. Our business also needs new technology to cut through the ever-growing deluge of data in financial filings and overcome the flaws in legacy fundamental data and research.

Our Robo-Analyst technology levels the playing field for self-directed investors, advisors and RIAs by providing fundamental insights previously available only to Wall Street insiders. No other firm can provide such fundamental insights, proven superior by The Journal of Financial Economics, as we do at scale. By leveraging this technology, self-directed investors no longer have to settle for the often incomplete and conflicted research from traditional research providers.

We believe that every investor deserves access to comprehensive fundamental research like ours.

This article originally published on March 10, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.